Image: South_agency/E+ via Getty Images

Image: South_agency/E+ via Getty Images

If you're a dividend investor looking for value in today's market, we have some exciting opportunities for you. In this article, we'll be discussing 10 top Real Estate Investment Trusts (REITs) that offer strong dividend coverage, impressive growth potential, and attractive prices.

Apartment REITs: A Promising Opportunity

Let's start with apartment REITs. Despite the challenges posed by the pandemic and legal restrictions on eviction, we believe these REITs have significant upside potential. We're particularly bullish on the following six apartment REITs:

- AvalonBay Communities (AVB)

- Equity Residential (EQR)

- Camden Property Trust (CPT)

- Essex Property Trust (ESS)

- Mid-America Apartment Communities (MAA)

- UDR, Inc. (UDR)

Caption: A snapshot of the performance of apartment REITs.

Caption: A snapshot of the performance of apartment REITs.

All six of these apartment REITs trade at attractive forward AFFO multiples below 19x and have price-to-NAV ratios below .87. While some may offer larger discounts to our targets than others, we believe the apartment REITs will recover from the current market downturn.

Prior Opportunity: A Look Back

In October 2020, we published an extensive sector update on housing REITs. We highlighted the value and potential in this sector, emphasizing the solid management, strong balance sheets, and ongoing vaccine progress. We also debunked the notion that the decline in share prices was larger than any potential revenue loss.

Caption: A graphical representation of revenue and share prices.

Caption: A graphical representation of revenue and share prices.

While we adjusted our stance as share prices soared, we remained cautious and reduced our positions in apartment REITs during 2021. However, the recent decline in share prices has created an attractive buying opportunity.

The Apartment REIT Thesis: A Bargain Opportunity

With apartment REITs trading at unusually low multiples of AFFO per share and at larger discounts to NAV per share, now is the time to consider investing. Despite the challenges of declining rental growth rates, the significant drop in share prices more than offsets these concerns.

Take Equity Residential (EQR) as an example:

- Shares cost $60.97 today (as of the time of writing).

- Down over $21.00 from our sale price in July 2021.

- That $21.00 per share decline is equivalent to about three years of gross revenue or more than six years of AFFO.

Caption: A snapshot of EQR's performance.

Caption: A snapshot of EQR's performance.

The decline in share prices far outweighs the potential revenue loss. Additionally, with a dividend yield of 4.1%, ESS is an attractive dividend champion with over 25 years of consecutive dividend growth.

Industrial REITs: Another Promising Sector

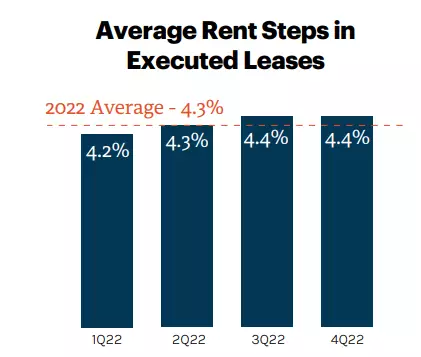

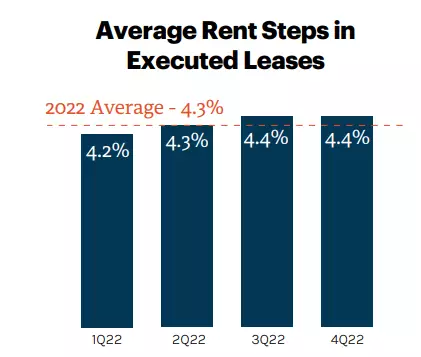

Moving on to industrial REITs, we recommend considering Rexford (REXR). While the valuation was not compelling in the past, the current share price of $60.23 presents a much better opportunity. With a strong focus on occupancy rates and significant leasing spreads, industrial REITs continue to perform well.

Caption: A snapshot of REXR's performance.

Caption: A snapshot of REXR's performance.

Despite some concerns about vacancy rates, these fears are unfounded as occupancy rates remain consistently high. Moreover, tenants are paying substantial leasing spreads, and rental increases are averaging 4.3% for 2022.

Tower REITs: Optimizing Growth Potential

American Tower (AMT) is another REIT that shouldn't be overlooked. Despite a modest dividend yield of 2.9%, AMT offers significant growth potential. With a payout ratio of only 61% and a proven track record of generating growth in AFFO per share, AMT is well-positioned to capitalize on the deployment of 5G technology.

Caption: A snapshot of AMT's performance.

Caption: A snapshot of AMT's performance.

As 5G technology becomes more widespread, the demand for towers will increase exponentially. With an attractive valuation and promising growth prospects, AMT is a solid choice for dividend investors.

Conclusion: Plenty of Opportunities in REITs

In this article, we've highlighted 10 REITs that we believe offer substantial value and growth potential. While our focus has been on apartment, industrial, and tower REITs, there are numerous other opportunities available in the market.

Remember, investing in REITs requires a long-term perspective, and it's essential to consider your investment goals and risk tolerance. By carefully evaluating the fundamentals and market conditions, you can make informed decisions that align with your investment strategy.

Bullish outlooks: AVB, EQR, CPT, ESS, MAA, UDR, REXR, PLD, AMT, SUI, ELS