If you're eyeing real estate investment trusts (REITs) as an investment option, you're likely drawn to the attractive high yield offered by Annaly Capital (NLY -2.09%). However, consider exploring other options like Prologis (PLD 0.13%) and Rexford Industrial (REXR -1.15%), which may offer substantial growth opportunities. Let's delve into the details.

Prologis: A Global Distribution Powerhouse

With a market capitalization of approximately $110 billion, Prologis is one of the largest REITs in the market. Its extensive portfolio comprises over 5,500 warehouses spanning North America, South America, Europe, and Asia. In total, the company owns a staggering 1.2 billion square feet of warehouse space across 20 countries, strategically positioned in key global distribution hubs. This makes Prologis a go-to destination for customers.

Currently, Prologis benefits from new leases signed at rates 74% higher than expiring leases, driving robust growth in the fourth quarter of 2023. While this phenomenal growth may not be sustainable indefinitely, the staggered lease expirations ensure that there are more gains to be made. Moreover, Prologis holds undeveloped land adjacent to its properties, presenting a $40 billion opportunity for constructing new warehouses. The company's focus on short-term and long-term growth avenues sets it apart.

Despite a recent dip in stock price due to concerns over the warehouse sector returning to pre-pandemic levels, Prologis offers an enticing dividend yield of 2.8%. While not the highest, the company's growth prospects suggest that dividend growth will remain attractive. In fact, over the past decade, Prologis has consistently increased its dividend by a substantial 11% annually.

Caption: Rexford Industrial chart showcasing key performance statistics.

Caption: Rexford Industrial chart showcasing key performance statistics.

Rexford Industrial: A Regional Powerhouse

While Prologis boasts a worldwide presence, Rexford Industrial specializes in Southern California's warehouse market. With a market capitalization of nearly $12 billion, Rexford Industrial manages a portfolio encompassing 45 million square feet of warehouse space.

Southern California's warehouse market is the largest in the U.S. and boasts one of the lowest vacancy rates nationwide. The region is actively prioritizing housing development and curbing warehouse expansion, ensuring sustained high demand for years to come. This favorable environment has resulted in substantial rent increases, mirroring the success of Prologis. Rexford's focused regional approach positions the company to enjoy significant rent growth in the coming years, thanks to limited supply.

Though the dividend yield stands at a moderate 2.8%, Rexford Industrial's dividend growth has been impressive, averaging around 18% per year over the past five years. Investors' pessimistic view of warehouses has pushed the yield to decade highs, despite the company's solid fundamentals.

Annaly Capital: Buyer Beware

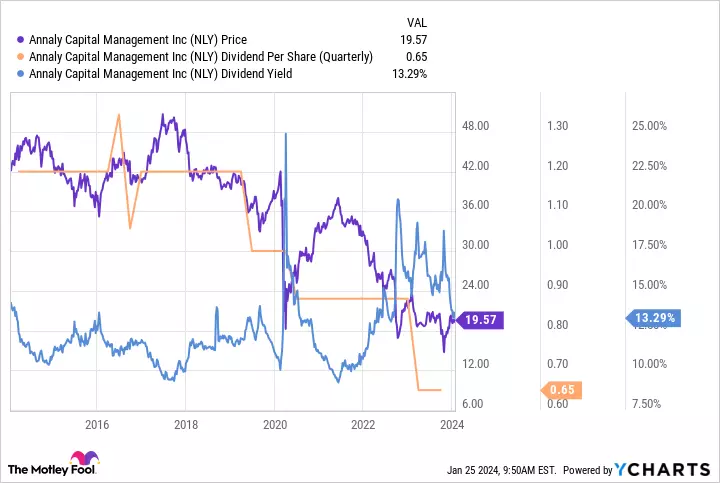

A quick glance at Annaly Capital's chart tells the entire story of this REIT. While the stock offered a dividend yield exceeding 10% for a significant period, it failed to deliver on expectations, with multiple dividend cuts and a steep decline in share price.

Caption: Annaly Capital chart showcasing key performance statistics.

Caption: Annaly Capital chart showcasing key performance statistics.

Investing in Annaly solely for its high yield would have resulted in lower income and significant paper losses. Annaly operates as a mortgage REIT, a complex business heavily influenced by interest rate fluctuations and property market dynamics. While the company provides institutional investors with exposure to mortgage securities, individual dividend investors lured by the attractive yield often end up disappointed.

Choose Wisely

While Annaly's double-digit yield may seem tempting, it's crucial to consider the REIT's poor dividend history. Prologis and Rexford represent more appealing choices, despite their lower yields. These companies offer robust growth prospects and consistent dividend growth. In most cases, opting for the lower yielders proves to be the wiser choice for investors.

So, if you're on the lookout for REITs to add to your portfolio, consider investing in Prologis and Rexford Industrial. Their potential for growth positions them as attractive long-term investments in the dynamic real estate market.