Introduction

The year 2020 was one filled with surprises, particularly for the housing market. The global pandemic and economic recession drastically changed the trajectory of the market. However, despite the challenges, the housing market emerged as a winner, with record-high home sales and prices. As we transition into 2021, there are expectations for a return to normalcy, although some affordability challenges may temper the frenzied momentum. In this article, we will explore the forecast and predictions for key housing trends that will shape the year ahead.

Realtor.com 2021 Forecast for Key Housing Indicators

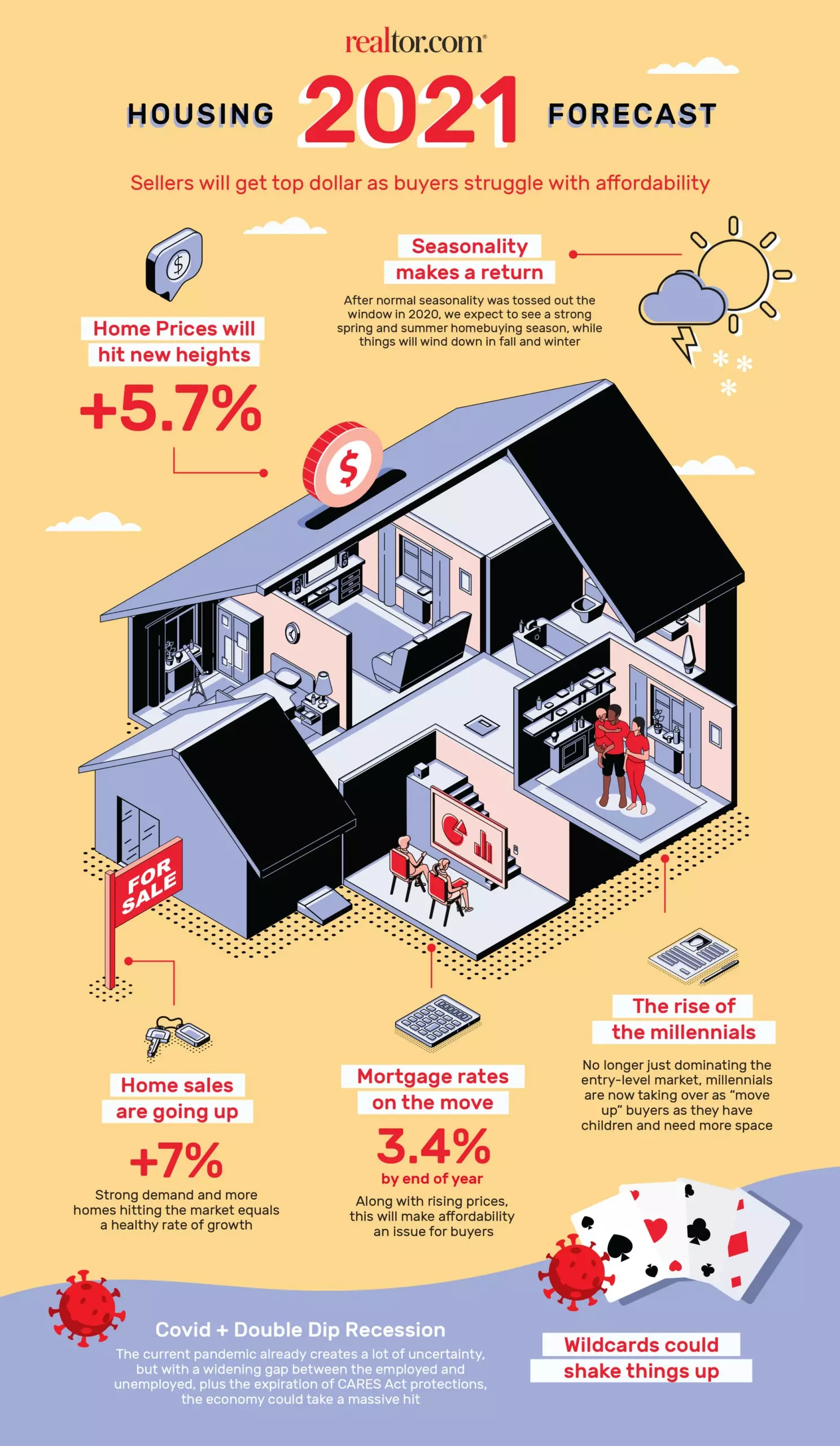

Here are the key housing indicators that Realtor.com has forecasted for 2021:

- Mortgage Rates: Average 3.2% throughout the year, 3.4% by the end of the year.

- Existing Home Median Sales Price Appreciation: Up 5.7%.

- Existing Home Sales: Up 7.0%.

- Single-Family Home Housing Starts: Up 9%.

- Homeownership Rate: 65.9%.

Fig. 1: Realtor.com housing market forecast 2021 - infographic

Fig. 1: Realtor.com housing market forecast 2021 - infographic

Seasonality and 2020 Context: The Baseline

The seasonal pattern for home sales and other metrics in 2020 was disrupted by the arrival of the coronavirus and subsequent shelter-at-home orders. These measures were implemented just before the optimal time for sellers to list their homes, resulting in a housing inventory gap as buyers started returning. This created a frenzy in the housing market, with high sales and low time on the market. However, as we move into 2021, we expect the housing market to settle into a more normal pattern, taking into account the unusual base year of 2020.

Home Sales

Despite the early whipsawing in 2020, the housing market regained its momentum and finished the year with record-high home sales. In 2021, we anticipate a slowdown from the frenzied levels of 2020, but still expect home sales to be 7.0% higher than in 2020. As mortgage rates start to rise in the second half of the year, buyers may feel a sense of urgency to make their purchases before rates increase further. Additionally, there will be a healthy demand from first-time buyers, particularly Millennials and Gen-Z, as well as trade-up buyers from older generations.

Fig. 2: Updated 2022 Forecast Link

Fig. 2: Updated 2022 Forecast Link

Home Prices

The limited inventory of homes for sale in 2020, coupled with high buyer demand, led to a surge in home prices. The momentum of price growth is expected to slow in 2021 as more sellers enter the market and mortgage rates stabilize. However, the demand from buyers, particularly younger generations, will keep upward pressure on prices. We anticipate that home prices in 2021 will end 5.7% higher than in 2020, with a deceleration during the spring and summer, followed by a gradual reacceleration towards the end of the year.

Inventory

The housing market's long-term symptom, inventory shortage, is expected to persist in 2021. The number of homes available for sale was already insufficient before the pandemic, and the crisis further reduced inventory levels. However, we anticipate an improvement in the pace of inventory declines starting in late 2020. Although total inventories will remain relatively low, the number of newly listed homes is expected to increase, helping to power the anticipated growth in home sales.

Key Housing Trends

2021 Trends: Millennials & Gen Z

Millennials, the largest generation in history, will continue to shape the housing market in 2021. The older segment of this generation will be trade-up buyers, benefiting from substantial equity gains. Meanwhile, the younger segment will enter key years for first-time homebuying. Additionally, Gen Z buyers, aged 24 and younger, will continue their early foray into the housing market. Despite rising home prices, these younger generations have shown a willingness to enter the market and make changes to their home search criteria.

2021 Trends: Remote Work

The COVID-19 pandemic accelerated the prominence of remote work. As more companies offer flexible work arrangements, the demand for homes that support remote work will increase. Features such as home offices, high-speed internet connections, and proximity to coffee shops and other businesses will become more prevalent in home listings. Remote working will continue to be a significant factor influencing homebuying decisions in 2021.

2021 Trends: Suburban Migration

With the freedom from daily commutes to the office, many homebuyers have turned to suburban areas for affordable space that accommodates remote work, learning, and living. This trend was evident in the rental market as well, with a stronger bounceback in suburban home shopping compared to urban areas. The pandemic has further accelerated the preference for suburban living, as homebuyers seek affordable housing outside of urban cores.

Housing Market Perspectives

What Will 2021 Be Like for Buyers?

Buyers can expect a more hospitable housing market in 2021. An increased number of sellers and new construction will restore some bargaining power, especially in the second half of the year. Although home prices will continue to rise, low mortgage rates will help buyers afford the increases. The industry's acceleration towards technology will also enable buyers to explore homes and neighborhoods online, saving time and energy. However, fast sales will remain the norm in many areas, posing a challenge for first-time buyers. Preparation, such as identifying must-haves and obtaining pre-approval, will give buyers an edge.

What Will 2021 Be Like for Sellers?

Sellers will be in a good position in 2021. Home prices are expected to reach new highs, and low mortgage rates will keep buyer demand strong. However, sellers must set reasonable expectations as price gains will likely decelerate. Setting a timely sale and focusing on the next move will be key for sellers in 2021.

Housing Market Predictions 2021 - Metro Area Breakdown

Here is a breakdown of sales and price growth predictions for various metro areas in 2021:

(Metro Area, 2021 Sales Growth % y/y, 2021 Price Growth % y/y)

Akron, Ohio: 5.3%, 4.2% Albany-Schenectady-Troy, N.Y.: 7.1%, 3.7% Albuquerque, N.M.: 4.5%, 3.2% Allentown-Bethlehem-Easton, Pa.-N.J.: 0.3%, 4.9% ... (continued)

Note: The complete list of metro area predictions can be found in the original article.

Subscribe to our mailing list to receive monthly updates and notifications on the latest data and research.

Disclaimer: This article presents forecasts and predictions based on available data and market trends. Please consult with real estate professionals and conduct due diligence before making any housing-related decisions.