Image credit: Sanaulac.vn

Image credit: Sanaulac.vn

As we approach 2024, the commercial real estate industry is poised for significant shifts and exciting opportunities. With interest rates stabilizing and a potential cut on the horizon, underwriting requirements reverting to the mean, and a growing focus on affordable housing, experts predict gradual changes in the coming months. Additionally, the impact of AI on the industry is becoming increasingly apparent, bringing both new tools and societal changes. Let's delve into some of the top predictions for commercial real estate in 2024 and what they mean for investors, developers, and industry professionals.

1. Interest Rate Hikes Winding Down

The Federal Reserve's decision to keep interest rates steady in November signals a potential end to the rate hikes that have been happening since 2022. This positive news, along with signs of a slowing economy, suggests that 2024 may see a pause in rate increases. While it's not set in stone, the market is pricing in a potential rate cut next year. This could lead to increased transaction velocity and provide opportunities for value-add acquisitions.

2. Underwriting Requirements Will Slightly Loosen

As uncertainty fades and positive returns on investment become more likely, lenders may start to loosen their requirements. While caution will still prevail, building relationships with lenders and financial partners is crucial in positioning yourself for future deals. Clear communication and proactive conversations will be the key to taking advantage of emerging financing opportunities.

3. A Push into Affordable Housing

Affordable housing continues to be a priority for the federal government and local administrations. Major markets, such as Seattle, are investing millions into this sector. Creative asset conversions, like transforming offices into mixed-use spaces, are gaining traction. While home prices are predicted to fall, the demand for multifamily units remains high, especially among younger demographics. Investors should focus on markets with stable rent and solid fundamentals, while taking advantage of affordable housing incentives.

4. Construction Deliveries Will Slow Demand

Construction activity has been picking up, but the majority of new assets are Class A properties. This may lead to reduced demand as high rents limit tenants' ability to afford these units. Industrial properties may also see increased deliveries, potentially leading to higher vacancy rates. However, the office sector is expected to experience increased demand as the economy performs strongly.

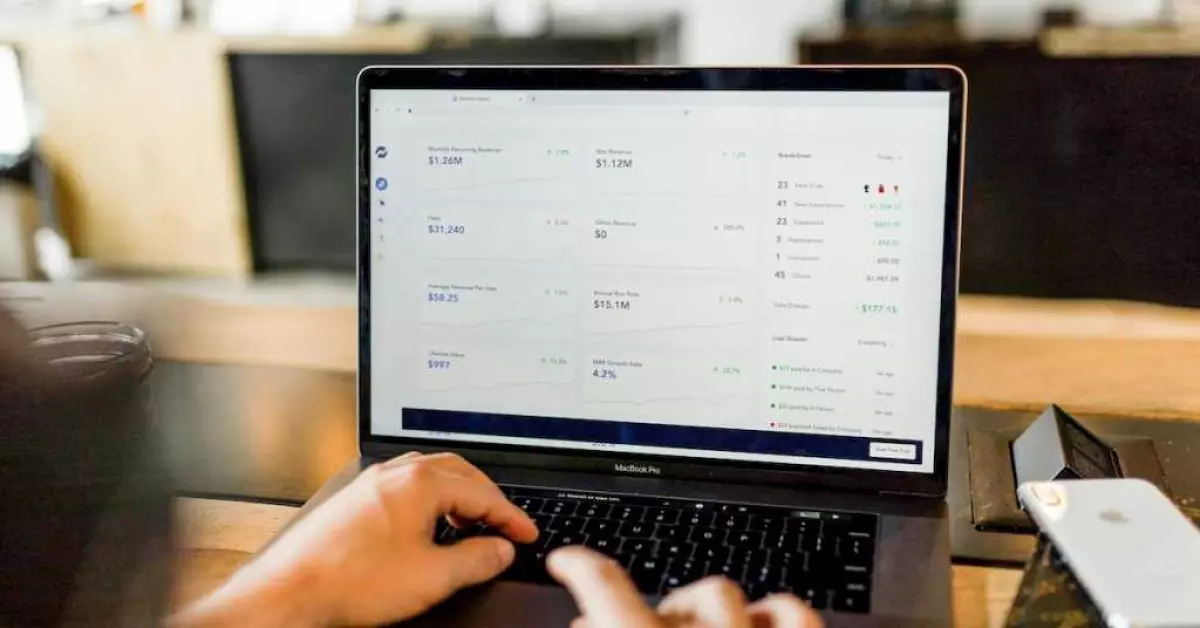

5. AI Will Change Productivity and Workflows

Artificial Intelligence is revolutionizing the commercial real estate industry. AI-driven tools enhance productivity, streamline operations, and enable professionals to uncover, analyze, and close deals more efficiently. Embracing this technology will provide a competitive advantage in 2024 and beyond.

6. The Reign of Retail Concepts

Contrary to the predicted "retail apocalypse," the retail sector is transforming and becoming more meaningful. Retail operators are experimenting with creative concepts to attract and retain visitors. Flagship brand stores, experiential shopping, and microunits are making retail hubs valuable to corporations looking to build long-lasting customer relationships. The in-store experience remains critical, with many consumers opting to shop more in-store.

7. Rising Insurance Costs

Increased insurance costs, particularly in coastal markets, are a concern for investors and owners. The frequency and severity of disasters have heightened insurance companies' perception of risk. Future-proofing developments and considering insurance premiums as operational costs are essential factors to consider when purchasing a property. Making buildings more climate-resilient through renovations may help reduce insurance costs in the long run.

8. Auctions Will Become Important Tools

Online auctions are gaining popularity as a quick and efficient way to sell non-performing or healthy assets. They offer greater control, transparency, and broader reach for bidders, while providing sellers with effective marketing tactics and certainty of close. Banks seeking to dispose of potentially risky assets are also utilizing online auctions. This trend will continue to expand in 2024, presenting opportunities for those looking for real estate deals.

In conclusion, as we move into 2024, the commercial real estate industry is set to experience significant changes and opportunities. Stabilizing interest rates, loosening underwriting requirements, a push towards affordable housing, advancements in AI technology, the transformation of retail concepts, rising insurance costs, and the increasing importance of online auctions will shape the industry. By staying informed and adapting to these trends, investors, developers, and industry professionals can navigate the year ahead with confidence.