The stock market is at an all-time high, which can make it challenging to find good investment opportunities. However, even in this environment, there are still options for growth and income. In particular, there are three real estate dividend stocks that have yet to fully participate in the bull market. These stocks have caught my attention and I have recently added them to my retirement account.

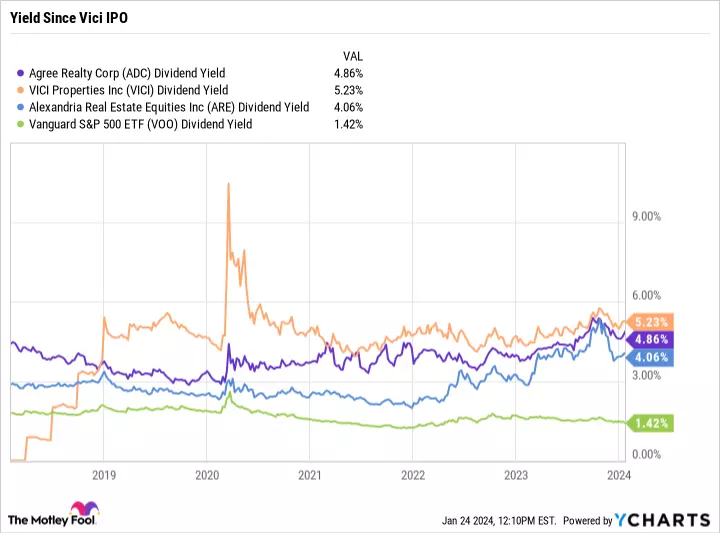

Caption: ADC Chart

Caption: ADC Chart

These stocks are Agree Realty (ADC), Alexandria Real Estate Equities (ARE), and Vici Properties (VICI). Each of these companies is a publicly traded real estate investment trust (REIT) that pays out at least 90% of their taxable income as dividends. While they may be sensitive to rising interest rates, the tide is expected to turn in their favor this year.

Agree Realty

Agree Realty is a highly regarded retail REIT that owns a diverse portfolio of about 2,100 properties across 49 states. The majority of its rent comes from investment-grade tenants, giving it stability and consistent cash flow. Despite the recent market fluctuations, Agree Realty's balance sheet remains strong, enabling it to continue its growth trajectory. Analysts have set a target price of $68.44 for Agree Realty, representing a potential upside of about 13%.

Alexandria Real Estate Equities

Alexandria Real Estate Equities is an office REIT that has been affected by the long-term impacts of COVID-19 and the rise of remote work. However, this company is different from other office REITs. It specializes in owning and operating life sciences space in major research and development clusters. Its properties are home to biopharma, university, and government tenants who require specialized facilities for critical laboratory work. Despite the challenges facing the office sector, Alexandria Real Estate Equities is expected to rebound with a target price of $143.11, an upside of nearly 18%.

Vici Properties

Vici Properties is the newest player in the market but has quickly made its mark. With a portfolio of 54 casinos, 39 experiential properties, and various entertainment venues across the U.S. and Canada, Vici Properties is deeply rooted in the hospitality industry. Analysts see a 14% upside for Vici stock, with a consensus target price of $35.15. This REIT has been raising its dividend consistently since its inception and shows potential for further growth.

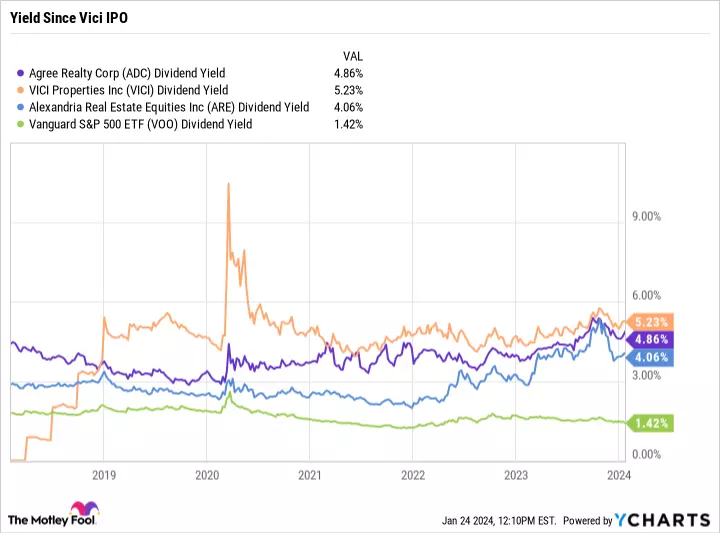

Caption: ADC Dividend Yield Chart

Caption: ADC Dividend Yield Chart

These REITs also offer attractive yields, ranging between 4% and 5%. As a retiree, I value income as much as growth, and these stocks have consistently outperformed the S&P 500 in terms of yield. Additionally, these companies have the potential for continued growth in both dividends and share prices, making them a valuable addition to my retirement portfolio.

While the stock market may be reaching new highs, I believe that there are still opportunities to be found. By investing in stable dividend-paying REITs like Agree Realty, Alexandria Real Estate Equities, and Vici Properties, I am aiming for a balanced approach that combines income generation with growth potential.