Real estate investment trust (REIT) Realty Income has seen a resurgence in its stock price, making it an attractive investment option. While it may not have explosive growth potential, Realty Income offers several compelling reasons to consider buying its stock. Here are six reasons why you should invest in Realty Income like there's no tomorrow:

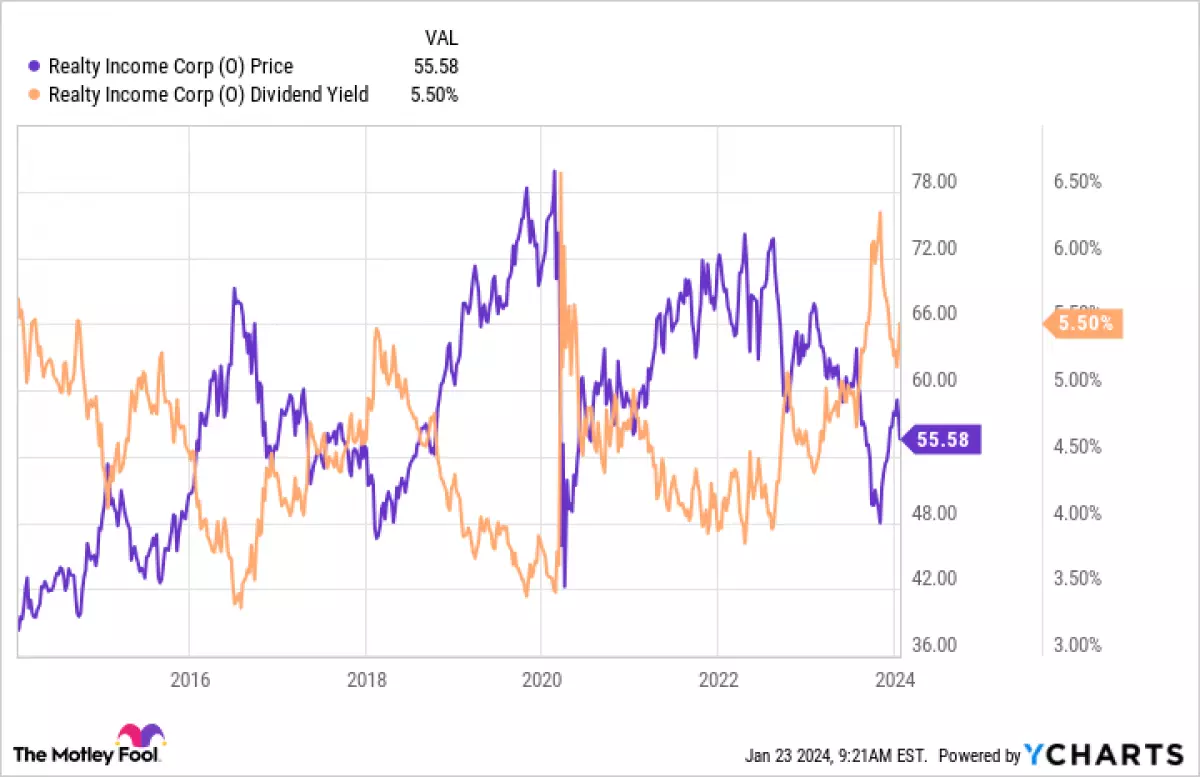

1. The dividend yield is near historical highs

Realty Income boasts a dividend yield of 5.5%, which is among the highest levels seen in the past decade. While there are higher-yielding REITs available, Realty Income's consistent performance suggests that it is historically undervalued. A high dividend yield is a good indication to further explore the company's fundamentals.

Image source: O data by YCharts

Image source: O data by YCharts

2. It's the largest net lease REIT

Realty Income dominates the net lease REIT niche, being more than twice the size of its closest competitor. With ownership of approximately 15,000 properties, Realty Income benefits from the risk diversification across its vast portfolio. Its scale not only allows it to pursue larger deals but also provides access to greater capital resources.

Image source: O Market Cap data by YCharts

Image source: O Market Cap data by YCharts

3. Realty Income holds a vital cost advantage

Having access to capital is crucial for REITs, as they rely on issuing shares and selling bonds to generate cash flow for dividends. Realty Income enjoys an investment-grade balance sheet, allowing it to acquire properties at more favorable prices than its peers. This cost advantage supports the REIT's long-term growth prospects.

4. Realty Income offers steady and reliable growth

As the leading player in the net lease sector, Realty Income faces challenges in sustaining high growth rates. However, investors looking for dividend stocks with reliable businesses will find Realty Income appealing. Over the past 29 years, the company has achieved a compound annual dividend growth rate of 4.3%, outpacing inflation and increasing the buying power of its dividends.

Image source: O data by YCharts

Image source: O data by YCharts

5. It has a proven dividend history

Realty Income has an impressive track record of dividend increases, having raised its dividend quarterly for 104 consecutive quarters. With monthly dividend payments, investors can rely on Realty Income for a steady income stream. This consistency makes Realty Income an attractive option for those seeking to replace a paycheck with stock market dividends.

6. Realty Income has diversified growth opportunities

Realty Income's management has made strategic moves to expand the REIT's growth potential. It has ventured into various sectors, such as Europe, casino assets, lending-based approaches, and retail healthcare. These diversified growth avenues provide Realty Income with ample opportunities to continue its growth trajectory and consolidate its position in the net lease sector.

In conclusion, Realty Income offers a unique investment proposition. While it may not suit every investor, its combination of positives, including a historically high dividend yield, makes it worth considering for safety-focused investors. Now could be the right time to initiate or expand your position in Realty Income.

Note: This article is for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a professional before making any investment decisions.