Introduction

Are you looking for a unique investment opportunity that offers access to the world of real estate? Look no further than the Blackstone Real Estate Income Trust (BREIT). This non-publicly traded real estate investment trust is open to individual investors, providing a chance to tap into the expertise of one of the leading alternative asset managers, Blackstone Real Estate. With a net asset value of $66 billion, BREIT has consistently achieved impressive returns for investors. In this article, we will delve into the details of BREIT, including its portfolio composition, performance, eligibility requirements, and fees, as well as guide you on how to invest in this exciting venture.

What Is the Blackstone Real Estate Income Trust (BREIT)?

The Blackstone Real Estate Income Trust, Inc. (BREIT) is a non-listed real estate investment trust that primarily invests in income-generating commercial real estate assets in the US market. With the goal of providing stable returns, BREIT focuses on a minimum of 80% of its portfolio in stabilized income-generating commercial real estate investments. Additionally, it also allocates up to 20% for real estate debt investments and assets outside the US. Launched in 2017, BREIT offers a perpetual-life investment platform, allowing individual investors to subscribe at any time. Subscription prices generally reflect the net asset value (NAV) per share, making it a transparent and accessible investment option.

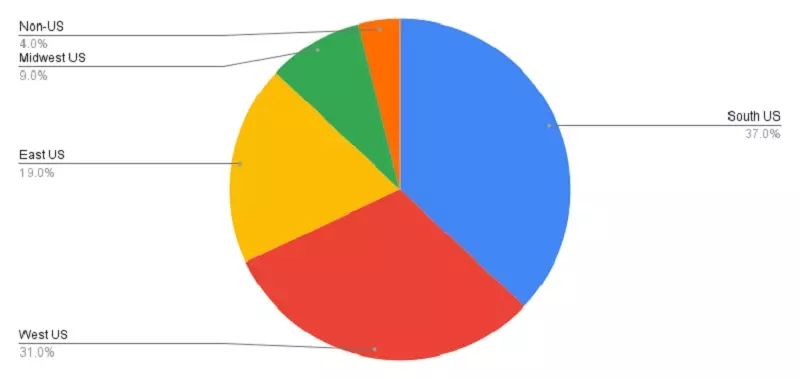

Figure 1: BREIT Portfolio Distribution by Property Sector, September 2023

Figure 1: BREIT Portfolio Distribution by Property Sector, September 2023

Blackstone Real Estate: A Trusted Name

While BREIT operates as a separate entity, it is sponsored by Blackstone Real Estate, a renowned real estate group affiliated with BX REIT Advisors L.L.C. Blackstone Real Estate boasts an impressive track record of success across market cycles, being the largest commercial real estate owner globally as of September 30, 2023. With $332 billion in investor capital under management and a global real estate portfolio value of $585 billion, Blackstone Real Estate strategically invests in high-quality assets, capitalizing on global economic and demographic trends.

BREIT Portfolio: A Diverse and Lucrative Mix

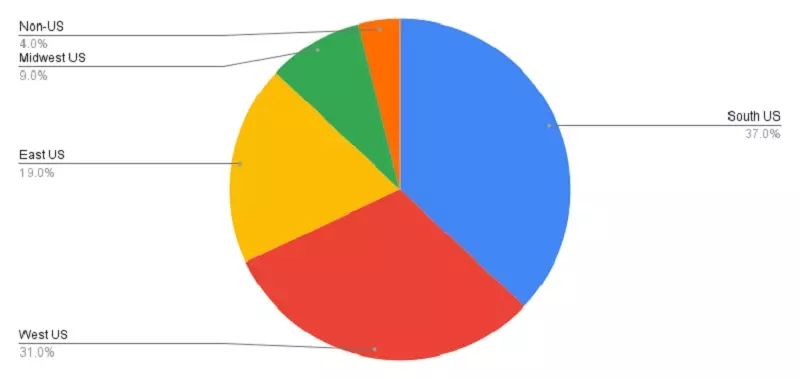

The BREIT portfolio is a testament to the trust's commitment to outsized growth potential and sound investment diversification. With a net asset value of $66 billion, BREIT allocates 86% of its portfolio to rental housing, industrial, and data centers, focusing on the fast-growing South and West regions of the US. Furthermore, 90% of the portfolio is dedicated to fixed-rated financing, enhancing stability and predictable returns. BREIT capitalizes on countercyclical rental housing subsectors, including student and affordable housing, to add further resilience and growth potential to its portfolio.

Figure 2: BREIT Portfolio Distribution by Geographical Region, September 2023

Figure 2: BREIT Portfolio Distribution by Geographical Region, September 2023

Performance Matters: A Closer Look

Let's dive into the performance metrics of BREIT. As of September 30, 2023, BREIT has achieved impressive annualized returns since inception, with 11.5% for Class D shares, 10.7% for Class S shares, and 11.0% for Class T shares. The trust aims to provide strong cash flow growth potential, with the portfolio generating over 6% estimated same property net operating income (NOI) growth year to date, outperforming the inflation rate of 3.7%. These returns position BREIT as an attractive option to hedge against inflation and to potentially outperform traditional investment vehicles.

Unlocking Opportunities: Eligibility and Fees

To participate in BREIT, individual investors must satisfy certain eligibility requirements. Accredited investors are generally preferred, with a minimum net worth of $250,000 or a gross annual income of at least $70,000 and a net worth of at least $70,000. Additional requirements may apply depending on specific state regulations. The minimum investment requirement for Class D, S, and T shares is $2,500, while Class I shares start at $1,000,000. However, select broker-dealers may offer BREIT at different minimum investment levels, so it's important to consult with your chosen broker-dealer.

When investing in BREIT, investors should be aware of the associated fees. These fees include advisor fees and share-class specific fees, which vary depending on the class of shares held. It's essential to understand these fees and their impact on your investment performance. To get a clear picture, you can utilize the interactive Alternatives Investor private real estate return calculator.

How to Invest in BREIT Shares

Investing in BREIT shares is a decision that warrants careful consideration and expert advice. To make an informed choice, it's recommended to work with a qualified financial advisor who can analyze your financial situation and guide you on whether investing in BREIT aligns with your goals. A financial advisor will also help determine the optimal allocation for BREIT within your alternative investment portfolio, taking into account your risk profile and desired outcomes. While the private real estate market offers enticing opportunities, professional guidance ensures the right fit for your unique circumstances.

Unlock the potential of the Blackstone Real Estate Income Trust and explore the world of private real estate investments. With BREIT, the doors to large-scale real estate investments are open to everyday investors. Take the first step and consult with a trusted financial advisor today.

Note: The information provided in this article is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.