Image: bpperry/iStock via Getty Images

Image: bpperry/iStock via Getty Images

REIT Rankings: Student Housing

Image: Hoya Capital

Image: Hoya Capital

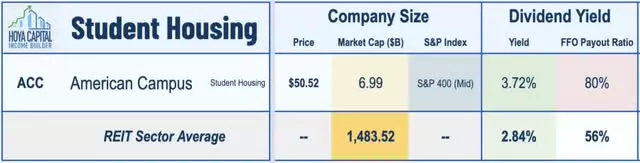

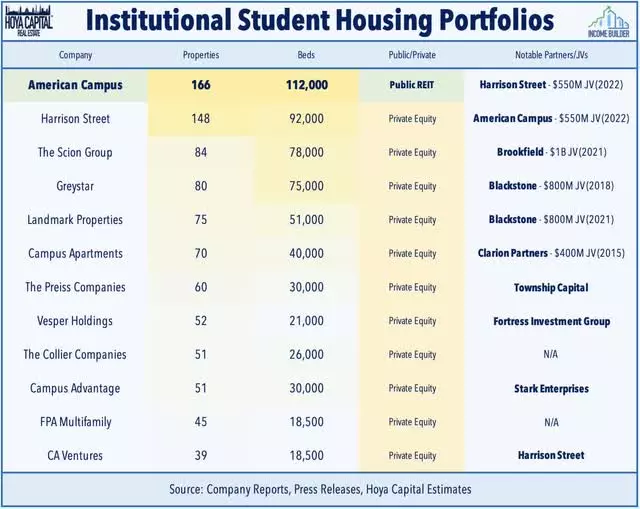

American Campus Communities (ACC) - along with the broader student housing sector - have witnessed a faster-than-expected rebound as students returned to flagship universities for the Fall semester. As the largest institutional owner of student housing properties in the United States and the eighth largest multifamily REIT, ACC has established itself as a leader in student housing development and a stalwart of the public-private partnership model.

Image: Hoya Capital

Image: Hoya Capital

ACC's focus on highly-selective flagship universities across Sunbelt markets, which predominantly offered in-person classes throughout the pandemic, has proven to be especially critical. The company owns 166 student housing properties, primarily consisting of high-value on-campus or near-campus purpose-built student housing facilities at major flagship 4-year public universities.

Strong Recovery and Positive Momentum

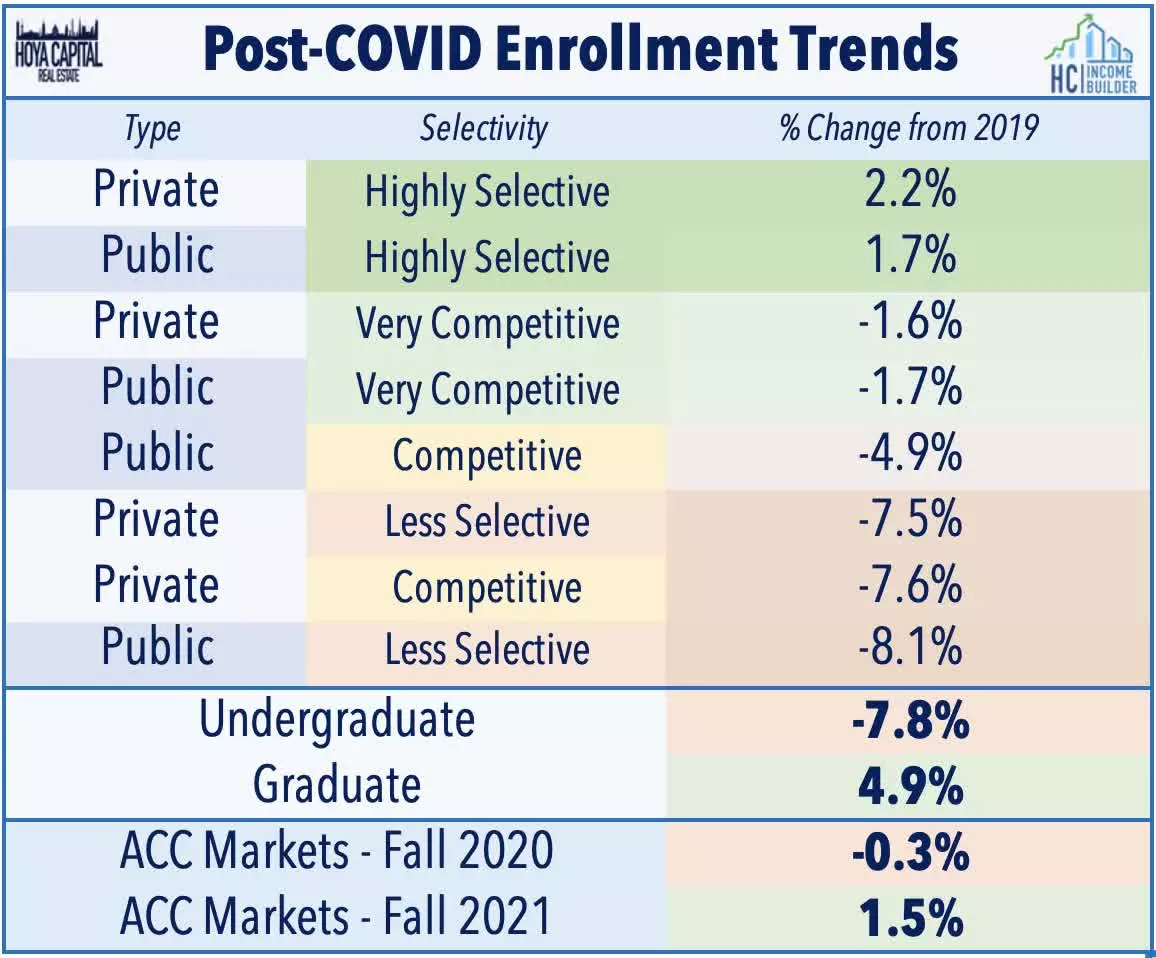

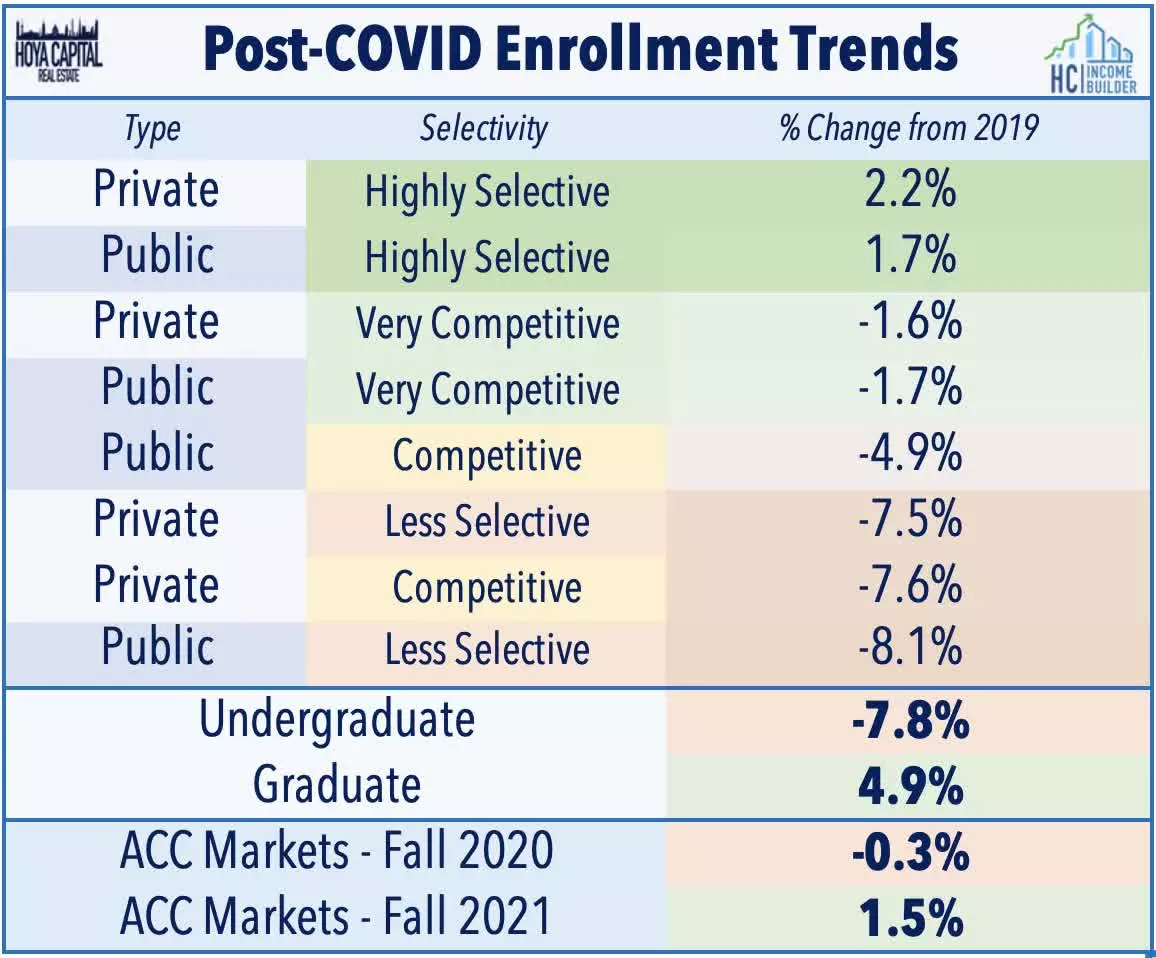

Despite enrollment declines at the national level due to the pandemic and other structural factors, student housing in top-tier university markets has returned to pre-pandemic levels. Enrollment at highly selective schools, which ACC targets, has actually increased from pre-pandemic levels. Furthermore, recent data suggests that momentum is building into the 2022 academic year, with strong growth in graduate enrollment.

Image: Hoya Capital

Image: Hoya Capital

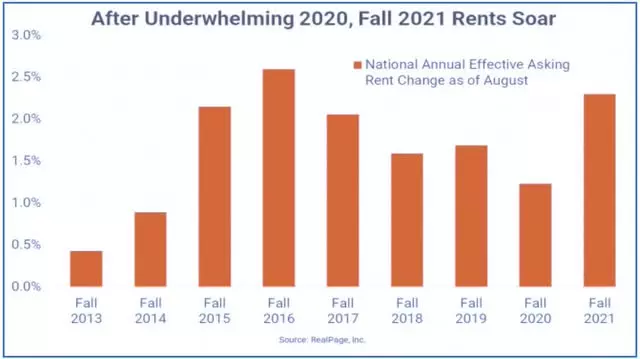

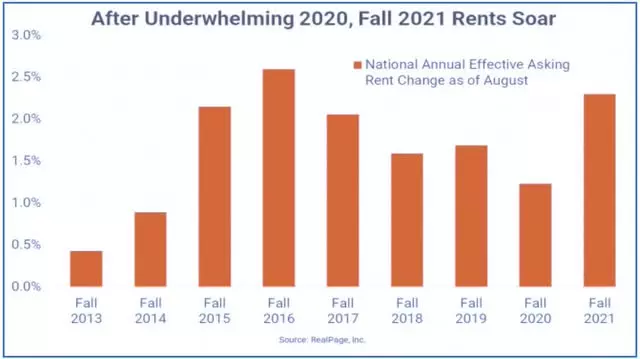

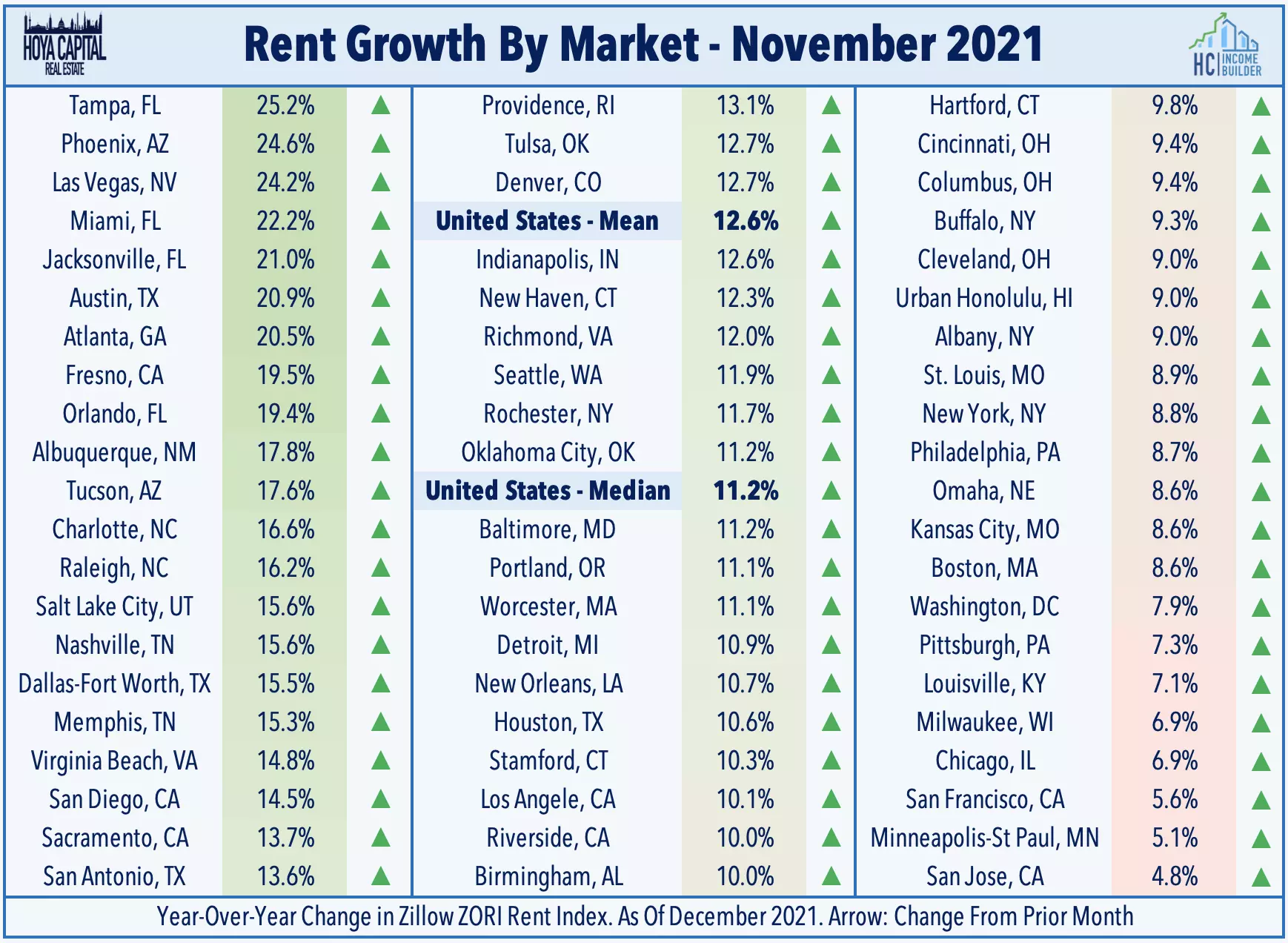

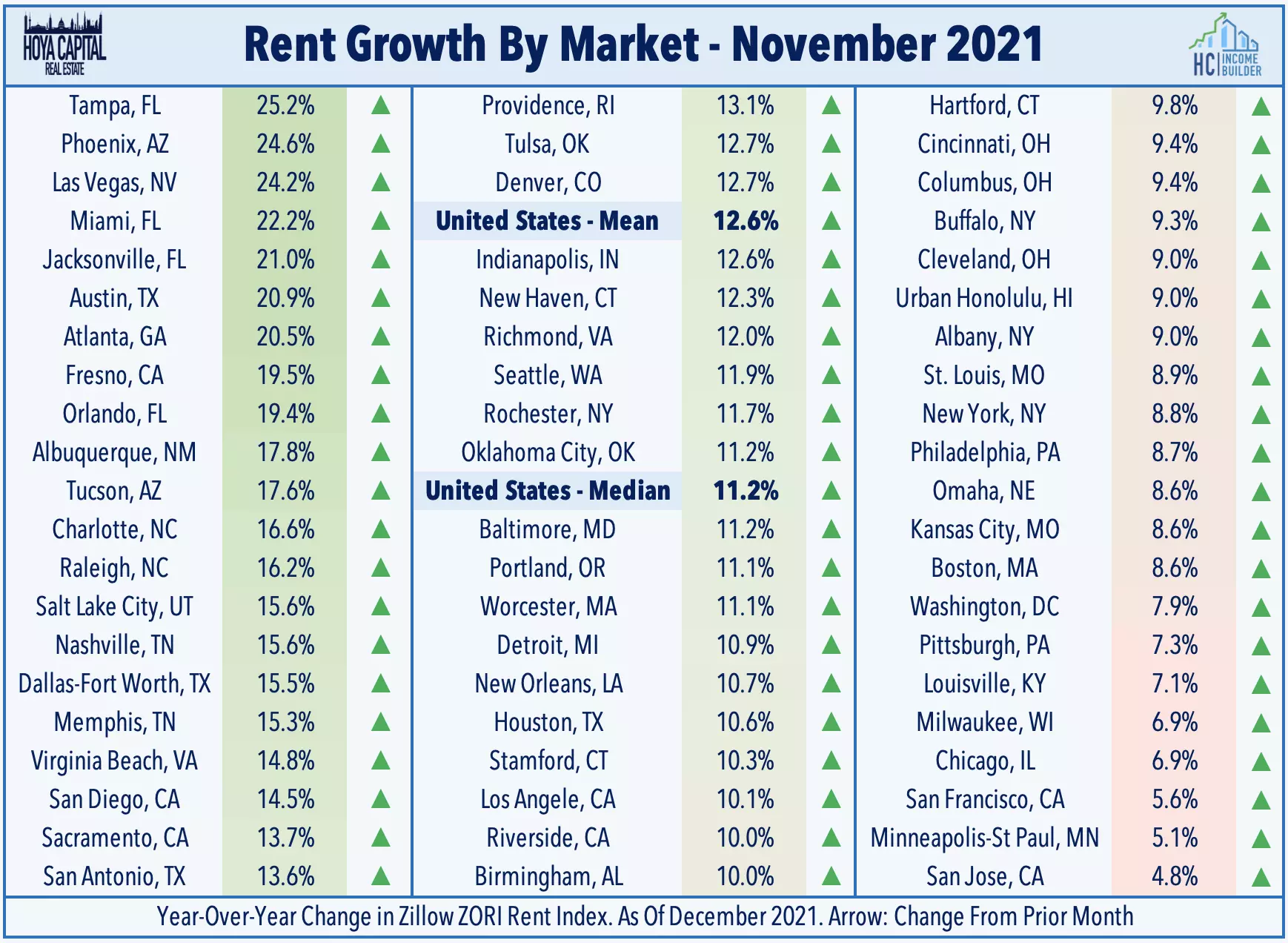

RealPage reported that student housing rents ended the Fall 2021 leasing season with a 2.3% increase from the previous year, marking the best year-end rent growth since 2016. Occupancy rates also reached a record-high of 94.1%, surpassing the pre-lease rate of 92.1%. These positive trends have continued into the early pre-leasing season for the Fall 2022 semester, with significant leasing activity and rent growth.

Image: RealPage

Image: RealPage

Compelling Investment Opportunity

ACC has reported impressive third-quarter results, driven by strong enrollment trends at top-tier universities and limited supply growth. The company's same-store NOI growth jumped 10.5% from the previous year, exceeding initial expectations. ACC's performance, combined with the overall strength of the residential REIT sector, highlights the potential for student housing as an attractive investment opportunity.

Image: Hoya Capital

Image: Hoya Capital

Despite its rally from the pandemic lows, ACC still offers an attractive valuation compared to other REIT sectors and its multifamily peers. With a dividend yield of 3.7% and trading at a significant discount to the average multifamily REIT, ACC presents an opportunity for investors. The company's deep NAV discount and the growing institutional interest in student housing make it a potential takeout candidate.

Image: Hoya Capital

Image: Hoya Capital

The Dynamics of Student Housing

Student housing, as an asset class, has gained prominence in recent years, attracting institutional capital seeking countercyclical investments. Traditional student housing facilities offer amenities tailored to students at affordable prices. These assets operate on a "by bed" rental model and have a shorter leasing window. However, they are also susceptible to changes in university housing policies and potential vacancy losses.

Image: Hoya Capital

Image: Hoya Capital

Compared to multifamily apartment REITs, student housing operates at slightly lower margins due to increased leasing costs and turnover. However, student housing operators, like ACC, benefit from lower property taxes and potential revenue streams from public-private partnerships with universities. These partnerships enable the development of modern housing facilities, supported by the university's guarantee of a steady flow of renters.

Image: Hoya Capital

Image: Hoya Capital

Back to School, Finally!

American Campus Communities, along with the broader student housing sector, has experienced a much-anticipated rebound as students return to campus. Despite challenges at the national level, student housing fundamentals in top-tier university markets have improved. ACC's position as a leader in student housing development, coupled with its deep NAV discount and institutional interest, positions it as a potential takeout candidate.

Image: Hoya Capital

Image: Hoya Capital

For more insightful analysis of real estate sectors, check out our quarterly reports on various topics. Please note that Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. Additionally, Hoya Capital holds positions in the Hoya Capital Housing 100 Index and the Hoya Capital High Dividend Yield Index.

Image: Hoya ETFs

Image: Hoya ETFs