Image: Konoplytska

Image: Konoplytska

REIT Rankings: Apartments

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on June 14th.

Image: Hoya Capital

Image: Hoya Capital

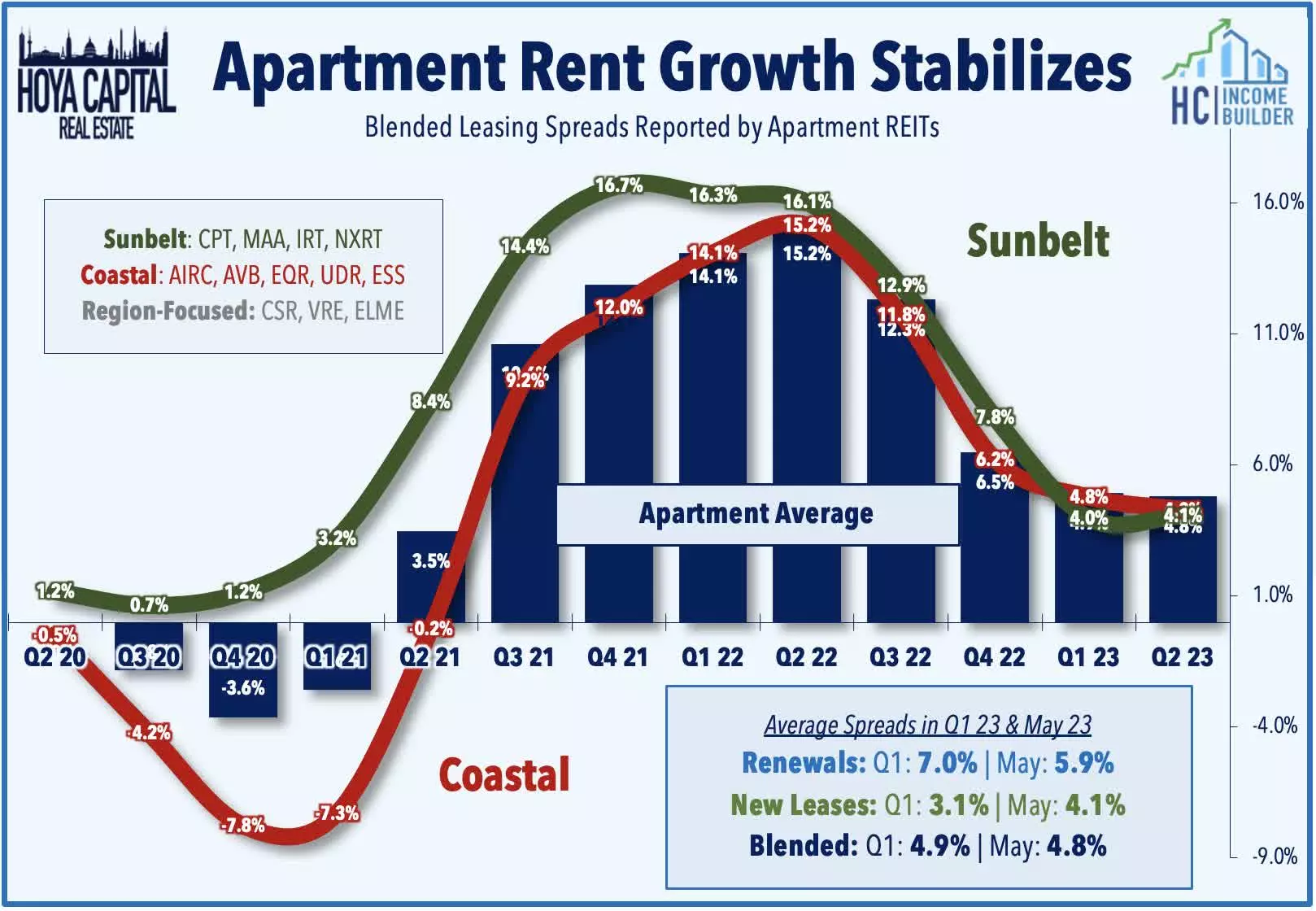

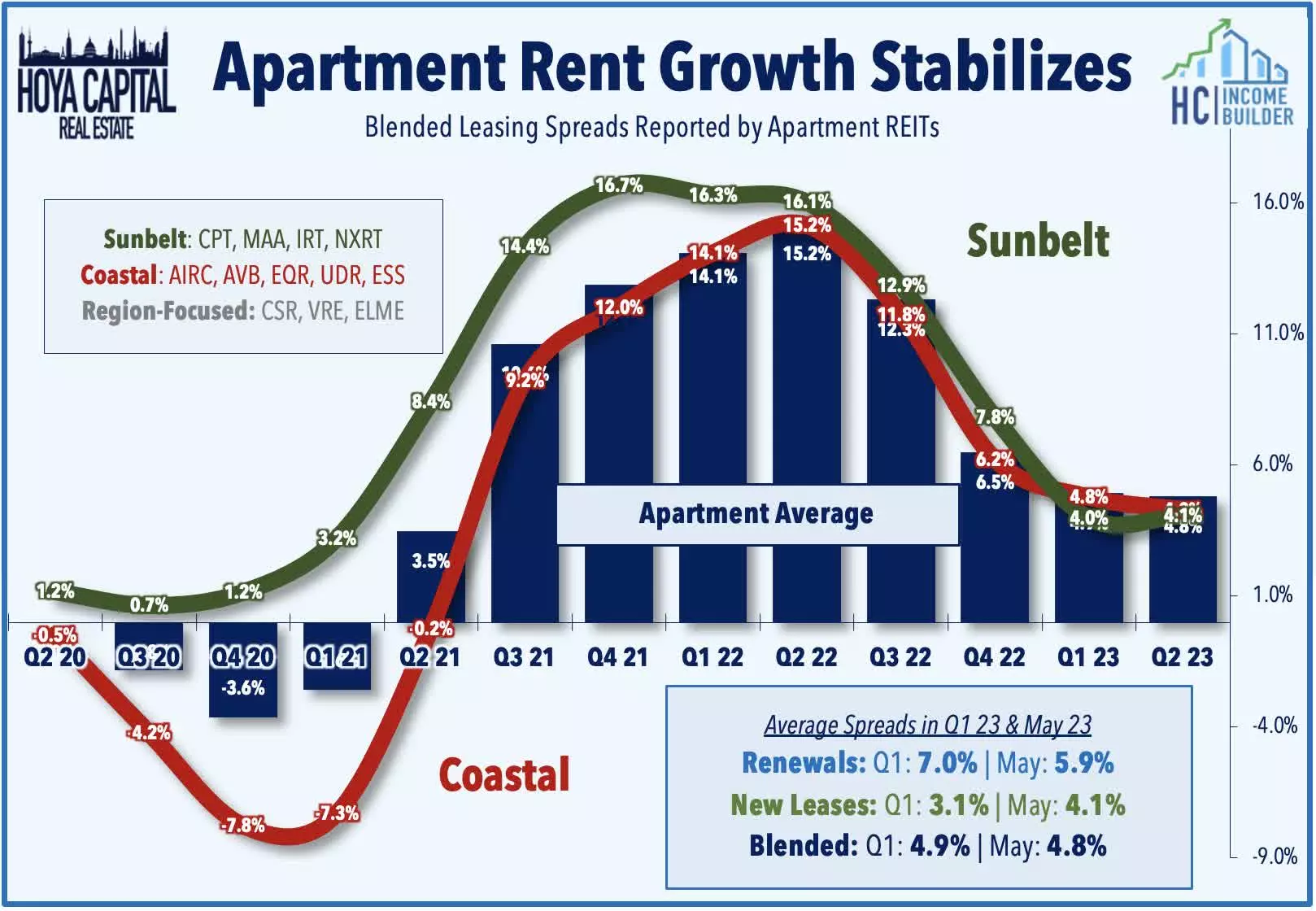

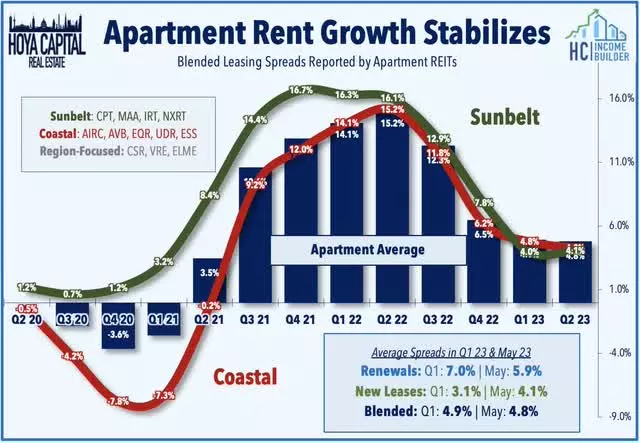

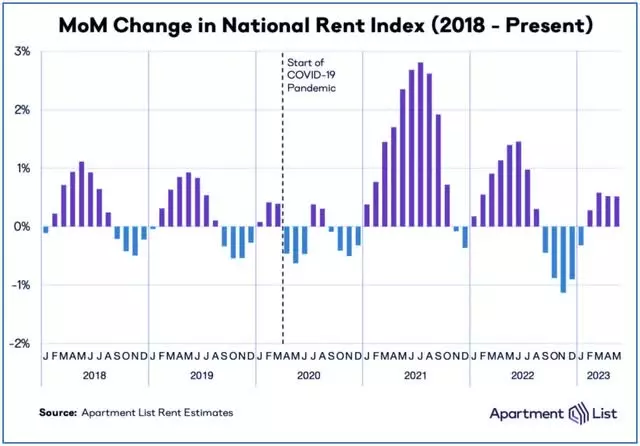

Apartment REITs, once left for dead in late 2022, are now the third-best-performing property sector, thanks to surprisingly strong property-level fundamentals. The Hoya Capital Apartment REIT Index tracks the fifteen largest apartment REITs in the US, which collectively own over a million rental units and account for approximately $130 billion in market value. While Apartment REITs had a lackluster performance in 2022, they've rebounded this year as concerns of a "hard landing" in rental markets have proven to be unfounded. Recent industry data indicates a stabilization in rent growth, with a reacceleration in fundamentals since bottoming in January.

Image: Hoya Capital

Image: Hoya Capital

Relief may be on the horizon for renters who have been facing double-digit rent increases. Rent growth has moderated significantly since peaking in 2021, and recent apartment REIT earnings and guidance have challenged the narrative of a "crash" in rental markets. While rent growth on new leases has cooled to around 3.5% in 2023, renewal spreads have remained firm at above 6%. This stability in renewal spreads has led Apartment REITs to expect strong average same-store NOI growth of nearly 7% and FFO growth of around 4% in 2023, making them one of the highest performing sectors in the REIT industry.

Image: Hoya Capital

Image: Hoya Capital

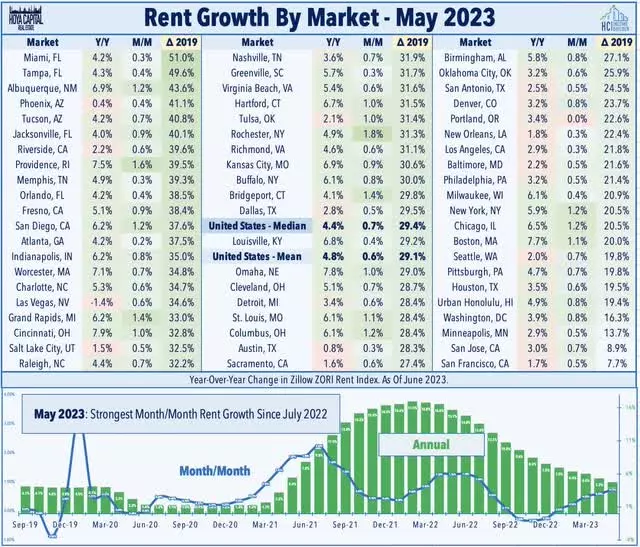

Despite concerns about supply, recent data and forecasts suggest a steady normalization in rent growth and a modest increase in vacancy rates. While some markets have seen price declines in other commodities, apartment REITs have remained resilient. Market-level performance has varied, with Northeast and Midwest markets showing the strongest rent growth, while some Sunbelt markets experienced pockets of supply growth. However, West Coast markets have remained weak.

Image: Hoya Capital

Image: Hoya Capital

The apartment market's performance is consistent with data from Zillow, which shows a moderation in rent growth but also a sequential month-over-month increase for the fifth straight month. Apartment List data also indicates rent growth and notes that Midwestern markets represent some of the last bastions of affordability. While some forecasts anticipate tempered rent growth due to supply, several data providers foresee rent growth ranging from 2.6% to 2.9% in 2023.

Image: Hoya Capital

Image: Hoya Capital

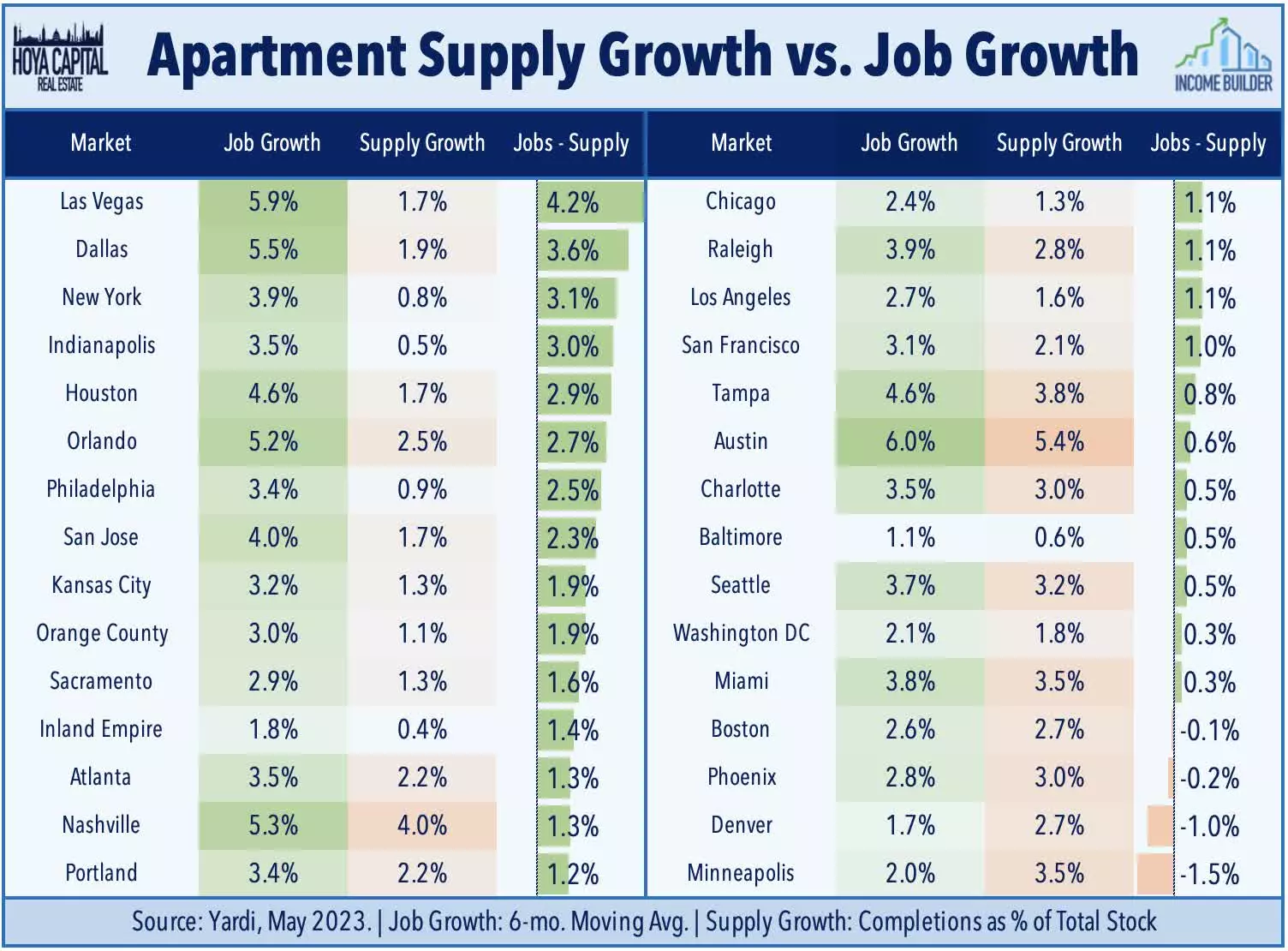

Supply concerns have been a factor dampening market sentiment, but the actual supply growth appears more manageable than perceived. Multifamily starts increased in 2021 and 2022, offsetting single-family development declines. The number of under-construction units has swelled to nearly 1 million units, and Yardi predicts a 2.9% increase in stock in 2023. While some markets may experience supply growth, job growth should be considered as an indicator of apartment demand. Some supply-heavy markets remain undersupplied relative to demand.

Image: Hoya Capital

Image: Hoya Capital

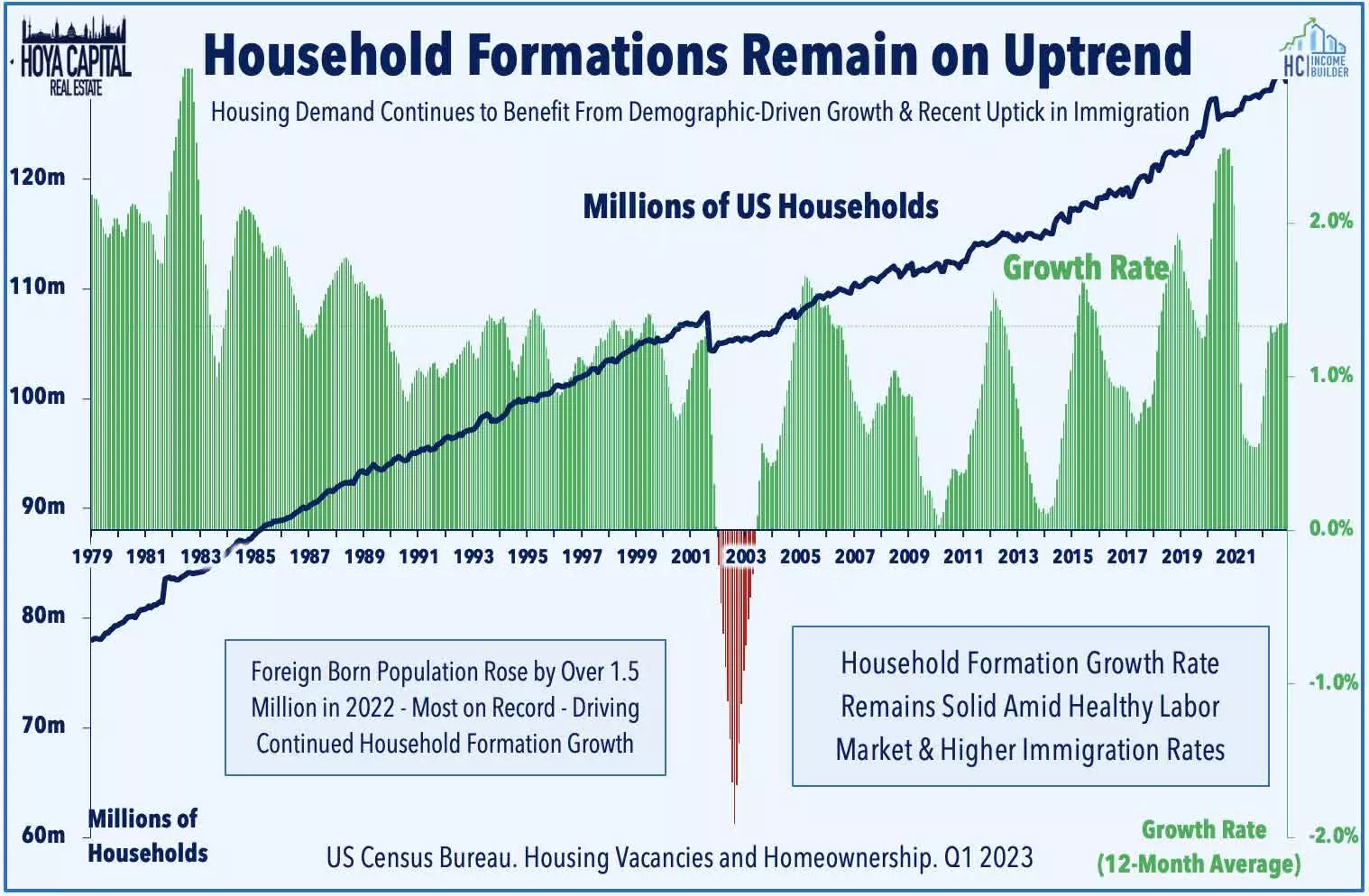

Demographics and changes in housing demand also contribute to the positive outlook for apartment REITs. The millennial generation, the largest cohort in American history, is entering the housing market, adding to the already undersupplied housing market. The pandemic's "Work From Home era" has accelerated household formations, and stronger-than-expected household formation trends align with population estimates that have been underestimated due to the undercounting of immigrant populations. These factors, along with increased net international migration, have boosted the US population, driving housing demand.

Image: Hoya Capital

Image: Hoya Capital

Apartment REIT Fundamentals

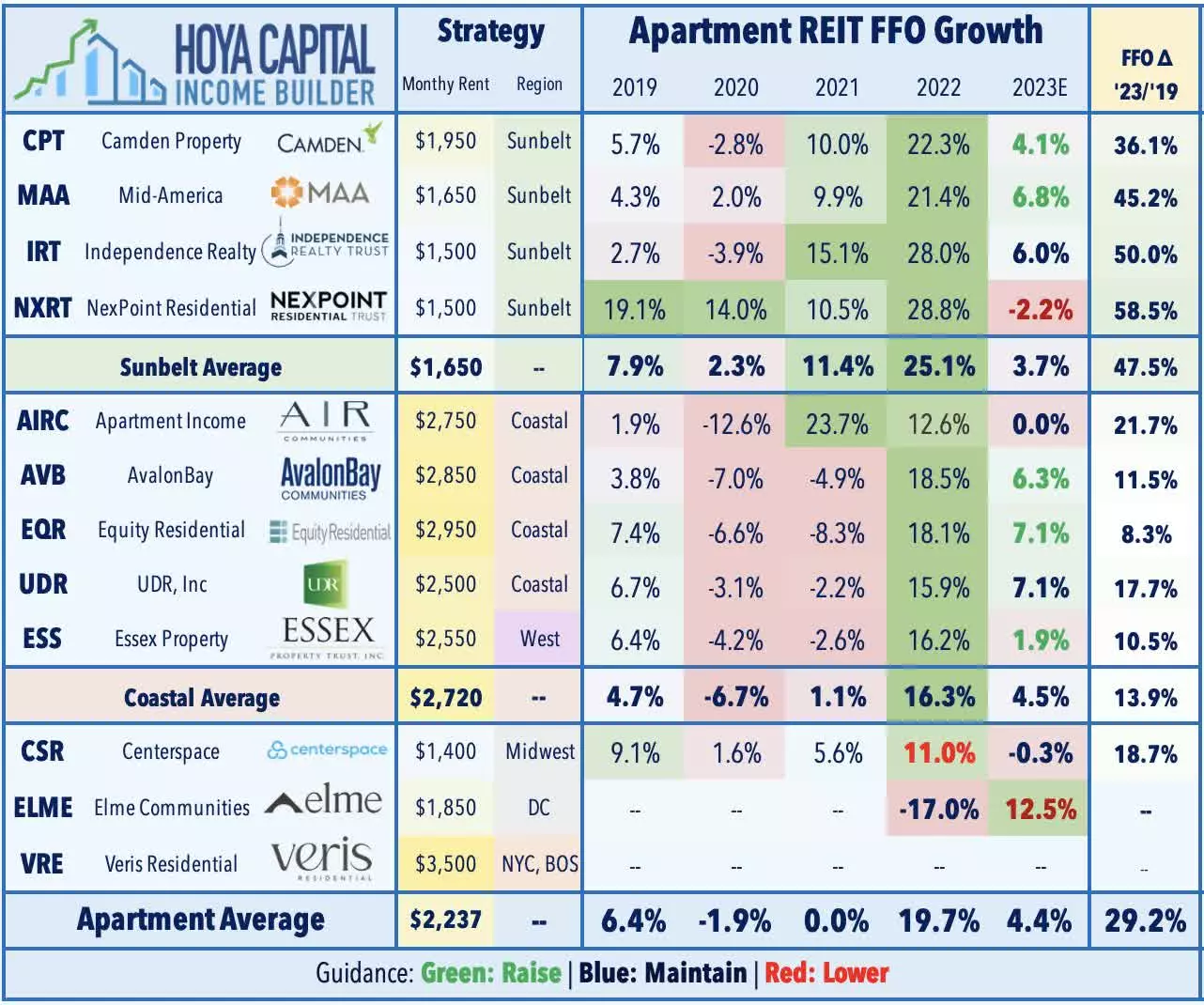

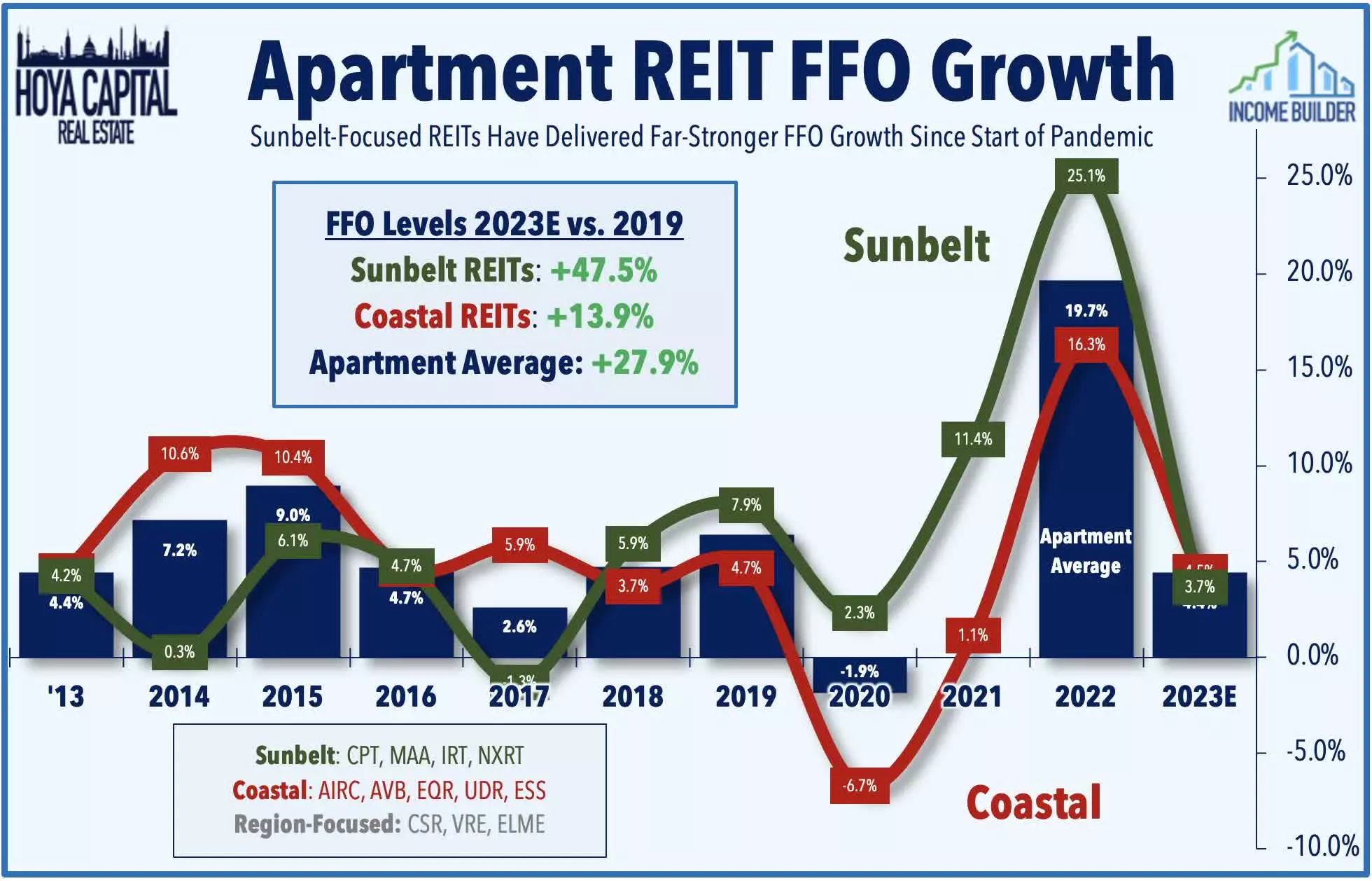

Apartment REITs have delivered strong earnings growth, with 2022 FFO growth of 19.7% - the second highest in the real estate industry. The upgraded outlook for 2023 indicates an average FFO growth of 4.4%, which would be among the strongest in the REIT industry. Renewal rent growth has been a key driver, with high-single-digit growth reported in Q1 and steady performance over the past three quarters. The coastal-focused REITs have shown impressive results, with some reporting double-digit blended spreads. Renewal rates have remained steady, even as new lease rates have slowed down.

Image: Hoya Capital

Image: Hoya Capital

Deeper Dive: Apartment REIT Portfolios

Apartment REITs have balanced geographical exposure across major US markets, with a focus on coastal or sunbelt and secondary markets. Their portfolios typically include a mix of luxury high-rise, mid-rise, and garden-style apartment communities. Some REITs are more geographically concentrated, deriving a significant portion of their revenues from specific regions such as New York City or Washington DC. Additionally, the composition of portfolios in terms of urban or suburban assets and Class A or Class B segments is crucial. Secondary and tertiary markets have seen lower supply growth, with luxury development concentrated in certain areas.

Image: Hoya Capital

Image: Hoya Capital

Apartment REIT Stock Performance

The Hoya Capital Apartment REIT Index has rebounded in 2023, outperforming the broad-based Vanguard Real Estate ETF and the SPDR S&P MidCap 400 ETF Trust. Apartment REITs have consistently been among the top performers in the REIT sector, delivering average annual returns of 15% from 2010 to 2022. Coastal-focused REITs, including AvalonBay, Equity Residential, and Essex, have experienced double-digit percentage gains this year.

Image: Hoya Capital

Image: Hoya Capital

Apartment REIT Dividend Yields

Apartment REITs have shown their resilience by maintaining strong dividend payouts. They were among the few REITs that raised their distributions during the pandemic. With an average dividend yield of 3.8%, slightly below the sector average, apartment REITs have demonstrated consistent dividend growth of around 3% since 2015. Their payout ratio is around 60%, providing flexibility for future growth opportunities or increased distributions. Several apartment REITs, including Independence, NexPoint Residential, and UDR, have already raised their dividends in 2023.

Image: Hoya Capital

Image: Hoya Capital

Takeaway: Return of 'Inflation-Plus' Growth

The rising cost of housing has become a common concern for renters and homeowners alike. However, apartment REITs have demonstrated resilience and remain an attractive investment opportunity. Rent growth has stabilized within the typical "inflation-plus" range of 4-5%, indicating a lingering undersupply of housing. The strengthening of rental rate and occupancy trends, coupled with the ongoing housing shortage, makes the multifamily sector an appealing investment. Sunbelt-focused REITs have delivered exceptional performance, and mid-cap REITs are potential targets for M&A activity. As the housing market continues to evolve, apartment REITs offer investors a chance to benefit from rising rents and real estate opportunities.

Image: Hoya Capital

Image: Hoya Capital