Bakersfield, California may not be as well-known as its coastal counterparts like Los Angeles or San Francisco, but it is a hidden gem in the state's real estate market. Nestled in the middle of the inland empire, Bakersfield offers affordable housing, a growing job market, and a stable economy. In this article, we will explore the Bakersfield housing market, its current trends, and the forecast for the upcoming years.

Bakersfield: A City on the Rise

With a population of around 400,000 people, Bakersfield is the ninth-largest city in California. The Bakersfield metro area is home to nearly 900,000 people and has been experiencing consistent growth over the past decade. Bakersfield's real estate market has seen impressive appreciation rates, with a 150.36 percent increase in the last ten years, equivalent to an average annual appreciation rate of 9.61 percent.

In the last twelve months alone, Bakersfield's appreciation rates have remained among the highest in the country, at 23.78 percent. This is higher than the appreciation rates in 88.41 percent of cities and towns across the United States. Short-term real estate investors have found success in Bakersfield, with an appreciation rate of 8.40 percent in the most recent quarter, resulting in an annual appreciation rate of 38.05 percent.

Despite a recent study that raised concerns about the housing market in Bakersfield, local real estate professionals have dismissed the findings as exaggerated. They believe that the market is steady, if not improving. Bakersfield was ranked 36th in a report by GOBankingRates, "50 Housing Markets That Are Turning Ugly," which evaluated risk variables such as price appreciation, foreclosure rates, and marketing delays.

Bakersfield Housing Market Trends 2022

According to the real estate company Redfin, the Bakersfield housing market is highly competitive. In May 2022, Bakersfield home prices were up 19.5% compared to the previous year, with a median price of $389K. On average, homes in Bakersfield sell after 10 days on the market, slightly higher than the previous year's average of 9 days. Despite a slight decrease in the number of homes sold in May, from 579 to 492, Bakersfield remains a desirable market for buyers.

Many homes in Bakersfield receive multiple offers, some with waived contingencies. The average homes sell for about 2% above the list price and go pending in around 10 days. These statistics indicate a competitive market and a high demand for housing in Bakersfield.

Bakersfield Rental Market Trends

The rental market in Bakersfield is also experiencing growth. As of June 30, 2022, the average rent for a 1-bedroom apartment in Bakersfield is $1,060, reflecting a 13% increase compared to the previous year. The average rent for a studio apartment decreased by 3% to $925, while the rent for a 2-bedroom apartment remained flat. The average rent for a 2-bedroom apartment is currently $1,348, up 23% from the previous year, and for a 3-bedroom apartment, it is $1,900, up 27%.

Bakersfield Real Estate Market Forecast 2022-2023

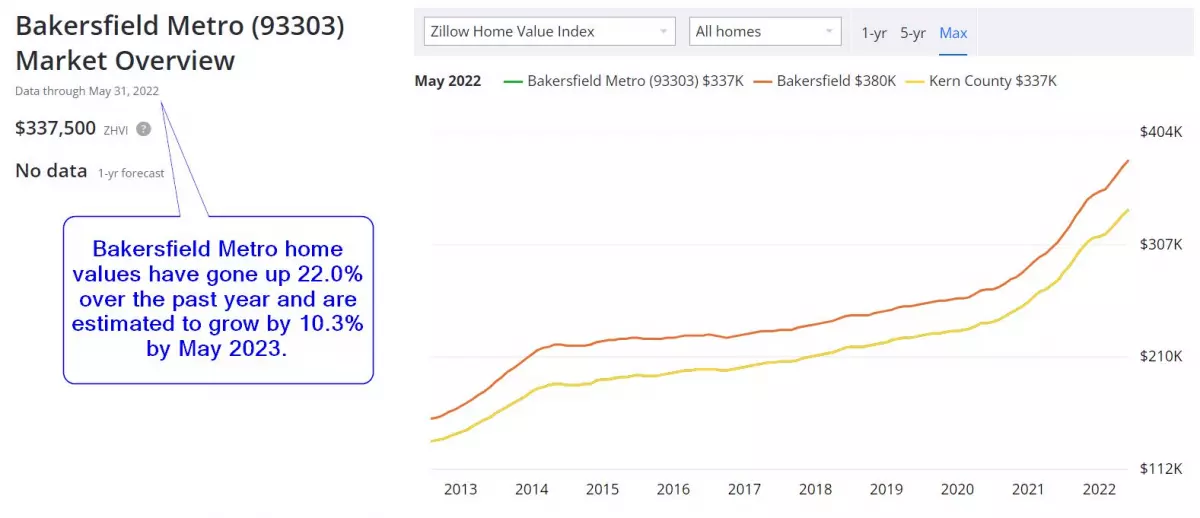

The Bakersfield real estate market is projected to remain hot in the coming years. According to Zillow, the typical home value in Bakersfield is $342,791. Home prices in Bakersfield have been steadily increasing, with an 11% rise from 2019 to 2020 and an impressive 22.6% increase in the past year.

Zillow predicts that Bakersfield home prices will continue to rise, with a forecasted increase of 10.3% by May of next year. This positive forecast indicates that Bakersfield real estate will be a profitable investment opportunity in the future.

Graph Credits: Zillow.com

Graph Credits: Zillow.com

Bakersfield Real Estate Investment Overview 2022

Investing in real estate in Bakersfield can be a wise decision with several factors working in favor of investors. Here are some key points to consider:

1. Affordability

The median home price in the Bakersfield housing market is $340,000, making it relatively affordable compared to other cities in California. The lower cost of living, coupled with a median age of around 30, attracts young families and individuals looking to save for the future or pay off debt while still enjoying the benefits of homeownership.

2. Demographic Momentum

Bakersfield is experiencing steady population growth, attracting migrants from neighboring areas due to its affordable housing options and job opportunities. The median wage of over $56,000 a year and a relatively low unemployment rate make Bakersfield an attractive place to live and work. With a median age of around 30, the city is likely to see continued demand for housing in the coming years.

3. Stable Job Market

Despite California's overall economic challenges, Bakersfield has managed to maintain a stable job market with an unemployment rate of around five percent. The availability of decent-paying jobs, particularly in sectors like agriculture and education, contributes to the city's economic stability and creates a demand for rental properties.

4. Rental Market Potential

The Bakersfield area has a large rental market fueled by factors such as prevailing wage levels and the presence of colleges and universities. The demand for rental properties is expected to remain strong, providing investors with opportunities for steady rental income.

5. Market Stability

The Bakersfield housing market has demonstrated stability over the years, avoiding rapid rises and falls that can lead to speculation. The appreciation rates have been aligned with population growth, offering investors solid and steady returns on their investments.

6. Reasonable Property Tax Rate

Compared to other regions in California, Bakersfield has a reasonable property tax rate of 1.1 percent on average. This, combined with the relatively lower property prices, results in a lower overall property tax burden for Bakersfield real estate owners.

In conclusion, the Bakersfield housing market presents a promising opportunity for real estate investors. With its affordable housing options, a stable job market, and a growing population, Bakersfield offers a favorable environment for those looking to invest in residential properties. However, as with any investment, thorough research and consultation with a real estate investment counselor are essential to make informed decisions.