Building a real estate empire remains one of the most effective ways to build wealth. By owning rental properties, you can enhance your investment returns and have a steady cash flow. But before you start envisioning a six-figure bank account, there are some essential steps you need to take. In this article, we will guide you through the process of building your own real estate empire. Read on to discover what you need to do, why each step is crucial, and how you can do them right.

Step #1: Get a Real Estate Education

Getting a real estate education is often overlooked by aspiring investors, but it is a critical first step. By learning about the industry, you can make informed decisions, avoid common pitfalls, and understand complex terms and situations. There are many resources available, such as online courses on platforms like Udemy, that cater to beginners and experienced investors alike. Enrolling in real estate schools can also provide you with valuable knowledge, even if you don't plan to become a licensed real estate agent. Remember, knowledge is power when it comes to building a real estate empire.

Getting a real estate education is often overlooked by aspiring investors, but it is a critical first step. By learning about the industry, you can make informed decisions, avoid common pitfalls, and understand complex terms and situations. There are many resources available, such as online courses on platforms like Udemy, that cater to beginners and experienced investors alike. Enrolling in real estate schools can also provide you with valuable knowledge, even if you don't plan to become a licensed real estate agent. Remember, knowledge is power when it comes to building a real estate empire.

Step #2: Pick a Strategy

As you dive deeper into the world of real estate, you will come across various investment strategies. Choosing the right strategy depends on your budget, experience, and time commitment. Here are a few popular options:

- Long-term buy and hold: Perfect for first-time investors, this strategy involves buying a property and renting it out for an extended period. It allows you to learn and earn while minimizing risks.

- Short-term buy and hold: Ideal for run-down properties, this strategy involves making repairs, renting the property, and selling it for a higher price within a year or up to five years.

- House wholesaling: This strategy involves finding a run-down house, putting it under contract with the seller, and then finding an interested buyer willing to purchase the property at a higher price.

- Flipping: Suited for investors with more funds, flipping involves buying a run-down property, making major repairs, and selling it at a higher price.

- BRRR (Buy, Rehab, Rent, and Refinance): Similar to flipping, this strategy involves buying a property, rehabilitating it, renting it out, and then refinancing it to obtain more funds.

When choosing between strategies, consider factors like the potential return on investment, your risk tolerance, and your long-term goals. Additionally, decide between traditional or short-term rental strategies based on the location and target market of your properties.

Step #3: Find Your First Property

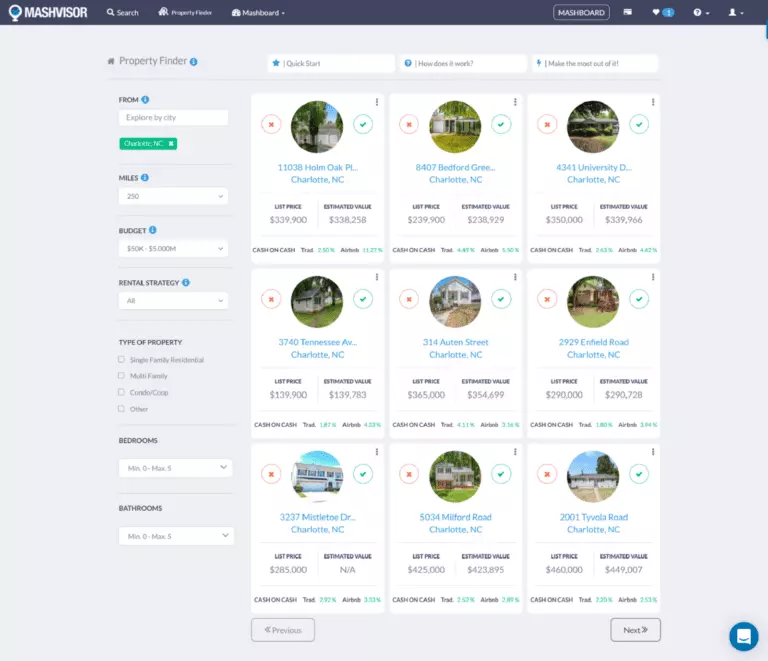

Now that you have a real estate education and have settled on a strategy, it's time to find your first property. One convenient way to search for rental properties is by using online tools like Mashvisor's Property Finder. This tool allows you to filter your search based on property type and optimal rental strategy. It also provides crucial data such as rental income, occupancy rate, and cash-on-cash return. Mashvisor's Property Finder AI can even suggest suitable properties based on your search history and patterns. Don't forget to explore off-market properties as well, which can often be purchased below market value, away from competition.

Step #4: Hire a Property Manager

As you continue to build your real estate empire, managing multiple rental properties can become overwhelming. Hiring a property manager can lighten your workload and ensure efficient property maintenance. Property managers take care of tasks such as coordinating repairs, resolving tenant concerns, marketing your property, and collecting rent. It may cost around 8 to 10% of your rental income, but having professional help gives you more time to focus on expanding your empire. Seek referrals within your network to find a competent property manager, as your portfolio grows, attracting better talent becomes easier.

Step #5: Scale Your Operation

At this stage, you are not just building a real estate empire, but also witnessing money flowing into your account. To further expand your empire, you'll need to acquire more capital. Depending on your chosen strategy:

- For long-term buy and hold, set aside a percentage of your rental income to purchase your next property.

- With short-term buy and hold, use funds from your rental income and the profit from selling properties.

- If you're into wholesaling or flipping, save a portion of the net profit for yourself and use the rest to buy higher-end properties or multiple properties.

- BRRR strategy provides more funds when you refinance your rental property, allowing you to purchase new properties.

By continually scaling your operation, you can exponentially increase your rental income and wealth over time.

Conclusion

Building a real estate empire requires effort and dedication. Start by educating yourself about the industry, choose a suitable investment strategy, find your first property using online tools, and consider hiring a property manager to streamline operations. As you grow, continue expanding your portfolio, acquiring more capital, and building a team. Remember, building a real estate empire is a long-term journey that requires patience and perseverance. But with the right mindset and determination, you can enjoy the rewards of your hard work in due time.

Learn more about our product and start building your real estate empire today.