Have you ever wondered how some people manage to retire early and live life on their own terms? Meet Dr. C., a brilliant physician who achieved financial independence through real estate investing. In one conversation with him, he revealed his secret to success: "Buy one real estate investment property a year." Intrigued by this simple yet powerful advice, I delved deeper into his strategy to uncover the path to early retirement.

The Power of One Property a Year

Dr. C. emphasized that the type of property doesn't matter as much as the act of investing itself. By purchasing one property annually, he steadily built a portfolio that generated passive income and grew in value over time. Inspired, I decided to model his strategy on paper to visualize its potential.

But before we proceed, let's address the age-old debate of simple vs. complex models. As the renowned statistician George Box said, "All models are wrong, but some are useful." The key is to find a model that is simple yet effective, allowing for easy replication and action.

The 10-Year Plan: A Snapshot

Let's take a closer look at what your journey might resemble if you followed Dr. C.'s advice and bought a rental property every year for 10 years. Here are the rules of this model:

- Each property purchased is a single-family home.

- The purchase price remains constant at $100,000.

- You invest 30% ($30,000) of the purchase price each year.

- The home loan starts at $70,000.

- You maintain a maximum of four home loans at any given time.

- Cash flow per property is $400 per month.

- All cash flow is saved and used to pay down the home loans at the end of each year.

- Once a property is paid off, the cash flow increases to $800 per month.

- The appreciation rate is estimated at 3.4% based on the Case-Shiller index.

Now, let's explore the progress you can expect at the end of each year:

Year 1

- Invest $30,000 and acquire your first rental property.

- Cash flow: $400/month ($4,800/year).

- Home #1's loan reduces to $65,200.

Year 2

- Invest an additional $30,000 and obtain your second rental property.

- Cash flow: $9,600/year.

- Home #1's loan decreases to $55,600.

Year 3

- Continue the trend with a new investment of $30,000 and the acquisition of a third rental property.

- Cash flow: $14,400/year.

- Home #1's loan stands at $41,200.

Year 4

- Reach the maximum of four rental properties with a $30,000 investment.

- Cash flow: $19,200/year.

- Home #1's loan is $22,000, while the rest remain at $70,000.

Year 5

- Allocate your $30,000 investment to paying off the remaining loan on Home #1 and reducing Home #2's loan to $62,000.

- Cash flow: $24,000/year.

- Home #2's loan decreases to $38,000.

Year 6

- Invest $30,000 to purchase Home #5.

- Cash flow: $28,800/year.

- Home #2's loan reduces to $9,200.

Year 7

- Use your $30,000 investment to pay off the remaining loan on Home #2 and decrease Home #3's loan to $49,200.

- Cash flow: $33,600/year.

- Home #2's loan is $15,600.

Year 8

- Invest $30,000 in acquiring Home #6.

- Cash flow: $38,400/year.

- Home #3 is paid off, and the remaining cash goes towards Home #4's loan.

Year 9

- Purchase Home #7 with a $30,000 investment.

- Cash flow: $48,000/year.

- Home #4's loan is paid off, and the remaining cash is used to reduce Home #5's loan.

Year 10

- Complete the journey with a $30,000 investment in Home #8.

- Cash flow: $57,600/year.

- The loan on Home #5 is paid off.

Summary After 10 Years

At the end of the 10-year period, the results are remarkable:

- You own eight rental properties, approaching your goal of buying one property per year while adhering to loan restrictions.

- Four properties are completely paid off, contributing to increased cash flow.

- Your annual cash flow amounts to $57,600 ($4,800 per month), comparable to the income from a $2 million portfolio with a 3% drawdown.

- The total equity in your properties is estimated at around $750,000.

- Your total investment over the years amounts to $300,000.

A Snowball Effect and Achievable Dreams

By Year 10, you will begin to witness the snowball effect of your real estate investments, with the cash flow growing significantly. This strategy is highly replicable, making it accessible for most physicians seeking financial independence. Imagine the possibilities that a substantial cash flow can unlock: covering educational expenses or reducing your workload by freeing up shifts.

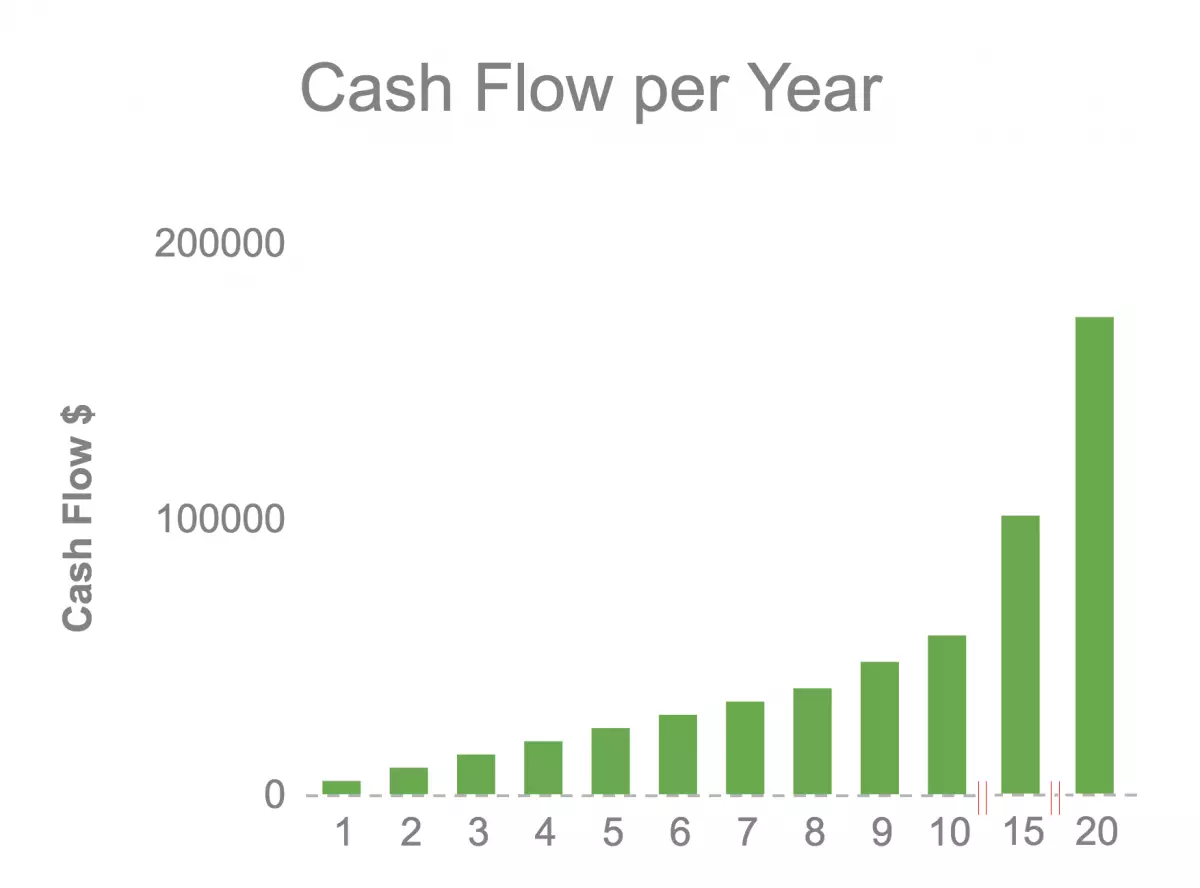

For those seeking an even more extended timeline, I explored the model for 15 and 20 years. However, the cash flow becomes overwhelming, and the model becomes more subjective to individual choices. Nevertheless, the results are noteworthy:

Year 15

- You own 12 homes, with 10 properties paid off.

- Cash flow: $100,800/year ($8,400/month).

- Equity in the properties: approximately $1.4 million.

Year 20

- You own 19 homes, nearing the rate of one property per year, with all 19 paid off.

- Cash flow: $172,800/year ($14,400/month).

- Equity in the properties: around $2.8 million and growing.

It's important to mention that if you were to accumulate a nest egg of $6 million and withdraw 3% annually, your income would approximate $180,000 in the first year alone.

The Path to Financial Independence Starts Here

As you can see, following Dr. C.'s advice and purchasing one property per year can lead to substantial passive income and, ultimately, retirement. Imagine embarking on this journey in your early to mid-30s, right when you become an attending physician. The financial freedom achieved through real estate investing can provide you with the option to work or retire on your own terms.

Speaking from personal experience, I have pursued this strategy and am well on my way, having acquired rental units corresponding to the number of years I have been an attending physician. Join me on this exciting adventure towards passive income and click below to join our waitlist for the next class season. Remember, there is no obligation, and we can't wait to welcome you to our community.