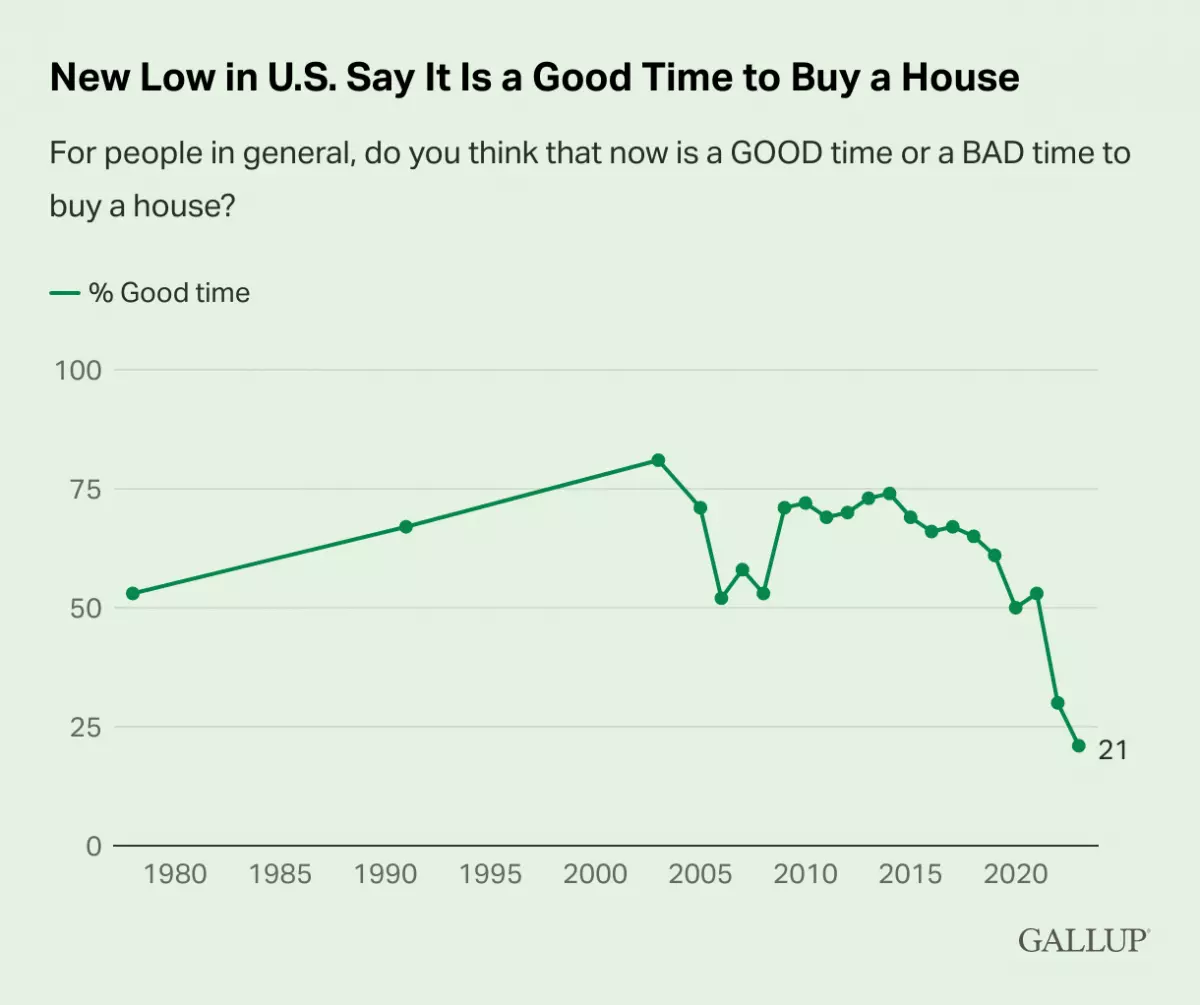

Homebuyers across America are expressing increasing pessimism about the current state of the housing market. According to a recent Gallup poll, only 21% of U.S. adults believe it's a good time to buy a house, marking the lowest percentage since Gallup began conducting its annual poll in 1978. This figure has dropped by 9 percentage points compared to last year, and it's the second time it has fallen below 50%.

The survey, part of Gallup's annual Economy and Personal Finance poll conducted between April 3-25, reveals a widespread bleak outlook on the housing market, transcending demographic boundaries such as region, urbanicity, homeownership status, income, education, and party affiliation.

This downward trend in sentiment is striking, especially considering that during the height of the housing crisis between 2006-2008, Americans remained more optimistic about purchasing a home, with 52% of respondents expressing positivity towards homebuying. This sentiment is now more than 30 percentage points below the levels observed during the Great Recession.

Will home prices continue to increase?

Besides measuring Americans' overall perceptions of the housing market, Gallup also monitors public expectations for housing prices in their respective areas. The survey found that in 2021, 71% of respondents predicted a local home price increase over the next year - the highest percentage since Gallup began tracking the data in 2005. Last year, a similar 70% held this view.

Currently, 56% of respondents believe that home prices in their area will rise, while 25% expect prices to remain the same, and 19% anticipate a decrease. Although expectations have declined compared to last year, they are still relatively high. For instance, between 2009 and 2012, after the housing bubble burst, only between 22% and 34% of respondents expected home prices to increase.

Expectations of home price appreciation vary regionally

Regionally, residents of the Midwest are less likely than those in other parts of the country to believe that local home prices will increase over the next year. While 45% of Midwestern residents expect a rise in prices, the figures for Western, Southern, and Eastern residents are 55%, 61%, and 62%, respectively.

Moreover, there are differences between urban, suburban, and rural areas. Only 45% of residents in towns or rural areas anticipate local home price increases, compared to 64% of city dwellers and 57% of suburban residents.

Real estate still considered the best long-term investment

Despite the pessimism surrounding the current housing market, real estate continues to be the preferred long-term investment for many Americans. When asked to choose the best long-term investment option, 34% of respondents selected real estate. This figure is significantly lower than last year's record-high of 45%, but it is consistent with the proportion observed between 2016 and 2020, before the housing market experienced a surge during the pandemic.

On the other hand, the perception that gold is the best long-term investment has nearly doubled since 2022, rising from 15% to 26% this year. Consequently, gold has surpassed stocks to claim the second position.

While 19% of Americans expect home prices to decrease in the coming year, a much smaller percentage compared to the figures observed in 2008 and 2009, they are less likely now than in the past few years to anticipate price increases. Any stabilization or potentially even a decline in home prices could make housing more affordable, especially if interest rates also stabilize or decline in the future.

In conclusion, the Gallup poll reveals a deepening sense of pessimism among Americans when it comes to buying a house in the current economic climate. The combination of elevated mortgage rates, soaring home prices, and low inventory levels has contributed to this growing frustration. However, expectations for future home price increases remain relatively high, with some regional variations. Despite the challenges, real estate still holds its position as the preferred long-term investment option for many Americans.