The California housing market has been a focal point of interest, particularly in recent months. In this report, we delve into the latest data from November, shedding light on the trends and dynamics affecting the housing market in the Golden State.

How is the California housing market doing currently?

The California housing market is experiencing significant shifts, with existing home sales facing challenges and the median home price showing both resilience and fluctuations.

Current State of California Home Sales

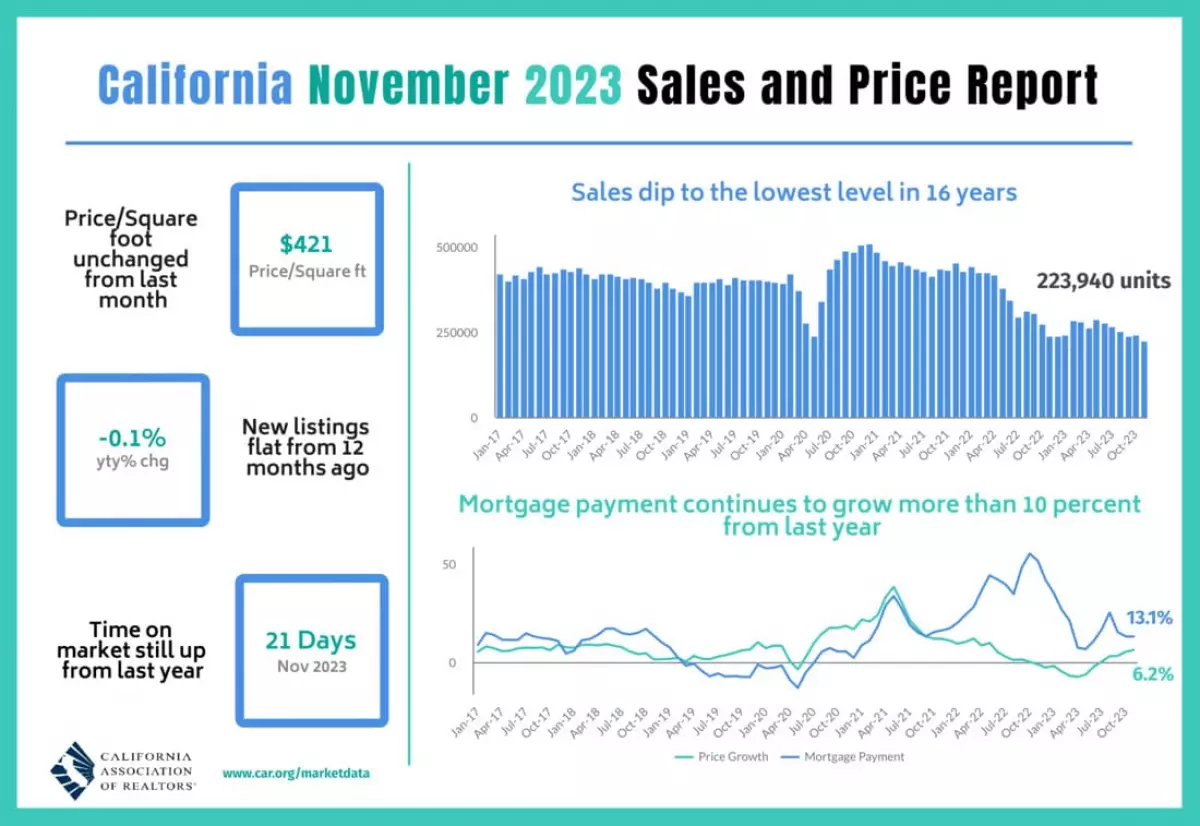

According to the latest report from the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.), existing, single-family home sales in California totaled 223,940 in November. This figure, representing a seasonally adjusted annualized rate, marked a substantial decline of 7.4 percent from October and a 5.8 percent decrease compared to November 2022.

The data further revealed that year-to-date statewide home sales witnessed a notable drop of 25.9 percent in November. The prolonged decline in sales is attributed to elevated borrowing costs, creating a challenging environment for prospective homebuyers.

Impact of Elevated Mortgage Interest Rates

The persistent increase in mortgage interest rates has played a pivotal role in suppressing home sales. The report highlights that as borrowing costs remained elevated, California existing home sales experienced the most significant monthly decline in the past year, reaching the lowest level since the Great Recession.

2024 C.A.R. President Melanie Barker emphasized, “Elevated mortgage interest rates and a persistent shortage of homes for sale hindered home sales in November.” The situation reflects the intricate interplay between market forces and economic factors influencing the real estate landscape.

Median Home Price Trends

While home sales faced challenges, California's median home price exhibited a combination of setbacks and resilience. In November, the statewide median home price was $822,200, indicating a 2.2 percent decline from October but a noteworthy 6.2 percent increase from November 2022.

C.A.R. Senior Vice President and Chief Economist Jordan Levine provided insights into this dynamic, stating, “While sales have been weak for the past several months, a tight supply of homes for sale is keeping home prices from falling.”

Looking Ahead: Prospects for 2024

The real estate landscape might witness a shift in dynamics as mortgage rates dropped to the lowest level in four months, prompting optimism for prospective homebuyers. The Federal Reserve's indication of plans to cut rates in 2024 could also influence market dynamics positively.

As the market anticipates potential changes in borrowing costs and with the spring homebuying season on the horizon, there is a possibility that more sellers will be motivated to list their homes for sale.

Will the California Housing Market Crash in 2024?

Infographic Courtesy of CAR

Infographic Courtesy of CAR

Regional Variances in California's Housing Market

Examining the regional dynamics of the California housing market provides a nuanced understanding of the challenges and opportunities faced by different areas. C.A.R.'s November 2023 resale housing report sheds light on key points that highlight regional variations in home sales and prices.

Regional Sales Trends

On a year-over-year basis, sales in all major regions experienced a dip in November. The Central Valley region stood out with the most significant decline of -14.4 percent from the previous year, closely followed by the Central Coast with a -10.4 percent drop. These two regions were the only ones facing a decline of more than 10 percent compared to the same month last year.

Other regions, including the San Francisco Bay Area (-6.2 percent), Southern California (-5.6 percent), and the Far North region (-5.5 percent), also recorded sales drops but at a more moderate pace. The regional variations highlight the diverse challenges faced by different parts of the state.

County-Level Analysis

At the county level, 34 of the 52 counties tracked by C.A.R. registered a sales decline from a year ago. Notably, 23 counties experienced a drop of more than 10 percent year-over-year, with 12 counties falling more than 20 percent from last November.

The counties with the most significant sales declines include Calaveras (-33.3 percent), Butte (-32.3 percent), and Mendocino (-31.9 percent). Conversely, 15 counties recorded sales increases from the previous year, with San Benito (68.4 percent), Mono (66.7 percent), and Lassen (30.0 percent) leading in year-over-year growth.

Median Price Trends Across Regions

While sales faced fluctuations, home prices demonstrated a more consistent upward trajectory across major regions. All regions experienced at least a 2.7 percent yearly increase in their median prices in November. Southern California led the way with a 9.9 percent year-over-year gain, followed by the Central Coast (6.1 percent), the Central Valley (5.5 percent), the San Francisco Bay Area (4.4 percent), and the Far North (2.7 percent).

County-Level Price Movements

At the county level, 34 counties registered a year-over-year median price gain in November, while 16 counties recorded a decline. Orange County (18.2 percent) witnessed the most substantial price increase, followed by San Benito (17.2 percent) and Yuba (15.5 percent). On the other end of the spectrum, Napa (-22.7 percent) recorded the most significant price decline, followed by Lassen (-19.1 percent) and Mariposa (-12.0 percent).

Housing Inventory Dynamics: Unveiling Trends and Challenges

Delving into the intricacies of the California housing market, the state's housing inventory reveals a complex interplay between sales, active listings, and market dynamics. Understanding the nuances of these factors is crucial in comprehending the current state of real estate in California.

Unsold Inventory Index (UII) and Active Listings

The recent improvement in housing inventory is a notable development, but the driving force behind this change is essential to consider. The statewide unsold inventory index (UII) increased by 11.1 percent on a month-over-month basis to 3.0 months, yet it is important to note that this increase is primarily a result of the decline in sales rather than a surge in active listings.

Active listings at the state level have faced a continuous decline for eight straight months on a year-over-year basis. The past seven months witnessed declines of more than 10 percent year-over-year, indicating a persistent challenge in the availability of homes for prospective buyers.

County-Level Active Listings

Nearly two-thirds of all counties, 31 in total, experienced declines in active listings from the previous year. Of these, 23 counties saw drops of more than 10 percent on a year-over-year basis. Sutter (-38.7 percent), Contra Costa (-35.0 percent), and Alameda (-33.3 percent) posted the most significant year-over-year drops in November.

Conversely, 18 counties recorded a year-over-year gain, with Del Norte leading in yearly growth at 38.3 percent, followed by Yolo (27.7 percent) and El Dorado (25.8 percent). On a month-to-month basis, the majority of counties, 44 out of 50, experienced a decline in active listings, emphasizing the slowing market activity during the holiday season.

New Active Listings Dynamics

While overall active listings faced challenges, new active listings exhibited a more diverse pattern. In 25 of the 50 counties tracked by C.A.R., new active listings increased from the previous year. Notably, Mono experienced a remarkable surge of 633.3 percent, with Tehama (100 percent) and Glenn (80 percent) also witnessing substantial jumps.

Conversely, new active listings in 23 counties declined from the previous year, with San Francisco (-33.7 percent) leading the decreases, followed by Mariposa (-31.3 percent) and Lassen (-23.5 percent).

Median Days on Market and Sales-Price-to-List-Price Ratio

The median number of days it took to sell a California single-family home was 21 days in November, reflecting a relatively brisk pace in the market. Additionally, C.A.R.'s statewide sales-price-to-list-price ratio was 100 percent in November 2023, indicating a strong correlation between listing prices and actual sales prices. This ratio represents a slight increase from 96.7 percent in November 2022, suggesting a tightening market.

ALSO READ: Will the US Housing Market Crash?

California Housing Market Forecast 2023: Recently Revised

Based on the latest data and market conditions, the California Association of Realtors (C.A.R.) has revised its Housing Market Forecast for 2023. The forecast provides insights into the projected trends and expectations for the housing market in the state. Overall, it indicates a challenging market environment in California, with a decline in home sales and a projected decrease in median home prices compared to the previous year.

The revised Housing Market Forecast, released in April 2023, differs from the California Housing Forecast released by the C.A.R. on October 12, 2022. Here are the key differences between the two forecasts:

-

October 2022 Forecast: The forecast projected existing single-family home sales to total 333,450 units in 2023, representing a decline of 7.2% from the projected pace of 359,220 units in 2022.

-

April 2023 Revised Forecast: The revised forecast estimates a steeper decline in existing single-family home sales, with 279,900 units projected to be sold in 2023. This reflects an 18.2% decrease compared to the 342,000 units sold in 2022.

-

October 2022 Forecast: The forecast predicted a decline in California's median home price by 8.8% to $758,600 in 2023, following a projected 5.7% increase to $831,460 in 2022.

-

April 2023 Revised Forecast: The revised forecast also expects a decline in the median home price, but the projected figure is slightly higher at $776,600, reflecting a 5.6% decrease from the median price of $822,300 recorded in 2022.

Overall, the revised forecast released in April 2023 indicates a more pessimistic outlook for the California housing market compared to the October 2022 forecast. It predicts a steeper decline in home sales and a slightly higher median home price decrease. These adjustments likely reflect the changing market conditions and factors influencing the California housing market over time.

The revised forecast takes into account various factors influencing the housing market, such as mortgage rates, inventory levels, buyer demand, and economic conditions. The decline in home sales is primarily attributed to higher mortgage rates and the limited availability of homes on the market. These factors have contributed to a decrease in buyer activity and overall sales volume.

Despite the decline in sales, the median home price in California is expected to remain relatively high. The increase in market competition, with homes spending less time on the market and a higher percentage of homes selling above asking price, has influenced the rise in median home prices.

It is important to note that the forecasted figures are based on current market conditions and historical trends. However, unforeseen events or changes in economic factors can influence the actual performance of the housing market throughout the year.

Here's the snapshot of the California Housing Forecast for 2023 which was released by the C.A.R. on October 12, 2022.

Where Will Home Prices Drop in California?

Source: Zillow

Source: Zillow

According to Zillow, the latest data, as of November 30, 2023, reveals that the average home value in California is $746,055, reflecting a 2.3% increase over the past year. Notably, homes in the state go to pending status in approximately 16 days, showcasing a dynamic and competitive market.

Key Metrics for November 30, 2023

- For Sale Inventory: 64,262 homes

- New Listings: 22,062 homes

- Median List Price: $729,600

These metrics offer a snapshot of the available inventory and the influx of new listings, highlighting the vibrancy of real estate activity in California.

Median Sale Price and Sale-to-List Ratio (October 31, 2023)

- Median Sale Price: $697,167

- Median Sale to List Ratio: 1.000

The median sale price and sale-to-list ratio provide crucial insights into the pricing dynamics, emphasizing the correlation between listed and actual sale prices in the market.

Sales Price Distribution (October 31, 2023)

- Percent of Sales Over List Price: 49.4%

- Percent of Sales Under List Price: 37.2%

The distribution of sales prices over and under the list price sheds light on the competitiveness of the market and the negotiation dynamics between buyers and sellers.

Market Dynamics: Is California a Buyer's or Seller's Market?

Understanding whether the current state of the housing market favors buyers or sellers is crucial for making informed decisions. The data indicates a market where 49.4% of sales are happening over the list price, suggesting a seller's market. However, the presence of 37.2% of sales under list price introduces a level of balance, indicating opportunities for buyers as well.

Are Home Prices Dropping?

As of the latest data, there is no indication of a significant drop in home prices. The 2.3% increase in average home value over the past year demonstrates a steady appreciation rather than a decline. This stability in home values contributes to the overall confidence in the California real estate market.

Top 10 Areas in California for Home Price Decline in 2024

1. Ukiah, CA

In Ukiah, California, the Metropolitan Statistical Area (MSA) is projected to see a decline in home prices. The forecast indicates a decrease of -1% by the end of December 2023, followed by a more substantial decline of -3.1% by February 2024. The trend continues with an anticipated decline of -7.8% by November 2024. These projections suggest a challenging environment for homeowners and a potential opportunity for buyers seeking more favorable pricing.

2. San Jose, CA

The city of San Jose, a significant economic hub in California, is also expected to witness a decline in home prices. The forecast shows a modest increase of 0.3% by the end of December 2023, followed by a more pronounced decline of -2.8% by February 2024. The downward trend continues with an anticipated decrease of -6.1% by November 2024. These projections highlight potential challenges for homeowners in the San Jose area.

3. Eureka, CA

In Eureka, California, the MSA is forecasted to experience a decline in home prices, starting with a decrease of -0.7% by the end of December 2023. The decline continues with an expected drop of -2.4% by February 2024 and a more significant decrease of -5.8% by November 2024. This forecast signals a market shift that may impact both sellers and buyers in the Eureka region.

4. San Francisco, CA

San Francisco, known for its vibrant real estate market, is projected to see a decline in home prices. The forecast indicates a modest decrease of -0.3% by the end of December 2023, followed by a more notable decline of -1.6% by February 2024. The trend continues with an anticipated decrease of -4.8% by November 2024. These projections suggest a potential adjustment in the San Francisco housing market.

5. Sonora, CA

Sonora, located in California's MSA, is expected to experience a decline in home prices. The forecast begins with a decrease of -0.8% by the end of December 2023, followed by an anticipated drop of -2.4% by February 2024. The downward trend continues with an expected decrease of -4.8% by November 2024. These projections signal a shift in market dynamics in the Sonora region.

6. Santa Rosa, CA

The Metropolitan Statistical Area of Santa Rosa in California is also included in the areas with expected decreases in home prices. The forecast begins with a modest decline of -0.3% by the end of December 2023, followed by a more notable decrease of -1.4% by February 2024. The trend continues with an anticipated decrease of -4.7% by November 2024. These projections suggest potential challenges for homeowners in Santa Rosa.

7. Clearlake, CA

In Clearlake, California, the Metropolitan Statistical Area (MSA) is part of the areas with forecasted decreases in home prices. The projections indicate a decrease of -0.6% by the end of December 2023. The downward trend continues with an anticipated drop of -1.8% by February 2024 and a more substantial decrease of -4.5% by November 2024. These forecasts suggest a market adjustment in Clearlake, potentially impacting both sellers and buyers in the region.

8. Chico, CA

Chico, California, is another MSA in the state with expected decreases in home prices. The forecast begins with a decline of -0.6% by the end of December 2023. The downward trend continues with an anticipated drop of -2% by February 2024 and a more notable decrease of -4.3% by November 2024. These projections highlight potential challenges for homeowners in the Chico area.

9. Truckee, CA

Truckee, located in California's MSA, is forecasted to experience a decline in home prices. The projections start with a decrease of -0.5% by the end of December 2023, followed by an anticipated drop of -1.9% by February 2024 and a more significant decrease of -4.2% by November 2024. This forecast signals a market shift in the Truckee region that may impact both sellers and buyers.

10. Napa, CA

Napa, California, is also included in the areas with expected decreases in home prices. The forecast begins with a modest decline of -0.4% by the end of December 2023. The downward trend continues with an anticipated drop of -1.5% by February 2024 and a more notable decrease of -3.8% by November 2024. These projections suggest a potential adjustment in the Napa housing market that could present challenges for homeowners.

California Housing Market Forecast 2024 [By C.A.R.]

Source: C.A.R.

Source: C.A.R.

On September 20, 2023, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) released its highly anticipated “2024 California Housing Market Forecast,” outlining key projections for the state's housing market in the upcoming year.

Positive Rebound in California Housing Market

In 2024, the California housing market is expected to experience a rebound, primarily attributed to a decrease in mortgage rates. The forecast predicts a substantial increase of 22.9 percent in existing, single-family home sales compared to the projected pace of 2023.

Sales and Prices Projection

The forecast estimates a total of 327,100 units in single-family home sales for 2024, showcasing a promising rise from the projected 266,200 units in 2023. Additionally, California's median home price is anticipated to climb by 6.2 percent to $860,300 in 2024.

Market Environment and Factors Influencing the Forecast

Factors like slower economic growth and cooling inflation are anticipated to bring down mortgage interest rates, creating a more favorable market environment to stimulate California home sales in the coming year. A housing shortage and competitive market are expected to continue exerting upward pressure on home prices.

Economic Indicators and Job Growth

The forecast takes into account economic indicators, predicting a modest 0.7 percent increase in the U.S. gross domestic product for 2024. The state's nonfarm job growth rate is estimated to be 0.5 percent. However, the unemployment rate is expected to slightly increase to 5.0 percent in 2024 from the projected 4.6 percent in 2023.

Impact on Mortgage Rates and Housing Supply

With the expected softening of the economy in 2024, the Federal Reserve Bank is predicted to loosen its monetary policy, leading to a downward trend in mortgage rates throughout the year. This could provide buyers with greater financial flexibility, resulting in increased housing demand and further upward pressure on home prices. Despite an expected increase in active listings, housing supply is projected to remain below the norm.

The “2024 California Housing Market Forecast” by C.A.R. paints an optimistic picture of the state's housing market, anticipating a significant rebound in home sales and a notable increase in median home prices. This forecast considers various economic factors and market conditions, providing valuable insights for both buyers and sellers. As the year unfolds, the actual market performance will undoubtedly shed more light on the accuracy of these projections.

Is It a Good Time to Buy a House in California?

The decision of whether it's a good time to buy a house in California hinges on various intricate factors that characterize the ever-changing California housing market. Recent data from the California Association of REALTORS® (C.A.R.) illuminates the current market sentiment and professional predictions, aiding in the assessment of this pivotal question.

Considering the market dynamics as of the week ending December 9, 2023, here's a breakdown to determine the opportune timing for prospective homebuyers in the state:

Market Activity

Examining the week's activity ending on December 9, 2023, the following daily average figures were observed:

- Closed Sales: 418 per day

- Pending Sales: 408 per day

- New Listings: 385 per day

These daily average figures reflect the robust activity in the market, with a significant number of closed and pending sales, along with new listings entering the market. This level of activity may indicate a dynamic and competitive environment for buyers.

Realtors' Insights

Insights from real estate professionals are crucial in understanding the trajectory of the market. As of the specified week, the perspectives of realtors are as follows:

- Realtors Anticipating Increase in Sales: 8.4%

- Realtors Anticipating Increase in Prices: 9.7%

- Realtors Anticipating Increase in Listings: 11.5%

These insights from real estate professionals indicate a degree of optimism in the market. While a portion of realtors anticipates an increase in sales and prices, a notable percentage also foresees an increase in listings. This balance of perspectives suggests a nuanced market with potential opportunities for both buyers and sellers.

Considering the Trends

Based on the trends observed in December, it's important to weigh various factors:

- Market Dynamics: The high daily averages of closed and pending sales, along with new listings, indicate a vibrant market with active buyer and seller participation.

- Realtors' Optimism: The positive outlook from real estate professionals suggests confidence in the market's trajectory, with expectations of increased sales, prices, and listings.

- Regional Forecasts: Considering the forecasted decreases in home prices in specific regions for 2024, buyers may find opportunities in areas experiencing adjustments.

While the market activity in December showcases a dynamic real estate landscape in California, the decision to buy a house depends on individual circumstances, preferences, and the specific dynamics of the desired location. Prospective buyers should consult with real estate professionals and stay informed about regional trends to make well-informed decisions aligned with their goals.

Housing Affordability Trends in California - 3rd Quarter 2023

Source: Housing Affordability Index By C.A.R.

Source: Housing Affordability Index By C.A.R.

The housing market in California has long been known for its high prices and competitive nature. California housing affordability has reached a 16-year low, according to the latest report from the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.). The third quarter of 2023 witnessed a significant downturn, with only 15 percent of households able to afford the median-priced home, reflecting a decline from 16 percent in the previous quarter and 18 percent in the same quarter last year.

Key Statistics:

- Median Home Price: $843,600

- Minimum Annual Income Required: $221,200

- Monthly Payment: $5,530

- Interest Rate: 7.14%

This quarter marked a turning point as the effective interest rate surged to a two-decade high of 7.14 percent, up from 6.61 percent in the second quarter of 2023 and 5.72 percent in the third quarter of 2022. This increase in borrowing costs has contributed to the decline in housing affordability, pushing it to the lowest level since 2007.

Single-Family Homes:

Less than one in five home buyers (15 percent) could afford a median-priced, existing single-family home in California during the third quarter of 2023. This is a substantial drop from the peak of 56 percent in the first quarter of 2012. A minimum annual income of $221,200 was necessary to qualify for the purchase, with monthly payments, including taxes and insurance, amounting to $5,530.

The effective composite interest rate crossing the 7 percent mark for the first time in over two decades has added to the challenges. However, there is hope that a potential economic slowdown could result in rate drops, providing relief to both the supply and demand sides of the housing market and improving affordability in the coming quarters.

Condominiums and Townhomes:

For condominiums and townhomes, the scenario is slightly different. Twenty-three percent of home buyers were able to afford the $650,000 median-priced condo or townhome. However, this represents a decline from the previous quarter's 25 percent and the third quarter of 2022's 28 percent. A minimum annual income of $170,400 was required to make a monthly payment of $4,260.

Nationwide Comparison:

Comparing California with the national average, more than a third of the nation's households could afford a $406,900 median-priced home, requiring a minimum annual income of $106,800 for monthly payments of $2,670. Despite this, nationwide affordability has decreased from 39 percent a year ago.

Thus, the third quarter of 2023 has brought challenges to the California housing market, with affordability hitting a 16-year low. The interplay of rising interest rates and escalating home prices has created a complex landscape for potential homebuyers. As the state navigates these challenges, the hope is that economic factors may contribute to a positive shift, improving housing affordability in the upcoming quarters.

Sources:

- California Association of REALTORS (C.A.R.)

- Zillow

- Rentometer