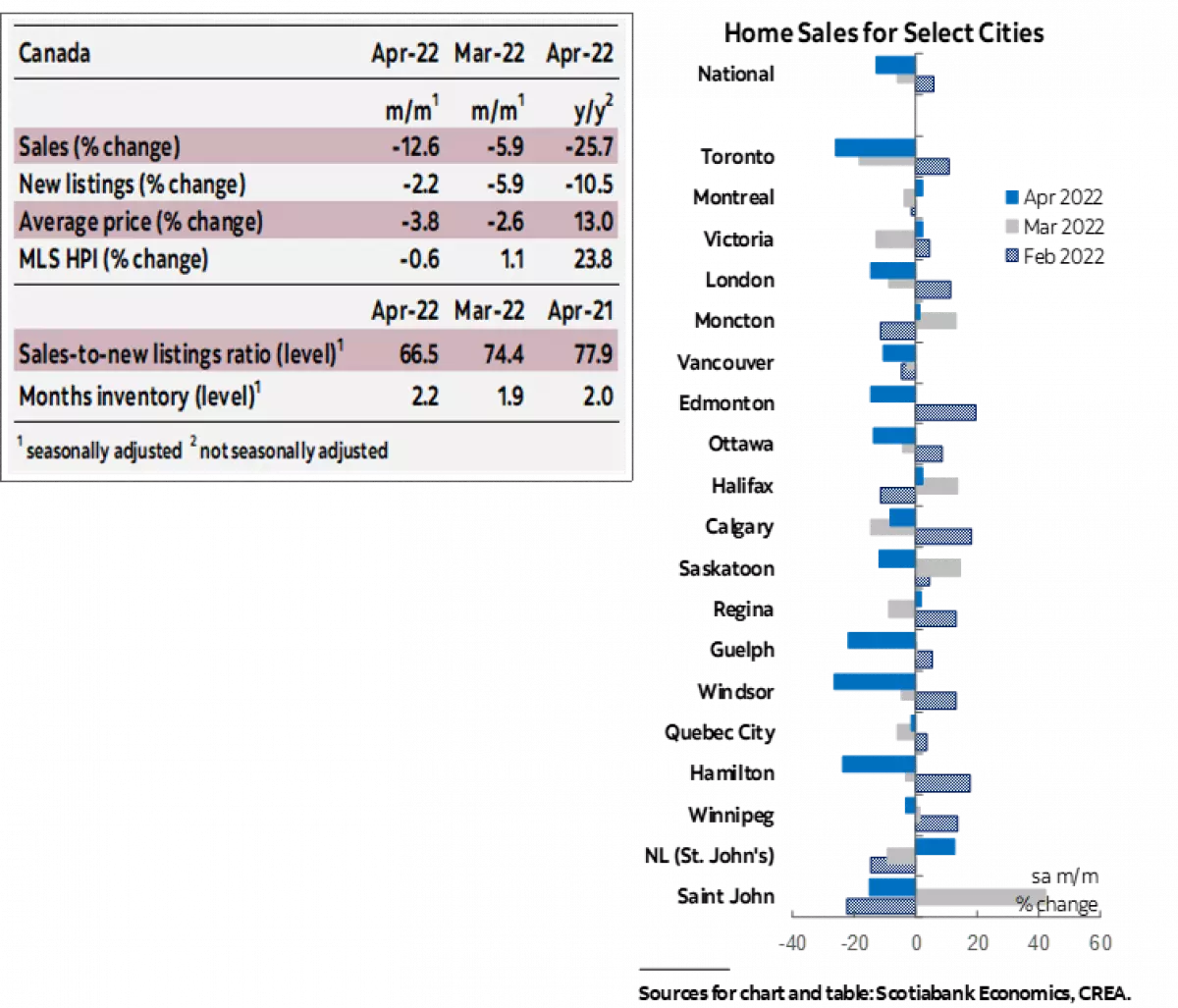

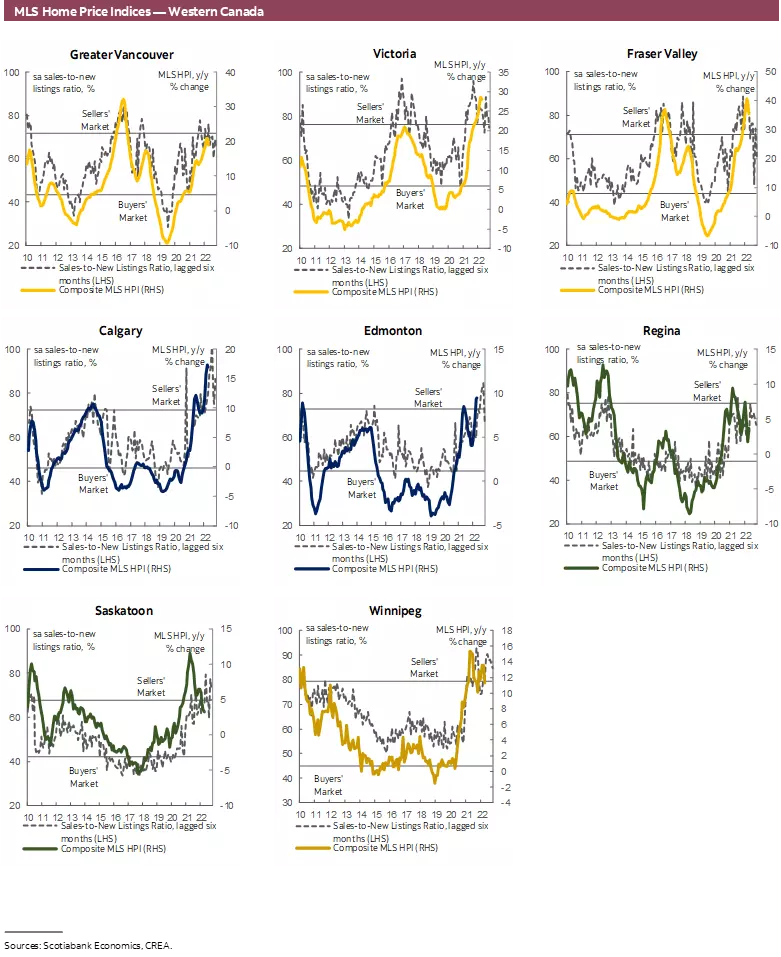

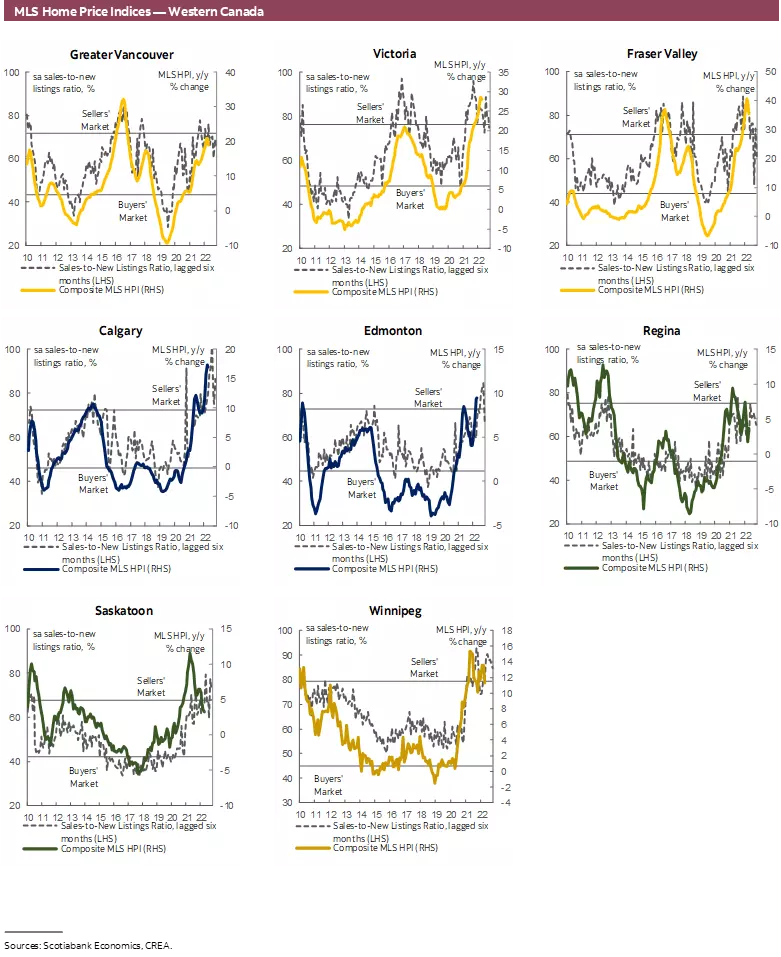

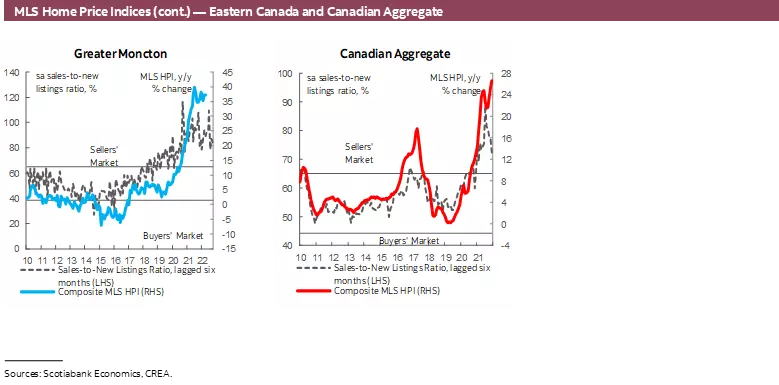

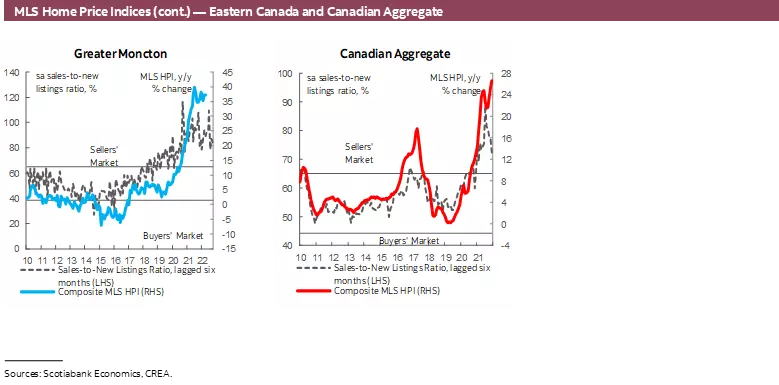

The Canadian housing market experienced a significant decline in home sales in April 2022, according to the latest data. This sudden decrease, coupled with a drop in listings, has resulted in a more balanced market. While the market has been tight in recent months, the sales-to-new listings ratio has now eased to its lowest level since June 2020. As a result, the composite MLS Home Price Index (HPI) also saw a slight decline, marking the first monthly fall since April 2020.

Regional Variations

The decline in sales was widespread, with the Greater Toronto Area leading the way. Of the 31 local markets tracked, 24 reported a decrease in sales, with many larger markets experiencing double-digit declines. However, it's worth noting that while sales were lower compared to the same period last year, they still remain the second-highest on record for April and are 23% higher than the April-average from 2000-2019.

Listings and Market Conditions

In terms of listings, there was a fairly even split between markets where listings rose and those where they fell. This smaller pullback in listings has put 16 local centers in balanced market territory. Additionally, the drop in sales has pushed Toronto and Barrie into buyers' market territory. Although the inventory of homes for sale has increased from its record lows, it is still well below the long-term average.

Price Movements

In April, all home types experienced monthly price declines, except for apartments, which saw a small price gain. Two-storey family homes led the fall in prices, followed by one-storey family homes and townhouses. Despite the monthly decline, the composite MLS HPI for all homes in Canada remained significantly higher compared to the same period last year, albeit at a slower pace of growth compared to previous months.

Implications

The cooling of the housing market in April was largely expected as the market adjusts to rising interest rates and changes in sentiment and attitude. The Bank of Canada's rate hikes have increased interest rate sensitivity among borrowers, leading to higher borrowing costs. This, combined with rising food and gas prices, has put pressure on households' debt-servicing ratios. As a result, some consumers may find it harder to make their debt payments.

Furthermore, the uncertainty surrounding the war in Ukraine and its impact on supply chains and inflation has contributed to a heightened sense of uncertainty in the housing market. Many buyers are adopting a wait-and-see approach, delaying their home buying plans due to the current economic environment and outlook for interest rates.

Conclusion

The April 2022 housing market update reveals a significant decline in home sales and a more balanced market. The drop in sales, coupled with an even split of rising and falling listings, has resulted in a decrease in the sales-to-new listings ratio. Although prices have fallen slightly, they remain higher compared to the same period last year. As the market continues to adjust to rising interest rates and external uncertainties, buyers and sellers are navigating a changing landscape.

Image Source: Scotiabank, Image 2, Image 3, Image 4, Image 5