Introduction

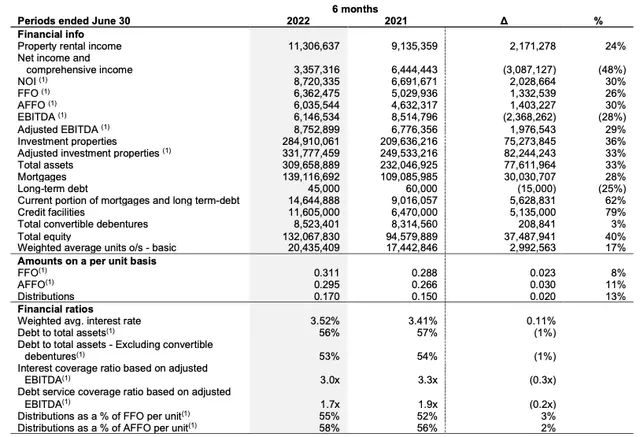

You may have come across countless high-growth, high-yield real estate investment trusts (REITs) in your investment journey. However, there is one hidden gem that often goes unnoticed - Canadian Net REIT. With limited analyst coverage and minimal investor attention, this REIT might not be on your radar. But don't let that fool you. Canadian Net REIT has been steadily growing its funds from operations (FFO) and offering a decent cash distribution yield, even in today's challenging economic climate.

Image: Walmart store exterior

Image: Walmart store exterior

What Canadian Net REIT Does

Canadian Net REIT is an internally-managed open-ended REIT that focuses on acquiring and owning high-quality, triple net, and management-free commercial real estate properties. This unique lease setup ensures that tenants bear the costs of property insurance, property taxes, and property maintenance, resulting in stable and predictable cash flow for the REIT.

The company strategically targets properties occupied by credit-rated national tenants in prime locations with high traffic. Its portfolio consists of retailers, national service-station and convenience store chains, quick-service restaurant chains, and others. The presence of AAA tenants further reinforces the strength of its properties.

Image: Canadian Net REIT's portfolio distribution

Image: Canadian Net REIT's portfolio distribution

Track Record of Growth

Canadian Net REIT is not just any run-of-the-mill REIT. It proudly holds the title of being a Canadian Dividend Aristocrat, continuously increasing its cash distribution since 2012. Its 10-year cash distribution growth rate of 10.5% speaks volumes about its commitment to generating value for its investors.

Image: Canadian Net REIT's track record of growth in FFO and cash distribution

Image: Canadian Net REIT's track record of growth in FFO and cash distribution

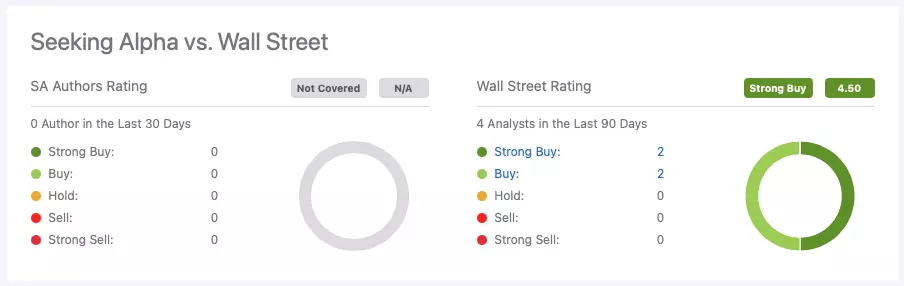

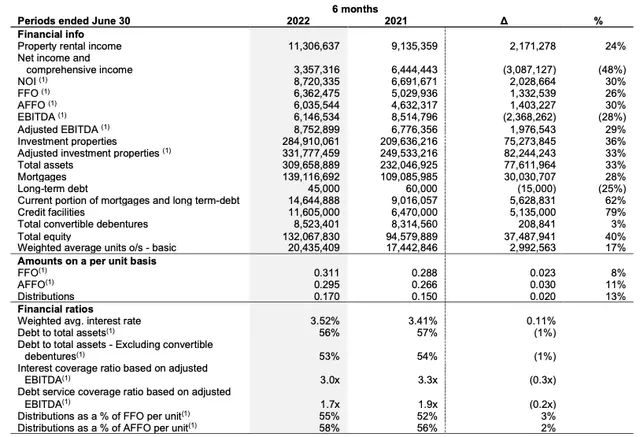

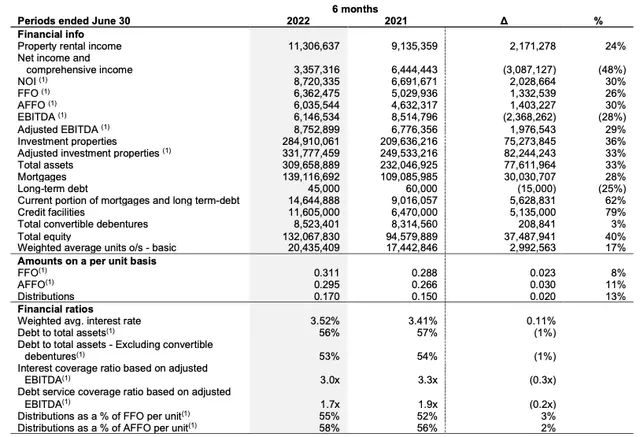

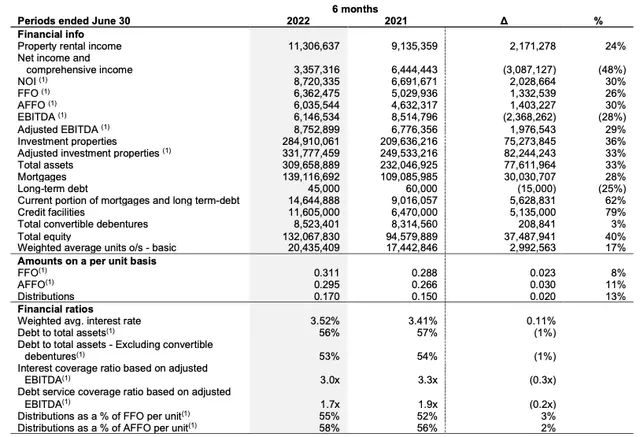

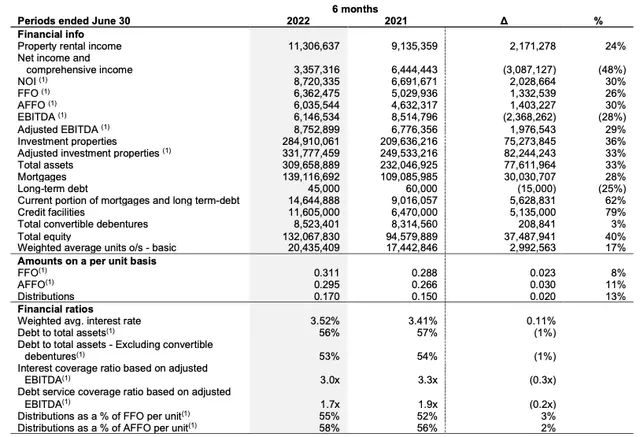

Recent Results

In the first half of the year, Canadian Net REIT showcased impressive financial results. Noteworthy highlights include a 24% growth in property rental income, a 30% increase in NOI, and an 8% rise in FFO per unit. Additionally, its investment property portfolio expanded by 36% to C$284.9 million.

Image: Canadian Net REIT's financial information for H1 2022

Image: Canadian Net REIT's financial information for H1 2022

Cheap Valuation & Conclusion

Despite the challenges posed by rising interest rates, Canadian Net REIT has demonstrated resilience. While its total return may have dipped slightly this year, it has outperformed the broader REIT industry by almost 6%.

Image: Performance comparison - Canadian Net REIT vs. iShares S&P/TSX Capped REIT Index ETF

Image: Performance comparison - Canadian Net REIT vs. iShares S&P/TSX Capped REIT Index ETF

At its current valuation, Canadian Net REIT is a compelling investment opportunity. Trading at a low multiple compared to its long-term normal valuation, the stock offers a discount of approximately 25%. Furthermore, with a yield approaching 5.0%, investors can enjoy both growth and income potential.

Image: Canadian Net REIT's fundamental analysis

Image: Canadian Net REIT's fundamental analysis

It's important to note that Canadian Net REIT may not be as liquid as some other stocks due to its low trading volume. With a small market cap of approximately C$142 million and an enterprise value close to C$300 million, it remains a hidden gem. However, for investors seeking long-term value and stable cash flow, this might be the perfect opportunity.

So, take a closer look at Canadian Net REIT and unlock its hidden potential. Don't miss out on this high-growth, high-yield REIT that offers a unique investment proposition in the real estate sector.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. As with any investment, conduct thorough research and consult with a professional financial advisor before making any investment decisions.