Investing in real estate is a proven way to build wealth, and commercial real estate investing offers some of the highest income streams. If you've been investing in residential real estate and are interested in expanding into the commercial sector, this guide is for you. We'll break down everything you need to know to get started, including the latest trends in commercial real estate, the different types of commercial properties, the benefits of commercial real estate investing, and how to secure financing for your investments.

Commercial Real Estate Investing Trends in 2022

The COVID-19 pandemic had a significant impact on commercial real estate, with offices, hotels, and retail stores suffering heavily. However, the industry is expected to continue its trend of economic recovery in the coming year. Many commercial real estate investors remain optimistic as the industry adapts to the changing landscape.

While 2021 started with a pessimistic outlook, experts predicted stabilization by the end of the year. Surprisingly, there was increased demand for industrial properties, leading to several predicted trends for 2022 in different types of commercial real estate investments:

-

Retail Stores: The rise of online shopping has led to bankruptcies in the retail sector, with experts predicting up to 25% fewer retail stores by 2025. Urban areas like New York and San Francisco are expected to see a shift towards healthcare, grocery, and other alternative stores.

-

Offices: With more companies adopting work-from-home policies, office demand could be permanently reduced by 15%. However, the emergence of "hybrid" office policies, where employees only come in on certain days of the week, may stabilize the demand for office spaces.

-

Hotels: Despite eased travel restrictions, hotels are predicted to struggle throughout the year ahead. Full recovery is not expected until 2023, especially for upscale hotels in densely populated areas.

-

Warehouses: Warehouses are expected to be the leading performer among commercial real estate investments due to the growing demand for e-commerce orders. Experts predict an additional demand of 250 million square feet for warehouse space in 2021.

-

Apartments: Despite initial concerns during the pandemic, multifamily properties are performing well, with stable demand and historically low-interest rates. Apartments at more attainable prices are expected to remain stable in the year ahead.

-

Rental Property Upgrades: As renters adapt to work-from-home lifestyles, there may be an influx of applications for larger units. Upgraded units may also become more desirable in competitive markets throughout 2022.

-

Commercial Development: New development projects are expected to rise as housing markets attempt to meet growing demands. Commercial investors skilled in development projects may find ample opportunities for new builds in the year ahead.

Alt Tag: How to Get Into Commercial Real Estate

Alt Tag: How to Get Into Commercial Real Estate

What Qualifies as "Commercial Real Estate?"

Commercial real estate refers to properties that are leased out for business and retail purposes. Unlike residential real estate, where investors collect rent from residential tenants, commercial real estate investors lease out properties to businesses. The definition of commercial real estate also includes raw land purchased for commercial property development.

Commercial properties can be categorized into five main types:

-

Office: This is the most common commercial real estate type, ranging from single-tenant offices to skyscrapers. Office buildings are classified as Class A, Class B, or Class C based on factors like location and condition.

-

Retail: Retail buildings include strip malls, community retail centers, banks, and restaurants. These properties are typically located in urban areas and vary in size.

-

Industrial: Industrial buildings are suitable for manufacturing industries, offering spaces with height specifications and docking availability. Warehouses and large manufacturing sites fall under this category.

-

Multifamily: Multifamily properties consist of apartment complexes, high-rise condominium units, and smaller multifamily units. Properties with more than four units are considered commercial real estate.

-

Special Purpose: Special purpose properties are designed for specific uses that are difficult to repurpose. Examples include car washes, self-storage facilities, schools, and leisure/tourism properties such as hotels and sports stadiums.

Mixed-use development properties, which combine residential and commercial space, are also prevalent in the commercial real estate sector.

Alt Tag: Commercial Real Estate FAQs

Alt Tag: Commercial Real Estate FAQs

The Many Benefits of Commercial Real Estate Investing

Investing in commercial real estate offers various benefits, both personally and financially. Here are some key advantages to consider:

-

Higher Income: Commercial properties have a better return on investment, averaging between six to twelve percent, compared to one to four percent for residential properties. Commercial leases are typically longer, reducing vacancy risks and providing a more consistent income stream.

-

Cash Flow: Commercial properties offer a relatively consistent stream of income due to longer lease periods. Many commercial tenants also cover additional expenses such as real estate taxes, property insurance, and maintenance costs, increasing owner benefits.

-

Less Competition: The commercial real estate market is generally less saturated with investors compared to the residential market, providing opportunities for those willing to enter the sector.

-

Longer Leases: Commercial properties have longer lease agreements compared to residential properties, resulting in impressive returns and reliable monthly cash flow.

-

Business Relationships: Commercial real estate investing allows for business-to-business relationships, providing opportunities to build professional connections and expand your network.

-

Limited Operational Hours: Unlike residential properties, commercial real estate ownership typically involves more predictable working hours, avoiding around-the-clock maintenance and tenant communication.

Alt Tag: Investing in Commercial Real Estate

Alt Tag: Investing in Commercial Real Estate

How to Invest in Commercial Real Estate: Getting Started

To embark on your commercial real estate investment journey, it's important to understand the following steps:

-

Understand the Differences: Commercial real estate is valued differently and comes with unique income opportunities and lease terms compared to residential properties. Research and familiarize yourself with the commercial real estate market and the factors that affect its dynamics.

-

Analyze Comparables: Analyze recent sales of similar properties in the area to determine the current market value of the property you're interested in. Compare factors like location, size, and style to find the most accurate comparables.

-

Use the Right Success Metrics: Familiarize yourself with key metrics used in commercial real estate investing, such as net operating income, capitalization rate, and cash-on-cash return. These metrics will help you evaluate the profitability and potential returns of your investments.

-

Reserve Cost Contingencies: Set aside funds as cost contingencies to cover unexpected expenses that may arise during property acquisition and early stages of ownership. A typical cost contingency budget in commercial investing ranges from 5% to 15% of the investment amount.

-

Avoid Common Mistakes: Be aware of common mistakes in commercial real estate investing, such as improper valuations, financial ignorance, neglecting due diligence, and not working with a team of experienced professionals.

Alt Tag: Commercial Real Estate Loan Types

Alt Tag: Commercial Real Estate Loan Types

Types of Commercial Real Estate Loans

To finance your commercial real estate investments, several loan options are available, each with its own eligibility requirements and terms. Here are a few common types of commercial real estate loans:

- Small Business Administration (SBA) 7(a) Loan

- Certified Development Company (CDC) / SBA 504 Loan

- Conventional Loan

- Commercial Bridge Loan

- Hard Money Loan

- Conduit Loan

Before securing financing, it's essential to understand whether you'll be financing the commercial property as an individual or an entity, as lenders have varying requirements for each. Additionally, consider metrics such as Loan-to-Value Ratio (LTV) and Debt Service Coverage Ratio (DSCR) to determine loan eligibility and negotiate favorable financing rates.

Commercial Real Estate for Beginners

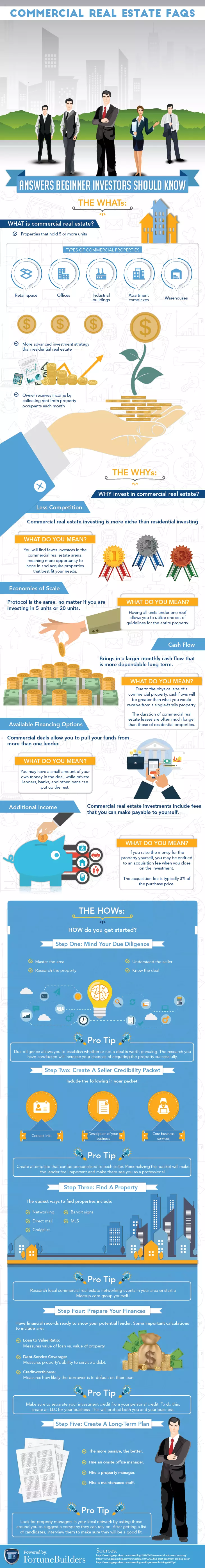

If you're new to commercial real estate investing, it's important to have a proper business plan in place. Here are answers to a few commonly asked questions for beginner investors:

-

How Do I Know If I'm Ready? Evaluate your ability to think big, build relationships, and successfully execute due diligence. Commercial real estate requires a mindset geared towards larger-scale investments, the ability to network and build relationships, and thorough research and analysis.

-

Do I Need a Real Estate License? While not mandatory, obtaining a real estate license can provide professional opportunities and allow you to earn commissions from transactions. However, it involves time commitments and exams, so consider whether it aligns with your investment goals.

In summary, commercial real estate investing offers lucrative opportunities for wealth creation. By applying core skills from residential investing, conducting thorough due diligence, building networks, and understanding financing options, you can successfully navigate the commercial real estate market and achieve your investment objectives.