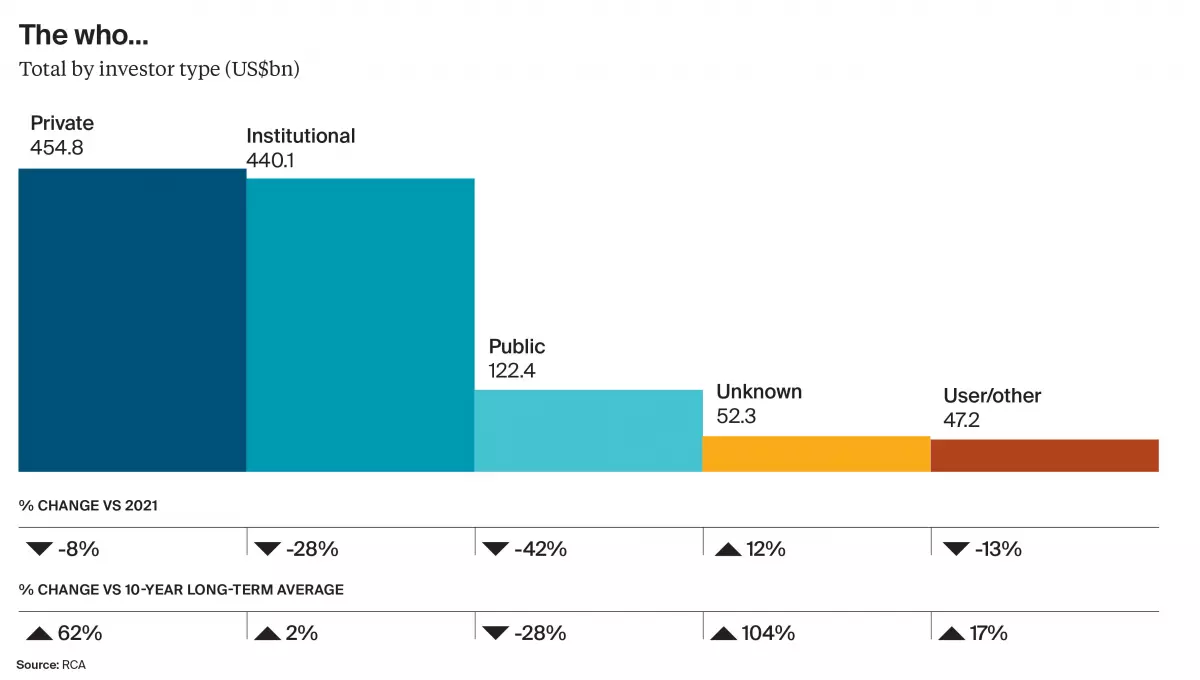

Despite the challenges posed by the global economy and geopolitical factors in 2022, private investors remained actively involved in commercial real estate markets. According to RCA, private investors accounted for 41% of the total investment in global commercial real estate, making it their highest share on record.

Commercial real estate investment - who is investing capital and where?

Commercial real estate investment - who is investing capital and where?

While institutional investment saw a decline of 28% from 2021 volumes, private investment reached $455 billion in 2022. Although slightly down from its peak in 2021, this figure is still 62% above the 10-year average, making 2022 the second strongest year in commercial real estate history.

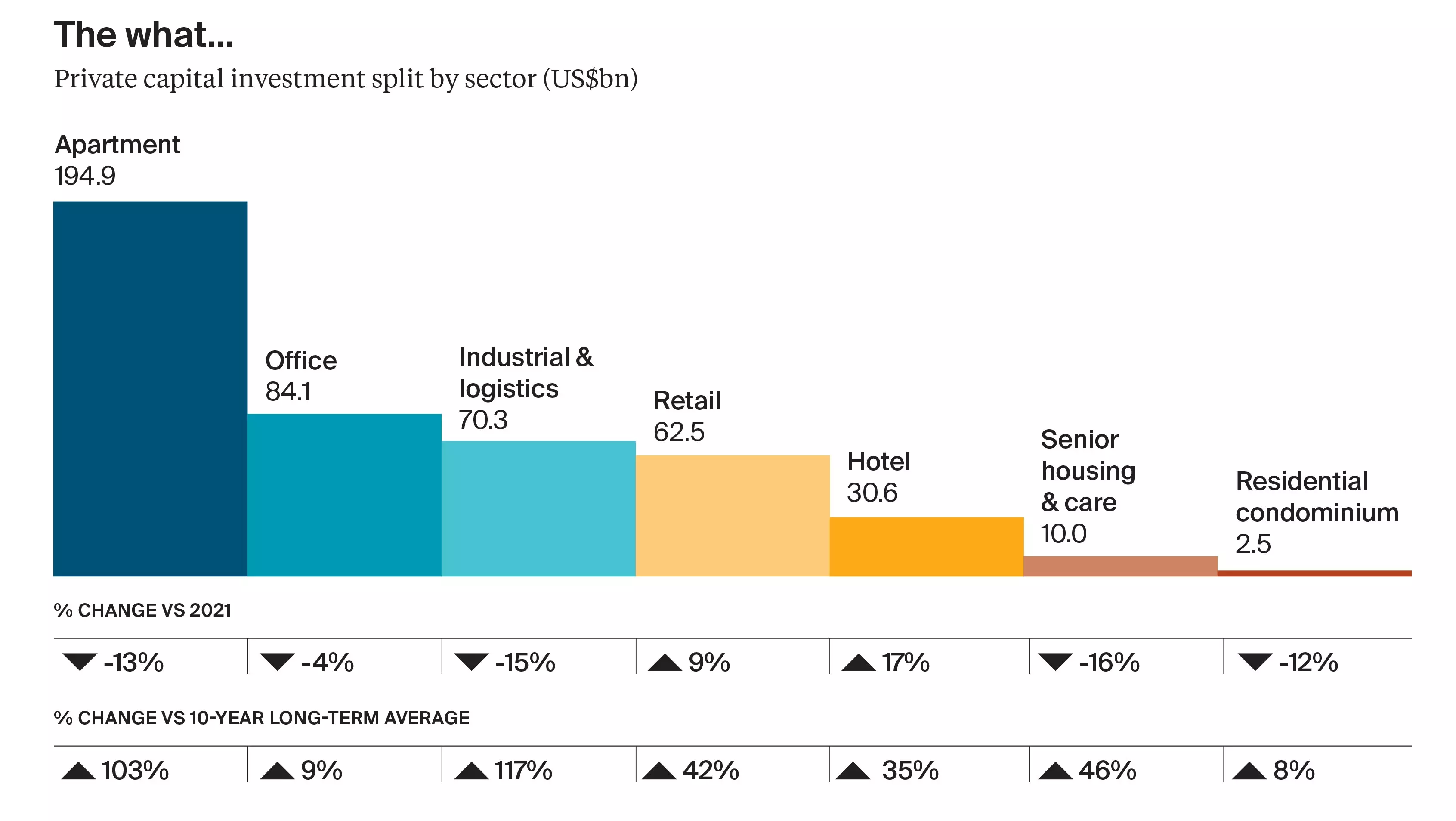

Investment Sectors of Choice

The residential multifamily sector, private rented sector (PRS), offices, and industrial assets garnered the most interest. In fact, 43% of respondents to the Attitudes Survey revealed that they already had investments in offices, while 40% had invested in industrial assets. Ownership in retail, life sciences, healthcare, PRS, data centers, and education real estate also saw increased growth in 2022 compared to the previous year.

Commercial real estate investment - who is investing capital and where?

Commercial real estate investment - who is investing capital and where?

Top Destinations for Capital

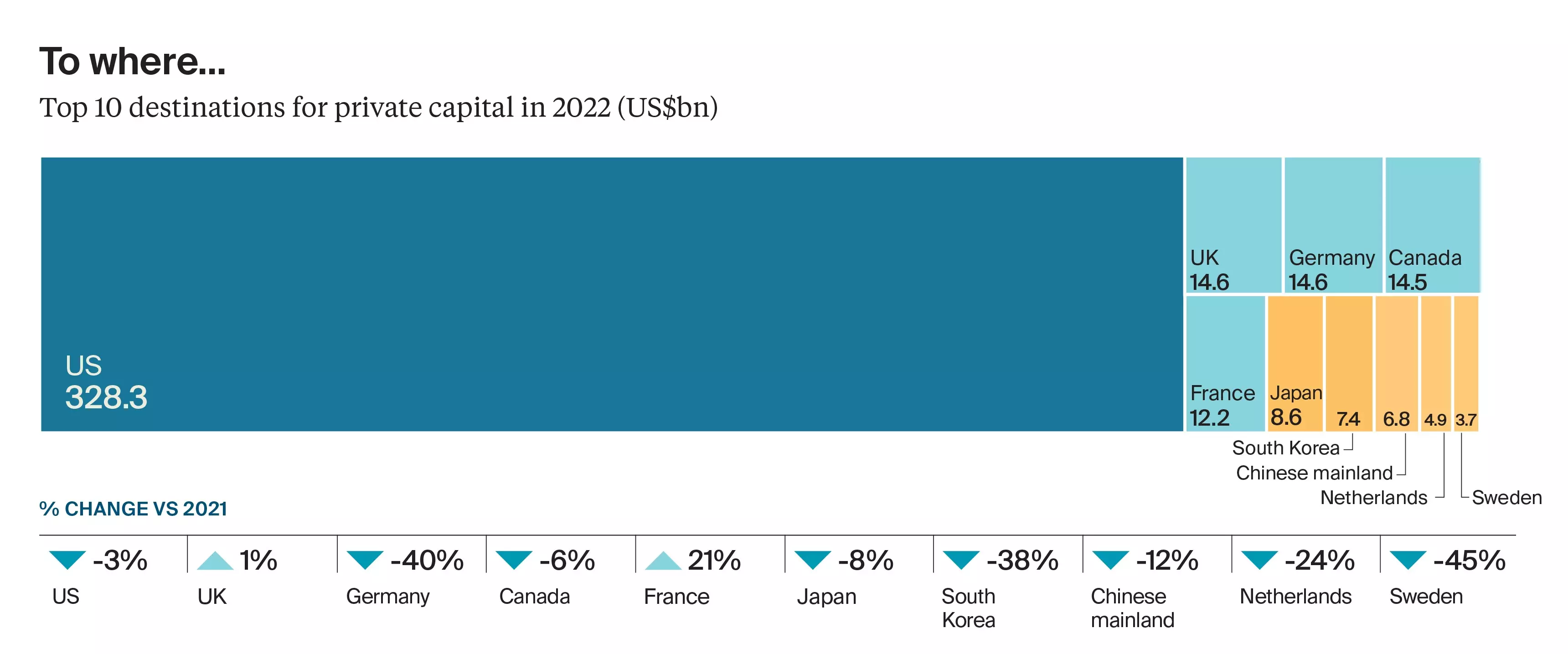

The United States, United Kingdom, Germany, Canada, and France emerged as the top targets for private capital investments in 2022. Among these, only the UK and France experienced year-on-year increases in total private investment. The UK saw a 1% increase, reaching $14.6 billion, while France witnessed a substantial 21% jump to $12.2 billion, thanks to its resilient economy and relatively low inflation levels compared to the rest of Europe.

Commercial real estate investment - who is investing capital and where?

Commercial real estate investment - who is investing capital and where?

Factors Influencing Investment Decisions

In 2023, inflation is expected to be a significant driver in investment decisions. According to our HNW (high-net-worth) Pulse Survey, 80% of respondents stated that inflation would have a considerable influence on their investment choices, with 37% indicating a significant impact and 43% some degree of influence. Commercial real estate, with its strong growth potential, particularly in indexation-driven assets, may emerge as a preferred investment option in higher inflationary environments. However, as major economies start to see a decrease in inflation, the influence of inflation on investment choices is likely to diminish.

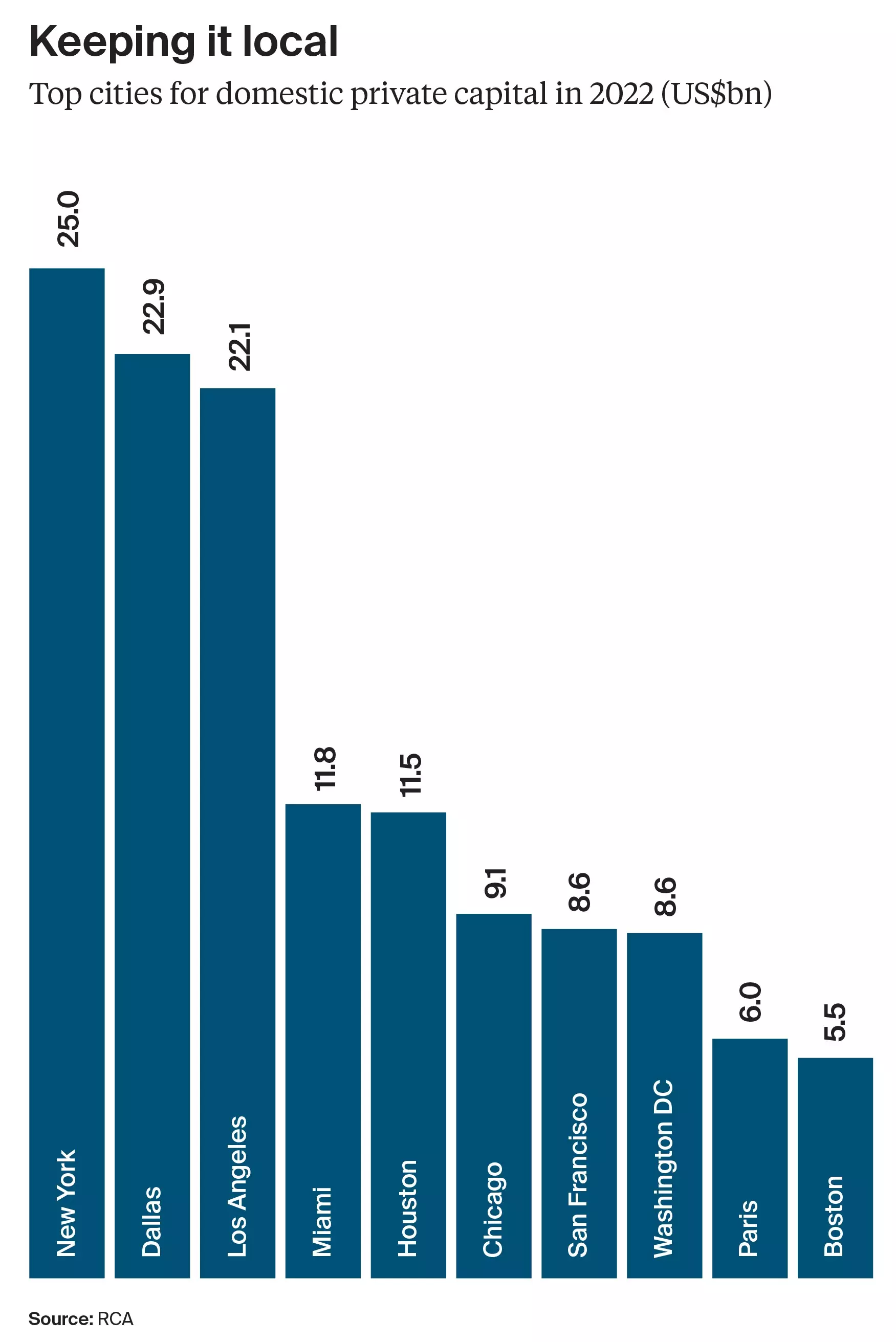

Private buyers continued to invest in US cities in 2022, with US metropolises making up 67% of the total volume. Interestingly, Paris was the only non-US city to feature in the top 10 cities attracting private capital investment.

Commercial real estate investment - who is investing capital and where?

Commercial real estate investment - who is investing capital and where?

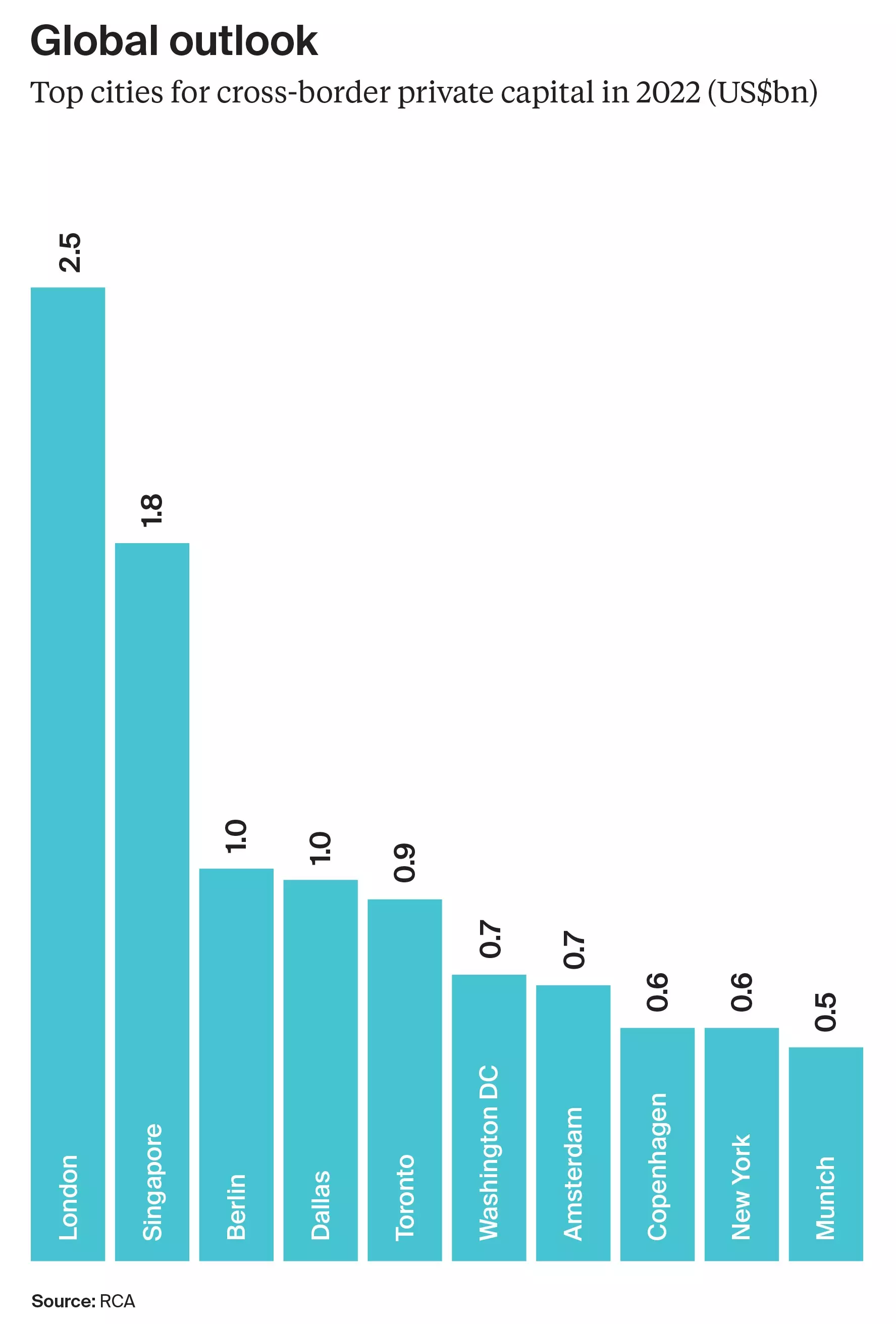

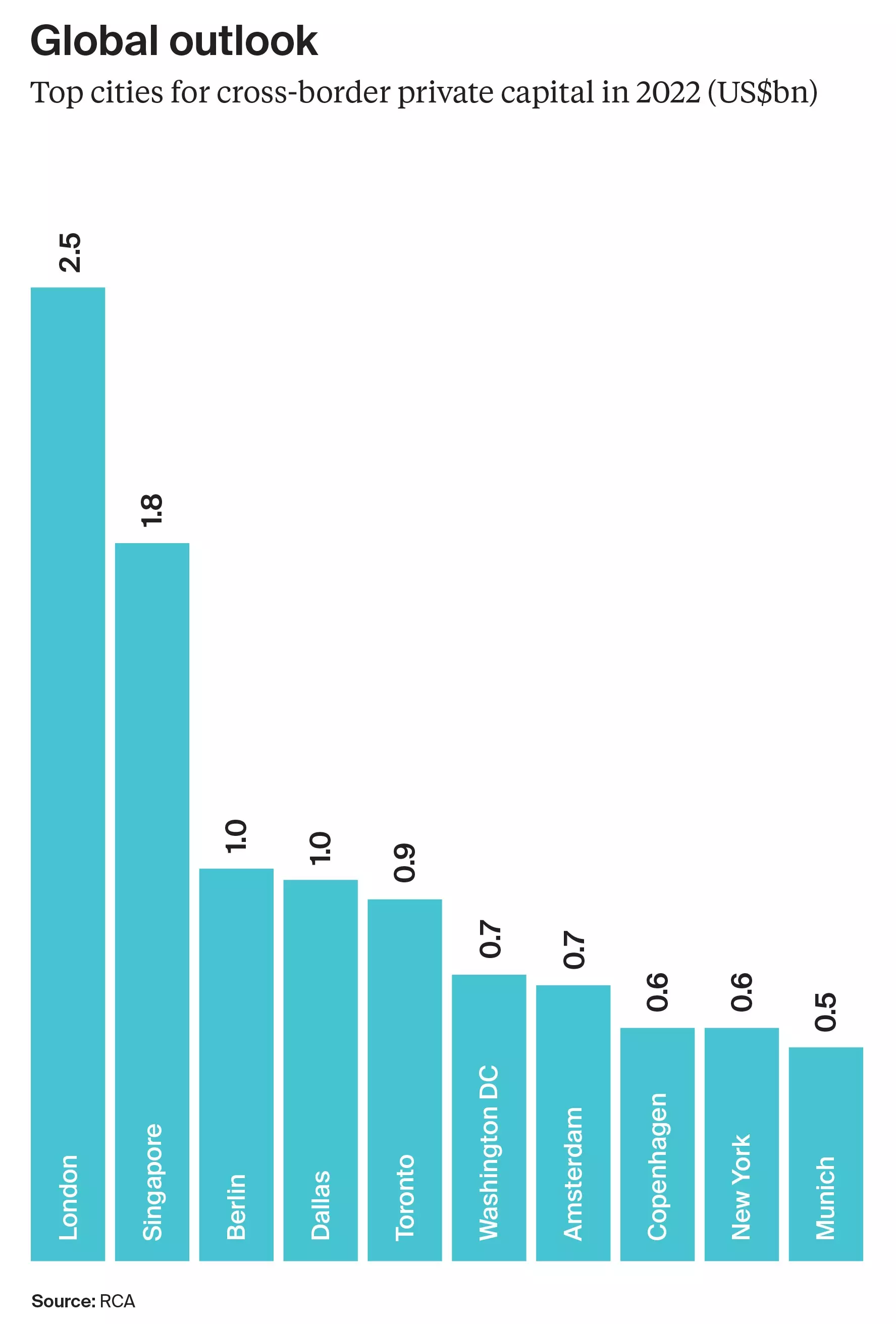

London, despite ranking eleventh overall for total private investment (cross-border and domestic), topped the list for cross-border private capital with $2.5 billion. This accounted for 44% of the total private investment into the city and 15% of total global cross-border private investment into cities in 2022.

Commercial real estate investment - who is investing capital and where?

Commercial real estate investment - who is investing capital and where?

In terms of capital source, private investors from the US dominated the market, with $302 billion invested. This accounted for more than a quarter of total commercial real estate investment and 66% of private investment. However, US private buyers saw a 3% decline in investment compared to the previous year. Among the top 10 sources of private capital, investors from France and the Chinese mainland were the only ones to increase their investments in 2022, with a 27% and 25% growth, respectively.

Conclusion

Commercial real estate investment continues to thrive, with private investors playing a significant role in the market. Despite the challenges of the global landscape, private investment remains strong, and the sector shows promising growth potential. As inflation becomes a crucial factor in investment decisions, commercial real estate, particularly indexation-driven assets, may attract more attention. The US, the UK, Germany, Canada, and France remain popular destinations for capital, with London leading the way in cross-border private investments. To gain more in-depth analysis and insights into the latest trends in global wealth, download the full report.

Download the full report to stay informed about the ever-evolving world of commercial real estate investment and make more informed decisions.