Image Source: CrowdStreet

Image Source: CrowdStreet

Are you interested in investing in real estate but find the usual high minimum investment amounts a barrier? Look no further than the CrowdStreet Private Equity REIT I (C-REIT). CrowdStreet, one of the largest real estate crowdfunding platforms, has launched this new fund with a minimum investment of only $25,000.

CrowdStreet Private Equity REIT I (C-REIT) Overview

The CrowdStreet Private Equity REIT I (C-REIT) aims to provide accredited investors with easy access to a diversified portfolio of growth-oriented private commercial real estate projects. Managed by CrowdStreet Advisors, this fund offers a low-cost entry point for new investors and allows experienced investors to further diversify their holdings through a single investment.

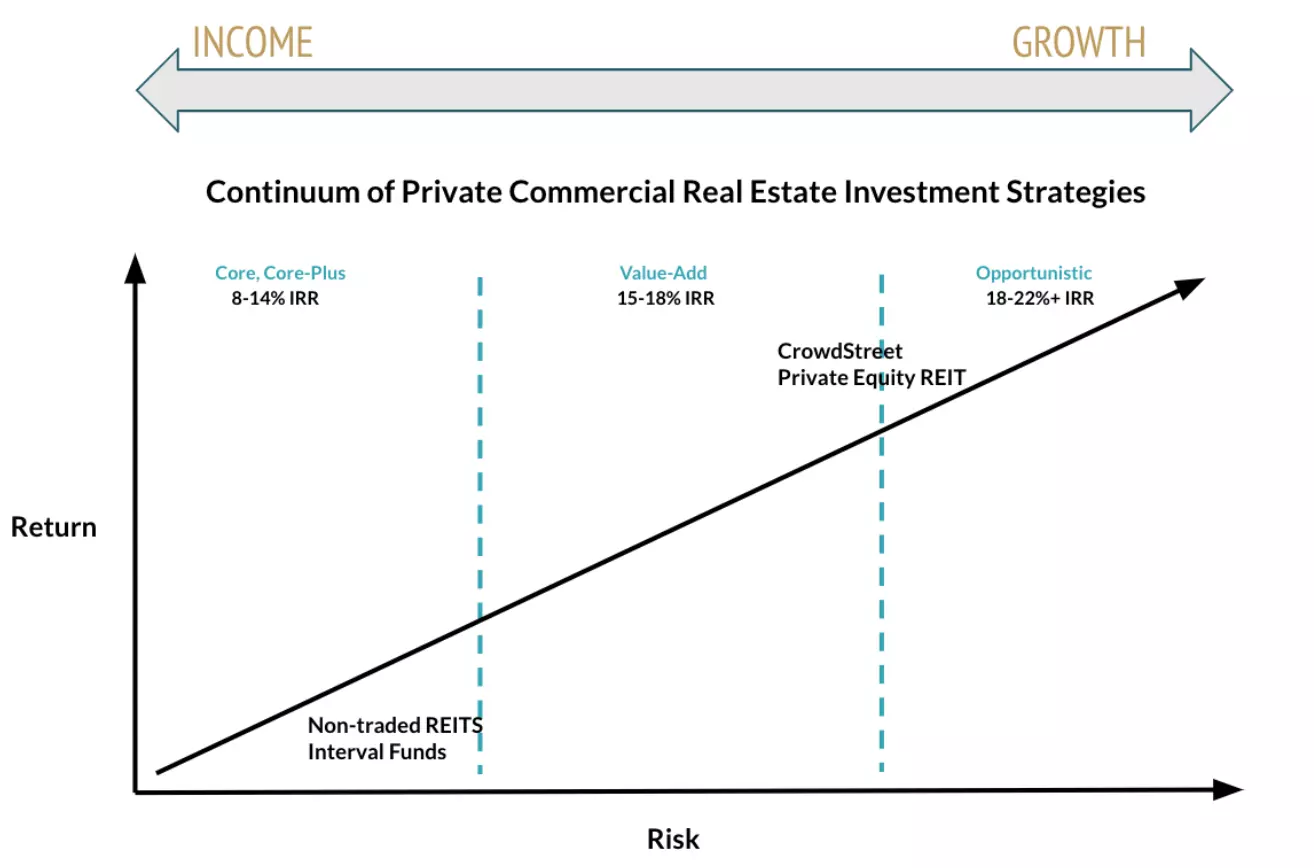

What sets C-REIT apart is its focus on "18-hour cities" - those with lower valuations, higher yields, and higher growth rates. These cities, such as Austin, Nashville, and Raleigh-Durham, offer attractive investment opportunities driven by strong market fundamentals.

Additionally, the C-REIT aims to invest in approximately 20-25 private opportunistic and value-add commercial real estate projects. With its thematic investments, middle-market focus, and identified growth markets, this fund seeks to leverage demographic and social trends that CrowdStreet's investment team believes will be long-term drivers of demand.

Key CrowdStreet C-REIT Characteristics

Image Source: CrowdStreet

Image Source: CrowdStreet

The CrowdStreet C-REIT offers several key characteristics that make it an appealing investment option. Here are a few highlights:

High-Conviction Thematic Investing

The Investment Manager of the C-REIT selects opportunities based on extensive proprietary research and real-time insights. They identify key investment opportunities driven by demographic and social changes in the commercial real estate market. These include trends such as an aging population, the growth of e-commerce, the U.S. housing shortage, and migration to the Sunbelt.

Deal Selection Using Proprietary Market Insights

CrowdStreet's advantage lies in its significant volume of deal evaluation and data gathering. This allows for early access to strong opportunities and insights into unrecognized market trends. The Portfolio Management team, comprising industry veterans, selects the proposed opportunities after a secondary screening.

Access to Off-Marketplace Transactions and First Access to Marketplace Deals

The C-REIT benefits from exclusive, early access to projects brought to CrowdStreet for evaluation. This allows the fund to negotiate guaranteed capacity in sought-after projects. Additionally, the fund may invest in time-sensitive projects with limited capacity that are not available on the Marketplace. This access creates opportunities for investors to participate in potentially high-value deals.

Diversification across Sponsor, Sector, and Geography

The C-REIT aims to diversify its investments across sponsors, asset types, and geography. By focusing on sectors supported by high-conviction investment themes, such as multifamily, industrial, and life sciences, the fund seeks to provide investors with exposure to a well-rounded real estate portfolio.

Private Equity Commercial Real Estate (CRE) in an Accessible Registered Fund Structure

Image Source: CrowdStreet

Image Source: CrowdStreet

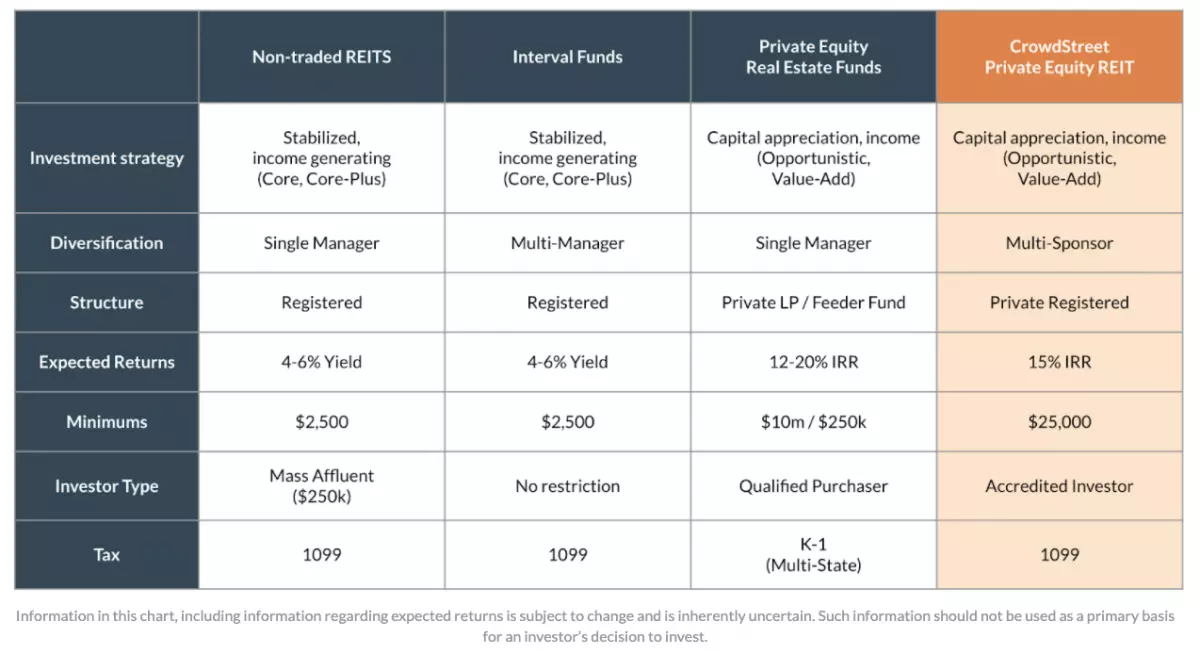

To make CrowdStreet deals more accessible, the C-REIT is structured as an investment company under the 1940 Investment Company Act and is treated as a Real Estate Investment Trust (REIT). This combination allows for an unlimited number of accredited investors, a low minimum investment of $25,000, and simplified 1099 tax reporting. Unlike other REITs, the C-REIT solely invests in private commercial real estate projects, reducing exposure to public markets.

My Thoughts On The CrowdStreet Private Equity REIT I (C-REIT)

As an investor, I appreciate the convenience and peace of mind that come with investing in a fund managed by professionals. CrowdStreet's team reviews all the deals on their platform and selects the most appropriate ones for the C-REIT, ensuring that investors don't miss out on potential opportunities.

Diversification is crucial in real estate investment, and the C-REIT offers just that. With its focus on 20-25 deals, investors can benefit from a diversified portfolio without the need for every single deal to succeed.

Furthermore, having experienced professionals like CrowdStreet CIO Ian Formigle and Jack Chandler, former Global Head of Real Estate at Blackrock, overseeing the fund inspires confidence. Their expertise adds value and reassurance to investors.

The REIT structure and simplified 1099 tax reporting are additional advantages of investing in the C-REIT. Tax reporting becomes less cumbersome, as a single 1099 replaces the need for individual K-1 forms associated with each deal.

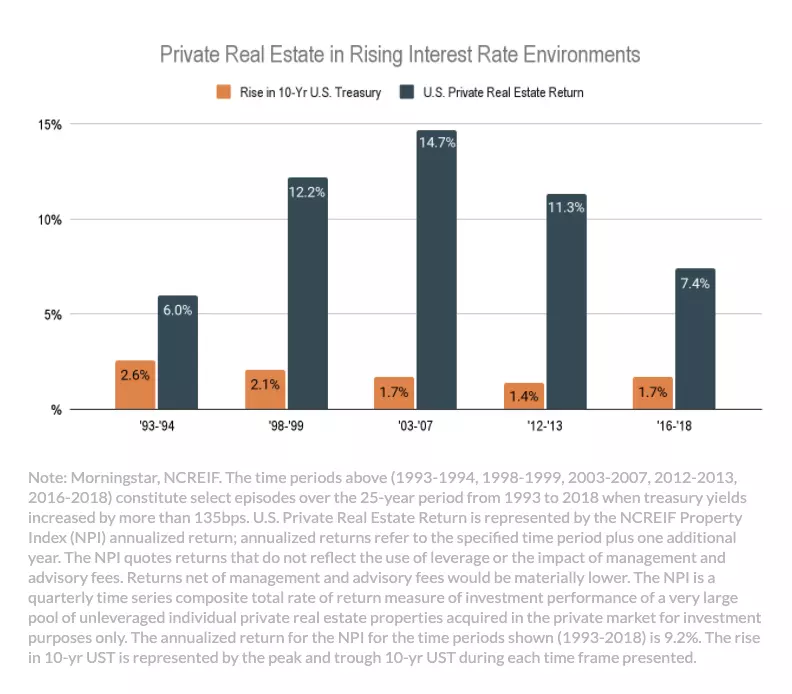

Investing in a diversified real estate fund like the C-REIT is an intelligent choice, especially in an environment of elevated inflation and low mortgage rates. It offers exposure to high-quality commercial real estate in fast-growing parts of the country.

If you're interested in exploring more private REIT options, I recommend checking out Fundrise, a vertically integrated real estate investing platform with a focus on single-family and multi-family rental properties in the Sunbelt.

Personally, I have invested $810,000 in real estate crowdfunding to diversify my portfolio and generate passive income. If you'd like to learn more about real estate crowdfunding, I encourage you to visit my Real Estate Crowdfunding Learning Center.

To summarize, the CrowdStreet Private Equity REIT I (C-REIT) presents a compelling opportunity for investors interested in real estate. With its low minimum investment, diverse portfolio, and professional management, it offers a convenient and accessible way to capitalize on the potential of the commercial real estate market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please conduct thorough research and consult with a professional financial advisor before making any investment decisions.