[Image: YvanDube]

[Image: YvanDube]

Diversified Healthcare Trust (NASDAQ:DHC) recently reported its full-year 2022 earnings, causing a surge in share prices and the rally of debt prices. The company's debt is currently trading at yields between 9% and 13.5% to maturity. While the earnings report generated optimism, I still have reservations about investing in shares or debt and hold serious concerns about the future of the business.

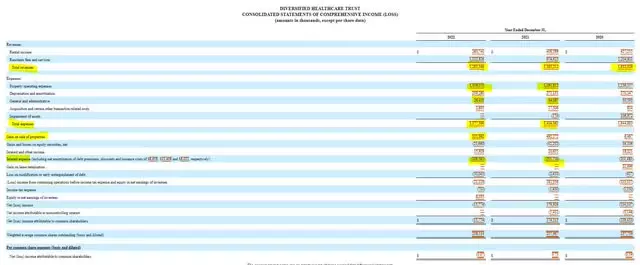

Struggles Reflected in the Income Statement

[Image: FINRA]

[Image: FINRA]

Diversified Healthcare Trust's income statement for 2022 reveals ongoing challenges for the company. Revenue dropped by $100 million, while expenses only decreased by $37 million. Of particular concern is the increase in operating expenses, which constitute the majority of total expenses, due to wage and inflationary pressures. Despite improvement in the fourth quarter, the company's senior housing division (SHOP) contributed only 5% of the company's NOI while accounting for 62% of its assets.

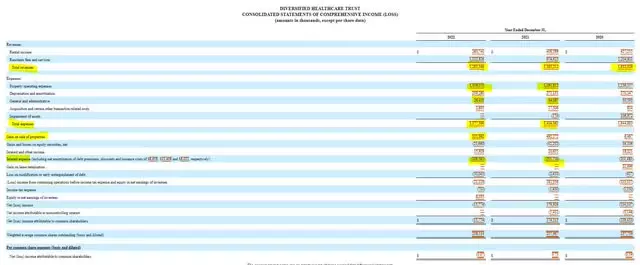

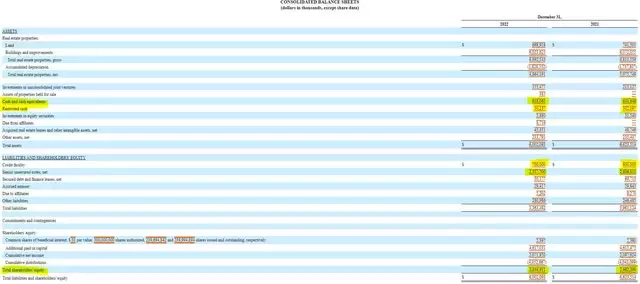

Shareholder Equity and Balance Sheet Stability

[Image: SEC 10-K]

[Image: SEC 10-K]

From a balance sheet standpoint, Diversified Healthcare Trust maintained relatively stable shareholder equity at $2.6 billion in 2022. This was achieved through asset sales and the use of restricted cash to reduce debt. Total debt levels decreased from $3.6 billion to $3 billion. While some proponents view the level of shareholder equity and unencumbered assets as strengths, their long-term implications need closer examination.

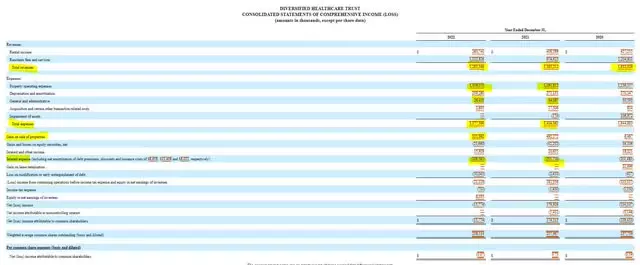

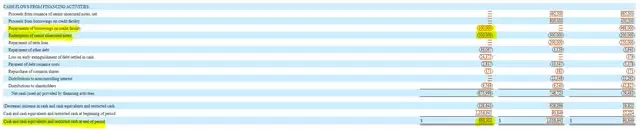

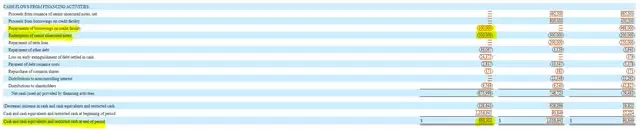

Cash Flow Concerns

[Image: SEC 10-K]

[Image: SEC 10-K]

Diversified Healthcare Trust's cash flow statement holds significant importance for potential fixed income investors. However, the report reflects a worrying trend. In 2022 alone, the company burned $40 million in cash from operations, and after accounting for capital expenditures, the figure rose to nearly $340 million. Additionally, the fourth-quarter report revealed negative operating cash flow, indicating that the company's turnaround is far from complete.

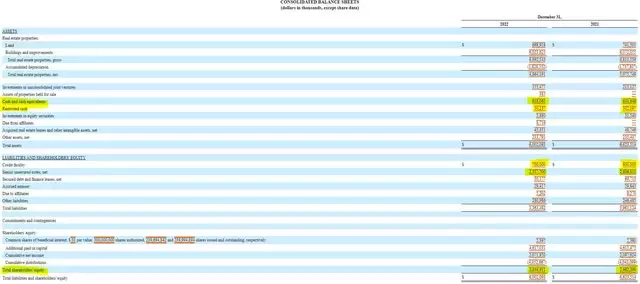

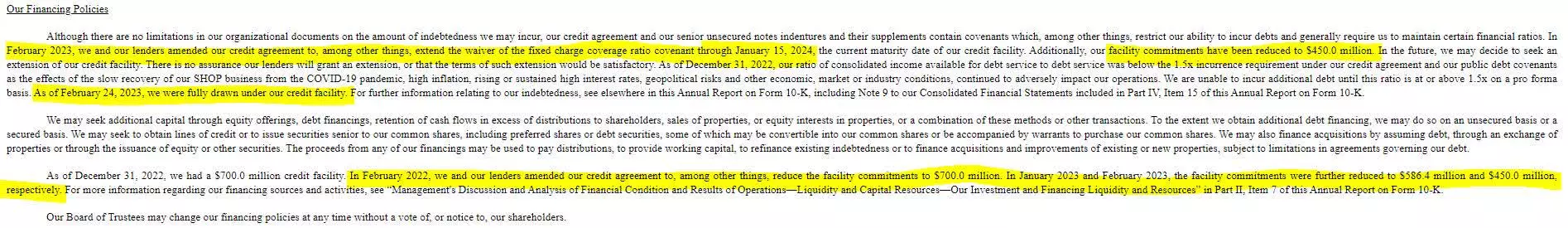

Liquidity and Future Challenges

[Image: SEC 10-K]

[Image: SEC 10-K]

While Diversified Healthcare Trust possesses $688 million in cash, it faces challenges beyond negative free cash flow. The company's fully tapped-out credit facility, along with the need to negotiate waivers from covenant violations, hampers its liquidity. Currently, the business has $550 million in cash with no additional sources of liquidity. Furthermore, the revolving line of credit carries an interest rate of 7.2%.

Lease Expirations and Debt Maturities

[Image: SEC 10-K]

[Image: SEC 10-K]

Looking ahead, Diversified Healthcare Trust faces two significant challenges. First, 21% of the company's leases are set to expire before the end of next year, accounting for 19% of total income. While this may seem positive, negotiating lease renewals during an economic downturn could prove challenging. Second, the company must address $750 million in debt coming due by 2025, requiring external financing to cover the 2025 maturity.

Ambitious Capital Plans and Future Funding

[Image: SEC 10-K]

[Image: SEC 10-K]

A further cause for concern lies in the company's planned capital expenditures for 2023 and 2024. Management disclosed that SHOP segment capex alone is projected to reach approximately $220 million annually. Additionally, the company mentioned upcoming capex renovations for many properties. These commitments will significantly deplete the company's remaining cash and potentially disrupt senior living occupancy in the short term.

Reverse Stress Test and Accessibility to Capital

[Image: SEC 10-K]

[Image: SEC 10-K]

Taking a reverse stress test approach, it becomes evident that even in the best-case scenario of full occupancy, generating $250 million in new cash flow, Diversified Healthcare Trust would struggle to pay down debt. This leads to the inevitable need to raise capital funds. While the company possesses unencumbered assets, securing financing against these assets, especially in the current interest rate environment, presents a distinct challenge. The reduction in exposure by the revolving line of credit lender, required to waive a covenant violation, highlights the difficulty in accessing future capital.

Conclusion

[Image: Earnings Transcript]

[Image: Earnings Transcript]

Despite signs of progress in the fourth-quarter report and the alleviation of distress in the company's shares, it is crucial for investors to acknowledge the significant financial problems and ambitious capital expenditure plans faced by Diversified Healthcare Trust. At the very least, a distressed debt exchange seems likely, and the associated risks are not worth undertaking.