Image source: stockstudioX/E+ via Getty Images

EPR Properties (NYSE:EPR) offers income investors a refreshing alternative with its well-supported 7% dividend yield. Unlike traditional REITs, EPR Properties is an entertainment-focused REIT that owns a unique portfolio of experiential properties, including theaters, tourist attractions, fitness and wellness centers, and snow-sport destinations. While the COVID-19 pandemic initially impacted the REIT, it has experienced a strong post-pandemic recovery, making it an attractive investment option.

A Promising Recovery and Dividend Reinstatement

I previously recommended EPR Properties as a countercyclical investment, with the potential for a reinstated dividend and substantial FFO recovery following the reopening of its facilities post-COVID-19. Since then, the REIT's FFO picture has steadily improved, and the predicted dividend reinstatement has come to fruition. Although the stock has revalued lower by 8%, I believe EPR Properties is a buy for income investors and offers potential for revaluation.

A Unique Portfolio Supporting Strong FFO Recovery

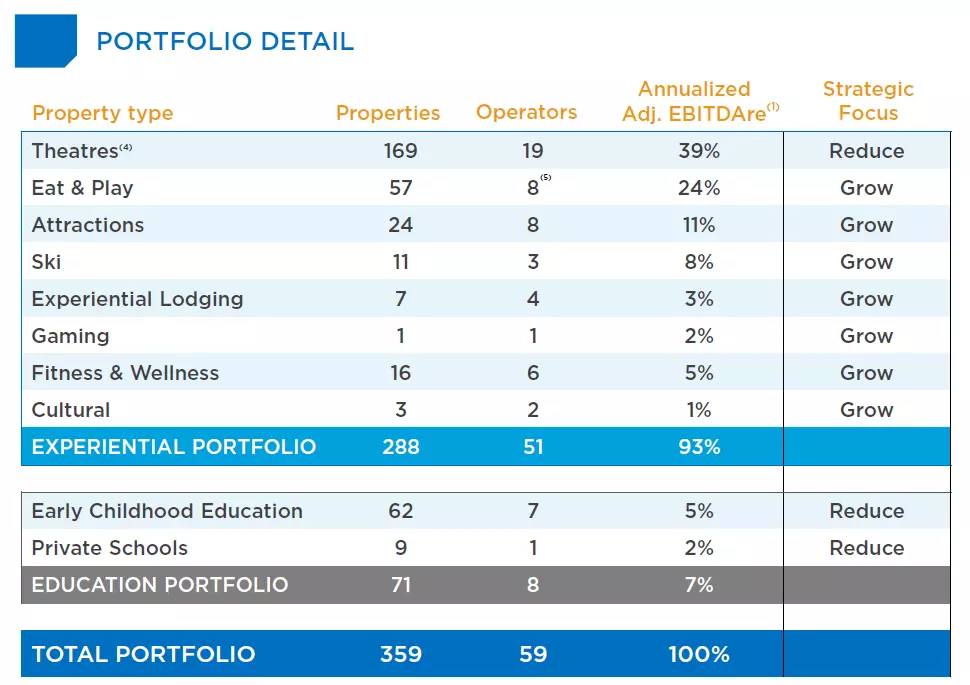

EPR Properties stands out from other REITs due to its focus on entertainment facilities that offer visitors unique experiences. With holdings in theaters, tourist attractions, and snow-sport destinations, the REIT has created a diverse portfolio. While the trend towards streaming has impacted theater attendance, EPR Properties made strategic decisions to reduce its exposure to this segment. In total, the REIT owns 288 experiential properties and an additional 71 properties in the education sector.

During the pandemic, the REIT experienced a decline in visitor numbers due to travel restrictions and facility closures. However, in recent years, EPR Properties has achieved a significant FFO recovery, returning its revenue and funds from operations profile to pre-pandemic levels. Furthermore, the REIT has resumed paying a monthly dividend, further demonstrating its recovery.

A Strong Balance Sheet and Well-Laddered Debt Maturity Structure

EPR Properties boasts an investment-grade balance sheet and has received stable credit ratings from major rating agencies such as Fitch, S&P, and Moody's. With more than 50% of its capitalization consisting of equity, the REIT maintains a moderate amount of net debt relative to its total equity. Additionally, EPR Properties has a well-laddered maturity schedule, with the majority of its debt due in FY 2026 or thereafter. These factors contribute to the REIT's stability and further support its investment potential.

Potential for Dividend Raise in 2024

Thanks to the robust FFO recovery following the pandemic, EPR Properties now offers income investors impressive dividend coverage. In Q3'23, the REIT achieved $1.47 per-share in adjusted diluted FFO, resulting in a dividend coverage ratio of 178%. This coverage allows the REIT the possibility of increasing its dividend in FY 2024. With the combination of strong FFO growth and stable balance sheet, EPR Properties presents an attractive yield play for the future.

EPR Properties' Fair Value

EPR Properties has guided for $5.14 per-share in adjusted funds from operations for the current fiscal year, representing 5% growth year over year. Considering the REIT's potential to achieve similar levels of FFO as pre-pandemic times in FY 2024, it is currently valued at a forward P/FFO ratio of 9.1X. However, it is important to note that EPR Properties was valued much higher before the pandemic, suggesting the potential for restoration. Assuming a 12.0X P/FFO ratio, which is reasonable for a REIT offering a well-covered 7% dividend yield, shares of EPR Properties could have a 32% upside revaluation potential, reaching a fair value closer to $65.

Risks and Closing Thoughts

Investing in EPR Properties relies on the assumption that the U.S. economy will not experience a recession and consumer spending on travel and leisure experiences will continue to grow. Any decline in consumer spending or a new pandemic would negatively impact the REIT's funds from operations trajectory. Overall, I believe EPR Properties is an excellent investment option, supplying a well-supported 7% dividend yield and showcasing the potential for FFO growth. With a positive outlook, there is also an opportunity for a dividend raise in FY 2024.