A Promising Year for Agricultural Land in Wisconsin

The year 2022 has brought significant changes to the agricultural land market in Wisconsin. According to the latest data, the average price of agricultural land sold in the state has seen a remarkable 11.3% increase compared to the previous year. This surge represents a staggering 23.5% increase from 2020. Although there were fewer acres sold and fewer sales overall, the market remained resilient amid challenging economic conditions.

Figure 1. Average price of agricultural land sold in Wisconsin and the number of sales each year from 2010-2022

Figure 1. Average price of agricultural land sold in Wisconsin and the number of sales each year from 2010-2022

Regional Variation in Land Prices and Market Dynamics

While the state average portrays a positive growth trend, there are notable variations in land prices at the regional level. Certain regions of Wisconsin have experienced more favorable market conditions than others. One contributing factor to this disparity is the ability of landowners to hold onto their property, limiting the supply of land available for sale. Even in the face of economic challenges and the decline of dairy farms, most landowners have been able to retain their land and continue activities such as cropping or renting. These factors have played a significant role in supporting market values.

Urban sprawl has also contributed to maintaining or even increasing land values in some areas. The impact of urban development on land values has been particularly significant, especially in regions experiencing rapid urbanization. These factors highlight the complexity of the agricultural land market and the multitude of forces shaping its trajectory.

Unprecedented Growth in Land Values

Comparing the growth in land values over the years, it is evident that the period between 2020 and 2022 witnessed the largest annual increase in land values in the past decade. With an average annual growth rate of 13%, this surge surpassed the previous record set between 2016 and 2018, which saw an average gain of 5%. However, this significant growth corrected itself from 2018 to 2020, with an annual loss in value of approximately 2% per year. The long-term sustainability of these heightened growth rates remains uncertain.

The increase in land prices in 2022 can be attributed to multiple factors, including the rise in corn and bean prices. Additionally, the stimulus payments received by farmers in 2020, 2021, and the first quarter of 2022 may have also contributed to this price surge. Interestingly, despite the increase in land prices, the number of sales in 2022 was lower than in 2021, suggesting that families are increasingly holding onto their land.

The Complex Nature of Land Value Estimation

Estimating land values accurately is a challenging task due to the unique nature of each individual parcel of land. Unlike residential properties, which see thousands of sales each year, only a fraction of Wisconsin's agricultural land changes hands annually. Thus, relying solely on opinion surveys or high-priced sales as indicators of market value can be misleading.

To overcome these challenges, the Wisconsin Department of Revenue (DOR) collects alternative data through transfer return forms submitted during property sales. This objective and timely data source provides valuable insights into changes in agricultural land values over time. By utilizing this data, experts can make a more accurate assessment of market trends.

The Influence of Land Characteristics and Location on Value

Wisconsin's agricultural land values differ from those of its neighboring states due to various factors. A significant portion of the state's land is not suitable for continuous row crop farming and is instead used for forage production, woodlots, and pasture. Additionally, the shorter growing season in northern Wisconsin limits the agricultural potential of the land in that region.

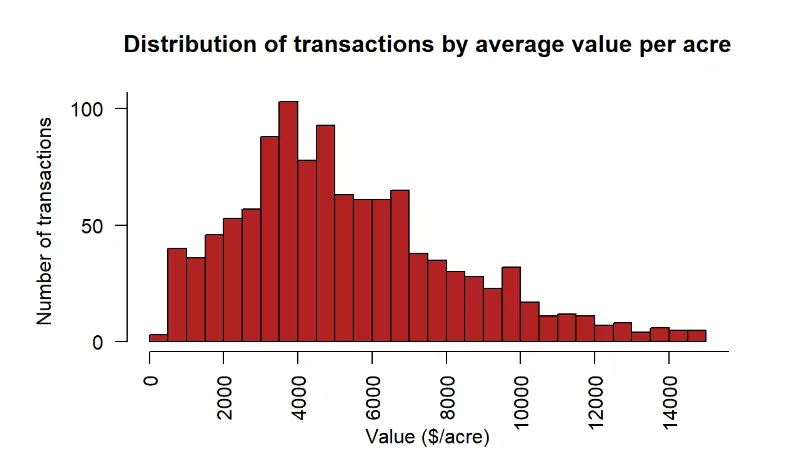

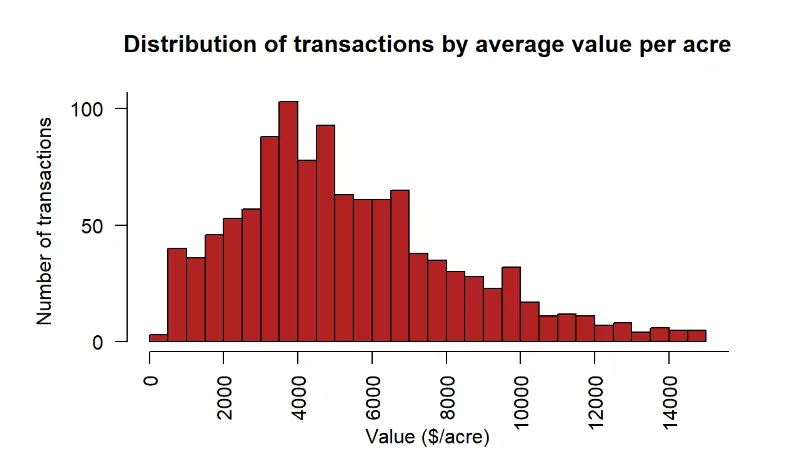

Figure 2. Distribution of transactions by average value per acre

Figure 2. Distribution of transactions by average value per acre

Analyzing the sales data reveals wide variation in the price per acre across the state. Approximately 16% of sales fall below $2,600 per acre, while 38% of sales exceed $6,000 per acre. The remaining 46% of transactions fall within the $2,600 to $6,000 range. While high-priced sales often make headlines, very few transactions surpass $10,000 per acre.

Methodology and Data Sources

To provide a comprehensive analysis of agricultural land values, it is important to consider the methodology employed in collecting data. The Wisconsin Department of Revenue's transfer return data, collected through the transfer return tax, serves as an objective and reliable data source. The transfer return forms, submitted with tax payments during property sales, provide valuable insights into the market.

The state's agricultural land sales data, including bare land and improved properties, are summarized by the Wisconsin Agricultural Statistics Service. It is worth noting that the NASS (National Agricultural Statistics Service) also utilizes the transfer return data for their reports. However, their reports are not limited to parcels of a certain size and include properties in cities and villages. The transfer return data allows for earlier assessments of land value trends.

Regional Variation in Land Prices

When analyzing land prices at the district level, it becomes evident that location plays a crucial role in determining value. The nine reporting districts in Wisconsin exhibit variations in average price per acre. However, it is important to note that assessing market trends in districts with higher average prices, such as Southeastern and South Central Wisconsin, becomes more challenging due to the influence of dairy and row crop industries.

| NASS District | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Central | $3,009 | $2,905 | $2,904 | $3,093 | $3,060 | $2,999 | $3,515 | $3,431 | $3,526 | $3,739 | $4,086 |

| East Central | $5,100 | $5,327 | $6,034 | $6,488 | $6,412 | $6,065 | $6,541 | $5,888 | $5,797 | $6,227 | $6,542 |

| North Central | $2,243 | $2,469 | $2,684 | $2,554 | $2,910 | $2,560 | $2,933 | $3,084 | $2,640 | $2,842 | $3,169 |

| North East | $2,853 | $3,046 | $2,963 | $3,023 | $2,918 | $3,256 | $3,705 | $3,646 | $3,358 | $3,743 | $4,222 |

| North West | $2,328 | $2,474 | $2,338 | $2,471 | $2,392 | $2,282 | $2,132 | $2,556 | $2,375 | $2,945 | $3,296 |

| South Central | $5,271 | $5,058 | $5,468 | $5,221 | $5,418 | $6,163 | $6,084 | $5,644 | $5,777 | $6,152 | $7,199 |

| South East | $5,171 | $6,390 | $6,499 | $5,775 | $6,530 | $6,689 | $7,505 | $6,765 | $7,411 | $8,052 | $7,843 |

| South West | $3,640 | $3,494 | $3,756 | $3,581 | $3,880 | $3,681 | $4,628 | $4,364 | $4,364 | $5,429 | $6,313 |

| West Central | $3,282 | $3,505 | $3,685 | $3,304 | $3,456 | $3,758 | $3,892 | $3,836 | $3,845 | $4,215 | $4,768 |

Table 1: Average price per acre of Wisconsin Agricultural Land, 2012 - 2022

Linking Land Values and Rental Rates

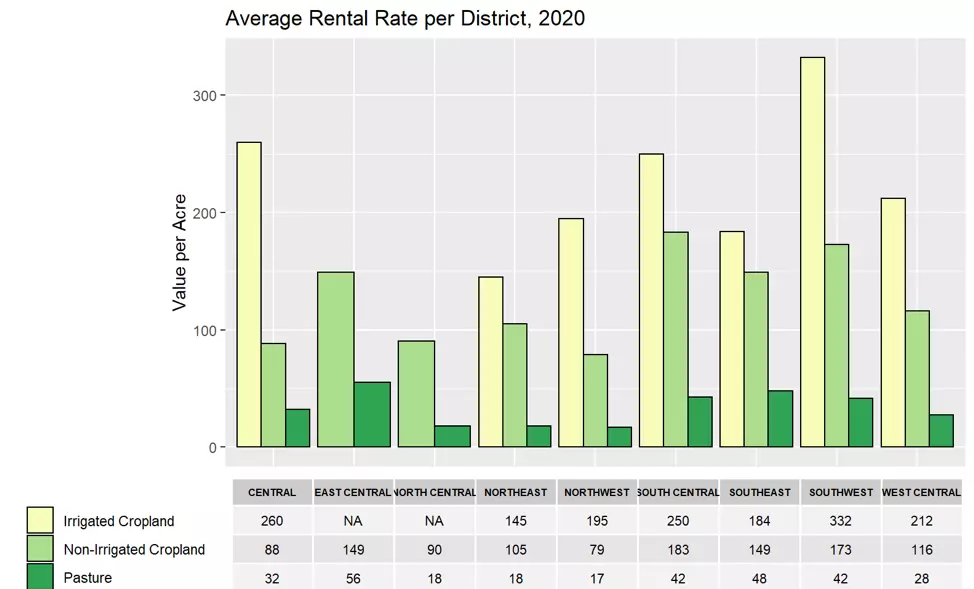

The relationship between land values and rental rates provides valuable insights into the market dynamics. In 2020, the average rental rate for non-irrigated cropland in Wisconsin stood at $138 per acre, a modest increase from the previous year's average of $137 per acre. This rental rate represents approximately 3.3% of the state-wide average sale price. Rental rates vary significantly within counties due to factors such as soil quality, topography, drainage, and existing relationships between landowners and tenants.

Analyzing the historical data from 2010 to 2022 indicates that rental rates have been gradually increasing. However, the rate of increase in rental rates has been slower compared to land values. This trend has resulted in a leveling off of rental rates, with a slight increase from $130 to $138 per acre between 2014 and 2020. Nevertheless, the rental rates may experience a more significant increase in the future as rental rate increases have lagged behind land value increases since 2020.

Figure 7. Average rental Rate per NASS District, 2020

Figure 7. Average rental Rate per NASS District, 2020

Implications for Land Owners and Farmers

The appreciation in land value primarily benefits landowners when they sell their assets. For operating agricultural businesses, changes in land values may not directly translate into financial gains. The high land prices serve as a retirement cushion for "last generation" farm businesses. However, these soaring prices pose challenges for new entrants who may require significant support from family members or benefactors to get started.

The competition for land between dairy farming and other uses poses a particular challenge in Southeastern, East Central, and South Central Wisconsin. If this trend continues, the dairy industry may continue to shift away from these regions to areas with lower land price competition.

Dairy farming is a capital-intensive endeavor, requiring substantial land resources for forage and grain production. Manure management and nutrient balancing also present ongoing challenges. Moreover, Wisconsin's farmland use value assessment and record-low interest rates have helped reduce the costs of holding agricultural real estate. However, expanding dairy businesses may need to rely on long-term leases or manure trading arrangements to comply with environmental regulations and land-use constraints.

While Wisconsin provides an advantageous climate, topography, and infrastructure for dairy farming, the viability of the industry depends on access to affordable land resources.

Conclusion and Appendix

The agricultural land market in Wisconsin has experienced significant growth in 2022. However, properly estimating land values and rental rates remains a complex task. The data collected through the transfer return forms and other reliable sources shed light on market trends and inform decision-making processes.

For more information on land values and sales data, refer to the tables provided in the appendix.

Disclaimer: The information provided in this report is for informational purposes only and should not substitute for professional advice or independent appraisal from qualified professionals.

References:

- USDA-ERS Farm Land Value for details

- Farmland rental rates usually represent about 3% to 3.5% of the land market value.

- For example, see Moody's Seasoned Aaa Corporate Bond Yield for details.