Image source: source

Image source: source

In Maclean's eighth annual chartstravaganza, a collection of economists and analysts have come together to provide valuable insights into the future of Canada's economy in 2022. By choosing one chart each, these experts shed light on the key factors that will shape the Canadian real estate and housing market in the coming year and beyond.

How Canadian Households Will Navigate Higher Interest Rates

Expert Opinion: Brett House, Deputy Chief Economist, and Farah Omran, Economist, Scotiabank Economics

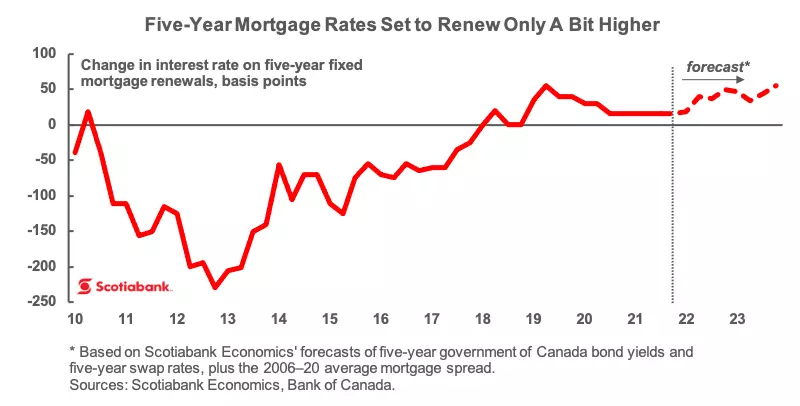

Canadian households and housing markets are expected to withstand the potential interest rate hikes that the Bank of Canada plans to implement in the near future. Interestingly, less than half of Canadian households have mortgages or home-equity lines of credit. Moreover, approximately 75 percent of existing mortgages are fixed-rate, offering stability in interest rates. Scotiabank Economics predicts that holders of the most popular five-year term mortgages, due for renewal in 2022, will experience an average increase of 36 basis points (equivalent to approximately $50 per month) in their mortgage payments. Renewals in 2023 are projected to witness a rate increase of about 45 basis points (around $65 more per month). Although no one desires to pay more on their mortgage, Canadian borrowers are prepared for higher rates due to the strict stress tests they underwent while securing their mortgages five years ago. This means they already had to prove they were capable of managing higher rates.

New mortgages obtained in 2021 had to satisfy even stricter standards, with borrowers being tested against a 5.25 percent interest rate, significantly higher than the rates on offer in December 2021. While variable-rate mortgages saw a surge in popularity in 2021, they still make up just a quarter of all outstanding mortgage balances. In most variable-rate terms, rising rates do not immediately translate into increased monthly payments but rather extend the duration of the loan. When higher interest rates result in larger current debt-servicing costs, mortgage holders can generally convert their mortgages into fixed-rate loans.

In summary, Canadians are well-prepared for a return to normal interest rates and appear to be equipped to handle potential rate increases with minimal impact on their finances.

Inflation's Role in Home Price Growth

Expert Opinion: Hilliard R. MacBeth, Portfolio Manager, MacBeth MacLeod Partners

Canada's housing bubble has become a significant concern for the country's financial system. House prices in Canada are considerably higher than those in most other countries, and the level of household debt taken on to sustain the bubble poses a significant risk.

One often overlooked aspect of the bubble is its limited contribution to inflation and the consumer price index (CPI), despite the skyrocketing house prices. This chart demonstrates that while house prices in Toronto, Vancouver, and throughout the country have increased by nearly five times, the CPI measurement of housing costs, specifically "shelter," has only grown by about 1.6 times. In fact, the growth in housing costs has been less than two percent per year in most cases.

This discrepancy arises because Statistics Canada calculates housing costs using a monthly payments approach that excludes the cost of buying a home. The monthly cost of housing includes mortgage payments, comprising both principal repayment and interest. Over the past two decades, interest rates have steadily declined, fueling the house-price bubble while keeping the cost of shelter growth relatively low.

Ironically, as the Bank of Canada plans to raise interest rates starting next year, house prices may decline while the CPI measurement of housing costs grows. This is because the rate of interest is a significant factor in the calculation.

Housing Construction vs. Business Investment

Expert Opinion: Doug Porter, Chief Economist, BMO Financial Group

Amidst the staggering economic statistics emerging from the pandemic, one stands out as particularly noteworthy: in the first three quarters of 2021, residential construction accounted for a larger share of Canadian GDP than business investment—a phenomenon that has never occurred before. Prior to the pandemic, business investment typically represented about twice the share of the economy compared to housing. A "normal" year would see approximately 12 percent dedicated to private capital spending and six percent to residential construction. However, in 2021, weak business investment combined with robust housing activity culminated in this unprecedented crossover. The figures remain consistent even when adjusted for inflation, as housing's share of activity ranks among the highest on record.

Looking ahead, housing is expected to moderate from the extremes witnessed in 2021, although it had already begun to decline from its peak early in the year. The significant unknown for the Canadian economy lies in whether business investment will now take the lead. While a moderate recovery is anticipated in the near term, Canada's heavy reliance on housing is likely to persist.

The Stimulated Home Shopping Frenzy

Expert Opinion: Stephen Punwasi, Co-founder, Better Dwelling

Amid discussions around the lack of housing inventory, the real issue at hand is excessive demand. When the Bank of Canada reduces interest rates and employs quantitative easing, their intention is to stimulate demand and generate inflation. By lowering rates, consumers are encouraged to enter the market and compete with existing buyers, resulting in increased demand for housing. This surge in demand for limited inventory leads to inflationary pressures.

This phenomenon is particularly evident in the Canadian real estate market. From April 2020 to October 2021, Canada experienced approximately 246,500 excess home sales above the trend. In contrast, new listings during the same period amounted to only 85,800 homes above the trend, significantly lower than the surge in home sales.

Additionally, BMO estimates that the annualized dollar value of excess home sales stands at approximately $150 billion, equivalent to six percent of Canada's GDP. It is crucial to note that this figure represents only the excess above the trend, stimulated by cheap credit. Strikingly, this surge in demand occurred despite minimal population growth.

As such, the Bank of Canada stimulated demand to raise home sales and inflation but now appears oblivious to the source of this surge.

The Escalation of Single-Family Home Values

Expert Opinion: Ben Rabidoux, Founder, North Cove Advisors

The number of single-family homes listed for sale in major Canadian metropolitan areas has sharply declined in recent years. In the Greater Toronto Area, listings have dropped by 52 percent compared to the previous year and a staggering 77 percent since 2017. Vancouver tells a similar story, with inventory down nearly a third from the previous year and over half since 2018.

While excess demand and speculation have undoubtedly contributed to this decline, the primary driver appears to be a shortfall in new construction over the past decade. This shortage occurred despite exceptionally strong population growth during the same period. Historically, population growth averaged around 3.1 million per decade, with new single-family home completions averaging just under 1.3 million. However, between 2010 and 2019, population growth surged to four million, while new completions fell to less than 1.1 million.

Unless Canada addresses this imbalance, single-family homes will continue to be highly sought-after assets in major markets across the country.

In conclusion, these five charts provide valuable insights into the Canadian real estate and housing landscape in 2022. From interest rate impacts and inflation dynamics to the role of housing in the economy and the challenges of supply and demand, these charts offer a nuanced understanding of the factors shaping the Canadian housing market in the coming year.