Image source: marekuliasz

Image source: marekuliasz

Introduction

Are you looking for an exciting investment opportunity in the real estate sector? Look no further than Four Corners Property Trust (NYSE:FCPT). As interest rates are expected to decline in the near future, this Real Estate Investment Trust (REIT) is positioned to thrive. With a diverse portfolio and a strong focus on high-quality tenants, FCPT offers a unique opportunity for investors.

Brief Overview

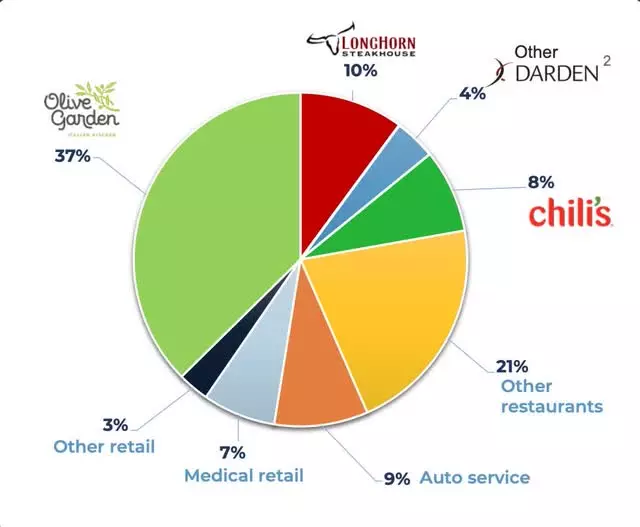

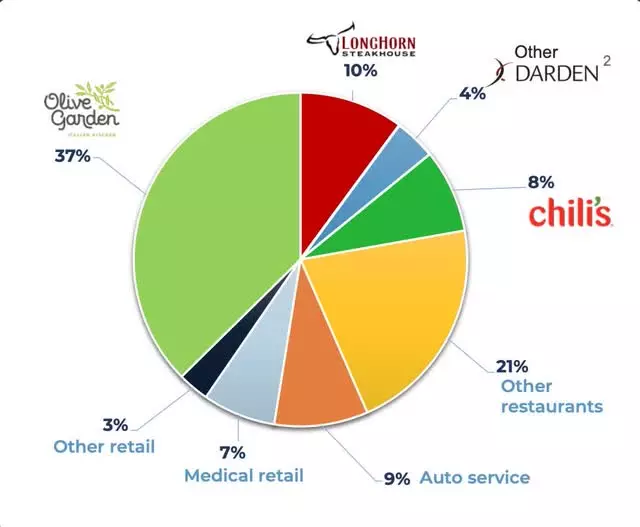

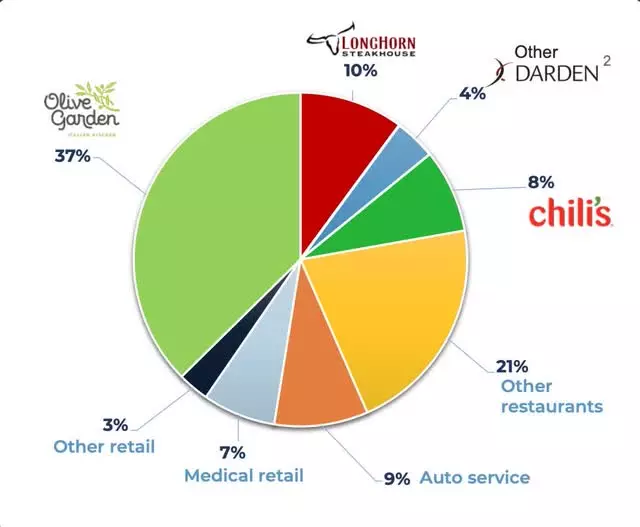

Four Corners Property Trust specializes in investing in real estate properties of restaurants, with major tenants including Olive Garden, Chili's, Burger King, and Cheddar's. Additionally, they have investments in the medical and auto industries, making their portfolio well-diversified. With a presence in 47 states and a focus on fast-growing areas like Texas and Florida, FCPT's reach is extensive.

Image source: FCPT investor presentation

Image source: FCPT investor presentation

Acquisition Spree

One remarkable aspect of FCPT is its impressive growth and record-breaking number of acquisitions. Despite the challenging economic landscape, the company has added 90 properties this year alone, with a significant portion being investment-grade tenants. This not only expands their portfolio but also strengthens it. Since its spin-off in 2015, FCPT has experienced rapid growth, with the number of properties increasing from 418 to 1,106.

Image source: FCPT investor presentation

Image source: FCPT investor presentation

Latest Earnings

FCPT reported solid Q3 earnings, with FFO and revenue showing positive growth. Their portfolio occupancy rate remained high at 99.8%, and they collected 99.9% of base rent for the quarter. Major tenants such as Chili's, Olive Garden, and Longhorn Steakhouse reported strong same-store sales, indicating the resilience and stability of FCPT's properties.

Quality Balance Sheet

Despite its smaller market cap, FCPT boasts a strong balance sheet and investment-grade credit rating from Fitch and Moody's. Their well-laddered debt maturities and healthy financial ratios provide stability and assurance to investors.

Image source: FCPT investor presentation

Image source: FCPT investor presentation

Strong Dividend Growth

Investors seeking a reliable income stream will be pleased with FCPT's dividend growth. Even during the challenges posed by the COVID-19 pandemic, the company maintained and even raised its dividend. With a safe AFFO payout ratio and a focus on sustainable dividend growth, FCPT is an attractive option for income-seeking investors.

Valuation

Wall Street analysts rate FCPT as a buy, with a price target above the current share price. Using the Dividend Discount Model and future estimates, the stock shows potential for double-digit upside. Additionally, the forward P/AFFO ratio is below the 5-year average, indicating a potentially undervalued stock.

Image source: Author creation

Image source: Author creation

Risk Factors

Like any investment, FCPT carries some risks. Its focus on the restaurant industry exposes it to economic downturns, such as recessions. Additionally, potential changes in consumer behavior due to the rise of GLP-1 drugs could impact the demand for restaurant properties. However, FCPT's diversification and strong tenant base mitigate these risks to a certain extent.

Bottom Line

Four Corners Property Trust is a hidden gem for real estate investors. With its impressive growth, strong financials, and diverse portfolio, FCPT presents an attractive investment opportunity. As interest rates decline and the macroeconomic environment improves, FCPT is well-positioned to provide investors with both capital appreciation and reliable dividends. Consider adding FCPT to your watchlist or even taking a speculative buy position.

I'll personally be keeping a close eye on FCPT as I navigate the market and anticipate the Federal Reserve's actions. While there are risks associated with the concentration in the restaurant sector, the potential upside and the company's strong fundamentals make FCPT an intriguing investment option.