Real estate has always been considered a stable and lucrative investment option, and with the current economic climate, it's poised to become even more attractive. The combination of effective vaccines, increasing inflation, low interest rates, abundant stimulus, the shift towards remote work, and the desire to own income-generating assets have all contributed to a bright future for real estate. In this article, we'll provide an overview of Fundrise, a leading real estate crowdfunding platform that allows both accredited and unaccredited investors to access private real estate opportunities previously reserved for the ultra-wealthy.

Fundrise: Democratizing Real Estate Investment

Founded in 2012, Fundrise has been at the forefront of revolutionizing the real estate investment landscape. They pioneered the concept of eREITs (electronic Real Estate Investment Trusts), enabling everyday individuals to invest in private real estate projects that were previously only available to high-net-worth individuals and institutions.

With over $3.2 billion in equity under management and more than 400,000 active investors on their platform as of 2022, Fundrise has experienced significant growth. This acceleration in assets and investors compared to the previous year showcases the increasing demand for real estate investment opportunities.

Fundrise sets itself apart by offering extensive investment analysis and an annual market outlook. Their focus on market fundamentals aligns with their investment philosophy, making them a reliable choice for investors seeking stability and long-term returns.

An Interview with Ben Miller, Founder of Fundrise

To gain further insights into Fundrise's value proposition and future plans, we conducted an in-depth interview with Ben Miller, the Founder and CEO. In this interview, Ben discusses Fundrise's mission to create a better financial system for individual investors and their commitment to democratizing access to high-quality real estate investments.

Fundrise's unique approach combines historically strong investment assets, such as private real estate, with a direct-to-consumer, online platform. By leveraging technology to connect investors directly with institutional-quality assets, Fundrise eliminates costly intermediaries, resulting in lower fees and the potential for higher risk-adjusted returns.

Investing in Private Real Estate with Fundrise

Fundrise differentiates itself from traditional real estate crowdfunding platforms by offering access to institutional-quality assets through their investment vehicles, such as eREITs. Unlike deal-by-deal fundraising models, Fundrise provides individuals with the opportunity to invest directly into diversified pools of assets. This approach ensures that investors can benefit from assets that meet strict partnership quality, size, scale, and risk/return criteria.

Their focus on acquiring and renovating affordably priced apartment communities in the sun-belt region has proven successful. These areas experience above-average population and economic growth, making them attractive for those seeking stable occupancy rates and strong rent growth.

Moreover, Fundrise has expanded its investment strategy to include last-mile, e-commerce-related industrial assets. These assets facilitate efficient delivery to densely populated areas, capitalizing on the surge in online shopping. By adapting their strategies to market trends, Fundrise aims to provide investors with a diversified portfolio that maximizes long-term returns.

Weathering the Storm: Real Estate in a Post-COVID World

Navigating the post-COVID real estate landscape requires a careful understanding of emerging trends. While certain property types, such as hotels, traditional retail, and large urban office buildings, have suffered due to the pandemic, e-commerce-focused industrial assets, suburban housing, and affordable apartments in the south and southeast have fared well.

Fundrise's investment philosophy prioritizes market fundamentals and aims to protect against market volatility. By anchoring portfolios with stable physical real estate assets, investors can weather economic storms and enjoy more consistent returns.

The Power of Private Real Estate Assets

Private real estate assets, like those offered through Fundrise, have demonstrated their ability to provide stable returns with lower volatility compared to stocks and publicly traded REITs. During the turbulence of 2020, Fundrise's performance surpassed that of the public markets, highlighting the shelter that real estate investments can provide during challenging times.

Investing in Fundrise can help mitigate the effects of stock market volatility, offering a smoother investment experience. As the Federal Reserve's financial stimulus measures continue to impact markets, the potential for inflationary and deflationary pressures looms. Physical real estate, as a hard income-producing asset, acts as a valuable buffer against these market uncertainties.

Impressive Performance and Historical Returns

Fundrise's historical performance data underscores their commitment to consistency and long-term value. Although returns may vary from year to year, Fundrise investors have enjoyed stable performance compared to public market analogues. Their focus on delivering strong returns through a low-fee, passive investment model has been successful, and they continue to enhance their efficiency and returns through technology-driven innovations.

Get Started with Fundrise

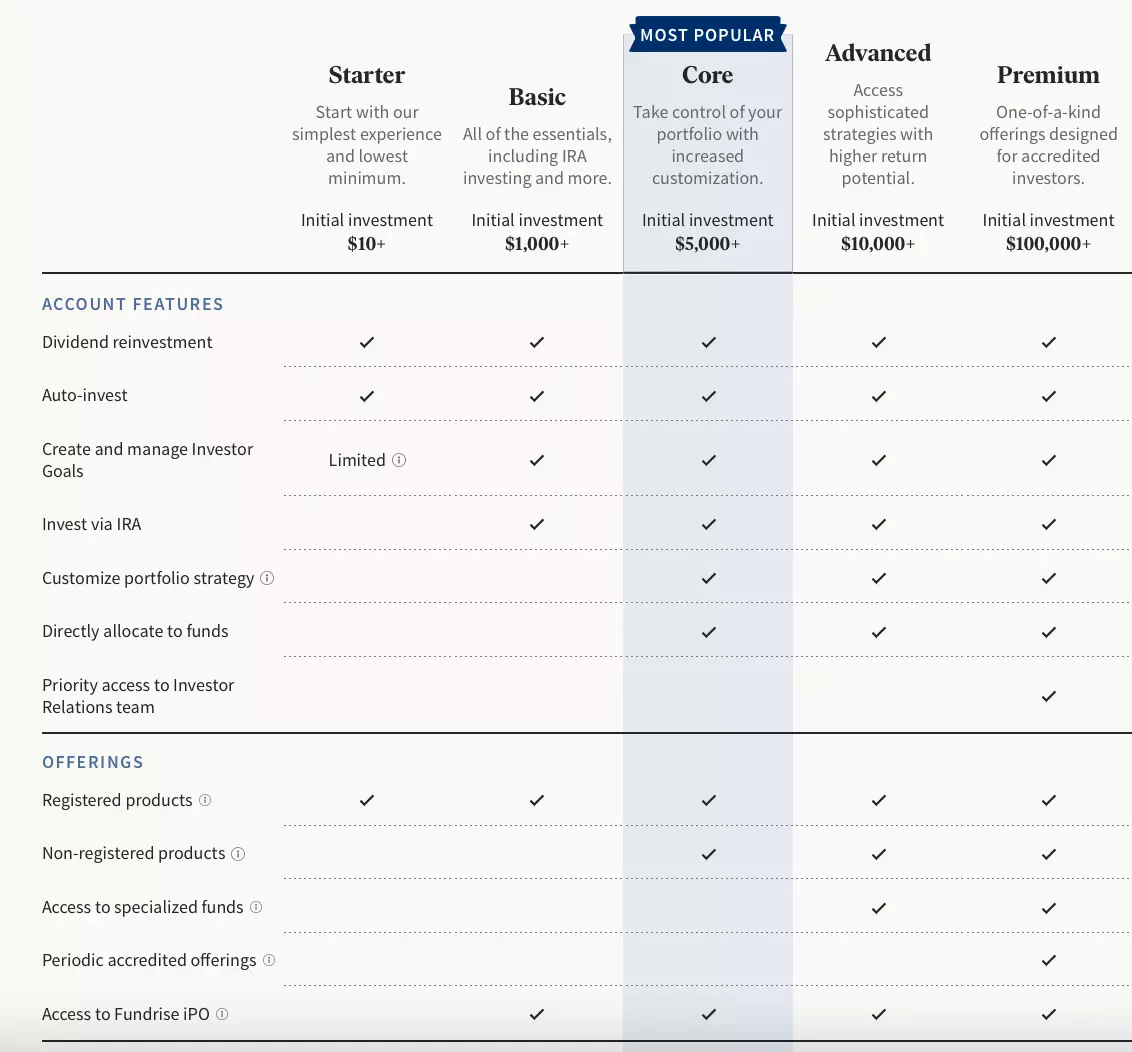

Regardless of your investment amount, Fundrise offers an opportunity to diversify beyond the public markets and reap the benefits of real estate investment. Their user-friendly platform allows you to select an investment plan that aligns with your goals, and their automated allocation system ensures diversification across a range of funds.

Upon joining Fundrise, you'll receive regular updates on your investments, keeping you informed of the performance and growth of your portfolio. With transparent communication and a front-row seat to the dynamic nature of real estate investing, Fundrise offers a unique investment experience.

To explore the potential of real estate investment with Fundrise, sign up for free on their platform and embark on your journey towards a more diversified and stable investment portfolio.