Investing in real estate has traditionally involved either buying physical properties or investing in Real Estate Investment Trusts (REITs) through a brokerage account. However, there is a newer option that has gained popularity in recent years - real estate crowdfunding platforms like Fundrise. In this article, we'll explore the pros and cons of investing in real estate through Fundrise.

About Fundrise

Fundrise was established in 2012 in Washington DC with the goal of making real estate investing more accessible and affordable. It is the first online investment platform to provide a simple and low-cost way for anyone to invest in real estate and earn consistent returns. Since its inception, Fundrise has grown to become a leading real estate investment platform, managing over $4.9 billion in assets for more than 130,000 investors.

Fundrise was established in 2012 in Washington DC with the goal of making real estate investing more accessible and affordable. It is the first online investment platform to provide a simple and low-cost way for anyone to invest in real estate and earn consistent returns. Since its inception, Fundrise has grown to become a leading real estate investment platform, managing over $4.9 billion in assets for more than 130,000 investors.

Fundrise operates as an online real estate crowdfunding platform, pooling funds from investors to invest in private real estate deals. These deals encompass a wide range of properties, from commercial buildings to single-family homes, offering investors a diversified portfolio of real estate investments.

How Fundrise Works

Investing through Fundrise is quick and easy. With just $500 and 10 minutes of your time, you can start investing in real estate. The process involves three simple steps:

Step 1: Provide Some Basic Information

To get started, visit the Fundrise website and provide basic information, including your email address, age, investment experience, investment goals, and the duration and amount of your investment. Based on this information, Fundrise will recommend an account level and investment plan for you.

Step 2: Select Your Account Level and Investment Plan

Fundrise offers three levels of accounts: Core, Advanced, and Premium, with varying minimum investment amounts. You can choose the account level that suits your needs and investment preferences. Each plan comes with specific perks, but the core plan generally covers all the essential features.

Additionally, you will need to select an initial investment plan, such as Supplemental Income, Balanced Investing, or Long-Term Growth. These plans offer different strategies for generating returns based on your investment goals.

Step 3: Create Your Account and Start Investing

Once you have chosen your account level and investment plan, creating your Fundrise account is straightforward. Simply follow the provided instructions to fund your account and start investing in real estate assets. Fundrise aims to provide a passive income stream for years to come.

Fundrise Key Features

Fundrise offers several features that make it an attractive investment option:

-

Minimum Investment: Fundrise allows investors to get started with as little as $500 for the starter plan, $1,000 for the core plan, $10,000 for the advanced plan, and $100,000 for the premium plan.

-

Core Fees: Fundrise charges a 0.15% advisory fee, 0.85% management fee, and potential organizational/miscellaneous fees of 0-2%.

-

Investor Requirements: Unlike many other investment platforms, Fundrise is open to both accredited and non-accredited investors.

-

Liquidity: Fundrise recommends a minimum investment horizon of 5 years. While you can potentially reclaim your funds before that time, it may involve additional fees and depends on economic conditions.

-

Investment Options: Fundrise primarily offers eREITs and eFunds, which invest in commercial and residential real estate, respectively, providing investors with a range of investment choices.

Fundrise Review: Pros and Cons

As with any investment opportunity, there are pros and cons to consider when investing in Fundrise.

Fundrise Pros

-

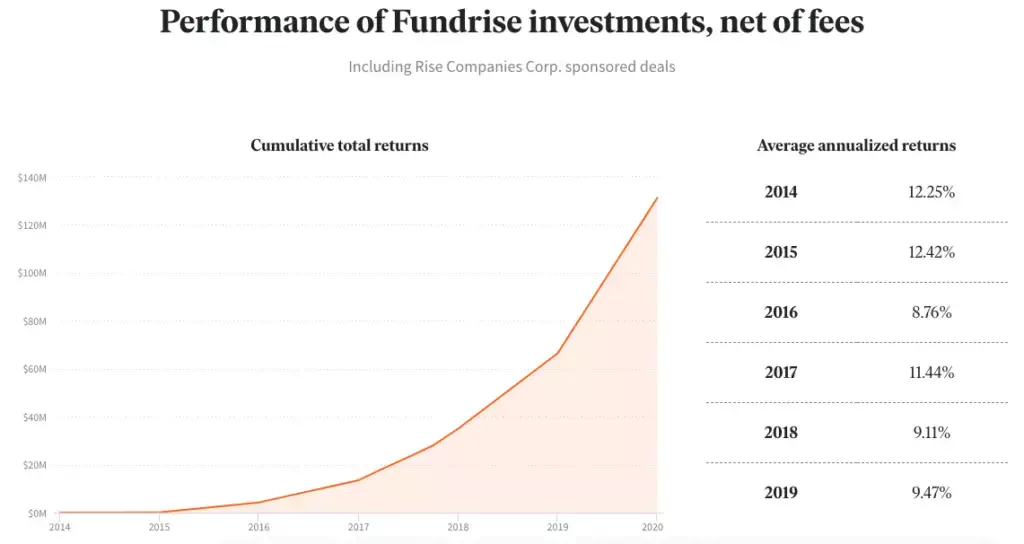

Return Potential: Fundrise has a track record of impressive historical returns, which makes it an enticing investment opportunity.

-

Low Investment Minimum: With a minimum investment amount of $500 for the starter plan, Fundrise offers a low barrier to entry for investors.

-

Diversification: Investing in real estate through Fundrise can serve as a diversification tool, complementing a portfolio of stocks and bonds.

-

Accessibility: Fundrise is available to both accredited and non-accredited investors, providing access to private real estate deals without the need to own physical properties.

-

Easy to Navigate Platform: Fundrise offers a user-friendly and modern investment platform, allowing investors to start investing in just a few minutes.

-

Passive Income: Fundrise provides an opportunity for passive income generation, requiring minimal ongoing effort.

Fundrise Cons

-

Liquidity: Investing in private real estate means investing in illiquid assets. It may not be easy to access your investment within 5 years and could involve additional fees.

-

Fees: Fundrise charges a 1% advisory and management fee, which can be higher compared to index funds and ETFs. It's important to be aware of potential hidden fees.

-

Risk: Though Fundrise has provided high historical returns, future returns are not guaranteed. There is a risk of lower returns or even potential loss of investment.

-

Company Stability: Fundrise is a relatively new platform, founded in 2012. It may lack a long track record compared to more established investment firms.

-

Taxes: Dividends from Fundrise investments are taxed as regular income, rather than at the lower rate applied to qualified dividends.

Fundrise Review: Frequently Asked Questions (FAQs)

To address common queries, here are some frequently asked questions about Fundrise:

Q: Is Fundrise a Good Investment? A: Fundrise has reported impressive historical annual returns, making it appear to be a promising investment. However, like all investments, it is essential to consider the associated risks.

Q: Does Fundrise Pay Dividends? A: Yes, Fundrise typically pays quarterly dividends that investors can choose to receive as cash or reinvest.

Q: How is Fundrise Taxed? A: Fundrise dividends are non-qualified and taxed as regular income, subject to your applicable tax rate.

Q: Is Fundrise Safe? A: As with any investment, there is risk involved. Fundrise invests in real, physical assets, but there is no guarantee that the value of your investment will not depreciate. It is important to assess your investment strategy and risk tolerance before investing.

Fundrise Review: Is Fundrise Worth It?

Fundrise is an intriguing investment platform worth considering. If you have already established an emergency fund, maxed out your 401(k), and invested in stocks and bonds, Fundrise can be a valuable addition to your investment portfolio. However, if you are starting with your first $500, there may be better options to explore before diving into Fundrise.

If you are interested in investing with Fundrise after reading our detailed review, you can get started here.