Image Source: LPETTET

Image Source: LPETTET

Introduction

When it comes to real estate in Nevada, the name VICI Properties Inc. (VICI) often takes the spotlight, especially on the famous Las Vegas Strip. However, there is another REIT that has been steadily making waves and deserves attention: Gaming and Leisure Properties, Inc. (NASDAQ:GLPI). While not as concentrated in Las Vegas as VICI, GLPI's impressive moves and strategic investments make it a REIT worth considering for your portfolio in 2024 and beyond.

Previous Thesis

In a previous article titled "Get A Smaller Piece Of Vegas With Gaming and Leisure Properties," I covered GLPI's agreement with the Oakland Athletics to bring the team to Las Vegas, which I believe will lead to sustainable growth for the company. Unlike VICI, which owns iconic properties like Mandalay Bay and Caesar's Palace, GLPI owns the land occupied by the smaller, yet significant Tropicana. This ground lease with the MLB team has already increased rental income for GLPI and raised its full-year FFO guidance.

Finding Accretion

Since my last article, GLPI has continued to demonstrate its financial resilience. While their earnings may not be staggering, their steady FFO and revenue growth show a conservative and thoughtful investment approach. They recently entered into a ground lease agreement with Hard Rock Casino in Illinois, further increasing their cash flow income. Additionally, GLPI has expanded its property portfolio, adding three more properties during the quarter. These strategic moves have contributed to a year-to-date increase in AFFO and a raised guidance.

Image Source: Author creation

Image Source: Author creation

Room For Dividend Growth

GLPI's dividend is currently well-covered and has room for growth. With a payout ratio in line with industry peers like VICI, GLPI has consistently grown its AFFO and dividend in the past six years. Their solid financials and track record make the current price an attractive entry point for investors looking to benefit from potential dividend growth.

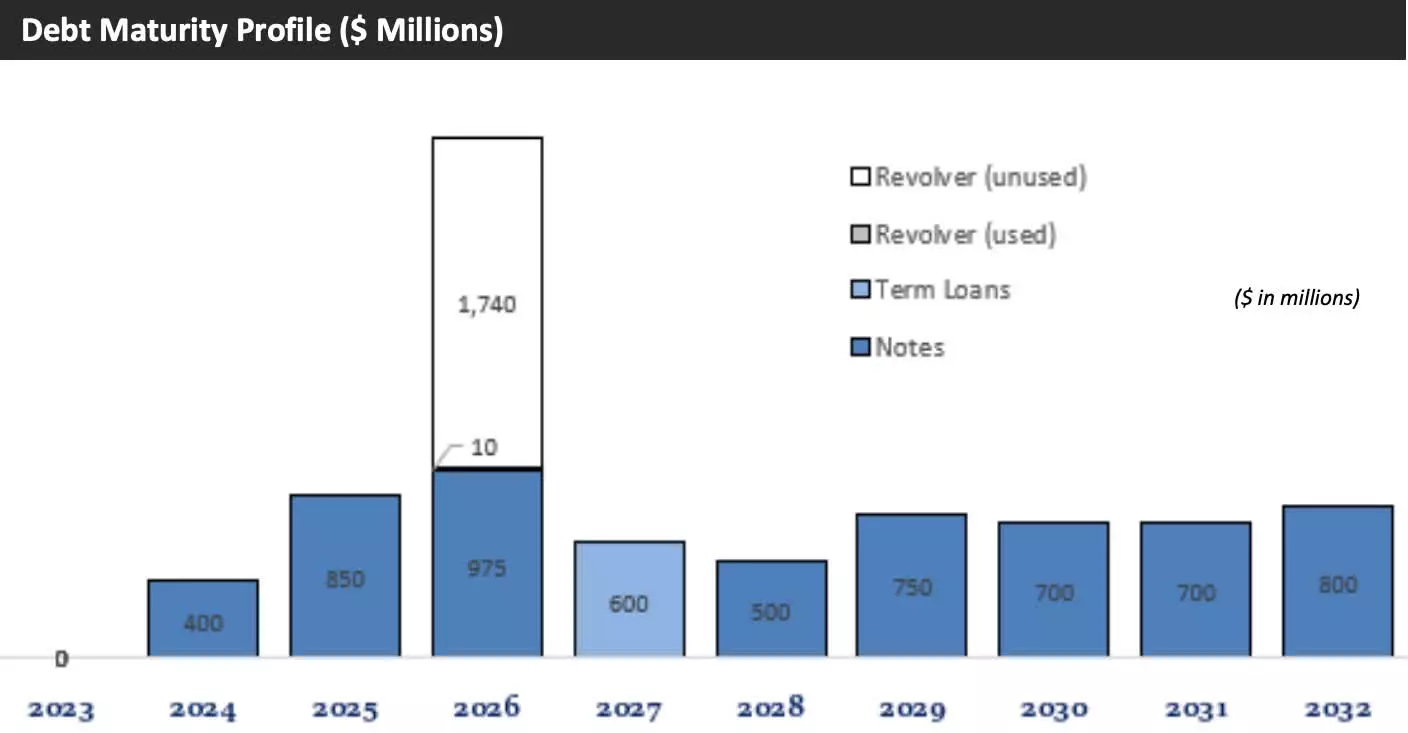

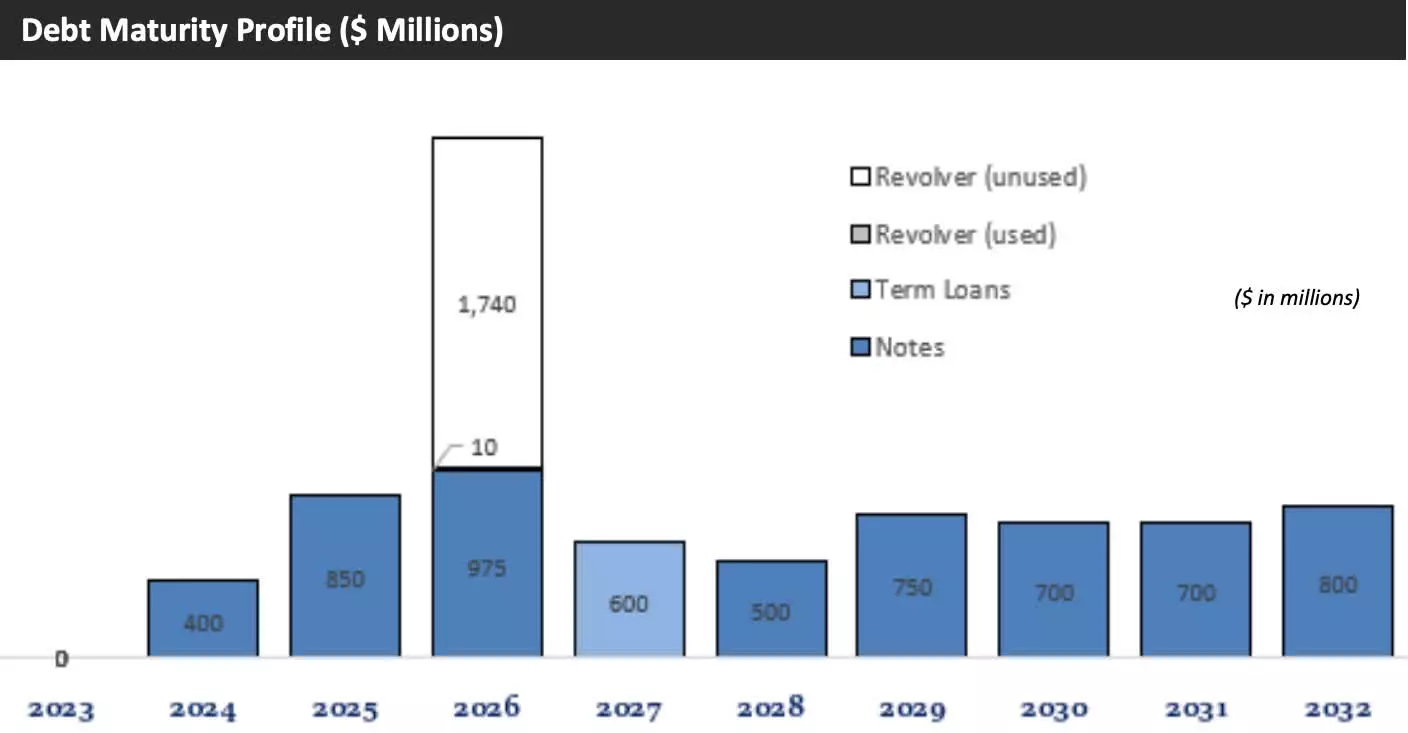

Deleveraging

Despite the challenging economic backdrop and high interest rates, GLPI has managed to increase its liquidity and lower its net-debt-to-EBITDA ratio. This successful deleveraging indicates the REIT's strong financial management and could lead to a possible credit rating upgrade in the near future. With manageable debt maturities and ample liquidity, GLPI is well-positioned to weather any upcoming economic uncertainties.

Image Source: GLPI investor presentation

Image Source: GLPI investor presentation

Is It A Buy, Hold, Or Sell?

Currently, GLPI appears to be fairly valued, showing resilience even during market fluctuations. With a forward P/AFFO ratio below the sector median and favorable ratings by industry experts, GLPI offers an opportunity for investors. This REIT also presents potential upside to its price target and could benefit from expected interest rate cuts. As Warren Buffett wisely said, it's better to buy a wonderful company at a fair price, and GLPI seems to fit that description.

Potential Catalysts/Risks

GLPI's move into Las Vegas positions the company for positive growth, thanks to the city's popularity as a tourist destination. Furthermore, the upcoming Super Bowl LVIII and the potential arrival of more professional sports teams in the city can bring additional opportunities for GLPI. Expansion into other states is also an option for future growth. However, a potential risk for GLPI lies in a recession, as the casino industry heavily relies on consumer spending. Compliance with regulations and cybersecurity measures is also an ongoing concern.

Bottom Line

Gaming and Leisure Properties may not be as well-known as some of its peers, but it is a REIT that has been steadily growing its portfolio through strategic acquisitions and ground leases. With a firm foothold in Las Vegas and ample room for expansion, GLPI is poised for future success. Deleveraging and careful financial management provide stability, even in uncertain times. Considering the potential for dividend growth and the attractive entry point, GLPI remains a compelling investment choice in the REIT sector.

Please note: This article is for informational purposes only and should not be considered as financial advice. Always do your own research and consult with a professional advisor before making investment decisions.