General Electric (NYSE: GE) has recently made a groundbreaking announcement that will undoubtedly reshape its future. The decision to sell off the majority of its GE Capital assets and steer towards becoming a technology-focused company is expected to open up unprecedented possibilities for investors. This article dives into the details of this strategic move and explores the potential buying opportunity it presents.

A Bold Transformation

GE's plan includes the sale of $26.5 billion worth of GE Capital Real Estate assets while retaining the financial services arms directly tied to its industrial businesses. Alongside this transformation, the company will incur a special items charge of $16 billion in the first quarter of 2015, with only $4 billion in cash expenses. However, GE's industrial businesses are on track to generate double-digit per share operating earnings, projected to be between $1.10 and $1.20 for the full-year fiscal 2015.

Within three years, GE anticipates a significant shift in its earnings composition. With a reduction in financing business, approximately 90% of the company's earnings are expected to come from its high-return industrial business.

Source: GE infographic

Source: GE infographic

A Generous Repurchase Plan

In addition to the sale of assets, GE has authorized up to $50 billion in share repurchases, aiming to reduce the total outstanding shares to approximately 8-8.5 billion by 2018. This reduction represents a staggering 15.8% - 20.8% decrease from the current share count of roughly 10.1 billion. Moreover, GE envisions returning over $90 billion to shareholders through dividends, buybacks, and the Synchrony financial service business exchange by 2018. These figures account for a significant proportion of GE's present $266.9 billion market capitalization.

Despite these substantial repurchases and returns to shareholders, GE remains committed to maintaining its strong dividend at the current level in 2016. Furthermore, the potential for future growth is not compromised, as the company plans to retain room for "bolt-on" acquisitions, enabling expansion in core markets and potential earnings increase.

Capitalizing on the Opportunity

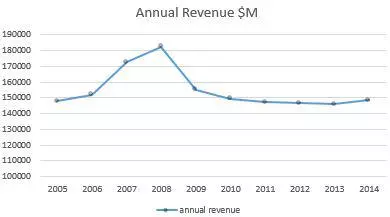

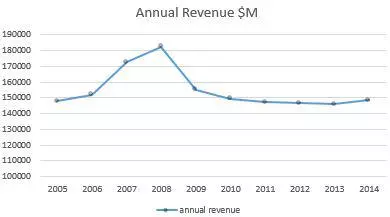

The timing of GE's strategic moves could not be better. With stagnant revenue growth and a stock that has struggled to gain momentum in recent years, this transformation opens up a plethora of possibilities. It is worth noting that while GE's annual revenue stood at $148.6 billion in fiscal 2014, only a slight increase from 2005, the company has recognized the need for change.

Data Source: gurufocus.com

Data Source: gurufocus.com

By shifting its focus towards higher-margin industrial business, GE aims to increase the contribution of this sector to 90% of its revenue by 2018, up from the current 58%. This shift prompts a reassessment of GE's share price based on forward earnings estimates and a new price multiple.

Considering GE's projected operating earnings of $1.10 - $1.20 per share in 2015 and an estimated $2.00 per share in 2017, assigning a price multiple of 17 - 18 times earnings suggests a forecasted share price range of $34 - $36.

With the stock currently trading at $28.51, having already experienced an increase of nearly 11%, investors have the potential to witness another significant rise of 19.3% - 26.3% over the next two years. This projection does not account for the benefits of the proposed $50 billion share repurchase program, which is expected to drive earnings per share higher, ultimately increasing shareholder value.

Shifting Focus, Unlocking Potential

GE's renewed focus on technology aligns the company with its roots, allowing it to thrive in the current business environment. By proactively addressing concerns about activist investors and potential splits, CEO Jeff Immelt's visionary leadership is reclaiming GE's position as one of the most esteemed industrial manufacturers.

Now, more than ever, is an opportune moment to consider investing in GE. As the gap between current and projected EPS narrows and the full value of this transformative restructuring is not yet fully reflected in the share price, GE offers a golden buying opportunity. Let's join the journey as GE paves the way for a bold and prosperous future.

Disclaimer: The opinions expressed in this article are solely those of the author and should not be considered as financial advice. Investment in stocks involves risks, and readers should do their own research and consult with a financial advisor before making any investment decisions.