Investing in real estate has become more accessible than ever, thanks to the rise of crowdfunding platforms. Two popular platforms in this space are Groundfloor and Fundrise. Both offer unique investment opportunities, but which one performs better? Let's delve into their investment strategies and potential returns to find out.

Groundfloor's Investment Strategy

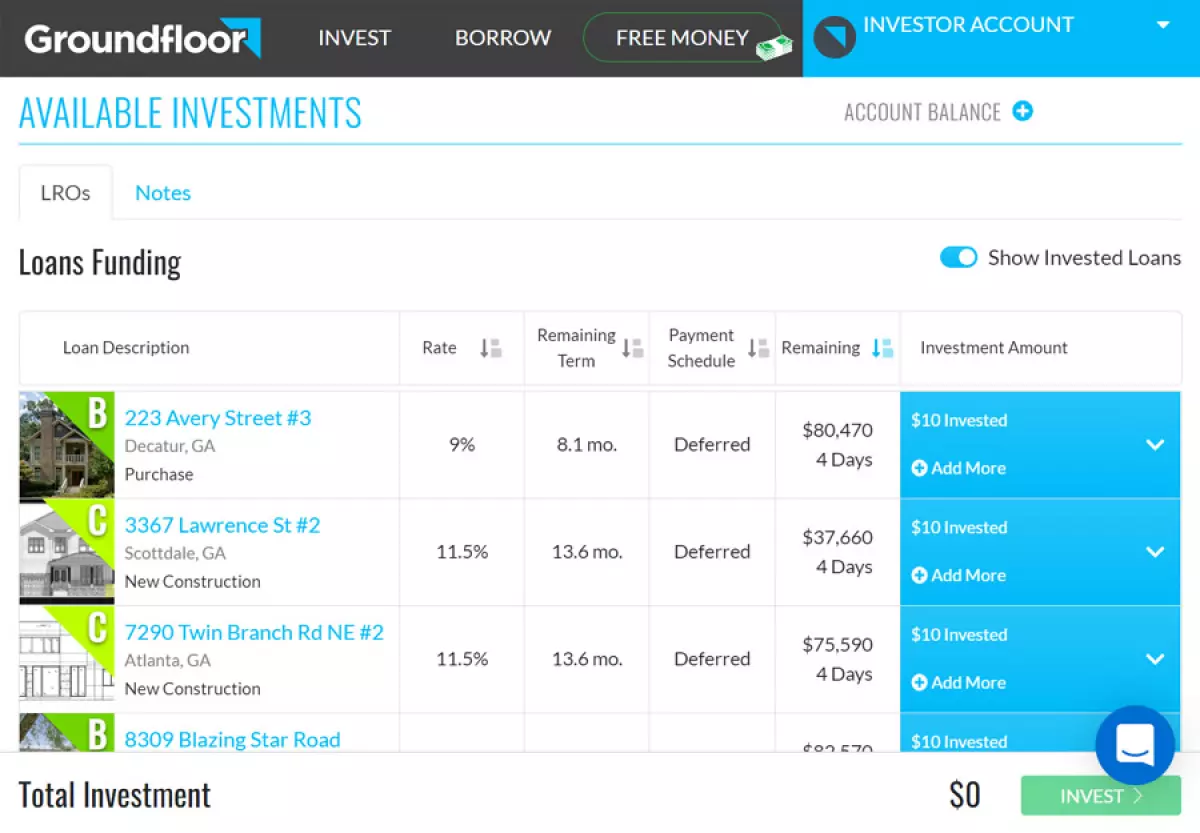

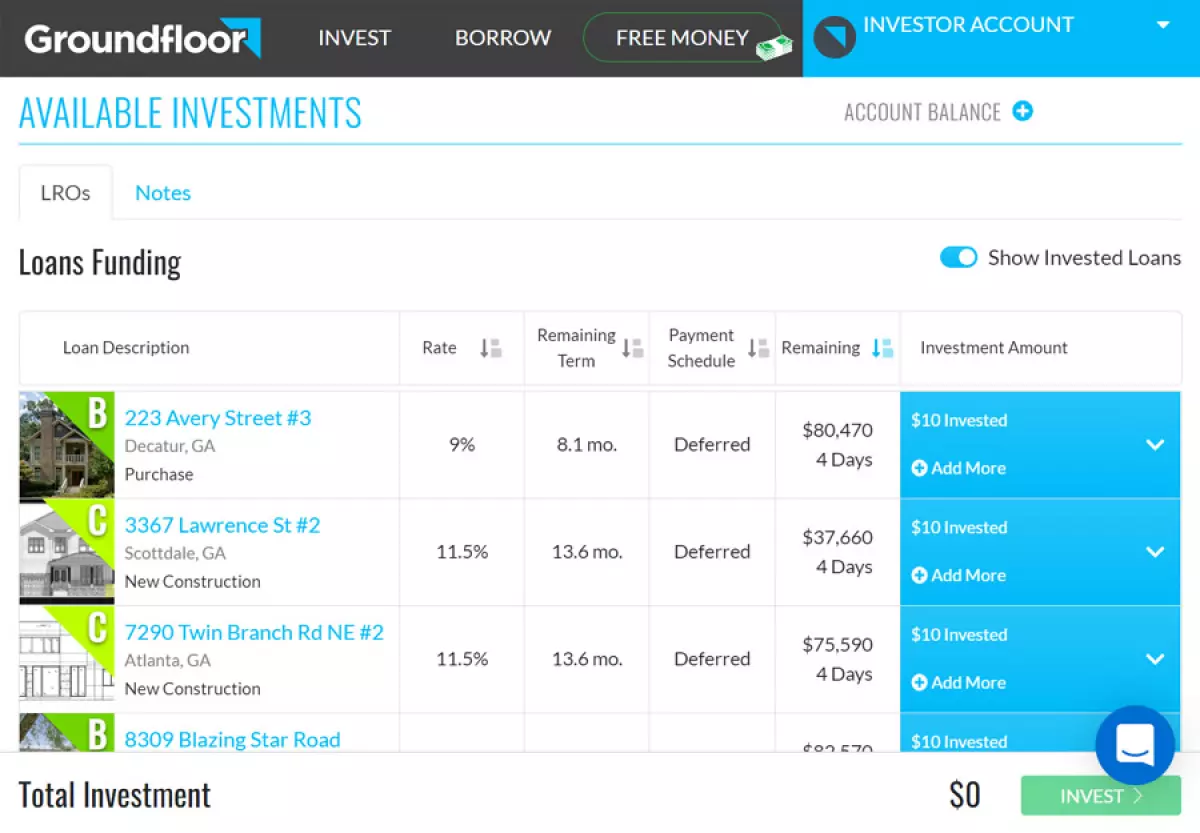

Groundfloor stands out by providing short-term real estate investments, a rarity in the market. To ensure the quality of their loans, Groundfloor employs a loan grading engine that assesses the risk and reward of each loan or project. They meticulously evaluate borrowers' creditworthiness and financials during the underwriting process.

One of Groundfloor's strengths is its commitment to compliance. They register all investments with the U.S. Securities and Exchange Commission (SEC), ensuring their validity. Additionally, Groundfloor has a team of real estate professionals and financial experts who evaluate loans and create underwriting models. With a comprehensive technology platform, they monitor investments closely to ensure they perform as expected.

Groundfloor offers in-depth loan evaluation and robust monitoring.

Groundfloor offers in-depth loan evaluation and robust monitoring.

Can You Make Money With Groundfloor?

Groundfloor's track record speaks for itself. Over the past ten years, their platform has achieved an average yearly return of 10% across all full-cycle loans. What's more, Groundfloor does not charge any management or performance-based fees, creating a transparent investment environment.

Investing with Groundfloor is also convenient. You can automate your investments through recurring transfers and automatic investing in new loans. By specifying how much you want to invest in loans at different risk grade levels, you can diversify your portfolio effectively. They even offer Auto-Investor accounts with a higher minimum investment of $100.

While Groundfloor retired its Stairs program in 2023, you can still invest in fixed-interest notes that pay between 7-10% interest for terms ranging from three months to two years.

What Is Fundrise?

Fundrise, another prominent real estate crowdfunding platform, offers a wide range of funds and secured debt investments. When you invest with Fundrise, you gain access to a diversified portfolio that includes residential properties, apartment complexes, commercial properties, and office buildings throughout the United States.

Fundrise offers a diverse portfolio of real estate investments.

Fundrise offers a diverse portfolio of real estate investments.

One unique aspect of Fundrise is its venture capital program called the Innovation Fund. This initiative focuses on private technology companies, aiming to capitalize on their potential before they go public. Fundrise has stakes in promising tech companies like Canva, Vanta, Jetty, and more.

Fundrise's Investment Strategy

Fundrise offers electronic real estate investment trusts (eREITs) and pooled funds that own various real estate assets. These assets help diversify and minimize the risk from any one sector in the market. From apartment buildings and office buildings to industrial properties and retail centers, Fundrise has identified strategies and investments for each type.

For example, their apartment-building strategy focuses on one- to four-unit buildings in major metropolitan areas like Los Angeles, Orlando, and Atlanta. Their industrial-building strategy targets businesses in heavy industry, chemicals, food processing, manufacturing, and distribution/warehousing. Similarly, their retail center strategy focuses on ground-level retail space in medium to large-sized malls.

Fundrise also offers fractional ownership through its eREIT product, allowing investors to participate in thousands of properties without individually purchasing the assets.

Can You Make Money With Fundrise?

Fundrise prides itself on providing a transparent track record of returns. From 2017 to 2023, they achieved an overall historical average income return of 4.81%. With over one million investors and an impressive $3 billion investment portfolio, Fundrise aims to outperform the S&P 500 Index and public REITs.

The majority of Fundrise's investments have delivered positive returns, with some even surpassing the expected returns of their respective asset classes. To make investing even easier, Fundrise offers recurring investments and a dividend reinvestment plan, allowing your portfolio to grow automatically.

Ultimately, the decision between Groundfloor and Fundrise depends on your investment goals and risk appetite. Both platforms offer unique opportunities to invest in real estate and have proven track records. By choosing the right platform for your needs, you can potentially earn attractive returns while diversifying your portfolio.

So, which platform will you choose?