Introduction

Welcome, dear readers, to a fascinating analysis of Healthcare Trust Inc.'s newest Preferred Stock IPO. Our goal is to explore the trading potential of this fixed-income security and provide you with valuable insights. Although it may not align with our personal financial objectives, let's dive into this intriguing opportunity.

The New Issue

Before we delve into our analysis, here is a link to the 424B4 Filing by Healthcare Trust, Inc. - the prospectus. For this particular IPO, the company has issued a total of 1.4 million shares, generating $35 million in gross proceeds. Let's take a closer look at some essential details:

Source: Author's spreadsheet

Source: Author's spreadsheet

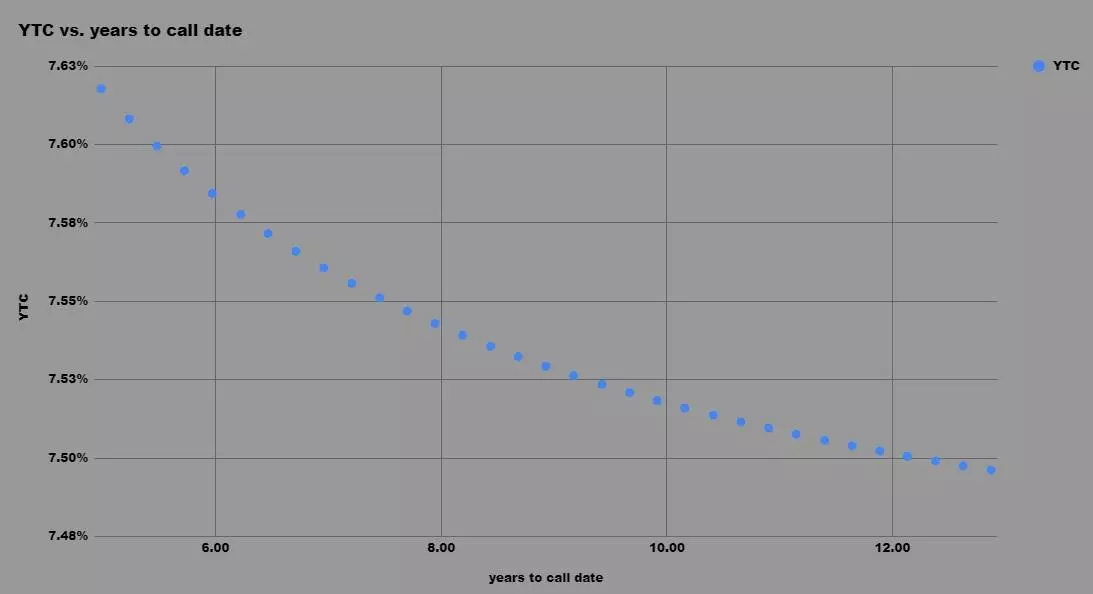

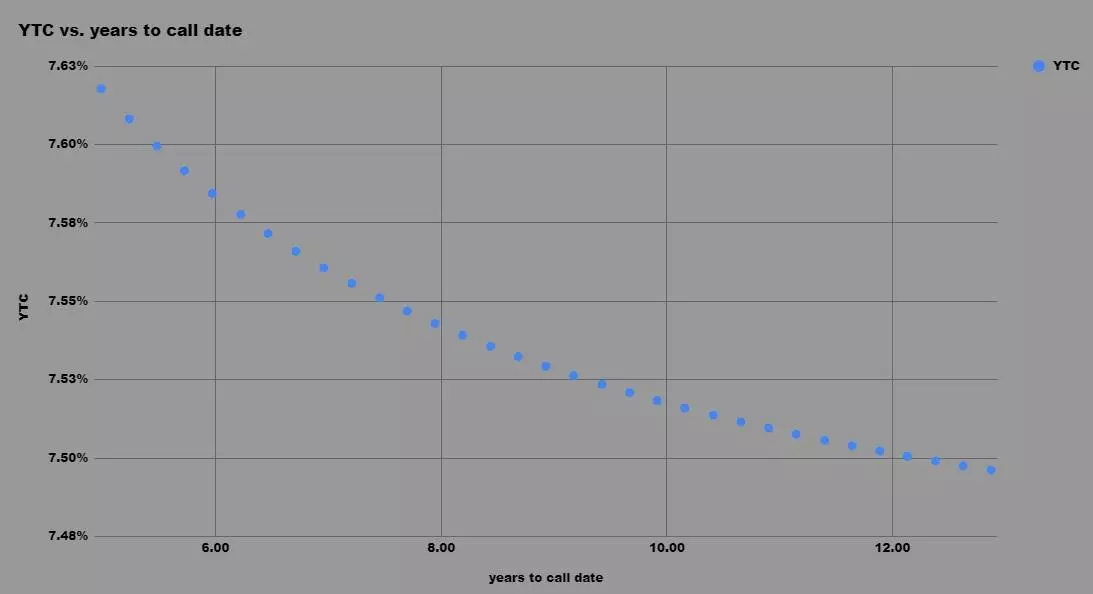

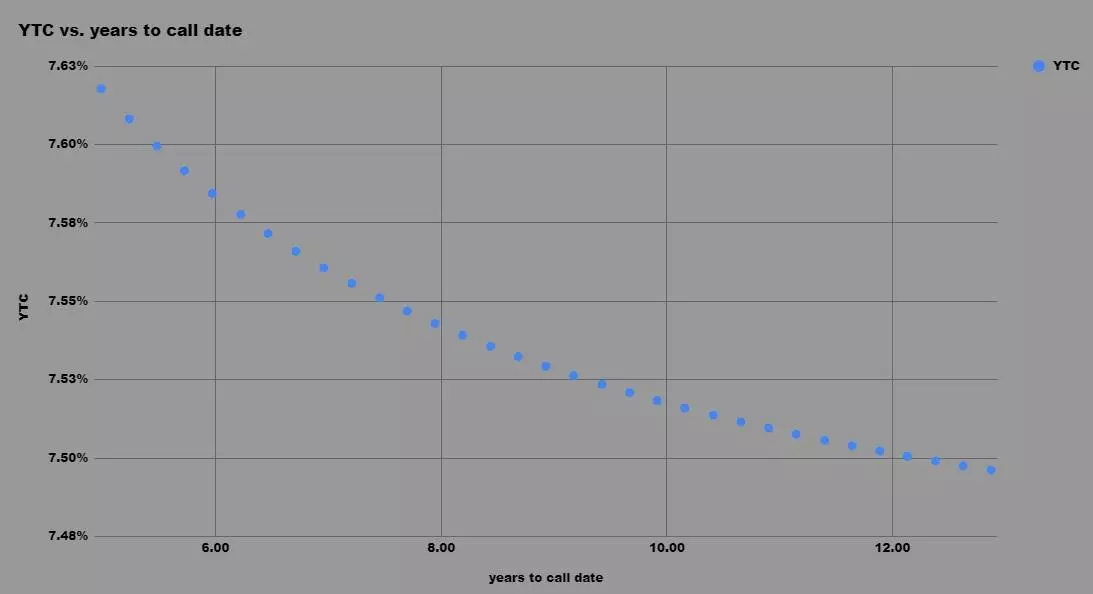

The Healthcare Trust, Inc. 7.375% Series A Cumulative Redeemable Preferred Stock (NASDAQ: HTIA) offers a fixed dividend rate of 7.375%. While it lacks a Standard & Poor's rating, it pays quarterly dividends and becomes callable as of 12/11/2024. Currently trading slightly below the par value at $24.75, it boasts a 7.44% Current Yield and a YTC (Yield to Call) of 7.62%. It's important to note that the dividends paid by this preferred stock are not eligible for the preferential 15-20% tax rate on dividends, nor the dividend received deduction for corporate holders. As a result, the "qualified equivalent" current yield and YTC stand at 6.21% and 6.35%, respectively.

Here is a snapshot of the stock's current YTC curve:

Source: Author's spreadsheet

The Company

Healthcare Trust, Inc. (HTI) is a non-traded real estate investment trust focused on acquiring a diverse portfolio of healthcare-related assets, including medical office buildings, senior housing, and other healthcare facilities.

Source: Company's website | Healthcare Trust, Inc.

Assets (As of September 30, 2019)

Source: 10-Q Filing by Healthcare Trust Inc. | Quarterly Financial Report

Properties (As of September 30, 2019)

Source: 10-Q Filing by Healthcare Trust Inc. | Quarterly Financial Report

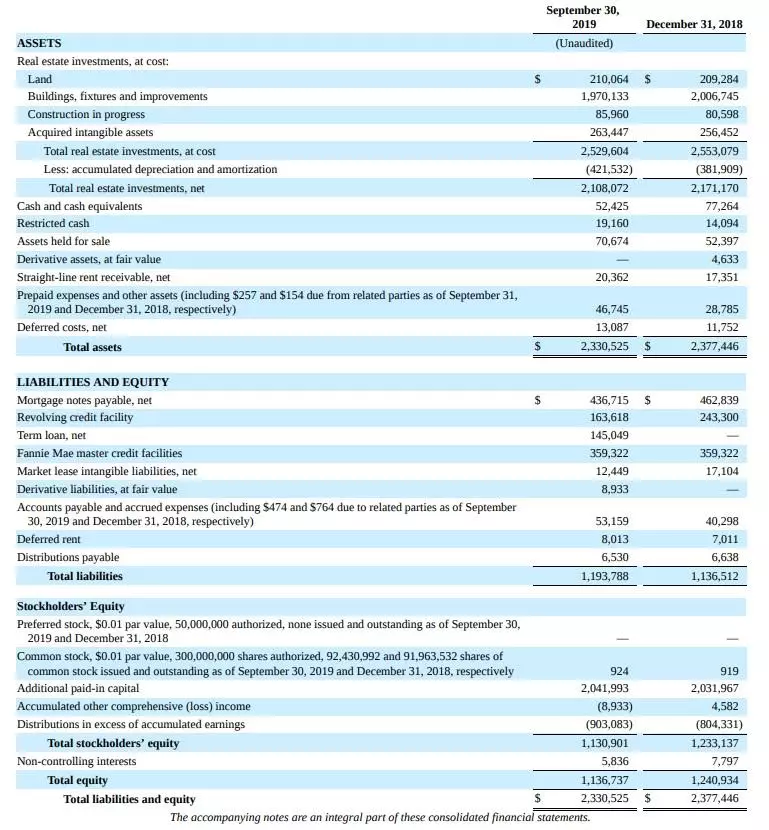

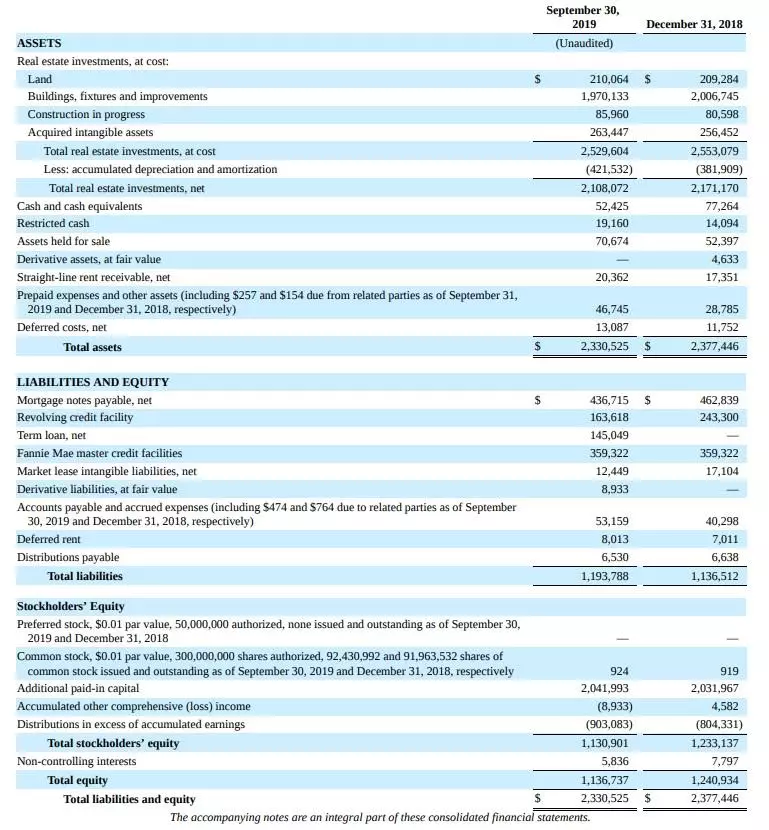

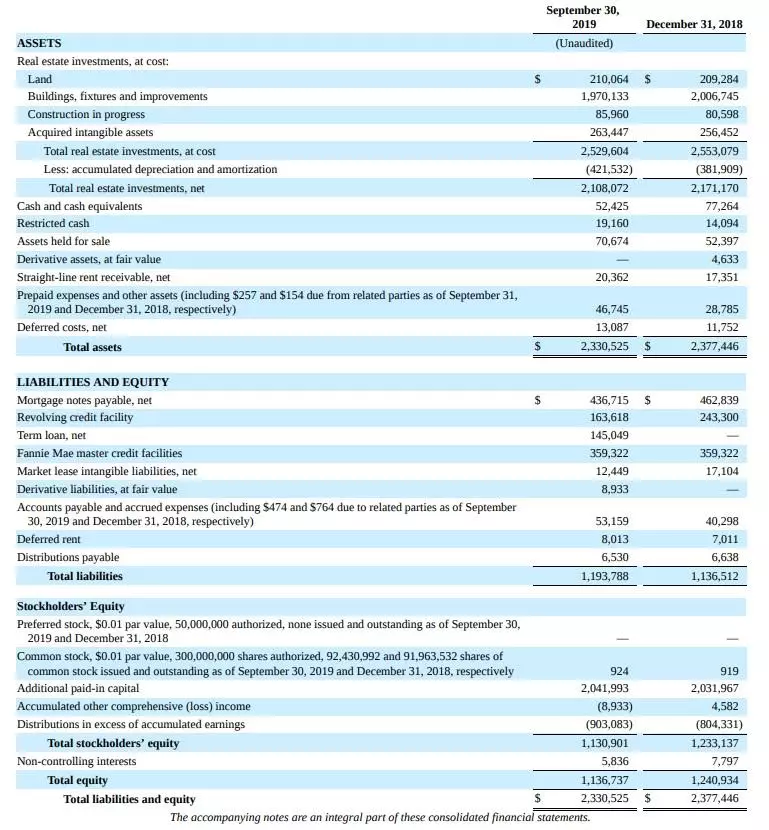

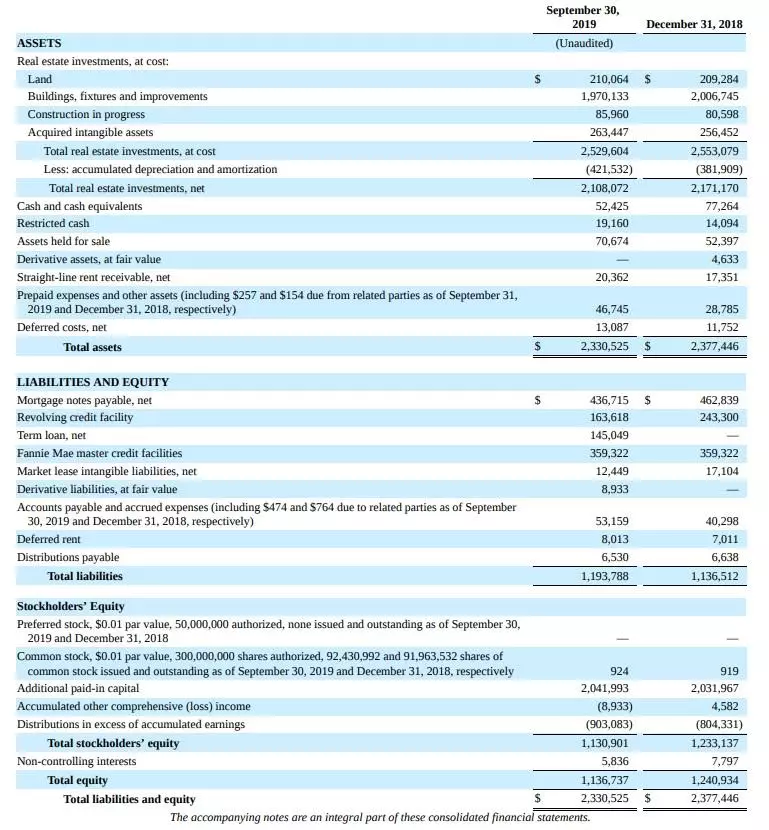

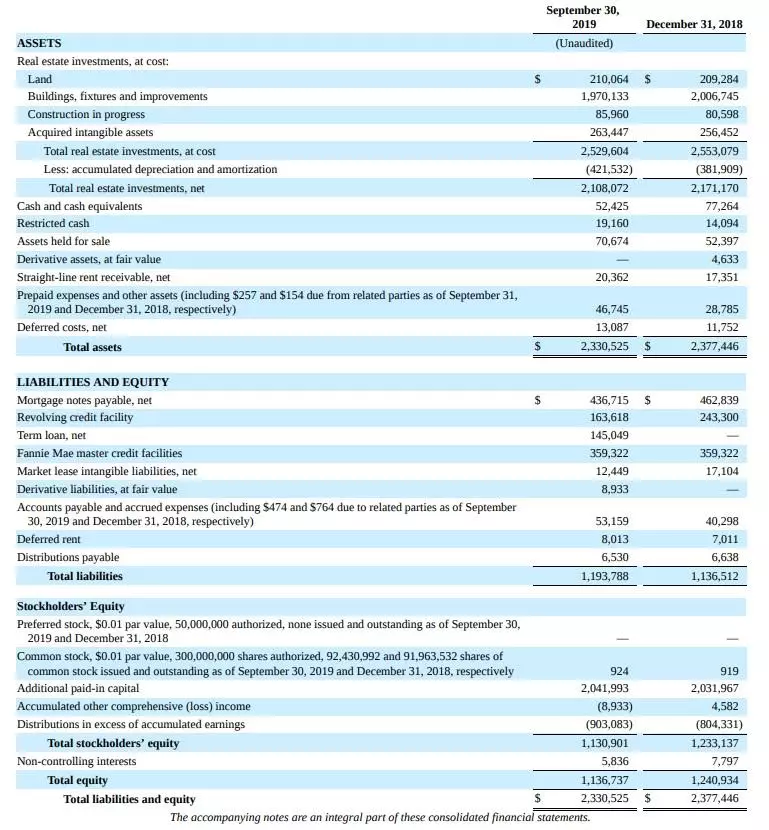

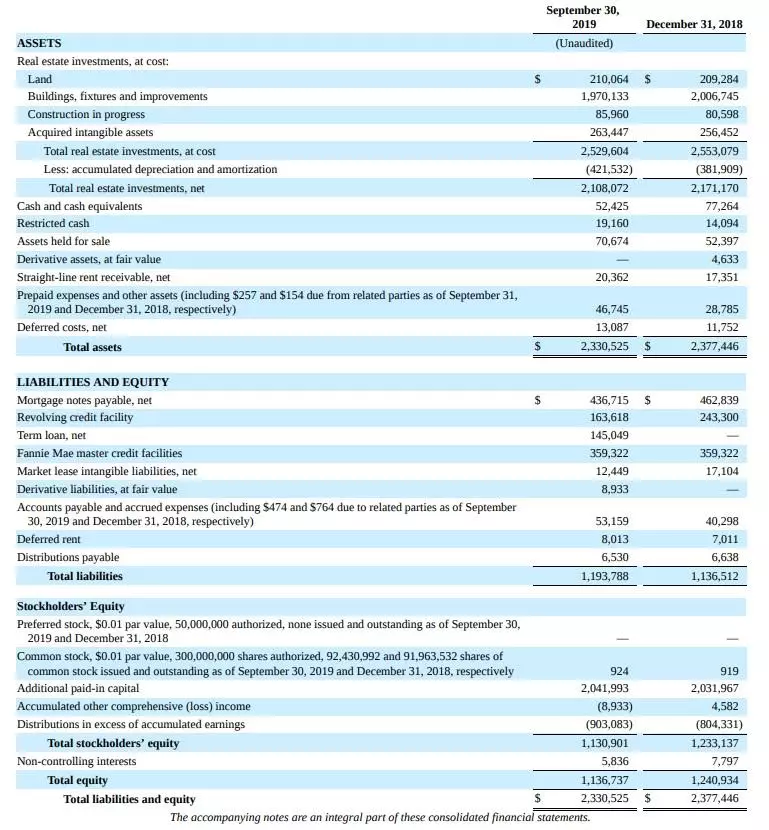

Balance Sheet (As of September 30, 2019)

Source: 10-Q Filing by Healthcare Trust Inc. | Quarterly Financial Report

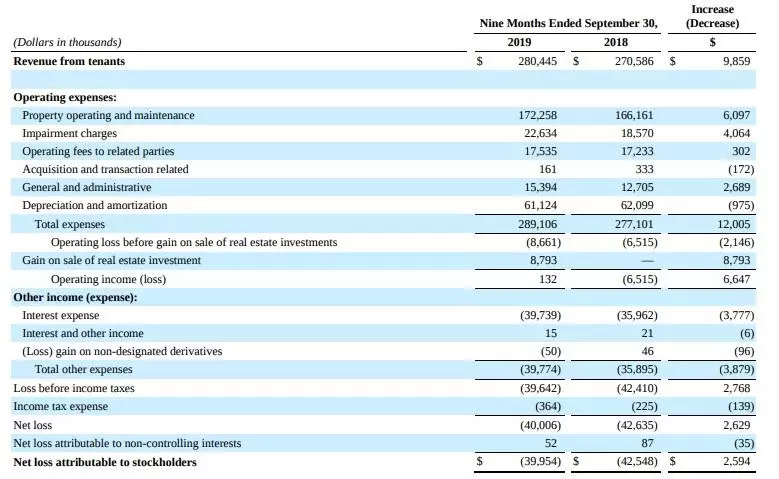

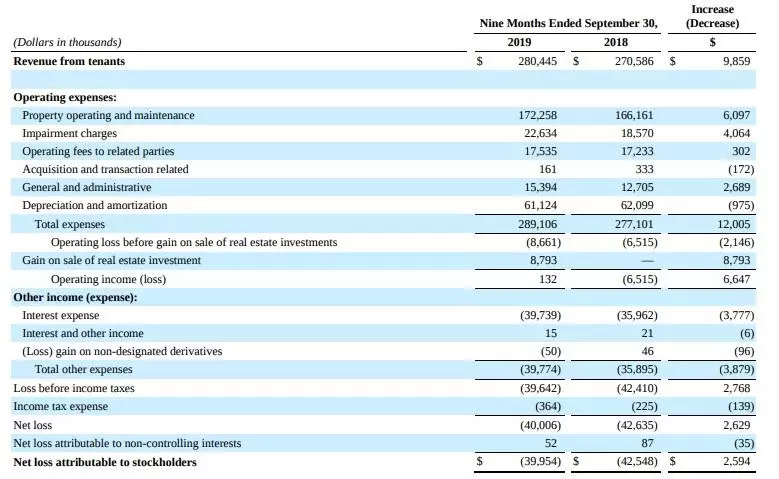

Income Statement (As of September 30, 2019)

Source: 10-Q Filing by Healthcare Trust Inc. | Quarterly Financial Report

FFO and MFFO (As of September 30, 2019)

Source: 10-Q Filing by Healthcare Trust Inc. | Quarterly Financial Report

Sector Comparison

In the "REIT - Healthcare Facilities" sector, Healthcare Trust's Preferred Stock IPO is one of four issues. The other three are Senior Housing Properties Trust's (SNH) baby bonds, SNHNL and SNHNI, and Global Medical REIT's (GMRE) preferred stock, GMRE-A.

Source: Author's database

Since GMRE-A is the sole comparable preferred stock, let's examine it more closely:

Source: Author's spreadsheet

Similar to HTIA, GMRE-A also pays a qualified fixed dividend rate of 7.50%. It is unrated, pays quarterly dividends, and can be called as of 09/15/2022. With a market price of $26.56, GMRE-A currently provides a Current Yield of 7.06% and a Yield-to-Call of 5.49%. Comparing these figures to HTIA's 7.44% Current Yield and 7.62% Yield-to-Call, it's evident that the newly issued preferred stock holds an advantage. HTIA offers nearly 2% higher Yield-to-Worst and two more years of call protection, making it a compelling choice. However, it's important to note that these preferred stocks are issued by different companies, and credit risk may differ.

All REIT Preferred Stocks

To gain a comprehensive view, let's compare all REIT preferred stocks with a par value of $25 that pay a fixed dividend rate and have a positive Yield-to-Call. We will exclude preferred stocks issued by Washington Prime Group (WPG) and Pennsylvania Real Estate Investment Trust (PEI).

By Yield-to-Call and Current Yield

Source: Author's database

Examine the Yield curve, while excluding callable preferred stocks currently trading below their par value, for a clearer perspective.

By Years-to-Call and Yield-to-Call

Source: Author's database

Special Optional Redemption

In the event that the Series A Preferred Stock ceases to be listed on the Nasdaq Stock Market, the New York Stock Exchange (NYSE), or the NYSE American LLC (a "Delisting Event"), Healthcare Trust, Inc. holds the option, subject to certain conditions, to redeem the outstanding Series A Preferred Stock, either wholly or partially, after the Delisting Event. The redemption price per share would be $25.00, along with accrued and unpaid dividends.

Upon a "Change of Control," Healthcare Trust, Inc. may choose to redeem the Series A Preferred Stock, either wholly or partially, within 120 days of the Change of Control. The redemption price per share would also be $25.00, along with accrued and unpaid dividends.

Source: 424B4 Filing By Healthcare Trust, Inc.

Delisting Penalty

Following a Delisting Event, the dividend rate specified for the Series A Preferred Stock would increase by 2.00% per annum to 9.375% of the $25.00 per share stated liquidation preference per annum. Once the Delisting Event is resolved, the dividend rate would revert to the initial rate of 7.375% of the $25.00 per share stated liquidation preference per annum.

Source: 424B4 Filing By Healthcare Trust, Inc.

Use of Proceeds

The estimated net proceeds from this IPO, after deducting the underwriting discount and expenses, amount to approximately $33.9 million (approximately $39.0 million if the underwriters exercise their option to purchase additional shares of Series A Preferred Stock in full). Healthcare Trust, Inc. intends to contribute these net proceeds to its operating partnership in exchange for preferred units that hold economic interests similar to the Series A Preferred Stock. The company plans to utilize the net proceeds for general corporate purposes, including potential property acquisitions.

Source: 424B4 Filing By Healthcare Trust, Inc.

Addition to the iShares Preferred And Income Securities ETF

With a current market capitalization of only $35 million, HTIA does not meet the criteria for inclusion in the iShares Preferred and Income Securities ETF. Despite this, it's worth noting that the ETF's composition can significantly influence the behavior of all fixed-income securities.

Conclusion

As dedicated fixed-income traders, we closely monitor every preferred stock and baby bond listed on the stock exchange. Healthcare Trust Inc.'s HTIA is no exception, and we are delighted to share our research with the public. While not every IPO offers arbitrage potential or a bargain, many new securities outshine their counterparts already trading on the market.

Healthcare Trust's Series A Preferred Stock is currently the only preferred stock issued by the company. In the "REIT - Healthcare Facilities" sector, there is limited variety, with only one other comparable preferred stock available. Global Medical REIT's GMRE-A, issued two years ago, currently offers a Yield-to-Worst of 5.49%, nearly 2% lower than HTIA's returns with two fewer years of call protection. From this perspective, the newly issued preferred stock holds a clear advantage. Moreover, when considering all fixed-rate preferred stocks issued by a REIT, HTIA boasts one of the highest YTWs. American Finance Trust Inc.'s AFINP is the other preferred stock that closely rivals the new issue, offering similar returns. However, it's essential to acknowledge that Healthcare Trust is a private company that may present challenges in terms of monitoring.

Through our analysis, we hope to provide you with valuable insights into this promising IPO. Although it might not align with our individual investment objectives, we believe it's crucial to explore every opportunity and share our findings with the public. Stay informed and make wise investment decisions.