Investing in real estate can be a lucrative way to generate passive income. One avenue worth exploring is high dividend REITs (Real Estate Investment Trusts). In this article, we will delve into the world of high dividend REITs, offering guidance on how to identify the best opportunities and manage your risks effectively.

Identifying a Top-Notch REIT

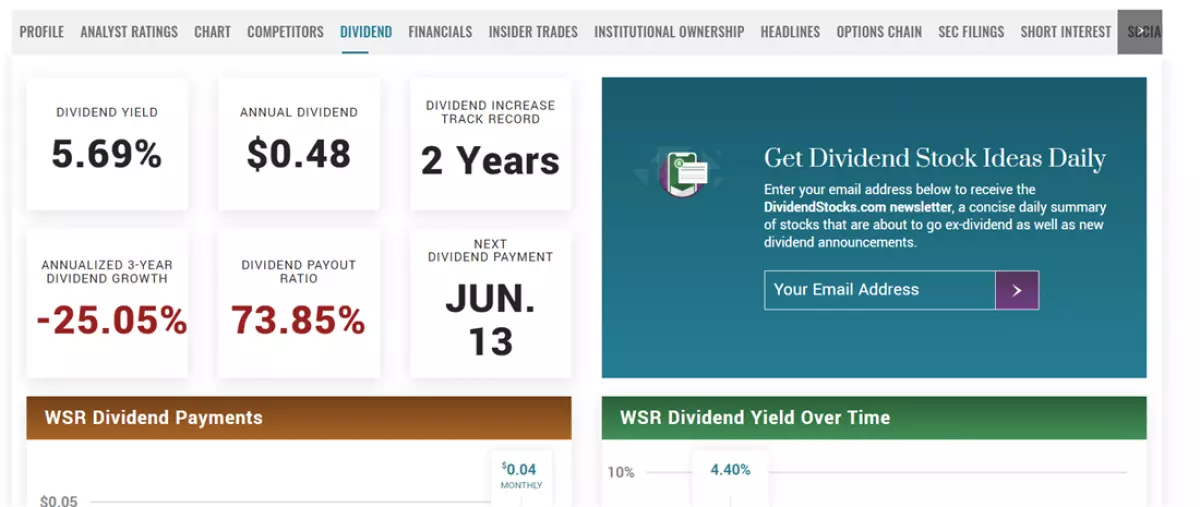

To kick things off, let's take a closer look at an example of a high dividend REIT. Whitestone REIT (NYSE: WSR) is a prime illustration of a successful REIT that focuses on managing community-centered properties in major metropolitan areas. With a diversified portfolio of commercial properties in Texas, Arizona, and Illinois, Whitestone caters to local residents and small businesses, offering a mix of retail, office, and other commercial spaces.

Image: Whitestone REIT aims to increase its dividend consistently.

Image: Whitestone REIT aims to increase its dividend consistently.

Whitestone aims to increase its dividend track record year after year. Although it doesn't currently qualify as a dividend contender or champion, it boasts a healthy dividend yield of 5.69% as of May 2023. This means that it pays out approximately 5.69% of the stock's share value each year. Investors also benefit from Whitestone's monthly dividend payments, providing a predictable stream of reinvestment capital.

Image text: Whitestone REIT offers a monthly dividend, encouraging long-term holding.

Image text: Whitestone REIT offers a monthly dividend, encouraging long-term holding.

Evaluating High Dividend REITs

While dividend yield is indeed an essential factor, it's crucial to consider additional elements when selecting the best high dividend REITs. Let's explore some key factors to help you maximize the benefits these REITs can offer:

Diversification

REITs allow investors to diversify their portfolios beyond traditional stocks and bonds by exposing them to the real estate asset class. By investing in multiple real estate classes within the sector, such as commercial properties and healthcare facilities, you can further diversify and limit potential losses.

Hedge Against Inflation

REITs possess characteristics that make them valuable assets in times of high inflation. Rental income generated by their properties provides a consistent revenue stream, especially as landlords can increase rental rates over time to keep up with rising costs. Additionally, property values tend to rise during inflationary periods, further boosting the capital appreciation potential of many REITs.

Selecting the Best High Dividend REITs

Now that we've covered the evaluation process, let's explore how to pick the best high dividend REITs to add to your investment portfolio:

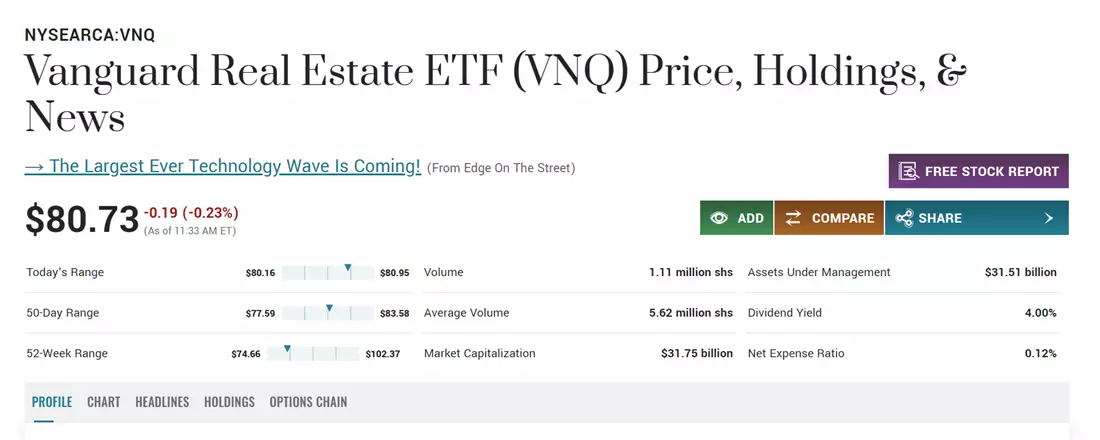

Step 1: Consider Stocks vs. ETFs

When investing in REITs, you have the option to purchase individual stocks or invest in exchange-traded funds (ETFs) that include REIT investments. ETFs provide the advantage of spreading your risk across multiple companies, making them a potentially less risky choice for investors. Take into account the dividend yields and expense ratios of different options when making comparisons.

Image: Vanguard Real Estate ETF offers a solid dividend.

Image: Vanguard Real Estate ETF offers a solid dividend.

Step 2: Consider Industry and Sector

Once you've identified potential investments, delve into the business operations and asset portfolios of the REITs you're considering. Assess the economic conditions and growth potential of the industry sectors in which these REITs operate. For instance, factors like population growth and employment trends can significantly impact the growth potential of a REIT.

Step 3: Examine Portfolio Assets

Before making your investment, thoroughly review the individual operations and assets within the REIT's portfolio. Accessing your chosen REIT's website or investor reports will provide valuable insights into its current holdings. By understanding the specific assets you're investing in, you can make more informed decisions.

Step 4: Monitor Your Investment

Once you've selected your REITs and made your investments, regularly monitor their performance. As dividends are paid out, they will be automatically deposited into your brokerage account. Long-term investors may opt for automatic dividend reinvestment, where dividends are reinvested into the stock at the current market rate. Alternatively, you can choose to receive the dividends in cash.

The Outlook for REITs

As the market gradually recovers from historic inflation levels, REITs are poised to perform exceptionally well in the second half of 2023 and beyond. The increasing cost of housing, coupled with a shortage of residential properties for sale, creates opportunities for REITs to thrive.

Investing in Real Estate through REITs

While high dividend REITs offer attractive incentives, it's vital to consider each investment's valuation and sustainability. Comparing debt levels and opting for investments with reliable dividends can help create a more robust passive income stream. Remember, high dividend REITs should complement a diversified investment portfolio that includes a mix of blue-chip and growth-oriented options.

FAQs: Answering Your Final Questions

Before you continue your research, let's address a few frequently asked questions about high dividend REITs and other income-generating assets.

Investing in high dividend REITs can unlock significant passive income opportunities. By following the steps outlined in this article, you can make informed decisions and build a rewarding investment portfolio. Begin your journey into the world of high dividend REITs today and pave the way to financial success.