Introduction

Are you considering diving into the Bay Area home market? Well, brace yourself because mortgage rates have been steadily climbing in recent months. In fact, there's a real possibility that they could exceed 7% by the end of the year. This means that potential homebuyers are facing higher loan payments, making it more challenging to find their dream home. However, despite these obstacles, the demand for homes in the Bay Area remains strong, and competition among buyers is heating up. Let's take a closer look at the current state of the Bay Area real estate market.

Rising Mortgage Rates and Increasing Demand

Over the past year, mortgage rates have been steadily increasing from their historic lows of below 3%. This has caused borrowers to face higher borrowing costs. However, even with these rising rates, many buyers are still forging ahead with their home purchases. The combination of pent-up demand and limited inventory has created fierce competition among those who can still afford to buy. As a result, the median price for a single-family home in the Bay Area has surpassed $1.3 million. This surge in prices represents a return to normalcy following the unprecedented real estate boom during the pandemic.

The Summer Homebuying Season

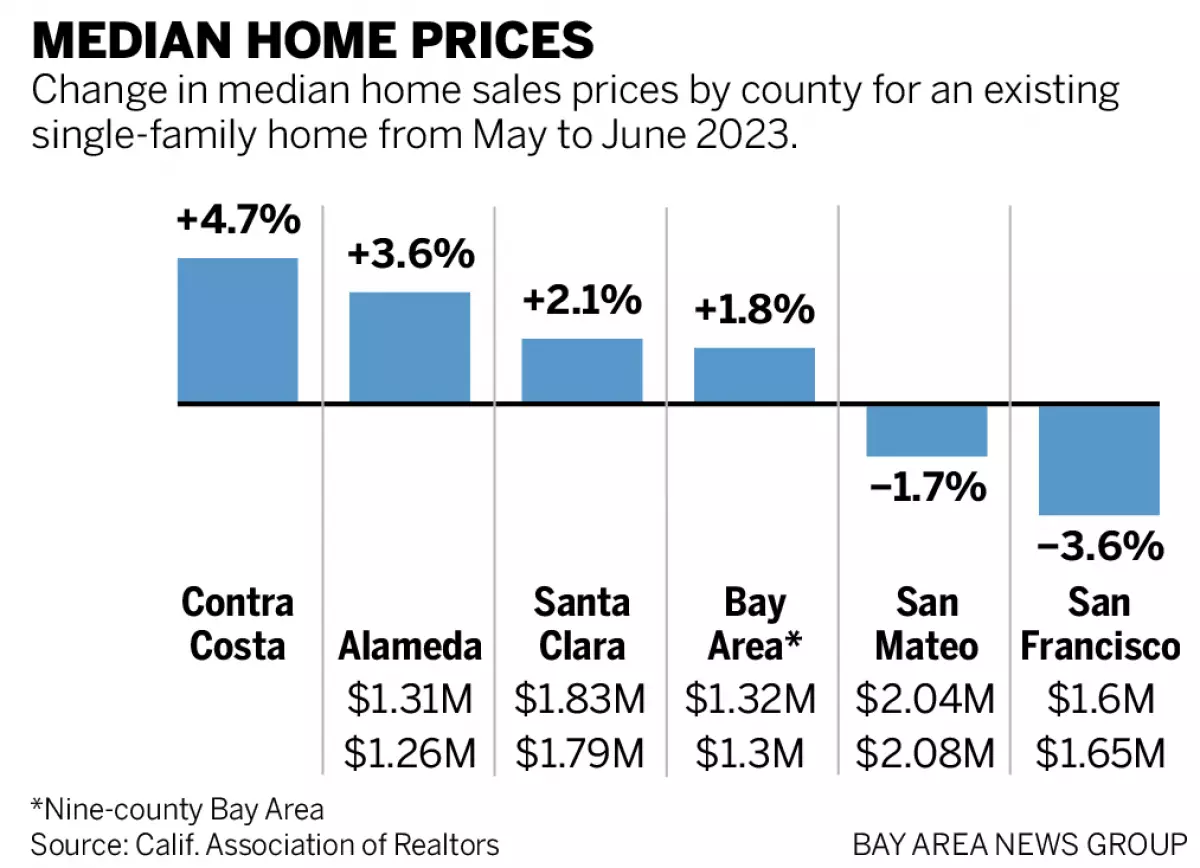

Traditionally, the summer months are the busiest for the real estate market. This year is no exception, as home seekers who were waiting for rates to drop are now accepting the increased borrowing costs. The spike in demand during the summer homebuying season has led to a 1.8% increase in the Bay Area's median home price in June, as reported by the California Association of Realtors. However, this figure is still 2.7% lower compared to the same period last year.

Chart on median home prices from May to June 2023

Chart on median home prices from May to June 2023

Regional Variations in Housing Prices

The rise in home prices is not uniform across all counties in the Bay Area. For example, Contra Costa County saw a 4.7% increase in prices from May to June, reaching $930,000. Meanwhile, Alameda County experienced a 3.6% increase to $1.3 million, and Santa Clara County saw a 2.1% increase to $1.8 million. On the other hand, San Mateo County witnessed a 1.7% decrease to $2 million, and San Francisco's median price fell 3.6% to $1.6 million.

The Impact of Mortgage Rates

Although the average rate for a typical 30-year fixed home loan declined slightly to 6.8%, rates have been trending towards 7% since April. The Federal Reserve is expected to raise the benchmark interest rate further to combat inflation. This could push mortgage rates even higher, possibly reaching 7.5% in the coming months. However, experts believe that the higher rates will not have a significant impact on Bay Area home prices. The region's chronic housing shortage and persistent demand still outweigh the influence of rising rates.

The Role of Mortgage Rates in the Housing Shortage

The Bay Area's chronic housing shortage is a major factor contributing to the limited housing supply. However, mortgage rates also play a role in the lack of available properties. Many homeowners locked in their mortgage rates before the rate surge in early 2022. As a result, these homeowners are hesitant to sell and give up their lower rates. This reluctance to sell contributes to the supply-demand imbalance in the housing market.

The Challenges for Homebuyers

Aspiring homeowners like Aparajita Tyagi and Ankit Bajpai are experiencing the difficulties of finding a home in the current market. The couple recently purchased a house in Berkeley but are now struggling to find a second home due to limited inventory. They are witnessing intense bidding wars but prefer to take their time to find the right fit rather than rush into a deal. Additionally, they hope that interest rates will decrease in the future to make homeownership more financially feasible.

Good News for Buyers

Despite the challenges, there is some good news for buyers trying to finance a home. Starting in May, the federal government reduced mortgage fees for buyers with lower credit scores. This reduction has the potential to significantly decrease total closing costs, making homeownership more accessible for middle-income borrowers. As a result, individual mortgage rates for some borrowers have also decreased, making their dream of owning a home a reality.

In conclusion, the Bay Area real estate market is facing the challenges of rising mortgage rates and a persistent housing shortage. However, despite these obstacles, the demand for homes remains strong, and buyers are adapting to the changing market conditions. As we navigate through the summer homebuying season, it is essential for potential buyers to stay informed and explore all available options. With patience and perseverance, finding the right home in the Bay Area is still possible.