The housing market is always a topic of interest, and many people are wondering what the future holds for 2024. Will mortgage rates go down? Should I buy a house? Is a housing market recession on the horizon? Let's dive into these questions and explore what the experts are saying.

Will Mortgage Rates Go Down in 2024?

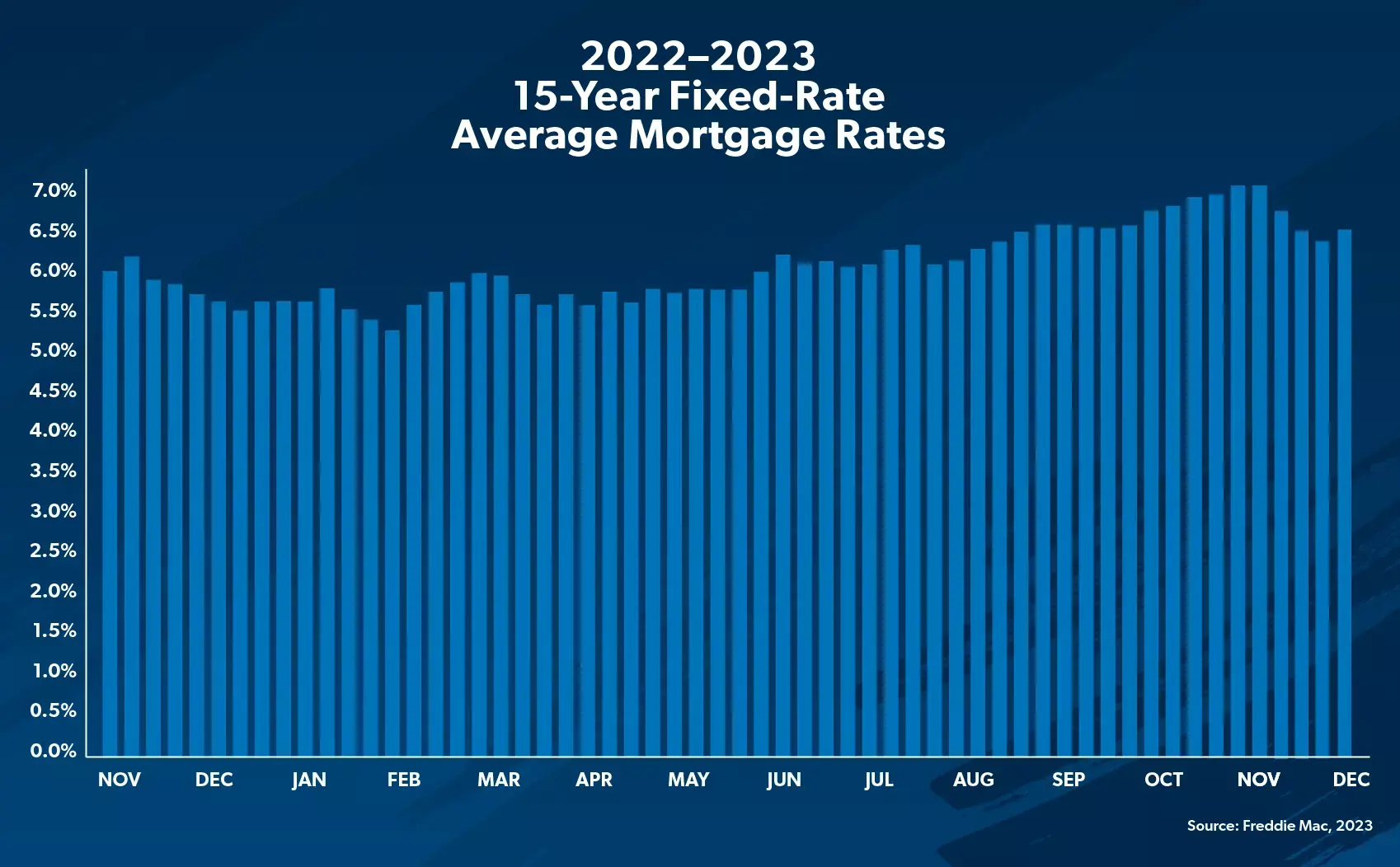

Mortgage interest rates have been on the rise in recent years, but will they finally start heading in the other direction in 2024? According to the National Association of Realtors, rates for 30-year mortgages are expected to go down from 7.5% to 6.3% by the end of the year. However, even with this decrease, the savings on monthly mortgage payments may not be significant. So, while rates may go down slightly, it's unlikely to make a big difference.

Should I Buy a House in 2024?

If you're considering buying a house in 2024, there are a few factors to consider before making a decision. First, ensure that you are financially ready. This means being debt-free, having an emergency fund, and ensuring that your monthly house payment will not exceed 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. Additionally, having a down payment and being prepared to pay closing costs upfront is essential. If you meet these qualifications, it may be a good time to buy.

Housing Market Recession: What Is It and Are We in One?

A housing market recession occurs when the total number of home sales decreases consistently for at least six months. Currently, that is not the case. In fact, home sales have been growing, indicating a steady housing market. A housing recession is only a concern if there is an excess of supply and a lack of demand, which is not the current situation.

Forecast: Will the Housing Market Crash in 2024?

If you're worried about a housing market crash in 2024, you can lay those fears to rest. Experts predict that prices will not drop substantially and are more likely to continue rising. The National Association of Realtors forecasts a 2.6% increase in existing home prices by August 2024, while Freddie Mac expects a 0.8% bump during the same timeframe. This indicates that the housing market will remain stable and favorable for sellers.

What's the Average House Price in 2024?

The average home price in the U.S. was $745,847 in October 2023, but it's important to note that this is an average across various types of homes. Median home prices are often a better indicator, as they eliminate the influence of abnormally high or low-priced properties. In October 2023, the median home price was $425,000. This is a useful benchmark to consider when evaluating the housing market.

Housing Inventory

Housing inventory refers to the number of houses available for sale. When inventory is low, buyers are willing to pay more, thus driving up home prices. While there has been a slight increase in housing inventory recently, the overall number of houses on the market is expected to remain low in 2024. This, coupled with ongoing buyer demand, suggests that home prices will stay relatively stable.

Buyer Demand

Despite the possibility of a decrease in buyer demand in 2024, it is expected to remain higher than housing supply. This means that home prices are likely to stay mostly the same, with some markets experiencing slight fluctuations. It's important to consider regional factors when evaluating buyer demand and its impact on the housing market.

Is Now a Good Time to Buy a House?

The market should not be the sole determinant of your decision to buy a house. If you are financially prepared, it can be a good time to buy a home, even if inventory is limited and interest rates are high. Conversely, if you are not financially ready, it's not a good time to buy, even if there is ample inventory and low-interest rates. Your personal financial situation should guide your decision-making process.

What the 2024 Housing Market Means for Buyers and Sellers

In terms of buyer and seller dynamics, it is not currently a buyer's market due to the limited housing supply. However, the market is not as hot as it has been in recent years, presenting buyers with more options and potentially less competition. For sellers, demand for homes still exceeds supply, allowing for a relatively quick sale at or near the asking price.

Will There Be a Lot of Foreclosures in 2024?

While foreclosures are expected to rise in 2024, they are unlikely to reach the levels seen during the Great Recession. Additionally, many homeowners currently facing foreclosure have positive equity, enabling them to avoid foreclosure by selling their homes. Therefore, the impact of foreclosures on the housing market is not expected to be significant.

How to Buy or Sell With Confidence in Any Housing Market

Buying or selling a house can be overwhelming, but it's not impossible. Despite the challenges posed by the current market, you still have control over your financial future. By ensuring that you are financially prepared, setting realistic expectations, and working with a knowledgeable real estate agent, you can navigate the housing market with confidence. Remember that your personal financial situation should guide your decisions, regardless of market conditions.