Our New Report on the State of Rental Housing in America

Introduction

Welcome to our latest report, "America's Rental Housing 2024." In this report, we delve into the current state of rental housing in the United States. From affordability challenges to policy issues, we explore the critical aspects impacting the nation. Join us for the livestream at 4:00 p.m. ET today to learn more.

Rental Market Insights

Rental Markets are Softening

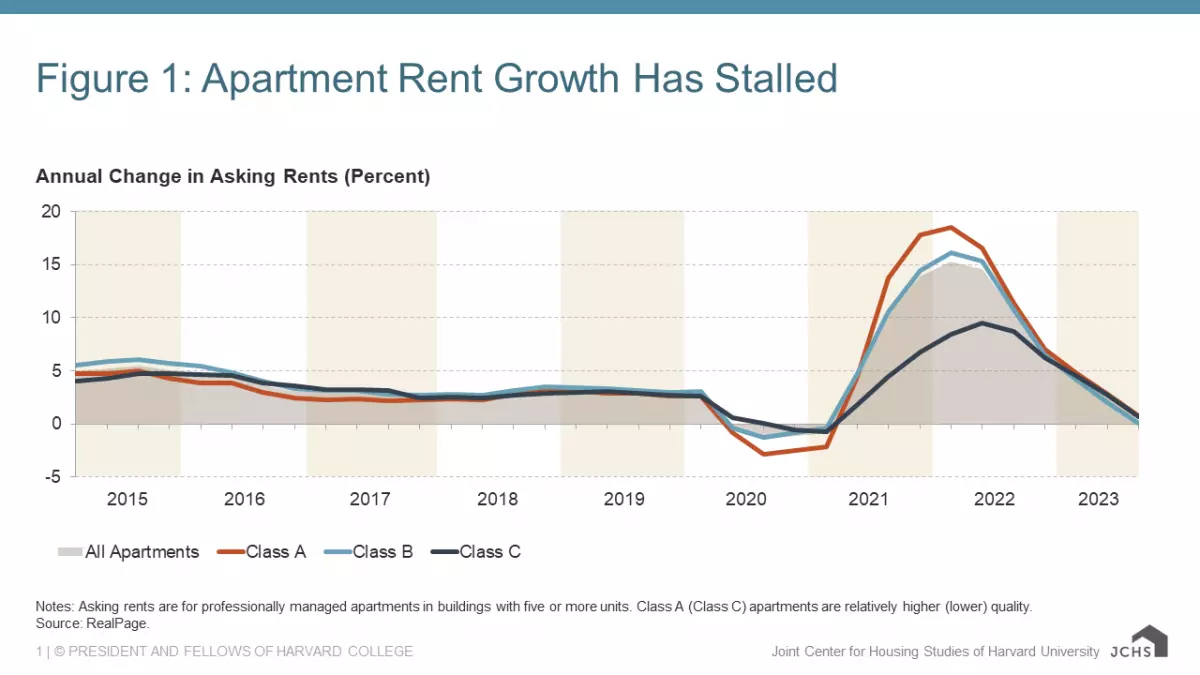

After experiencing an overheated period in 2021 and 2022, rental markets in the US are finally showing signs of cooling. The peak of apartment rent growth recorded an astonishing 15% annually in the first quarter of 2022, only to decelerate later on. By the third quarter of 2023, rent growth had slowed down to just 0.4% year over year. This shift is evident in Figure 1.

Figure 1: The line chart illustrates the year-over-year growth in asking rents for professionally managed apartment buildings in the US. Although there was a record-breaking increase of 15% in 2022, the growth has now slowed to 0.4%.

Figure 1: The line chart illustrates the year-over-year growth in asking rents for professionally managed apartment buildings in the US. Although there was a record-breaking increase of 15% in 2022, the growth has now slowed to 0.4%.

Rising vacancy rates have contributed to the slowdown in rent growth. The apartment vacancy rate increased from a record low of 2.5% in early 2022 to 5.5% in the third quarter of 2023. Historically high multifamily completions have played a significant role in pushing up vacancy rates. With approximately 436,000 multifamily units coming online during the third quarter of 2023, vacancy rates have increased accordingly.

Affordability Challenges Persist

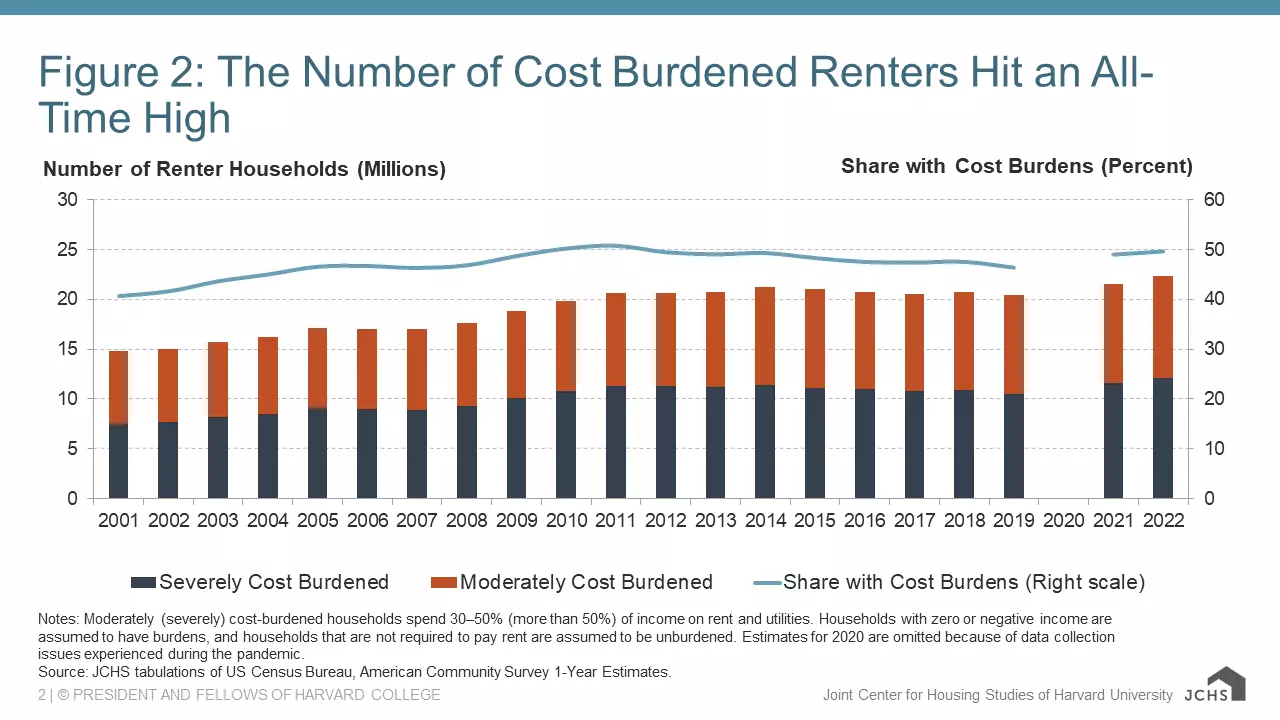

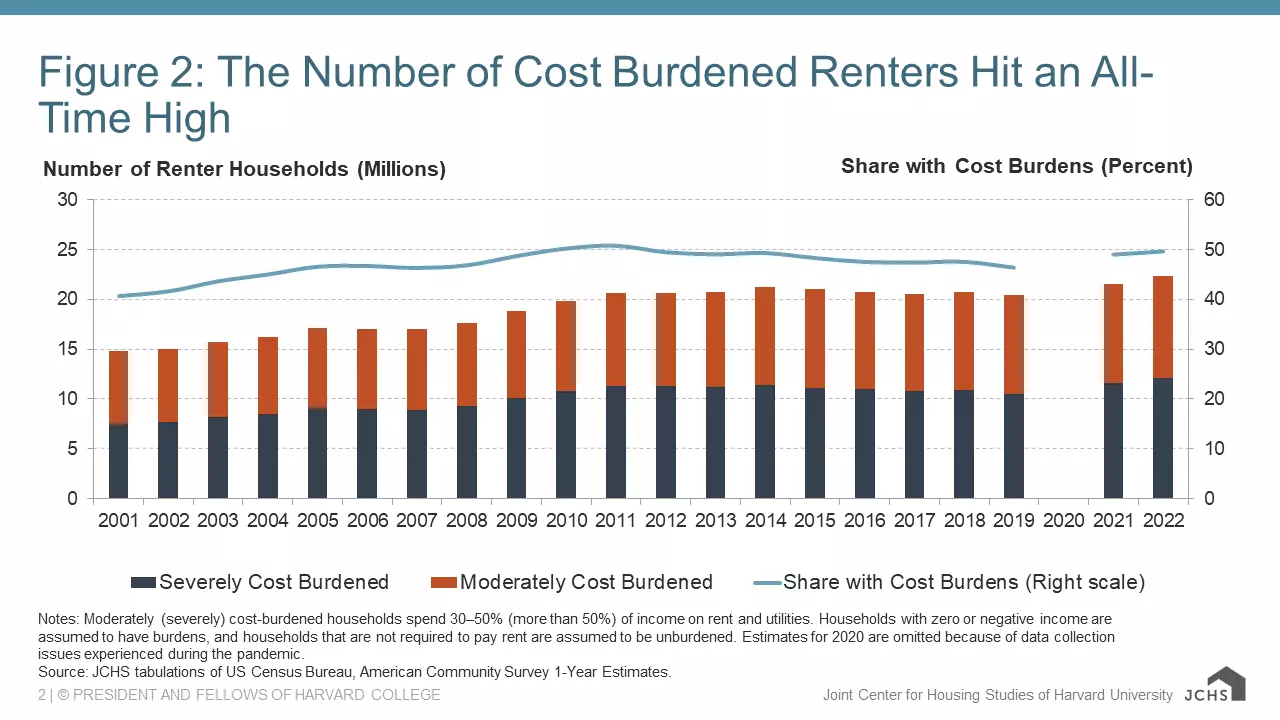

Despite the rental market cooling down, affordability conditions remain worse than ever before. Asking rents are still higher than pre-pandemic levels, leading to a staggering number of cost-burdened renter households. In 2022 alone, 22.4 million renter households experienced cost burdens, marking an increase of 2 million households since 2019. This has pushed the share of cost-burdened renter households to a staggering 50%. Refer to Figure 2 for a visual representation.

Figure 2: The stacked bar chart showcases the number of cost-burdened renter households from 2001 to 2022. The share of households with cost burdens reached a record high of 22.4 million in 2022, a significant increase from 15 million in 2001.

Figure 2: The stacked bar chart showcases the number of cost-burdened renter households from 2001 to 2022. The share of households with cost burdens reached a record high of 22.4 million in 2022, a significant increase from 15 million in 2001.

An upward shift in the rent distribution has contributed to this trend. Since 2012, the market has lost more than 2.1 million units renting for less than $600 and 4.0 million units renting for $600 to $999. Concurrently, there has been an increase of 8.4 million units renting for at least $1,400. This is primarily due to rent increases and high-end new construction. Rents have not only risen but have also outpaced incomes over the last two decades. This has led to struggles for renter households with an annual income under $30,000, with the median amount of money left over after rent and utilities reaching an all-time low of just $310 per month.

Housing Instability and Rental Assistance

Housing Instability is Rising

As rental markets cool down, the issue of housing instability is on the rise. While pandemic-era efforts such as eviction moratoriums and rental assistance programs initially helped keep renters housed, the winding down of these measures coupled with skyrocketing rents has made many renter households vulnerable to housing instability. Eviction levels have nearly returned to pre-pandemic rates, and as of mid-2023, around 12% of renter households reported being behind on rent.

Additionally, the end of pandemic relief measures and high rent growth have resulted in a sharp increase in homelessness. From January 2022 to January 2023, the number of people experiencing homelessness surged by nearly 71,000, reaching an all-time high of 653,100. Notably, the number of people staying in unsheltered locations rose significantly in both expensive states like California, Oregon, and Washington, as well as historically more affordable states like Ohio and Tennessee.

Rental Assistance Shortage

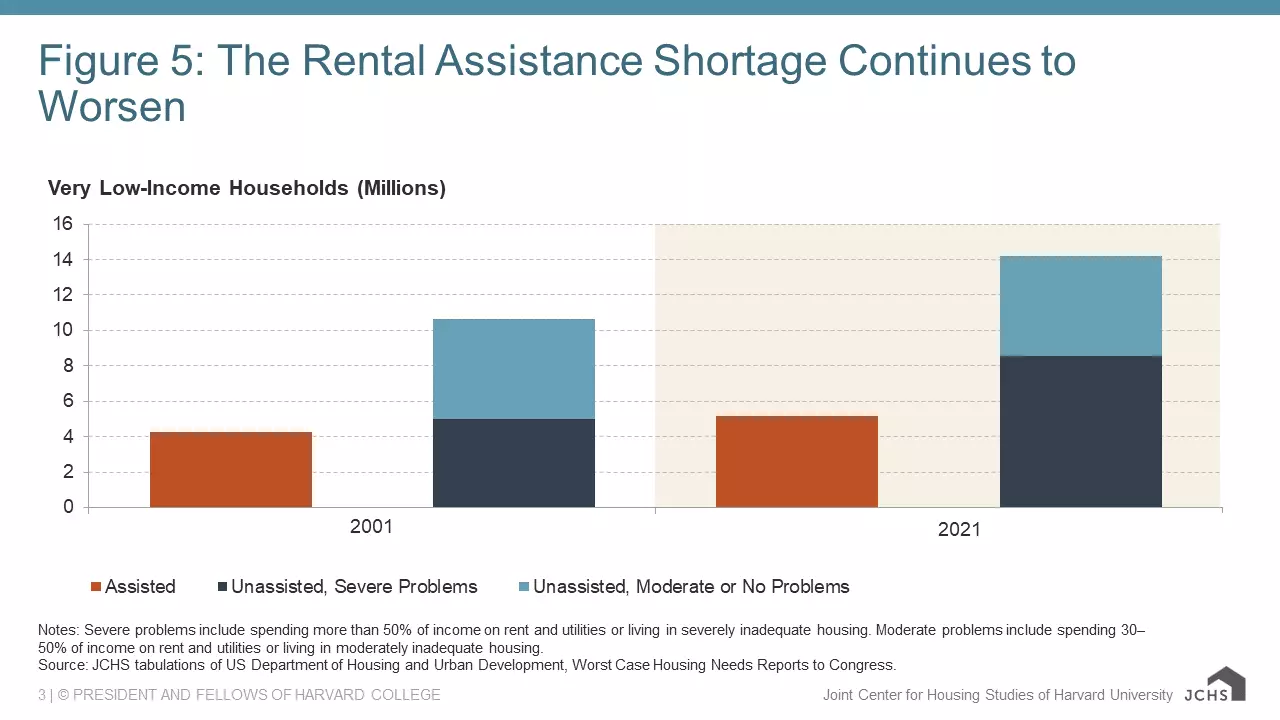

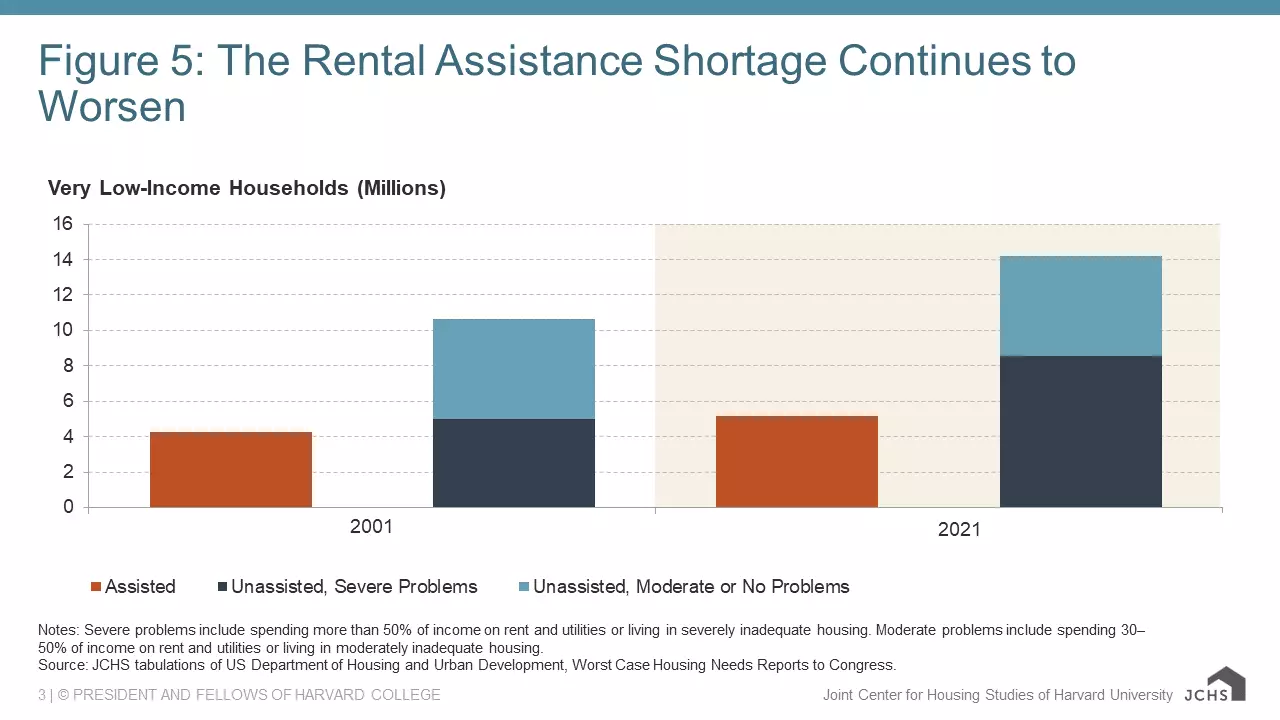

Despite worsening housing affordability and stability, rental assistance has not kept pace with the growing need. The number of very low-income renter households increased by 4.4 million from 2001 to 2021. However, the number of assisted households in this income range only increased by 910,000. This leaves 14 million income-eligible households to navigate an increasingly unaffordable market. Of those not receiving assistance, 8.5 million experienced worst-case housing needs, such as spending more than half of their income on housing or living in severely inadequate conditions. In 2021, 60% of unassisted households had worst-case needs, up from 47% in 2001. Explore Figure 5 for a comprehensive breakdown.

Figure 5: The stacked bar chart illustrates the number of households with very low incomes and the number receiving assistance from 2001 to 2021. The shortage of rental assistance persists, leaving many households facing severe problems.

Figure 5: The stacked bar chart illustrates the number of households with very low incomes and the number receiving assistance from 2001 to 2021. The shortage of rental assistance persists, leaving many households facing severe problems.

Investment Needs and Rental Market Activity

Investment Needs in the Rental Stock

The rental stock in the United States has reached its oldest age to date, with a median age of 44 years compared to 34 years two decades ago. Consequently, there is an urgent need for substantial investments. As of 2021, nearly 4 million renter households live in substandard conditions, and even physically adequate units require significant repairs. The repair needs of the occupied rental stock alone are estimated to cost $51.5 billion, according to the Federal Reserve Bank of Philadelphia.

Moreover, the rental stock requires upgrades to address climate change concerns and improve resilience to environmental hazards. In 2020, about half of renters making less than $30,000 experienced energy insecurity. The adverse effects of climate change, including extreme weather and rising temperatures, will further increase home energy demand and housing costs. To tackle these issues, the Inflation Reduction Act has allocated approximately $9 billion for household rebates and tax credits for approved upgrades, as well as $1 billion to enhance the energy and water efficiency of HUD-assisted stock. However, additional federal resources are still required to improve the resiliency of the 18 million occupied rental units located in areas with moderate annual economic losses due to environmental hazards. Figure 6 showcases these vulnerable areas.

Figure 6: The map displays the number of housing units in areas with significant expected annual losses from climate-related hazards.

Figure 6: The map displays the number of housing units in areas with significant expected annual losses from climate-related hazards.

Dampening Rental Market Activity

The high interest rate environment, observed over the past year, has increased the cost of debt for acquiring and building multifamily properties. Moreover, high treasury yields have raised the cost of equity as apartment investors seek greater returns to compete with relatively low-risk treasuries. This environment has made deals less profitable, leading to a decline in both multifamily lending and apartment transactions.

Of particular concern is the recent slowdown in multifamily construction. Although starts rose during the pandemic and remained at some of the highest levels in the past two decades until the first half of 2023, they have since dropped. By October, starts were down 30% year over year. Despite a record-high number of units currently under construction, the combination of market cooling and high interest rates could result in further declines in multifamily starts, leading to potential supply challenges in the future. Refer to Figure 7 for a visual illustration.

Figure 7: The line chart showcases the number of multifamily starts each month from 2000 to October 2023. Despite the recent decline, the number of starts remains relatively high compared to the early 2000s.

Figure 7: The line chart showcases the number of multifamily starts each month from 2000 to October 2023. Despite the recent decline, the number of starts remains relatively high compared to the early 2000s.

The Road Ahead

The upcoming months are expected to pose challenges for both renter households and property owners. While rent deceleration may bring relief to renters, the significant rent increases during the pandemic have created enduring affordability conditions, especially for low-income renters. Property owners, on the other hand, face slowing returns and rapidly rising costs. However, the substantial equity built up during the pandemic boom should help prevent widespread distress.

Pandemic-era relief measures have demonstrated that it is possible to keep tenants stably housed while ensuring landlords remain solvent. Moving forward, a similar level of commitment is needed to expand housing assistance, preserve the affordable housing stock, and make crucial improvements to the existing rental stock.

Join us in navigating the complexities of America's rental housing landscape. Together, we can foster a more inclusive and sustainable future for all.