Real estate is a lucrative investment option with the potential for high returns. With the value of global real estate estimated at $280.6 trillion in 2017, it's no wonder that it's the world's largest asset class. Whether it's the building you work in, your own home, or the hotel you're staying at, real estate is a significant part of our lives.

But how do you know if a property is a wise investment decision? In this article, we'll explore how to analyze a real estate investment and make informed choices.

Understanding the Types of Real Estate Investments

Before we dive into the factors to consider, let's familiarize ourselves with the five types of real estate investments:

- Office

- Industrial

- Housing (multi- or single-family)

- Hotel

- Retail

Each type has its own nuances, such as lease length, property laws, and building permits. It's essential to research these factors by location to determine which type of real estate investment aligns with your goals.

There are various ways to get involved as an individual investor, including owning property outright, contributing capital to a real estate venture, or investing in a real estate investment trust (REIT). Each option has its advantages and disadvantages, so consider factors like control over the investment property and opportunities for diversification when making your choice.

Factors to Consider in Real Estate Investments

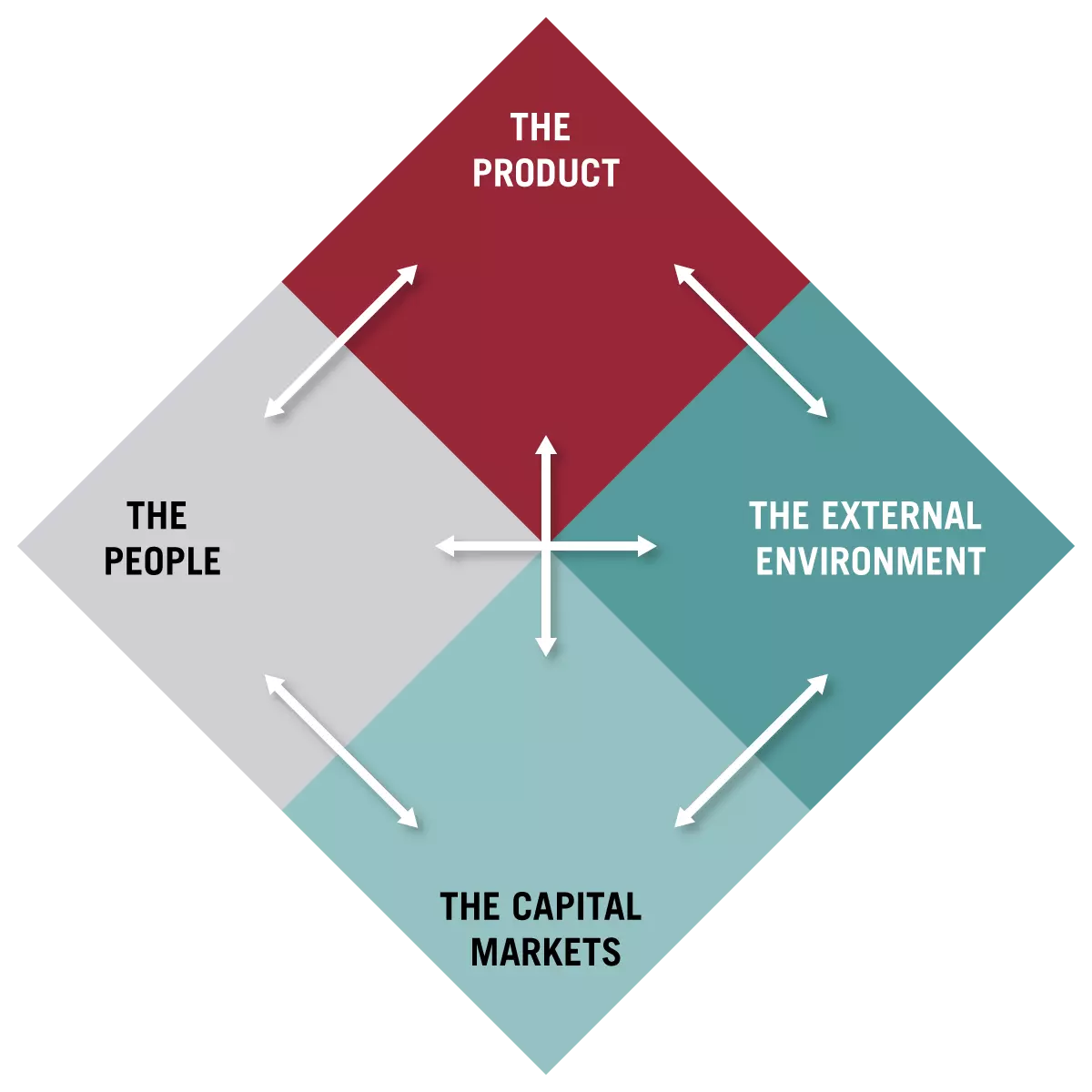

To analyze a potential real estate investment, you need to consider four key factors: the product, the people, the external environment, and the capital markets. These factors are interrelated and play a crucial role in determining the success of your investment.

1. The Product: Assessing the Property

The product refers to the building and the land it sits on. When evaluating an investment opportunity, consider factors that may affect the property's value:

- Infrastructure: Is the building in good condition and up to code? Are there any design flaws that could make the space unappealing?

- Signs of damage: Check for issues like mold, plumbing problems, or faulty HVAC systems that could render the space unlivable.

- Physical location: Consider factors like proximity to highways, public transportation, offices, parking, green spaces, stores, and restaurants.

- Local supply and demand: Research vacancy and absorption rates in the area.

- Projected costs: Determine if any improvement projects are necessary and assess maintenance requests and property tax rates in the area.

Evaluating the property itself is vital, but it's important to remember that it doesn't exist in isolation.

2. The People: Building Relationships

Real estate investments rely heavily on maintaining good relationships with various individuals involved in the process. From the fire chief and police chief to architects, neighbors, lawyers, contractors, and inspectors, successful real estate investors must navigate a network of relationships.

When considering a potential investment, evaluate your rapport with the people involved. If there are strained relationships, it might be a red flag. Building positive connections and honing negotiation skills can have a significant impact on the success of your investment.

3. The External Environment: Accounting for External Factors

Real estate investments are susceptible to external factors beyond your control. Consider these aspects when analyzing an investment opportunity:

- Weather and natural disasters

- Changes in local or national laws

- Technological advancements

- Demographic shifts in the area

- Global events such as the COVID-19 pandemic

It's impossible to predict all external factors, but being aware of their potential impact can help you make informed decisions.

4. The Capital Markets: Financing Your Investment

Once you've assessed the people, external environment, and the property itself, you need to determine how to finance your investment. Capital markets play a crucial role in connecting investors with profitable opportunities. Consider the different capital markets available to you and how they align with your financial goals.

Real estate investments often involve employing leverage by using debt or securing a mortgage. Alternatively, you can opt for equity investment, which grants you a share of the property's profits in exchange for upfront investment. Both private and public market channels offer opportunities for financing real estate investments, each with its own advantages and considerations.

Making Informed Investment Choices

To make wise real estate investment decisions, you must consider each facet of the real estate diamond: the product, the people, the external environment, and the capital markets. By carefully evaluating these factors, you can gain a clear understanding of the investment opportunity and determine if the property is worth pursuing.

Remember, real estate investment requires dedicated study and ongoing learning. If you're interested in deepening your knowledge of real estate and alternative investments, consider exploring online courses like Alternative Investments, which can equip you with the necessary skills to make smart investment choices and build diverse portfolios.

Expand your analysis skills and explore the world of real estate and alternative investments today!

Picture: Four factors of real estate - people, product, external environment, and capital markets.

Picture: Four factors of real estate - people, product, external environment, and capital markets.

Are you ready to take the next step in your real estate investment journey? Explore our five-week online course on Alternative Investments and other finance and accounting courses to expand your knowledge and skills.