Running the Numbers on Apartment Buildings and other Commercial Real Estate

Trying to estimate the value of an apartment building or any other commercial property? Look no further! In this article, we will guide you through the process step by step, ensuring you have all the tools you need to make an accurate assessment.

Commercial real estate valuation is based on a simple principle - the income it generates. The more income a property generates, the higher its value. Unlike single-family homes, where you have limited control over value, apartment buildings offer you the power to increase their worth. By purchasing a building at a fair market price, raising rents, and reducing expenses, you can boost the income and consequently the value of the property. It's truly amazing!

Tap Below for Calculators & Formulas to Help You Run the Numbers

Here's How to Estimate the Value of Commercial Real Estate

To determine the value of commercial properties accurately, you need two key factors: the Net Operating Income (NOI) and the Capitalization (cap) rate.

The NOI represents the income generated by the property after deducting all expenses but before debt service. On the other hand, the cap rate is the rate of return if you were to purchase the property entirely in cash. Although not a practical scenario, it serves as a standard measure for evaluating returns and property values.

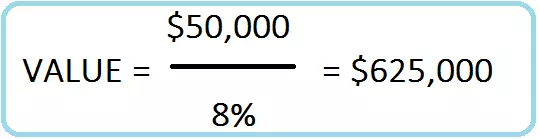

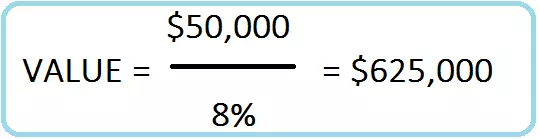

By dividing the NOI by the cap rate, you can determine a building's fair market value. For example, suppose a building generates $50,000 in Net Operating Income per year and the prevailing cap rate for similar buildings in the area is 8%. In that case, the fair market value would be $625,000.

Simple, right? But how do you obtain the NOI and the cap rate? Stick with us, and we'll guide you through the process.

How to Determine the Cap Rate

To assess the cap rate, you can analyze deals involving similar properties in the area. Look at the NOI of comparable sales and divide it by the sales price to calculate the cap rate. The more comparable sales you have, the more accurate the cap rate will be.

While you may not have direct access to this data, commercial real estate brokers do. They are a great resource for obtaining the cap rate for a specific area. Additionally, appraisers, who specialize in valuing commercial real estate, can provide valuable insights.

In other words, determining the cap rate is just a few phone calls away.

The Fair Market Value of Commercial Real Estate

Now that you have the cap rate for the area, all you need is the financials of a deal from your broker. Apply our formula and calculate the fair market value effortlessly.

That's it! You now have the knowledge and tools to accurately estimate the value of commercial property.

The Bottom Line in Estimating the Value of Commercial Property

Valuing commercial real estate becomes straightforward once you understand the prevailing cap rate and the Net Operating Income. However, exercise caution when assessing the NOI. Some brokers tend to overstate the income to make the numbers appear more appealing, leading to an inflated price. Always examine the NOI closely!

For further expertise and insights from fellow investors, join the Connected Investors Forum here.

When you're ready to finance your commercial or residential investment property, visit CiX.com. It's where private and hard money lenders compete to fund your next deal.