If you're looking to make money in real estate, then finding positive cash flow properties should be your top priority. While you could invest for appreciation, positive cash flow offers immediate and substantial benefits. It means that after paying all expenses associated with your property using the rent collected, you still have a net profit. In other words, it's having a surplus after covering costs with rental income.

Finding positive cash flow properties is not always easy, but by considering a few vital factors, you can increase your chances of success. Let's explore how you can identify these lucrative properties and maximize your real estate investments.

What Are Positive Cash Flow Properties?

Positive cash flow properties, also known as positive geared properties, are properties that actually make money for real estate investors. While all investment properties should ideally generate income, not all properties do. Some properties have rental expenses that surpass their rental income.

Positive cash flow occurs when a property's rental income exceeds its rental expenses. In other words, positive cash flow means having a net difference of income and expenses that is positive.

How to Calculate Positive Cash Flow

Calculating positive cash flow is simple. It is the difference between rental income and rental expenses:

Positive Cash Flow = Rental Income - Rental Expenses = + $$$

While this calculation may seem straightforward, determining rental expenses can be tricky due to the myriad of costs involved. You need to consider expenses such as management fees, repairs, property taxes, income tax, utilities, HOA fees, mortgage interest, and rental property insurance.

To simplify this process, you can use Mashvisor's investment property calculator, which provides a comprehensive breakdown of costs in seconds.

Why Are Positive Cash Flow Investment Properties Important?

Positive cash flow properties are essential for real estate investors for several reasons. Firstly, they ensure a consistent and immediate stream of income. Positive cash flow is the core of ROI (return on investment) in real estate investing. It also plays a significant role in determining metrics such as cash on cash return and cap rate, which are crucial for comparing and analyzing different investment properties.

Moreover, positive cash flow properties protect investors from market downturns. Regardless of the state of the real estate market, investors continue to earn income from their cash flow properties.

How to Find Positive Cash Flow Properties for Investment

Now that you understand the importance of positive cash flow properties let's explore how you can find them:

1. Find the Best Market to Invest In

The location of your investment property is crucial in determining its potential positive cash flow. Consider factors such as tenant pools and legal restrictions on rental types. Look for areas that offer attractive opportunities and cater to desirable tenant demographics.

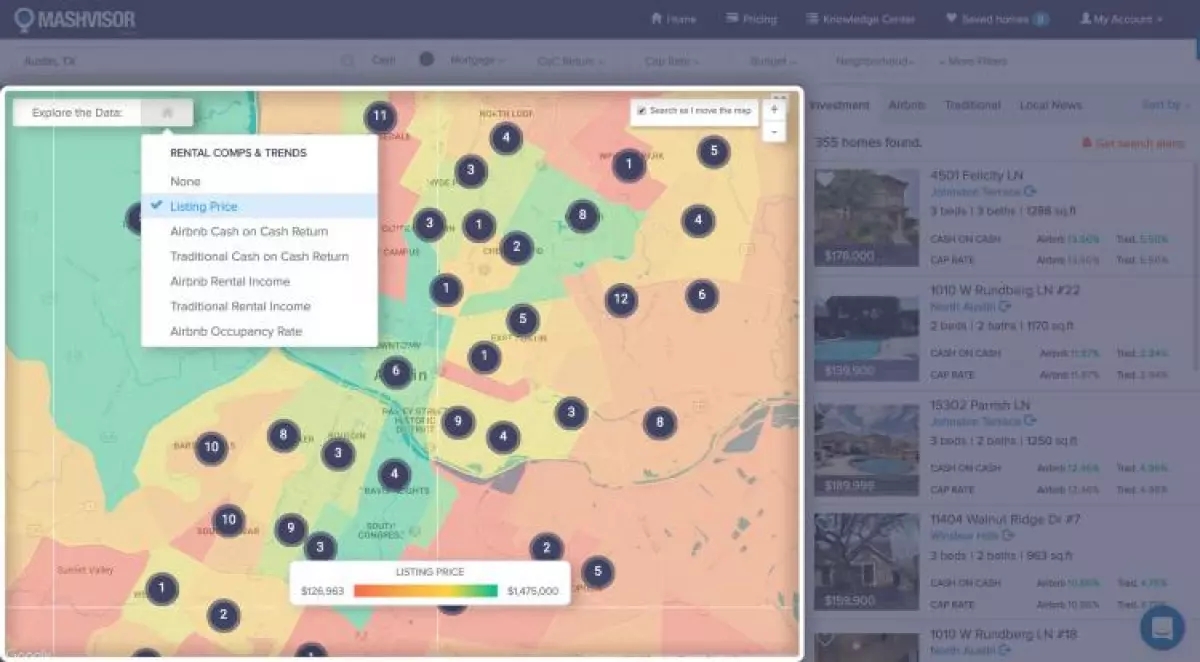

Mashvisor provides a user-friendly tool to help you find areas with high-producing properties. By entering your desired city, you can access data on cash on cash return, cap rate, and median property prices. The real estate heatmap allows you to identify areas with positive cash flow properties based on factors such as high rental income and occupancy rates.

Image source: link

Image source: link

2. Begin the Investment Property Search Process

Once you've identified a potentially cash flow positive market, it's time to start your property search. Offline methods include looking for "For Sale By Owner" signs, distressed properties, and checking local newspapers and magazines for advertisements.

Online platforms like Mashvisor offer property listings and real estate data, allowing you to search in multiple cities simultaneously. Set filters such as your budget, preferred property type, and rental strategy to find the highest cash flow properties in those markets.

Before starting your search, determine your budget and the maximum price you can afford while still generating positive cash flow. Research which property type makes for the best cash flow investment in your chosen market.

3. Conduct Investment Property Analysis

Performing a rental property cash flow analysis is crucial to ensure you're buying a cash flow positive property. Estimate running expenses, rental income, and expected cash flow. Mashvisor's rental property calculator provides metrics such as occupancy rate, cap rate, cash on cash return, rental income, and ongoing costs to evaluate potential cash flow properties.

4. Work with an Investor Friendly Real Estate Agent

If you lack experience in buying cash flow positive properties, consider working with an experienced investor-friendly real estate agent. They can assist with negotiations, help secure the best price, and provide guidance on comparative market analysis and cash flow analysis.

5. Set the Right Rental Rate

The rental rate you set significantly impacts the cash flow generated by your property. Ensure your rent covers recurrent costs and mortgage payments while leaving a positive cash flow. Consider additional services, such as professional cleaning, which tenants may be willing to pay extra for.

Pros and Cons of Cash Flow Properties

It's important to understand the pros and cons of cash flow properties to make informed investment decisions:

Pros of Cash Flowing Real Estate for Sale

- Provides a monthly income stream from the start.

- Protects against future interest rate hikes.

- Profit is not solely dependent on property value increase.

- Increases your credibility with lenders.

- Offers income potential even during market downturns.

Cons of Cash Flowing Real Estate for Sale

- Profits are subject to taxes.

- Properties in economically volatile areas may pose risks.

- Investment properties in low-income areas may have higher maintenance costs and tenancy issues.

Conclusion

Finding positive cash flow properties requires thorough research and analysis. Take your time, avoid rushing into decisions, and keep emotions in check. Stick to your budget and focus on properties that offer sustainable and profitable cash flow. By following these steps and leveraging tools like Mashvisor, you can increase your chances of finding lucrative cash flow properties and maximizing your real estate investments.

FAQs: Cash Flow Properties

1. Should You Consider Buying a Negative Cash Flow Property?

Investing in a negative cash flow property means that the expenses exceed the rental income. While this strategy can be profitable in the long run, it is risky, especially for beginners.

2. What Are the 2% Rule and the 50% Rule?

The 2% rule suggests that a property should rent for 2% or more of its purchase price to be considered a good deal. The 50% rule states that property expenses will amount to 50% of gross income. While these rules provide a quick estimate of profitability, they should not be the sole basis for investment decisions. Conduct thorough analysis using tools like Mashvisor's rental property calculator to get accurate calculations.