Accessing accurate and timely property data is crucial for gaining a competitive edge in the commercial real estate (CRE) industry. One important step in streamlining the deal-making process is learning how to find recently sold commercial real estate with minimal effort. In this article, we will explore effective strategies for identifying and leveraging valuable insights from recently sold properties to enhance your CRE strategies.

Use Public Records to Identify Recent Property Transactions

Finding recently sold properties within a specific country or city is often as simple as searching public records. Many county recorders and assessors provide public access to property records, offering essential information such as transaction and ownership history. One notable example is The Automated City Register Information System (ACRIS), a reliable source of public property records for New York City.

While this method is publicly available and generally free of charge, it does come with potential shortcomings. These include incomplete, inaccurate, or outdated information, limited property details, and a reliance on local regulations in each area. For a more accurate and in-depth research process, real estate professionals can opt for dedicated online databases. Numerous providers offer access to databases with up-to-date and comprehensive property information covering a wide array of markets and asset classes.

Tap Into Insights on Recently Sold Commercial Properties to Boost CRE Strategies

Knowing how to find recently sold commercial real estate information can benefit real estate professionals in several ways. Recent sales data on commercial properties provides valuable insights for:

- Market trends: Examining recent property sales ensures a better understanding of current market dynamics, including property value trends and demand for certain properties.

- Informed decision-making: Information on recent CRE transactions supports strategic decision-making and uncovers investment opportunities by assisting in assessing the performance of different properties and locations.

- Financing and valuation: Recent sales data impacts financing and investment decisions, as lenders and investors use this information to assess a property’s risk and return, which can influence the terms of financing or investment offers.

- Comparative analysis: Comparing recently sold properties with similar ones in the area helps determine the current market value of a commercial property and gain a better understanding of pricing dynamics.

Leverage Best Practices to Compare Similar Properties

Analyzing recently sold commercial property data is key to understanding market trends. Here are some best practices to follow:

- Define your search criteria: To ensure a precise research process, start by defining specific criteria for the commercial properties you are interested in, such as property type, size, location, amenities, and zoning regulations.

- Leverage the power of online databases and platforms: Use online databases and platforms to conduct a comparative analysis of CRE listings and sales information. These resources enhance the research process through automation and provide access to a wide range of data, which can be narrowed down using search filters.

- Filter and compare properties: Use filters to narrow down your search results based on your criteria. Once you have a list of properties matching your requirements, compare them based on factors such as sale price, price per square foot, location, condition, and other relevant details.

- Evaluate financial performance: In addition to comparing the sale prices of similar properties, evaluate their financial performance by taking into account metrics such as rental income, occupancy rates, operating expenses, and potential for future appreciation. This analysis can help assess the investment potential of each property.

Work with Online Databases to Simplify the Research Process

Accessing accurate property data is now easier with numerous online property databases available. These platforms facilitate access to property listings, transaction details, and ownership information on a national scale. Some specialize in commercial sectors, such as retail, office spaces, or industrial properties, while others cover all asset types. Notable examples include CommercialEdge Research, PropertyShark, Yardi Matrix, CoStar Reonomy, and Buildout.

CommercialEdge Research stands out by providing access to extensive CRE data, covering more than 14 million property records and over 8 million recent transactions with nationwide coverage across all asset types. The platform facilitates comparables analysis with a quick and easy-to-use comps tool that delivers up-to-date results.

Here's how CommercialEdge Research can optimize the research process, including identifying recently sold CRE properties:

Perform a property search

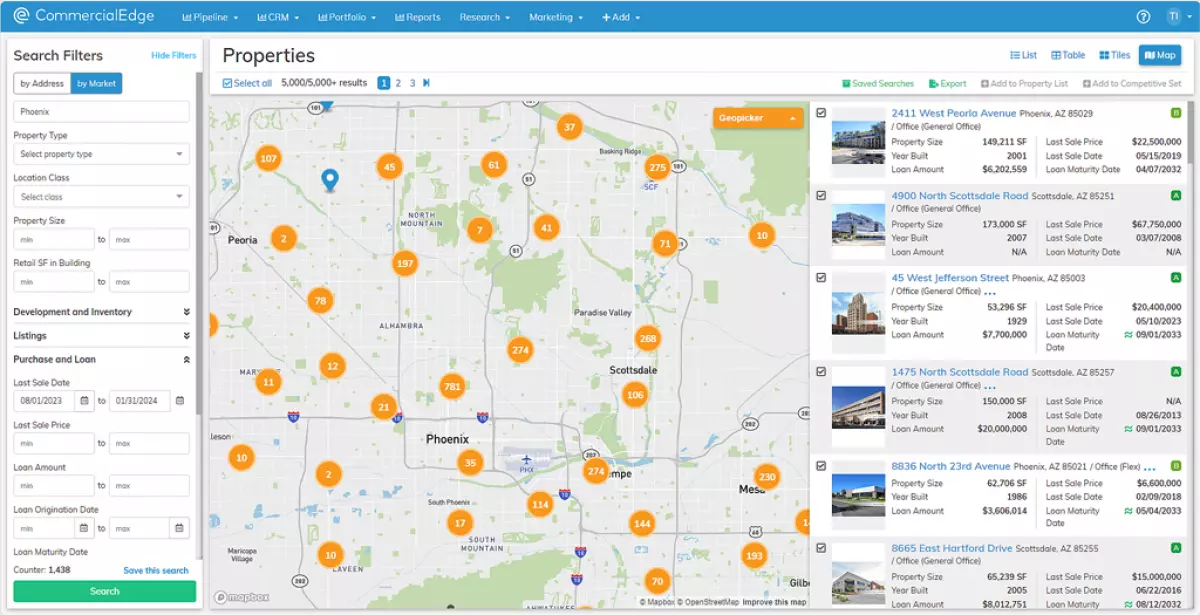

Perform a property search based on location, selecting a market, city, or address and a period for the specific sale dates to receive the complete list of recently sold assets in the specified area.

Recently sold commercial real estate

Recently sold commercial real estate

Narrow down search results using other available filters, such as property type, location class, property size, year built, and more.

Search results can then be saved, specific properties can be added to a list or a competitive set, or the list can be exported to a PDF, Excel, or other file formats.

Use the map view

Gain a visual overview of recent sales within a specific area with the Maps functionality. Applying the sale date filter will populate the map with color-coded sales data, enabling you to quickly identify areas where properties haven't changed hands in a while or pinpoint hotspots for property sales. You can also refine your search by property type for a visual representation of sales data in your submarket of interest.

This tool provides quick access to information about each property with a simple click, eliminating the need to access individual property reports.

Accurate property data is essential to strategic planning and decision-making in commercial real estate. Solutions such as CommercialEdge accelerate processes and save time by enabling real estate professionals to streamline their dealmaking.

Disclaimer: This guide aims to provide potential investors with sufficient information to determine if they are interested in pursuing discussions regarding a purchase or other transactions. Investors are encouraged to conduct their analysis, inspection, and examination and should rely solely on their own findings when determining their course of action.

Leveraging property data for strategic decision-making

Leveraging property data for strategic decision-making

By implementing these strategies and utilizing online databases like CommercialEdge Research, you can stay up-to-date with recently sold commercial real estate and make informed and strategic decisions in the ever-evolving CRE market. Happy researching!