Real Estate Investment Trusts (REITs) offer a unique opportunity for investors to tap into the lucrative real estate market without the hassle of property ownership. With a market capitalization of £5.8 billion in June 20231, the United Kingdom provides a thriving environment for REIT investments. If you're interested in learning how to invest in REITs in the UK, this guide is for you.

Why Invest in REITs?

REITs are companies that own, operate, or finance income-generating real estate properties. By investing in REITs, you gain access to a diversified portfolio of properties, such as residential buildings, commercial spaces, retail centers, and industrial assets. These investments offer multiple benefits, including regular income streams, potential capital appreciation, and portfolio diversification.

Step-by-Step Guide: Investing in REITs in the UK

Investing in REITs may seem overwhelming at first, but with the right approach, it can be a straightforward process. Here's a step-by-step guide to help you get started:

1. Research and Select REITs

Begin by researching and analyzing different REITs. Consider factors such as investment strategies, property portfolios, financial performance, and dividend history. Pay attention to property types, geographic locations, and management expertise. This due diligence will help you identify suitable REITs for your investment goals.

2. Open a Brokerage Account

Next, choose a reputable brokerage firm that provides access to the UK stock market. For beginners, we recommend platforms like eToro. Open an account, complete the necessary documentation, and fund your account.

3. Conduct Due Diligence

Before investing, thoroughly evaluate the selected REITs. Review financial statements, annual reports, prospectuses, and market research. Assess risks, growth potential, and stability. This will help you make informed investment decisions.

4. Place Buy Orders

Once you've selected the desired REITs, place buy orders through your brokerage account. Specify the number of shares and the desired purchase price. This step initiates your investment in the chosen REITs.

5. Monitor Your Investments

Regularly monitor your REIT investments. Stay updated on news and announcements related to the REITs and the real estate market. Evaluate the performance of your investments and ensure they align with your investment objectives.

6. Consider Dividend Reinvestment

Some REITs offer dividend reinvestment plans (DRIPs). These plans allow you to automatically reinvest dividends to acquire additional shares. Evaluate the benefits of DRIPs based on your investment strategy.

7. Review and Adjust

Periodically review your REIT investments and make adjustments as needed. Consider rebalancing your portfolio based on changes in market conditions, investment goals, and risk tolerance.

Best Investment Platforms for UK REITs

To facilitate your REIT investments, consider these top investment platforms in the UK:

1. eToro - Best place to invest in REITs UK

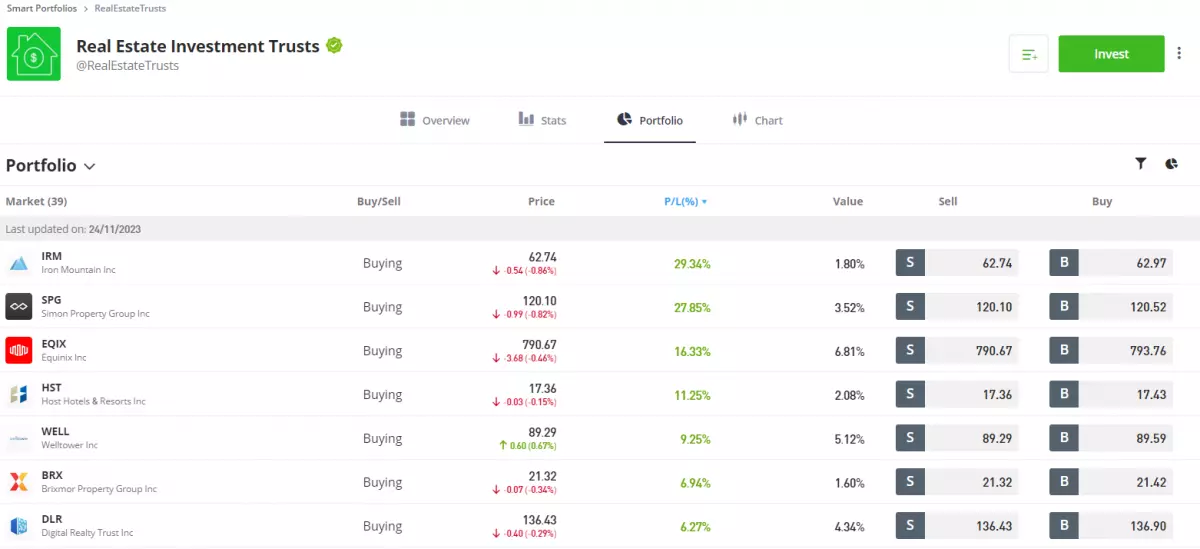

Caption: Diversify your investment portfolio with popular REIT ETFs through eToro.

Caption: Diversify your investment portfolio with popular REIT ETFs through eToro.

eToro offers a range of REIT options, including REIT ETFs like iShares Global REIT ETF and iShares Core U.S. REIT ETF. With a minimum deposit of just $10, eToro provides an accessible platform to tap into the potential of REITs.

2. Hargreaves Lansdown

Unlock a wide range of REITs for investment through your ISA or SIPP with Hargreaves Lansdown. Explore their diverse selection and take advantage of tax advantages offered by these investment accounts.

3. interactive investor

Enhance your investment portfolio and access a wide range of REITs through Interactive Investor. Whether you open a SIPP or an ISA account, Interactive Investor provides a comprehensive platform to manage your REIT investments.

Understanding UK REITs

It's essential to be aware of specific details regarding UK REITs:

- Dividend yields are considered rental income and exempt REITs from paying Corporation Tax on property investment profits.

- Individual investors may still be liable for Income Tax and/or Capital Gains Tax (CGT) on their profits, depending on income levels and investment structures.

- UK REITs are subject to a 0.5% stamp duty on all share purchases.

- Property income profits are not subject to the standard corporate tax rate. Instead, they are distributed as property income distribution and taxed based on individual tax brackets.

Types of REITs

There are different types of REITs to consider:

- Equity REITs: Own and operate income-generating properties.

- Mortgage REITs: Invest in mortgages or mortgage-backed securities.

- Hybrid REITs: Combine characteristics of equity and mortgage REITs.

- Publicly traded REITs: Listed on stock exchanges.

- Non-traded REITs: Not traded on exchanges and have limited liquidity.

- Specialty REITs: Focus on specific property types.

REIT ETFs

REIT ETFs provide exposure to diversified portfolios of REITs. These ETFs invest in a basket of REITs, enabling investors to access the real estate sector without owning individual REIT stocks. REIT ETFs offer advantages such as diversification, liquidity, and cost efficiency.

Investing in REITs through an ISA

Investing in REITs through an Individual Savings Account (ISA) provides tax advantages. ISA returns, including dividends and capital gains from REIT investments, are exempt from income tax and capital gains tax. This tax-efficient approach offers flexibility and convenience for managing your REIT investments.

Disadvantages of UK REITs

While investing in REITs can be beneficial, it's essential to consider potential drawbacks:

- Stamp Duty: UK REITs are subject to a 0.5% stamp duty, impacting returns and increasing transaction costs.

- Tax Considerations: Individual investors may still be subject to taxes on investment returns.

- Market Volatility: REITs are exposed to market fluctuations, impacting share prices and potential capital losses.

- Interest Rate Sensitivity: Changes in interest rates can affect REIT profitability and share prices.

- Sector-Specific Risks: Different real estate sectors carry unique risks, influenced by economic conditions and regulatory changes.

- Lack of Control: Passive investors have limited control over management decisions regarding underlying real estate assets.

Final Thoughts

Investing in UK REITs offers an attractive opportunity to participate in the real estate market. By investing in REITs, you can access income-generating properties and benefit from potential income streams and long-term capital appreciation. However, consider potential risks and disadvantages alongside the benefits. Conduct thorough research and make informed investment decisions to maximize your returns.

FAQs

You may also like:

- How to invest in stocks UK

- Best trading platform UK

- Best stock trading app UK

- Best investment app UK

- Best ETF platform UK

- Best forex trading app UK

Investing in REITs can be a rewarding and fulfilling way to grow your wealth. Take the first step today and explore the opportunities that UK REITs have to offer.