Introduction: Real estate wholesaling is an attractive investment strategy for those with limited funds and a desire for a short-term approach. It offers a low financial barrier to entry and eliminates the need to manage tenants, rental properties, or house-flipping projects. However, navigating the world of real estate wholesaling can be challenging for beginners, with complex contracts and state legal regulations to consider. In this ultimate guide, we will explore how wholesaling works, its pros and cons, and how to find properties for your wholesale venture.

What Is Real Estate Wholesaling?

Wholesaling is a real estate investment strategy where an individual, known as the wholesaler, finds and contracts a property at a significant discount. The wholesaler then assigns or resells the contract to another buyer, usually an investor, for a profit. Acting as intermediaries, wholesalers facilitate transactions between sellers and buyers without owning or renovating the property themselves.

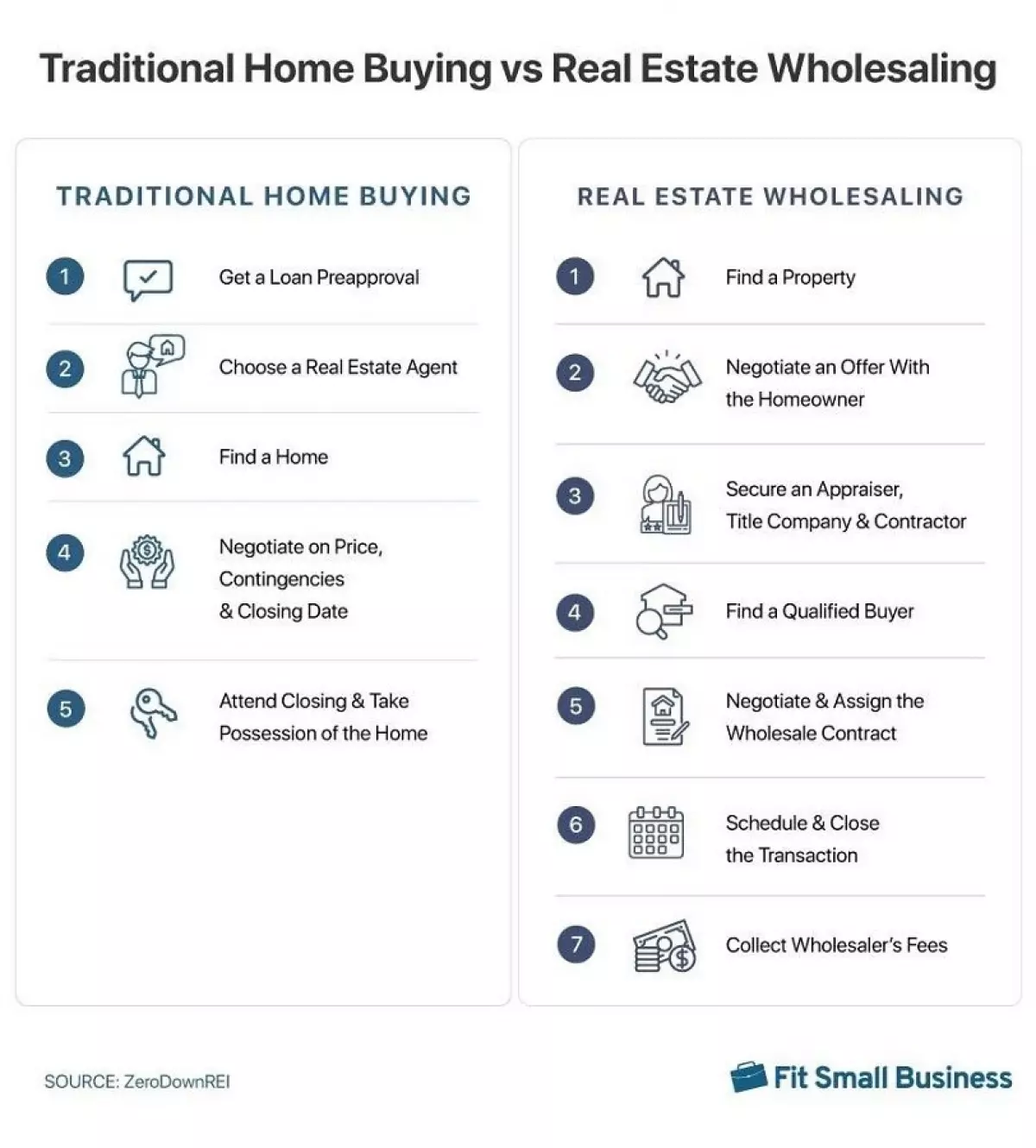

Image: An infographic comparing traditional home buying and real estate wholesaling.

Image: An infographic comparing traditional home buying and real estate wholesaling.

Who Is Real Estate Wholesaling Best For?

Real estate wholesaling is an excellent option for beginner investors with limited capital. It also suits contractors and investors with an eye for distressed properties and strong negotiation skills. While wholesaling requires time and research, it can yield significant rewards when done correctly. Building a network of real estate professionals, lenders, and other investors is essential for success in wholesaling.

Legal Considerations of Wholesaling

Real estate wholesaling is legal in the United States, but it is subject to varying legal requirements and regulations across states and local jurisdictions. It is crucial for wholesalers to familiarize themselves with the real estate laws in their area and ensure full compliance. Engaging in wholesaling without understanding the legal requirements can lead to legal issues, financial loss, and penalties. Seeking legal counsel and consulting local real estate authorities is advisable.

How Does Wholesale Real Estate Work?

To succeed as a wholesaler, you need a solid network, strong negotiation skills, and the ability to act quickly. Wholesalers aim to assign the contract to a new owner within 30 days, as sellers do not want their property tied up indefinitely. Here is a typical process for wholesaling real estate:

- Property identification: Wholesalers identify potential wholesale homes, often distressed or in need of repairs, that investors can purchase below market value.

- Contract negotiation: Wholesalers negotiate purchase contracts with property owners, securing favorable terms such as a low purchase price and flexible closing timelines.

- Assignment: Instead of closing on the property, wholesalers assign the contract to an end buyer, usually for a fee that represents their profit.

- End buyer purchase: The end buyer completes the property purchase according to the contract terms.

Back-to-Back Closing

In addition to assigning contracts, wholesalers can also purchase the property themselves using a method called back-to-back closing or double closing. This approach allows wholesalers to buy the property well below market value and sell it for a profit, keeping all of the net proceeds from the sale. However, it requires a larger initial investment and is best suited for experienced investors.

Pros & Cons of Real Estate Wholesaling

Real estate wholesaling offers several benefits, such as a low financial barrier to entry and the absence of property ownership and management responsibilities. However, it also presents challenges, including finding suitable properties and qualified buyers. Here are the key pros and cons of wholesaling real estate:

Pros:

- Low financial barrier to entry

- No property ownership or management responsibilities

- Potential for significant profits

Cons:

- Difficulty in finding properties and qualified buyers

- Legal complexities and compliance requirements

- Limited control over the final sale price

How to Wholesale Real Estate

Learning how to wholesale real estate requires several essential steps. These include research, negotiation skills, project management, building a network, and moving quickly from contract to assignment and closing. Preparation is crucial to minimize wasted time and money. Here is a step-by-step guide to starting your wholesaling journey:

1. Find Distressed Properties

Begin by identifying distressed properties that offer potential profit. These properties are often in poor condition or owned by motivated sellers and can be purchased below market value. Utilize free or low-cost methods like online sites, real estate groups, and assistants to find these properties. Additionally, consider using tools like REDX, which compile accurate contact information to simplify your search.

2. Negotiate an Offer With the Seller

Negotiating deals and convincing property owners to sell is a critical skill for wholesalers. Building trust with the owner is the first step. Approach homeowners professionally and emphasize the benefits of selling, such as relieving financial stress or deferred maintenance. Handle the contract, inspections, appraisals, and closing to alleviate the homeowner's burdens. Before proceeding, ensure your contracts comply with local laws by having them reviewed by a real estate attorney.

3. Secure a Title Company, Appraiser & General Contractor

Establish relationships with a title company, appraiser, and general contractor before you need them. An appraiser provides property valuation, a title company conducts title searches, and a contractor estimates repair costs. These professionals are crucial for ensuring profitable deals and buyer confidence. Seek referrals and recommendations from your network or reputable online sources.

Image: Members of your real estate wholesale team.

Image: Members of your real estate wholesale team.

4. Find a Qualified Buyer, Negotiate & Assign a Contract

Locating a buyer for your wholesale property is crucial. Target investors or contractors looking to renovate, or even potential homeowners seeking a renovation project. Cost-effective methods to find buyers include advertising on platforms like Craigslist and Zillow, distributing flyers in the neighborhood, and reaching out to real estate professionals in your network. Once you find an interested buyer, negotiate the deal and assign the contract. Use the contractor's estimate to your advantage and emphasize the urgency. Ensure your costs are covered, and discuss the property's after-repair value to encourage the buyer to proceed.

5. Schedule & Close the Deal

Set a closing date based on your projected timeline, making sure your contract specifies this. The closing occurs at the title company's or real estate lawyer's office, where the deed transfer concludes the wholesale deal. Buyers typically cover closing costs unless otherwise agreed. Collect your contract assignment and facilitation fee or net proceeds if you opted for a double closing. Consult with a real estate accountant to ensure proper financial planning, including setting aside funds for taxes.

Where to Find Wholesale Properties

Wholesalers can employ various strategies to find suitable properties. The effectiveness of each method may vary depending on your market. Combining different approaches can increase your chances of success. Consider the following methods to find wholesale properties:

- Networking within the real estate industry

- Online platforms and websites

- Real estate groups and associations

- Direct mail campaigns

- Referrals from other investors and professionals

Real Estate Wholesaling Business Tips

Starting a real estate wholesaling business requires careful planning, professionalism, and a focus on long-term success. Keep these tips in mind as you embark on your wholesale journey:

- Invest in real estate education and continuously expand your knowledge.

- Understand your market to source and evaluate properties effectively.

- Develop a comprehensive business plan outlining your goals and strategies.

- Comply with local real estate laws and consult legal and tax professionals when necessary.

- Implement marketing strategies to generate leads.

- Keep accurate financial records and manage your finances wisely.

- Conduct thorough due diligence before committing to a deal.

- Stay informed about industry trends and market changes.

- Seek guidance from mentors or experienced individuals in the industry.

How Much Do Real Estate Wholesalers Make?

The average annual salary for real estate wholesalers in the U.S. is around $50,862. However, individual salaries can vary depending on location, completed transactions, market conditions, and fees charged by wholesalers.

Frequently Asked Questions (FAQs)

- What is the difference between real estate wholesaling and property flipping?

- Are there any legal considerations to be aware of in real estate wholesaling?

- Can real estate wholesalers invest in properties themselves?

- How do I find qualified buyers for my wholesale properties?

Bottom Line

Real estate wholesaling offers an accessible entry point into real estate investing with the potential for high profits. However, it requires knowledge, networking, and diligence to succeed. Legal compliance and understanding contract intricacies are essential for wholesalers. By approaching wholesaling with professionalism, ethics, and a focus on long-term success, you can harness the immense opportunities it offers. Remember to consult with legal and tax professionals to ensure you navigate the process successfully and avoid costly mistakes.