Finding affordable rental housing can be a challenge, especially with the constant increase in rent prices. If you're in search of income-restricted apartments, you've come to the right place. This in-depth guide will help you navigate the world of income-restricted housing and provide insights on how to find them.

Understanding Income Restricted Apartments

Income-restricted apartments are housing options specifically designated for low-income individuals or families. These apartments have limitations on the maximum amount of income tenants can earn. While they are typically privately owned, they may receive state, local, or federal subsidies. In some cases, apartment communities may have a mix of both market-rent and income-restricted apartments.

Caption: Image Source - What Are Income-Restricted Apartments

Caption: Image Source - What Are Income-Restricted Apartments

The History Behind Income Restricted Apartments

During the Great Depression, the housing crisis prompted significant government involvement in providing affordable housing. This led to the establishment of the Housing and Urban Development (HUD) agency, which eventually became the U.S. Department of Agriculture's Rural Development department. In 1937, the Affordable Housing Act was passed to develop new affordable rental housing and subsidize the operation costs of income-restricted apartments.

What Is Section 8 Housing?

Section 8 housing, created under the Section 8 Housing Act of 1937, is still operated by the federal government today. It includes the housing choice voucher program, which allows tenants to receive federal vouchers for housing in participating developments. Additionally, Section 42 housing, a part of the Tax Reform Act of 1986, provides tax incentives to investors building affordable housing.

Income Restricted vs. Income-Based Housing

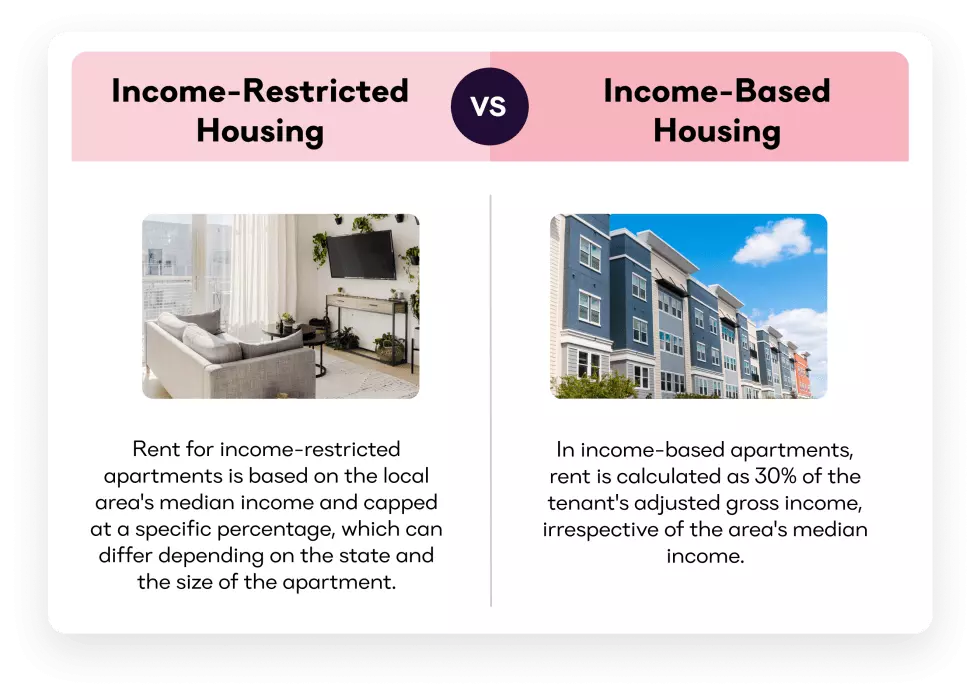

While the names may sound similar, income-restricted and income-based housing differ in their rent calculation methods. In income-restricted housing, rent prices are determined based on the median income for the local area, with a cap on a certain percentage of this figure. On the other hand, in income-based housing, rent prices are based on the adjusted gross income of the tenant, with a cap at 30% of this figure, regardless of the median income in the area.

Caption: Image Source - Income-Restricted Housing vs Income-Based Housing

Caption: Image Source - Income-Restricted Housing vs Income-Based Housing

Eligibility for Income Restricted Housing

Income-restricted apartments are typically reserved for families falling within the "Very Low" income threshold, as determined by HUD. Families categorized as "Extremely Low" income receive preference. Eligibility is based on the median income levels calculated annually by HUD for each metropolitan area. As median income levels differ from one city to another, eligibility requirements for income-restricted housing vary accordingly. To explore options in your area, visit the HUD Public Housing Agency (PHA) Contact Information website.

Cost of Income Restricted Housing

The average rent prices for income-restricted apartments vary significantly based on location and unit size. Maximum rent caps are determined locally using various methods. To find out how much income-restricted housing costs in your area, it is best to contact your local housing authority. You can access the contact information for local authorities here.

Caption: Image Source - Lease Agreement

Caption: Image Source - Lease Agreement

Finding Income Restricted Housing

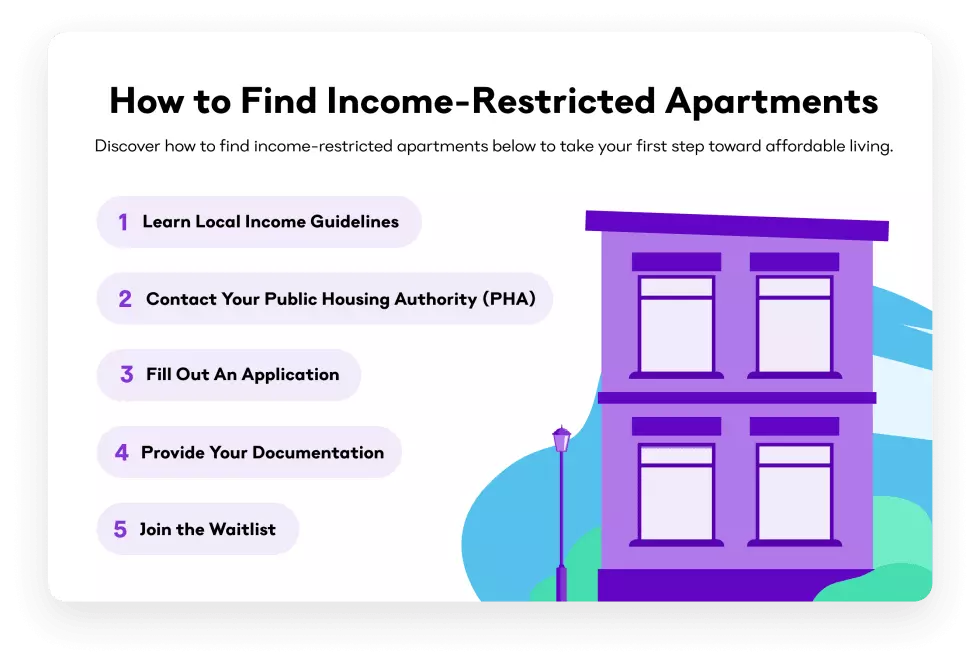

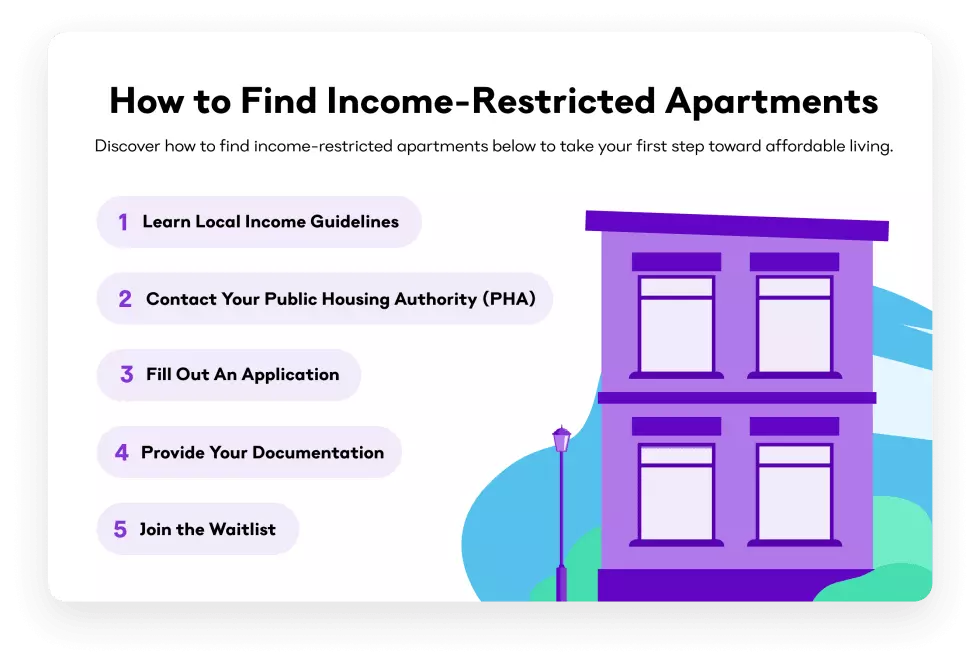

Now that you have an understanding of income-restricted housing, let's explore how to find these apartments in your area.

Learn the Income Guidelines for Your Area

Start by visiting the HUD website to learn more about the specific income guidelines for income-restricted housing in your area.

Contact Your PHA

Reach out to your local Public Housing Authority (PHA) once you have determined your eligibility based on the guidelines. Speaking with the PHA will help you gather information on rent costs, apartment sizes, and availability in your area.

Fill Out an Application

Government-owned apartments require applications through the PHA, while privately owned properties accept applications directly through the landlord. During the application process, everyone living in the apartment must pass a criminal background check. It's important to remember that private owners often have stricter standards compared to government-owned apartments.

Provide Your Documentation

During the application process, you'll need to provide all required documentation, including verified income for all household members. Adults will need to provide government-issued IDs, and birth certificates may be required for children.

Caption: Image Source - How to Save on Your Next Apartment

Caption: Image Source - How to Save on Your Next Apartment

Join the Waitlist

Due to the competitive nature of the affordable housing market, it is common to be placed on a waitlist. Being flexible with your apartment size preference may increase your chances of securing income-restricted housing sooner.

Find Your Next Apartment

Apartment List offers a variety of listings, including income-restricted, senior housing, military discounted housing, and more. You can take our quiz to find a place in your location and price range. Use our internal messaging system to contact landlords for further details about rental options and assistance.

FAQs about Income Restricted Apartments

What Are the Benefits of Living in an Income Restricted Apartment?

Living in an income-restricted apartment allows you to live comfortably within your means and afford other expenses such as utilities and groceries. The peace of mind that comes with being able to afford your bills is priceless.

What Are My Rights as a Tenant in Income Restricted Housing?

As a tenant in income-restricted housing, your rights are similar to those in other rentals. These rights are determined by state and local ordinances but typically include timely major repairs, notice before entry by landlords, minimum notice before eviction, safety standards, and the right to enjoy the property peacefully. Check your local laws for more information on your specific rights.

How Can I Become Ineligible for Income Restricted Housing?

Eligibility for income-restricted housing is generally based on local regulations. However, common reasons for removal from a housing voucher program include failure to pay rent or utilities, criminal activity, drug or alcohol abuse, missing recertification appointments or inspections, eviction, or providing false information to the housing authority.

What Happens if My Income Increases While Living in an Income Restricted Apartment?

If your income exceeds the eligibility threshold while living in an income-restricted apartment, you will not be immediately evicted. Typically, you will be allowed to occupy the housing for an additional six months after your income is reassessed. You will also have the opportunity for a hearing and the housing authority will provide you with 30 days to move out after terminating your contract. If your income decreases again during this time period, you can request a new hearing and assessment from the housing authority.

By following these guidelines and understanding the intricacies of income-restricted housing, you'll be well-equipped to find and secure affordable rental housing in your area.