Skyline Aerial of Honolulu Hawaii - Art Wager

Skyline Aerial of Honolulu Hawaii - Art Wager

Introduction

Welcome to an exciting exploration of Industrial Logistics Properties Trust (NASDAQ:ILPT), a deep-value industrial Real Estate Investment Trust (REIT) that presents an attractive investment opportunity. In this article, we will delve into the company's investment thesis, background, industry landscape, financials, and valuation. Join me as we uncover the hidden potential of ILPT.

Investment Thesis

ILPT is a deep-value industrial REIT that currently offers a significant margin of safety for investors. Despite facing challenges related to its floating rate debt, ILPT's net asset value (NAV) remains substantial, estimated at $13.22 per share. This makes ILPT an intriguing prospect with significant upside potential.

Background

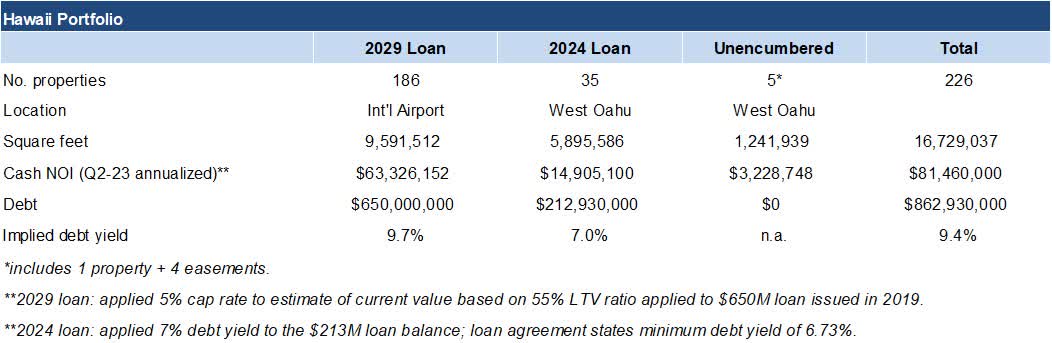

ILPT boasts an extensive portfolio of 318 wholly-owned properties strategically located across the U.S. These class A distribution and logistics facilities play a crucial role in supporting e-commerce companies in delivering goods to their customers. Notably, ILPT's most valuable assets are its 226 wholly-owned properties in Honolulu, Hawaii. These properties have consistently generated long-term, predictable cash flows since 2003, with a remarkable 96% occupancy rate. With the Honolulu industrial market currently standing at 99% leased, the potential for future rent growth in this region remains high. ILPT's management has expressed expectations for rent increases ranging from 30% to 40% moving forward. Furthermore, the majority of ILPT's properties consist of land leased to industrial tenants, requiring minimal ongoing capital expenditures.

Data from ILPT Q2-23 investor presentation; analysis, assumptions, and table produced by author.

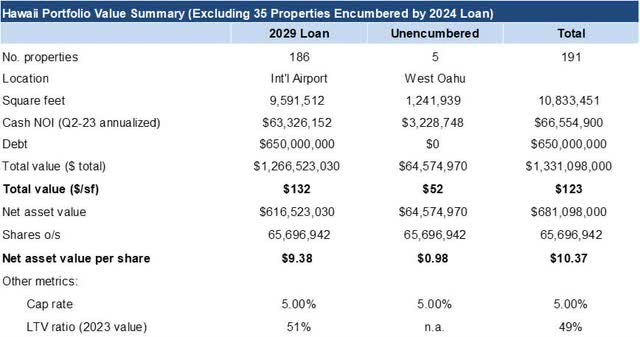

Data from ILPT Q2-23 investor presentation; analysis, assumptions, and table produced by author.

Industry

The U.S. industrial real estate sector demonstrates robust fundamentals. With a national vacancy rate of 4.1% in Q2-23, the market is expected to witness the delivery of approximately 490 million square feet of new constructions in 2023. While there is excess inventory to be absorbed, the limited development starts due to rising costs provide support for strong occupancy levels. Despite the impact of higher interest rates on growth plans, the demand for logistics properties remains unaffected. Prologis, the largest pure-play industrial REIT, anticipates a market rent growth of 7% in 2023. The rising replacement cost of industrial properties further strengthens the basis for future rent increases.

Financials

ILPT faced challenges in managing its floating rate loans, resulting in increased interest costs and a dividend cut. However, the underlying assets of ILPT, generating stable and long-term cash flows, offer significant reassurance. The portfolio maintains a remarkable 99% occupancy rate, with 77% of revenue coming from investment-grade tenants such as FedEx, Home Depot, and Amazon. Moreover, ILPT benefits from net lease contracts that offer protection from rising operating costs and include annual rent escalators. While the current interest rate reset poses challenges, ILPT is actively working towards refinancing its loans at lower rates. Despite short-term uncertainties, ILPT's financials and asset quality provide a solid foundation for potential growth.

Valuation

Assuming ILPT defaults on its floating rate loans, the estimated NAV for the remaining assets, called the "Leftover Portfolio," is approximately $868 million or $13.22 per share. This valuation takes into account various factors such as property location, encumbrance, and market rents. ILPT's undervalued stock presents an opportunity for investors to benefit from its hidden value.

Table produced by author.

Table produced by author.

Key Risks

While ILPT presents an attractive investment opportunity, it's essential to acknowledge the potential risks involved. One key risk is related to ILPT's external management by RMR Group, a mixed-reputation entity. It's crucial for ILPT's management to make rational decisions that prioritize shareholder value. Additionally, an industry downturn caused by an economic recession could affect market rents. However, ILPT's high occupancy rate, investment-grade tenants, and below-market rent provide some protection against this risk.

Catalysts

ILPT has several potential catalysts that could drive its growth and enhance shareholder value. These catalysts include debt reduction through asset sales or new joint ventures, refinancing floating rate loans with long-term fixed-rate debt, and the spin-off of heavily indebted properties. These strategic moves could significantly improve ILPT's financials and position it for a prosperous future.

Conclusion

Despite short-term uncertainties, ILPT presents an enticing opportunity for investors seeking a deep-value industrial REIT with significant upside potential. The company's stable and predictable cash flows, strategic property locations, and strong industry fundamentals make it an attractive investment prospect. With careful evaluation and a long-term perspective, investors can benefit from ILPT's hidden value and position themselves for substantial returns.

Remember, investing in stocks involves risk, and it's crucial to conduct thorough research and consider professional advice before making any investment decisions.