Image Source: sanaulac.vn

Image Source: sanaulac.vn

Unveiling the Industrial REIT Sector

The world of Real Estate Investment Trusts (REITs) is vast and diverse, encompassing various commercial and residential sectors. In our comprehensive REIT Rankings series, we delve into the intricate details of each sector, examining property-level fundamentals and macroeconomic forces that drive supply and demand conditions. By analyzing both common and unique valuation metrics, we equip investors with an array of options that align with their individual investing style and risk/return objectives.

The Rise of Industrial REITs

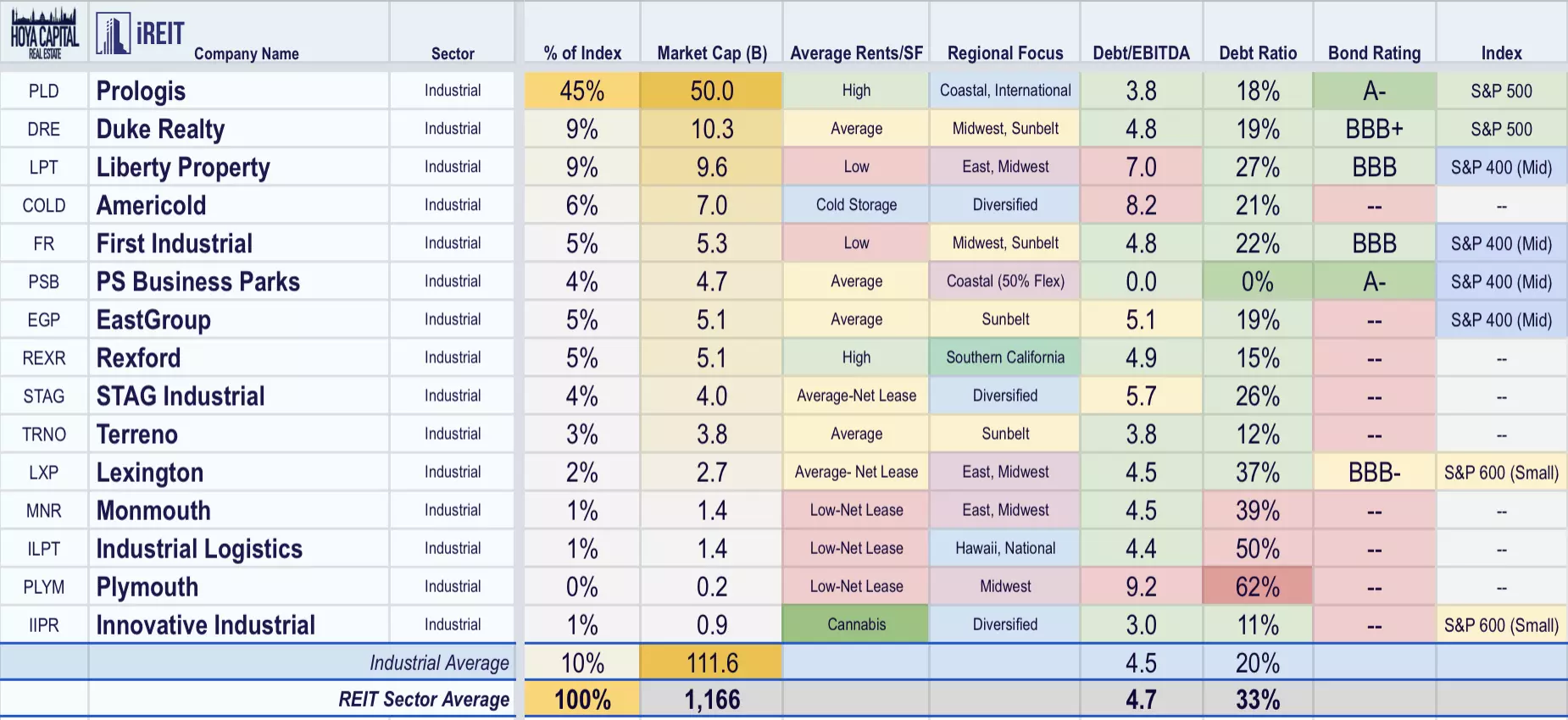

Industrial REITs, a major player in commercial property sectors, make up approximately 10% of the broad-based Real Estate ETFs (XLRE and VNQ). Our focus lies on the fifteen largest industrial REITs within the Hoya Capital Industrial REIT Index, boasting a collective market value of around $110 billion. Among these top players are notable names like Prologis (PLD), Duke (DRE), Liberty (LPT), and Americold (COLD), each contributing significantly to the sector's success.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Riding the E-commerce Wave

The remarkable performance of industrial REITs can be attributed to the vital role they play in the ever-growing e-commerce industry. As retailers and logistics providers strive to meet the demands of fast-paced online shopping, the need for supply chain densification and robust physical distribution networks has skyrocketed. This "need for speed" arms race has not only been fueled by e-commerce giant Amazon (AMZN), but also by traditional brick-and-mortar powerhouses like Walmart (WMT), Home Depot (HD), Target (TGT), and Costco (COST). These retailers have successfully embraced the omni-channel approach, investing heavily in e-commerce distribution in recent years. Consequently, the tenant roster of industrial REITs is diverse and includes major retailers and logistics providers such as FedEx (FDX), UPS (UPS), and XPO (XPO).

Segmenting Industrial Real Estate Assets

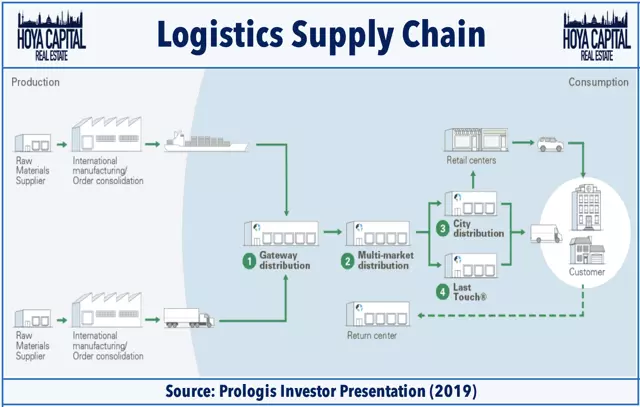

Prologis, a leading player in the industrial REIT sector, categorizes its real estate assets into four main segments: Gateway Distribution, Multi-Market Distribution, City Distribution, and Last-Touch Centers. Properties closer to the end-consumer command a higher per square foot value and face greater barriers to entry. Rent growth has been most robust in segments near the end-consumer. Prologis Research believes that supply chain trends will continue to drive outperformance in Last Touch and City distribution properties, as well as highly-functional Gateway and Multi-market properties where new supply faces significant barriers.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

The Consumer-Focused Shift

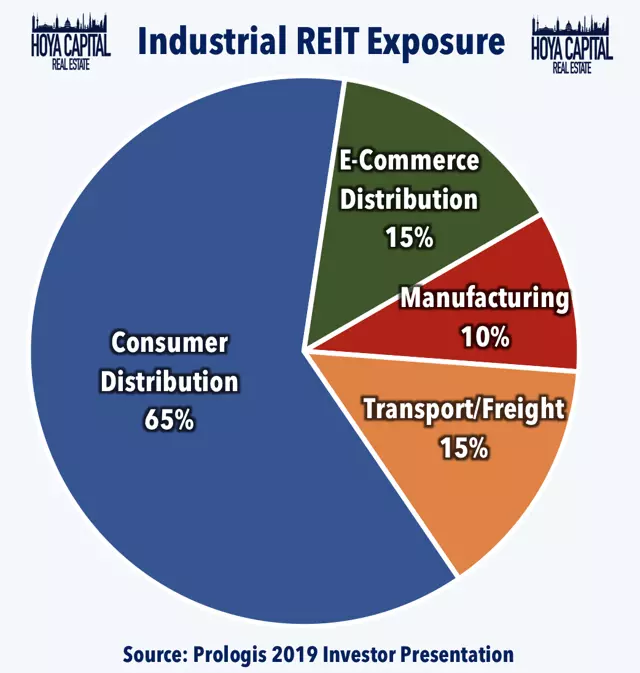

Over the past decade, industrial real estate properties have witnessed a shift towards a more consumer-oriented approach. Approximately 80% of industrial space usage now comes from consumer-oriented tenants. This evolution has reduced the sector's exposure to international trade risks associated with the US-China trade war while increasing its reliance on consumer spending and retail sales. Although Amazon dominates the e-commerce landscape, many other retailers are investing heavily in e-commerce logistics, indicating a promising future for industrial REITs. These REITs are well-positioned to capitalize on the continued growth of e-commerce, enjoying better competitive dynamics than third-party logistics providers that face a higher potential risk of disintermediation by Amazon.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Thriving Fundamentals

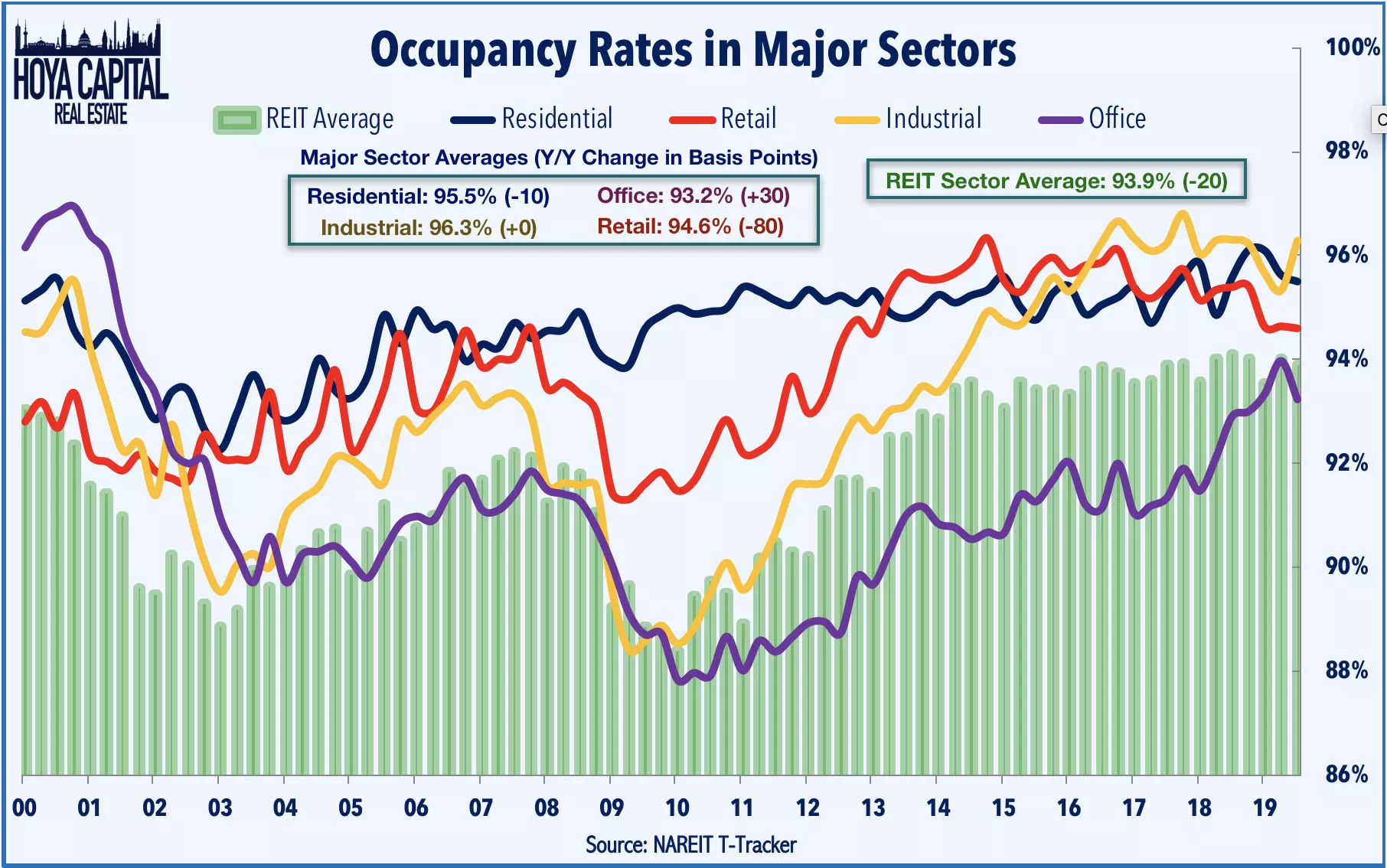

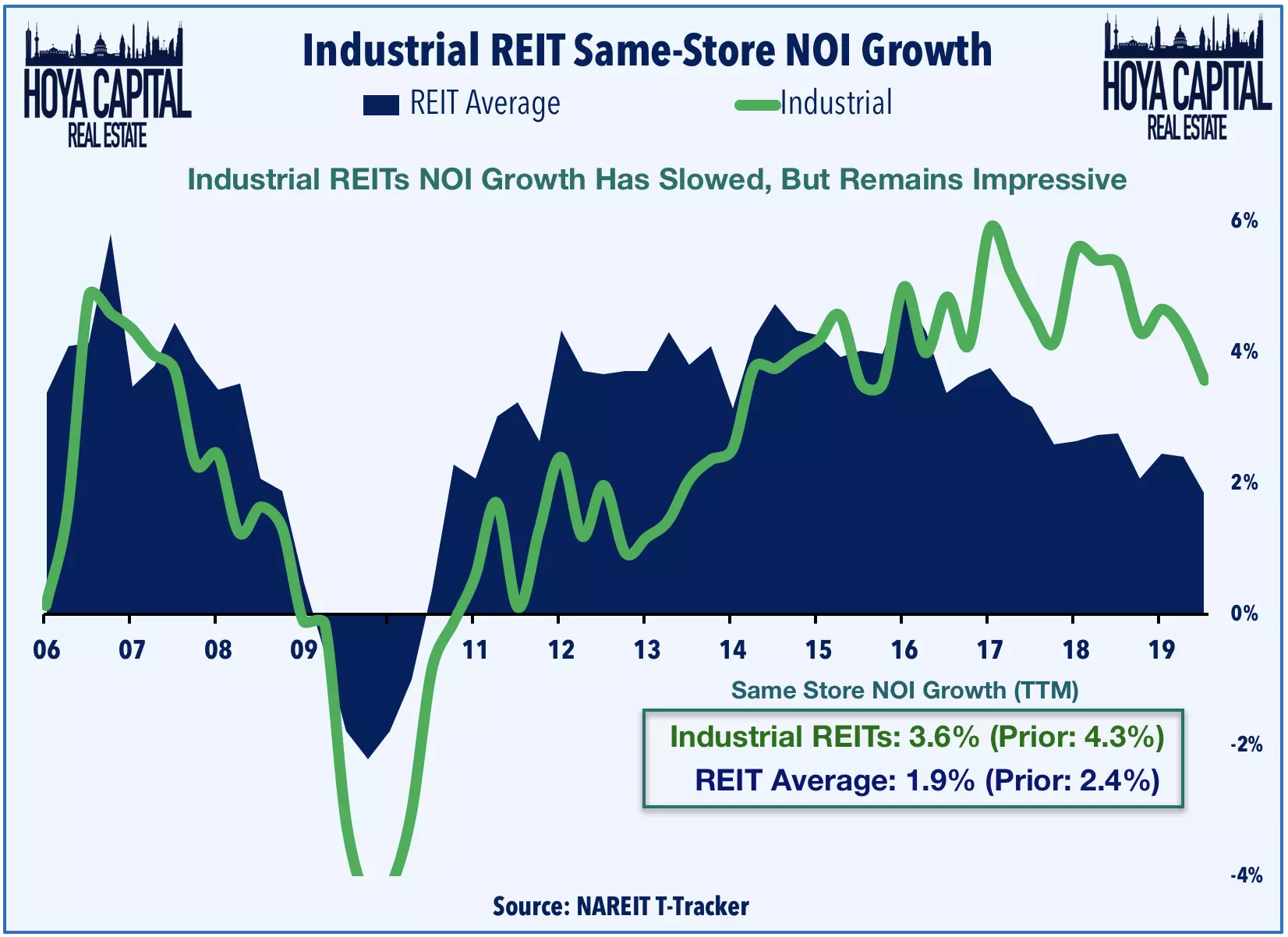

Undoubtedly, industrial REITs boast some of the strongest property-level fundamentals in the real estate sector. With an average same-store Net Operating Income (NOI) growth of nearly 5% per year since 2015, these REITs have consistently outperformed. The demand for industrial real estate has consistently outpaced supply growth for the past nine years, resulting in upward pressure on rents. Despite a significant increase in development activity, barriers to entry and regulatory constraints have curtailed supply growth, leading to mid-to-high single-digit market rent growth across major US markets.

Embracing E-commerce Dominance

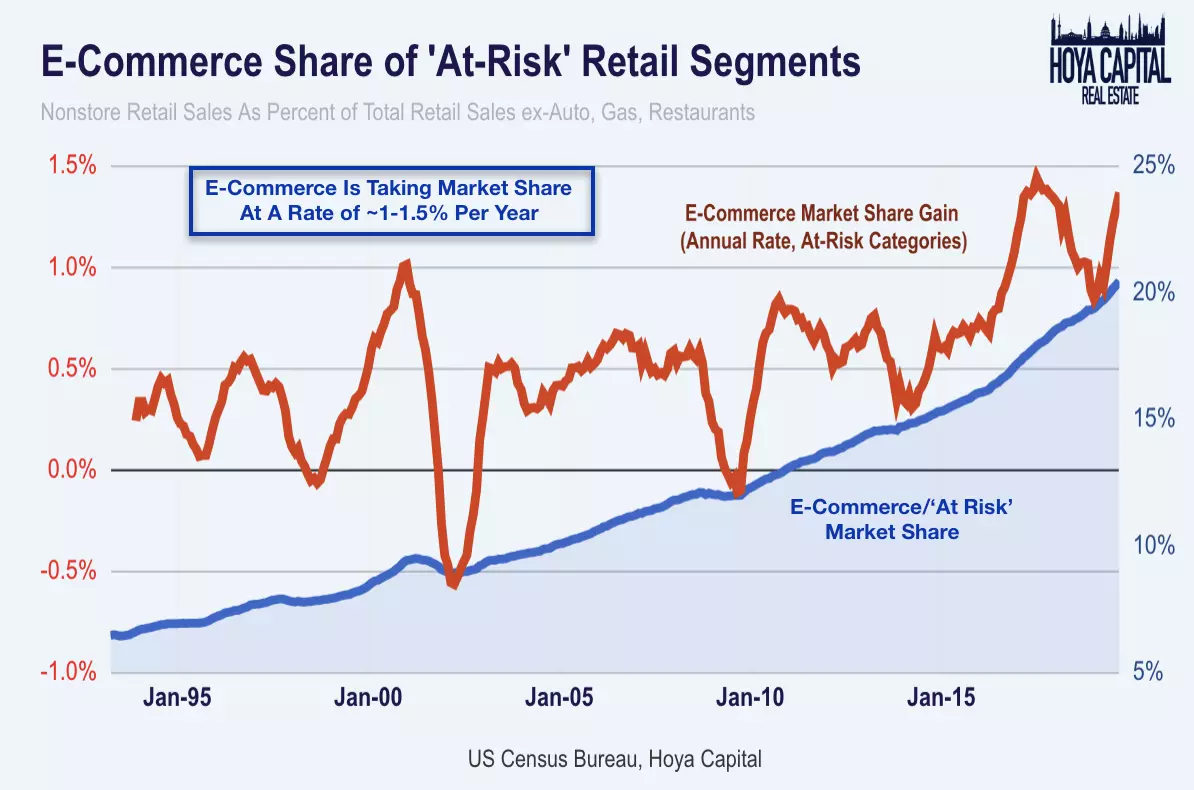

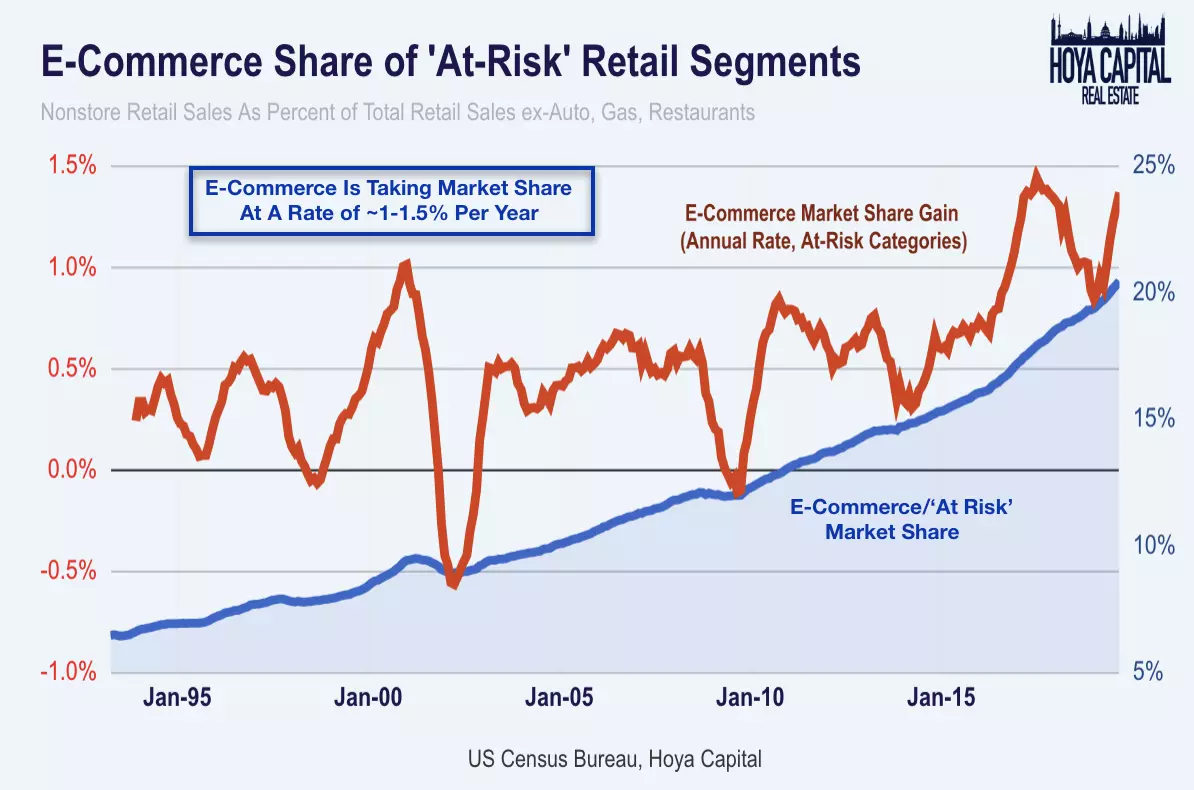

E-commerce sales may still represent only a fraction of total retail sales, but they have contributed to roughly half of the incremental growth in retail sales over the past three years. However, e-commerce requires three times more logistics space than traditional brick-and-mortar retail, making it less efficient in terms of industrial space usage. Although e-commerce accounts for less than 20% of total "at-risk" retail categories, it continues to gain market share from these sectors at a rate of approximately 1% per year.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

The Stellar Performance Continues

Industrial REITs have outperformed other major real estate sectors in recent years, defying initial skepticism. Despite trading at "expensive" valuations, these REITs have consistently surpassed broader market indices. In fact, industrial REITs have outperformed the broader REIT index by a staggering 60% since the start of 2016. The sector continues to flourish, driven by the resilience of the US consumer and unwavering dedication from retailers in the logistics arms race.

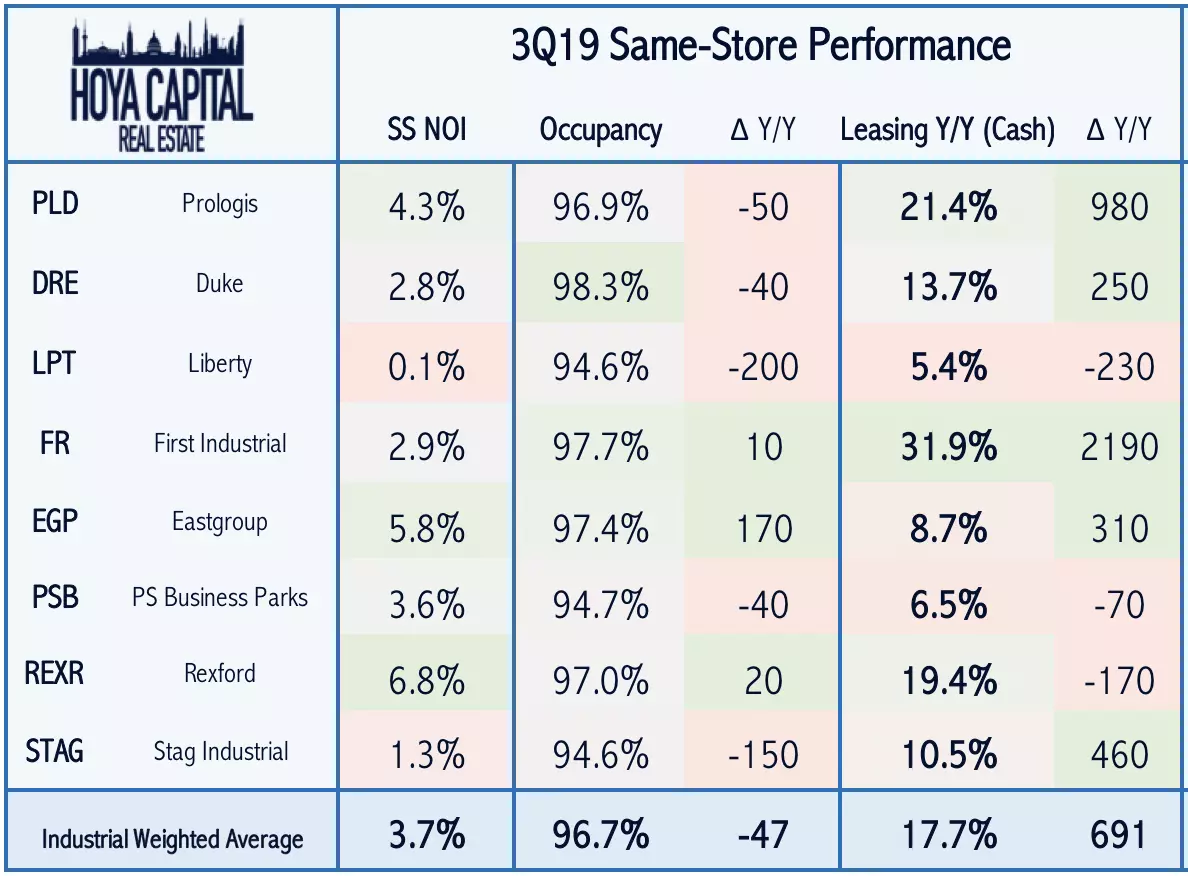

Strong Fundamentals and Optimistic Outlook

The overall performance of industrial REITs in the third quarter of 2019 reaffirms their solid foundation. While occupancy levels and same-store NOI growth may have slightly retreated from the previous quarter, re-leasing spreads have accelerated, signaling a shortage of industrial real estate space and robust pricing power for real estate owners. For the rest of 2019, industrial REITs are projected to achieve an average same-store NOI growth of 4.6% and maintain an average occupancy rate of 97%. External growth through acquisitions remains a key driver as industrial REITs take advantage of their strong equity valuations and use acquisitions as a means to fuel growth.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Embracing Growth and Opportunities

In addition to organic growth, industrial REITs have successfully tapped into external growth opportunities. With increased equity valuations, these REITs have been able to pursue accretive acquisitions, further strengthening their market position. Notable acquisitions include Prologis' plans to acquire Liberty Property, the third-largest industrial REIT, and the surge in value experienced by cannabis-focused Innovative Industrial. Ground-up development also remains a valuable source of growth, with attractive development yields compared to cap rates.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

The Bull and Bear Case

Amidst the remarkable success of industrial REITs, it is crucial to consider both the bullish and bearish perspectives. On the positive side, barriers to entry and limited supply growth continue to drive optimism. The sector's strong performance has also revived a significant Net Asset Value (NAV) premium, providing a cost of capital advantage that facilitates accretive acquisitions. Size and scale have proven to be important competitive advantages, especially in the face of giants like Amazon, making industrial REITs a reliable choice for investors. However, caution is warranted due to the potential impact of a Retail Apocalypse 2.0, store closures, and economic downturn. The sector's valuation and the risk of disintermediation from technological advancements also pose challenges.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Valuations and Dividend Yields

Industrial REITs consistently trade at premiums in terms of free cash flow (FCF) compared to REIT averages. However, when accounting for medium-term growth expectations, the sector appears more attractively valued. The average dividend yield for industrial REITs is 2.6%, slightly below the REIT average. Nevertheless, these REITs maintain a healthy payout ratio, leaving room for future dividend increases and development-fueled growth.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

Logistics: A Love Story

The unwavering rise of e-commerce and the increasing demand for speedy delivery have propelled industrial REITs to unprecedented heights. With limited supply and robust demand projected well into the next decade, industrial REITs are poised for continued success. Their fundamentals remain solid, pricing power intact, and growth rates likely to surpass the sector average. Industrial REITs are, without a doubt, the best-equipped players to thrive in the fast-paced world of e-commerce and supply chain densification.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

If you enjoyed this article, make sure to follow our page to stay up-to-date on the latest developments in the housing and commercial real estate sectors. For a comprehensive analysis of all real estate sectors, check out our quarterly reports, covering a wide range of topics from apartments and homebuilders to hotels and timber.