Are you considering diversifying your investment portfolio? Look no further than multifamily real estate. This investment strategy allows you to increase your income while minimizing vacancy rates. While single-family homes dominate the real estate market, multifamily properties offer unique advantages that shouldn't be overlooked.

What Exactly is a Multifamily Property?

A multifamily property refers to any residential property that consists of more than one housing unit. This can include duplexes, townhomes, apartment complexes, and condominiums. Even if the owner resides in one of the units, it is still considered a multifamily property. New investors can find lucrative opportunities in this market, whether they choose to live in one of their units or not.

Top Tips for Investing in Multifamily Real Estate

Investing in multifamily real estate is a different ballgame compared to building a single-family portfolio. Here are three crucial tips to keep in mind before diving into this investment strategy:

1. Find Your 50%

To identify potential deals, calculate how much income a specific multifamily property can generate. Take into account expected rental payments, storage fees, and parking fees, then subtract expenses like repairs and maintenance. If you don't have access to neighborhood comps, you can use the 50% rule. Halve the expected income to estimate expenses. The difference between estimated monthly income and expenses is your net operating income (NOI).

2. Calculate Your Cash Flow

Once you have determined the property's NOI, consider the estimated mortgage payments. Subtract the monthly mortgage from the NOI to calculate your estimated cash flow. This will help you determine if the investment is worth pursuing.

3. Figure Out Your Cap Rate

The cap rate represents how quickly you will recover your investment. To calculate it, multiply your monthly NOI by 12 to get the annual number. Then divide that number by the property's current market value. Aim for a cap rate in the 5%-10% range to strike a balance between risk and return.

Image: Investing in multifamily real estate

Image: Investing in multifamily real estate

What to Consider When Investing in Multifamily Properties

Investing in multifamily properties requires thorough due diligence. Consider the following factors when searching for potential properties:

The Location

Location is paramount in real estate, especially for multifamily properties. Look for high-growth areas with high demand and well-maintained neighborhoods.

The Total Number of Units

Evaluate the number of units in the property, including the number of rooms in each unit. Consider starting with duplexes, triplexes, or four-plexes as they offer lower risk and affordability for beginner investors.

The Potential Income

Determine the income the property can generate by researching rental prices and income in the area. Practice due diligence and consider the 50% rule as a conservative approach.

The Costs

Consider financing options and your credit score. Decide if you want to live in one unit while renting out the others to qualify for owner-occupied financing. Also, evaluate your down payment and debt-to-income ratio.

The Seller

Understand who is selling the property as it can impact the purchase price. Bank-owned properties may offer cost savings opportunities.

Image: Multifamily investment

Image: Multifamily investment

Single Family vs. Multifamily Investing

Deciding between single-family and multifamily properties is an ongoing debate in the real estate world. Each option offers unique advantages and requires a different management approach. Consider the following:

Multifamily Investing Benefits

- Bigger cash flow opportunities

- More control over value

- Larger pool of tenants

- Scalability for growing your portfolio

- Ideal for property management

- Tax benefits and blanket insurance policies

Single Family Investing Benefits

- More affordable upfront costs

- Higher appreciation potential

- Easier financing options

- Easier to manage a single unit

Image: Investing in multifamily properties

Image: Investing in multifamily properties

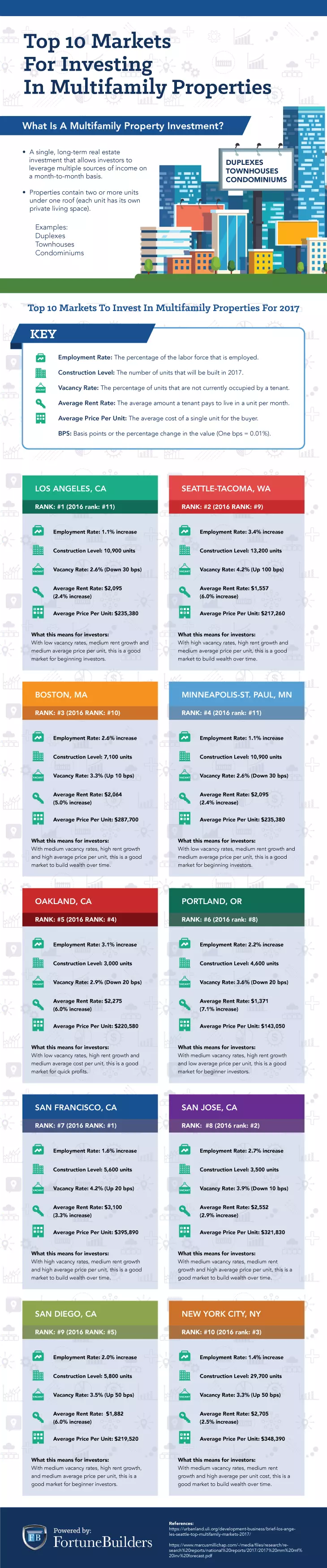

The Top 10 Markets for Multifamily Real Estate Investing

When it comes to real estate investments, location is everything. Here are the top 10 markets for multifamily real estate investing:

- Los Angeles, CA

- Seattle-Tacoma, WA

- Boston, MA

- Minneapolis-St. Paul, MN

- Oakland, CA

- San Jose, CA

- Portland, OR

- San Francisco, CA

- New York City, NY

- San Diego, CA

Financing Multifamily Real Estate

Various loan options are available for purchasing a multifamily property. Private or hard money loans from investors are common, offering flexibility but higher interest rates. Conventional mortgages, HUD loans, and government-backed loans are also options. Research the best financing method for your situation.

Managing Multifamily Properties

Managing multifamily properties requires more attention than single-family rentals. Consider working with a property management company to simplify day-to-day operations, tenant management, and maintenance. If you choose to manage the property on your own, utilize online tools to streamline communication, rent collection, and document organization.

In Conclusion

Investing in multifamily real estate is a great way to generate passive income and secure your financial future. By carefully considering the tips, location, financing, and management aspects, you can make informed investment decisions. Ready to take advantage of the opportunities in the real estate market? Start learning today by taking our online real estate investing class!