Vanguard Real Estate Index Fund offers investors an excellent opportunity to tap into the lucrative real estate sector. With a solid track record and above-average dividend yields, this mutual fund is worth considering for those looking for long-term capital growth and steady income.

What Sets Vanguard Real Estate Index Fund Apart?

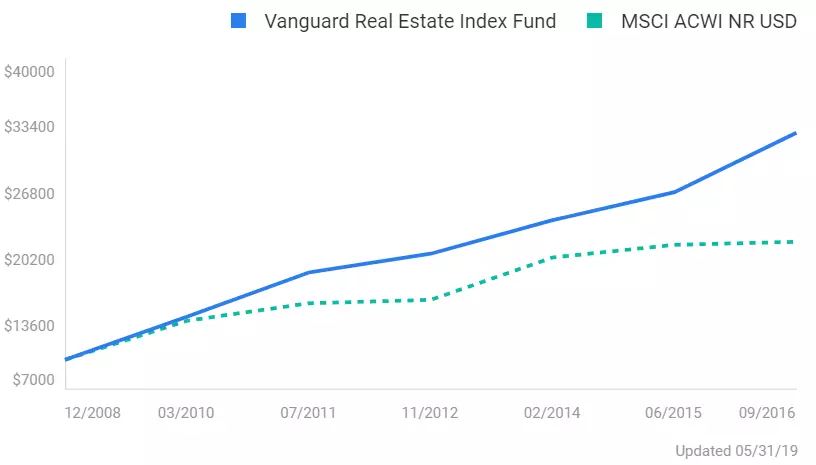

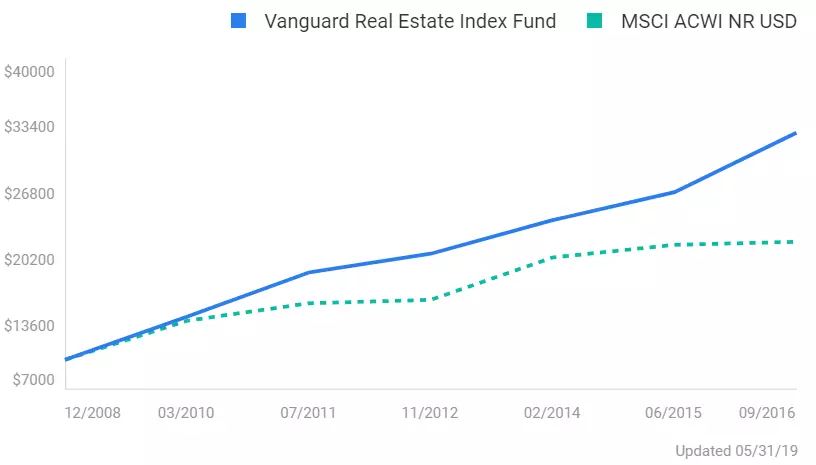

Since its inception in 1996, the Vanguard Real Estate Index Fund has delivered impressive returns. As of 8/2/19, the fund has returned an impressive 21.73% year-to-date, outperforming the S&P 500 due to the favorable performance of REITs. Over the long term, the index has performed well, generally in line with the S&P 500.

Diversification, convenience, and professional management are some of the key benefits of investing in mutual funds, and the Vanguard Real Estate Index Fund offers all of these advantages. Furthermore, the fund boasts a below-average expense ratio, resulting in significant savings for investors.

Understanding the Fund

The Vanguard Real Estate Index Fund invests primarily in equity REITs, excluding mortgage REITs from its portfolio composition. This strategic allocation allows the fund to mitigate the risk associated with industry concentration. With diversified investments across various asset classes, the fund offers stability and growth potential.

It's worth noting that the fund's portfolio consists of 189 equity REITs, including top performers like American Tower Corp, Crown Castle International Corp, and Prologis, Inc. These companies have a proven track record of dividend payments and boast high-quality portfolios.

How to Invest in the Fund

Investing in the Vanguard Real Estate Index Fund is straightforward, with various options available to suit different investor preferences. Here are the investment options to consider:

-

Admiral Shares (VGSLX): This share class requires a minimum investment of $3,000 and offers a lower fee structure than similar funds in the industry, with an expense ratio of just 0.12%.

-

Investor Shares (VGSIX): Previously offered by Vanguard, Investor Shares are being transitioned to Admiral Shares. Investors can choose to transition their shares or allow Vanguard to gradually transition them over a year.

-

ETF Shares (VNQ): With no minimum investment requirement, investors can purchase ETF shares for added flexibility.

-

Institutional Shares (VGSNX): Designed for institutional investors, this share class requires a minimum initial investment of $5,000,000. It offers an even lower expense ratio of 0.05%.

Vanguard Global ex-US RE Index Fund: Expanding Investment Opportunities

For those seeking international real estate exposure, Vanguard also offers the Vanguard Global ex-US RE Index Fund (VGRNX). This fund invests in international REITs and real estate companies, predominantly in Pacific markets, including China and Japan, as well as emerging markets. Although it carries higher risk due to international investments and currency volatility, it has generated an average annual return of 5.80% since its inception in 2011.

Is Vanguard Real Estate Index Fund Right for You?

Investing in the Vanguard Real Estate Index Fund is ideal for investors looking to capitalize on the real estate sector's potential. With its exceptional performance, low expense ratios, and the expertise of Vanguard's Equity Index Group, this fund presents a compelling opportunity for those with a long-term investment horizon.

Before investing, it's important to note that the fund primarily consists of stock investments, making it subject to higher rates of volatility compared to other investment types. Therefore, it's best suited for investors with a hold period of at least 10 years.

Make a sound investment decision and consider adding the Vanguard Real Estate Index Fund to your portfolio. With its strong performance history and focus on long-term growth, this fund can help you achieve your financial goals.