The investment environment in India is set to gain momentum as the country bounces back from the challenges posed by the pandemic. With a successful vaccination drive and fiscal and monetary policy support, India's economic growth is on the rise once again.

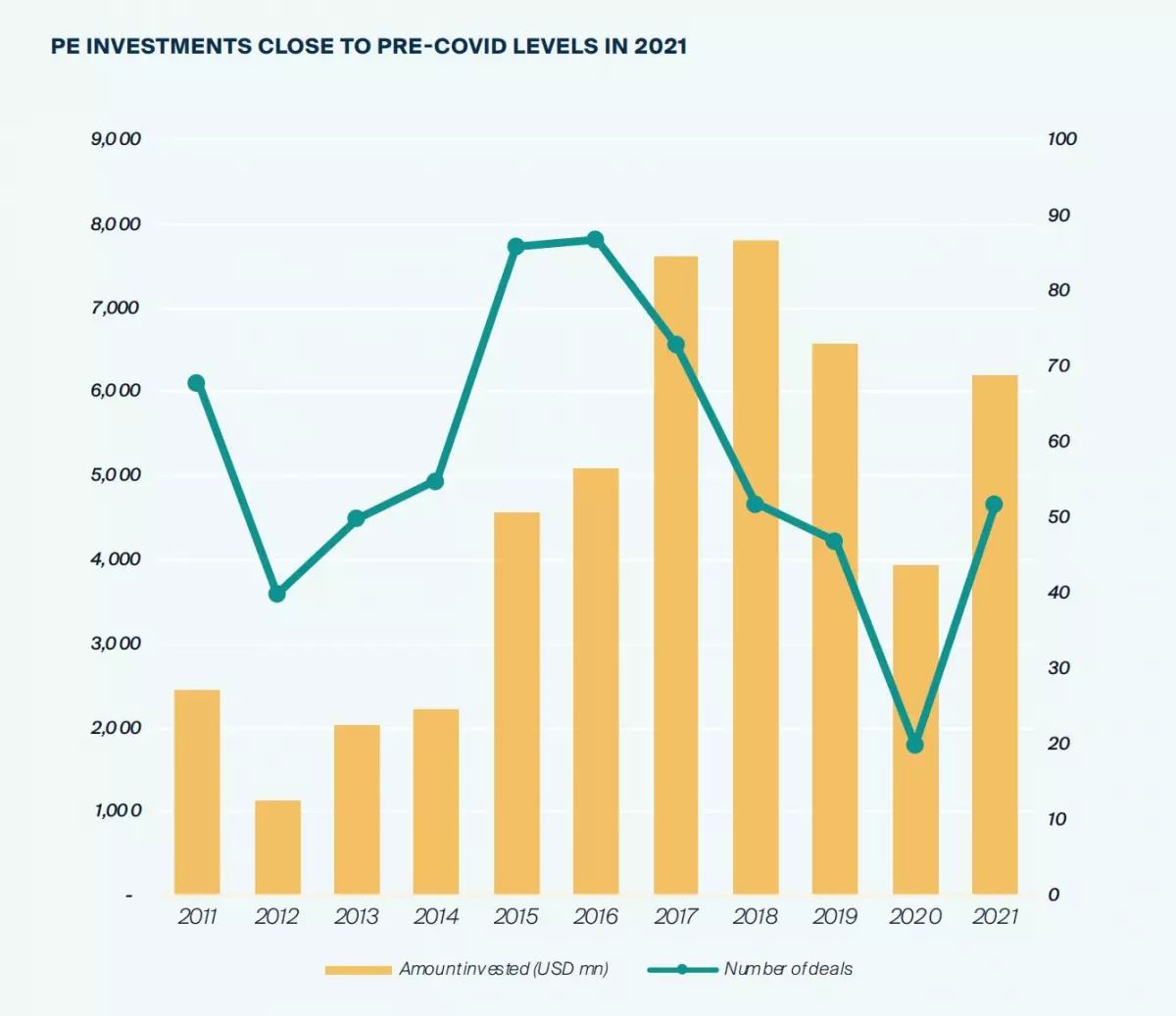

Despite the impact of a severe second wave, private equity investments in the Indian real estate industry saw a significant increase of 57% year-on-year in 2021. A total of $6.2 billion was invested across four segments: office, residential, warehouse, and retail.

Offices Reigning as Top Investible Grade Office Asset

Investible grade office assets have proven their resilience, making the office segment the leader in terms of investments. The office segment accounted for 46% of the total investment pie, amounting to $2.9 billion. The warehouse and industrial segments also saw substantial growth, with investments reaching $1.3 billion, a 55% increase compared to the previous year.

The pandemic has brought about a significant change in the housing market. Homeownership, which had been put off due to the rise of the "uberization culture," experienced a significant comeback. The residential real estate segment received $1.2 billion in investments, a staggering 223% year-on-year increase. Similarly, the retail industry witnessed a growth of 271% year-on-year, with investments totaling $817 million. Investor interest in stable retail assets grew, allowing the retail business to recover from the impact of the epidemic.

Positive Momentum for India Continues through 2022

India is expected to maintain its position as a preferred investment destination, with positive momentum anticipated to strengthen further. According to the Asian Development Bank (ADB), India is projected to be the fastest-growing major economy, with a growth rate of 7.5% for 2022-23, compared to 5% for China during the same period.

The office category will continue to attract the majority of investments, as businesses gradually return to the office post-pandemic. The improving demand for office spaces, coupled with a balanced supply environment, will have a positive impact on occupancy and support rent growth.

While interest rates are expected to rise later this year, the limited availability of investible grade assets will protect against a significant expansion of capitalization rates, which are currently hovering between 7.5% and 8.0%.

Warehousing will continue to be an attractive sector for investments, thanks to India's renewed focus on the "Make in India" program and the growing e-commerce ecosystem.

The residential sector has entered an upcycle, driven by positive consumer sentiments towards homeownership and a more prepared developer ecosystem. Residential real estate will be an appealing investment choice in 2022, with stakeholders demonstrating increased risk acceptance through higher equity participation.

India's retail sector will also witness investment interest, supported by the rebound of consumption demand in brick-and-mortar formats.

Overall, 2022 is expected to witness even higher investment activity in India's real estate market, driven by abundant liquidity and steady cap rates. The improving economic conditions will benefit investors across various real estate asset classes.

Investment momentum to strengthen in India

Investment momentum to strengthen in India

Drivers for India

- Equity route continued to dominate PE investments in real estate

- Cap Rates for commercial assets trended lower in recent years

Sectors to Watch in India

- Offices remained the preferred investment class for the fifth year in a row

- PE investments in residentials reached above pre-COVID levels in 2021

- PE investments in warehousing surged by 54% in 2021

This piece was originally published in 'Rising Capital in Uncertain Times' Active Capital Asia-Pacific Perspective (June/July 2022)'. The report aims to provide insight into the historical performance of the real estate market in the Asia-Pacific region and offers predictions for 2022, serving as a guide for investors. It also highlights the importance of Environmental, Social, and Governance (ESG) for investors looking to expand their ESG footprint in their portfolios.