Real estate investment trusts (REITs) can be a lucrative addition to any diversified portfolio, offering a passive income stream. While rising interest rates have impacted the real estate industry, Prologis (PLD 2.84%) stands out as a REIT that continues to deliver a growing dividend to its shareholders.

Prologis Benefits from the Growing Demand for Logistics Facilities

Prologis operates logistics real estate properties across 20 countries, focusing on high-growth markets. With a vast portfolio of over 1.2 billion square feet, Prologis specializes in serving business-to-business enterprises and online retail fulfillment centers. Some of its notable customers include Amazon, Home Depot, FedEx, and UPS.

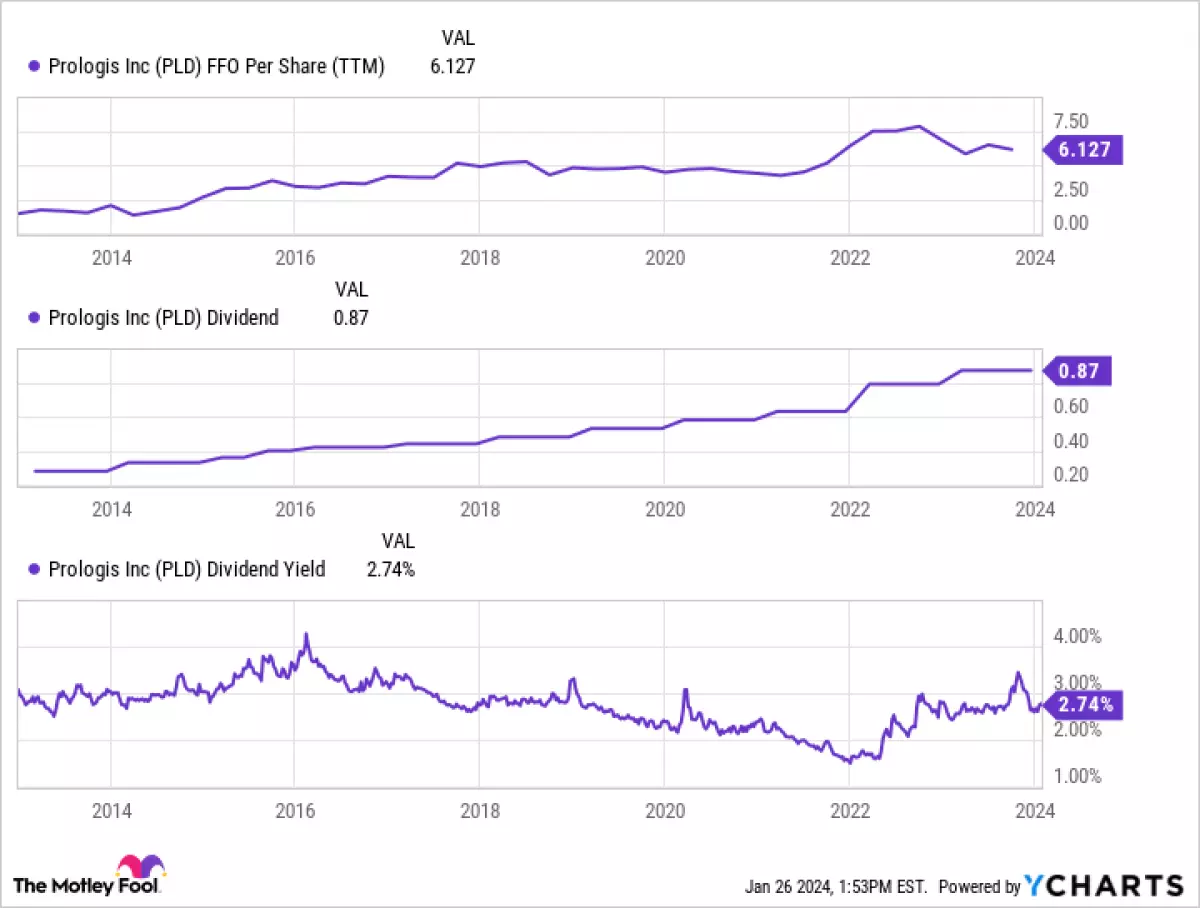

The surge in e-commerce and the need for resilient supply chains have significantly increased the demand for warehouse, storage, and distribution space. Prologis has capitalized on these trends, as evidenced by its consistent growth in funds from operations (FFO). Over the past decade, Prologis's FFO per share has grown at a compound annual growth rate of 15.6%, from $1.44 to $6.13.

This impressive growth has allowed Prologis to raise its dividend payment to investors for the past 10 years. Over that period, annual dividends per share have grown at a compounded annual rate of 12%, from $1.12 to $3.48. These figures make Prologis an attractive stock for investors seeking income generation from their portfolios.

Prologis FFO Per Share (TTM) data by YCharts

Prologis FFO Per Share (TTM) data by YCharts

Prologis Could Face Headwinds in 2024

While Prologis has benefitted from robust demand for logistics warehousing, the market could see some challenges in the future. Developers, driven by high demand and low interest rates, have been constructing additional logistics facilities, which are expected to enter the market in 2024. Rising interest rates and inflationary conditions have impacted this trend, potentially leading to slower rent growth for Prologis.

However, Prologis's management remains confident in its ability to overcome these challenges. The company projects a steady growth rate of 4% to 6% in rents over the next few years, resulting in a 9% to 11% growth in its core FFO.

Another positive aspect of Prologis is its robust balance sheet, which enables it to seize expansion opportunities that contribute to further growth. In 2022, Prologis successfully acquired competitor Duke Realty for $23 billion. Furthermore, it acquired properties worth $733 million last year and an additional $3.1 billion portfolio from Blackstone.

Should You Invest in Prologis Stock?

Concerns have emerged regarding the impact of higher interest rates on commercial real estate. However, industry experts, including CBRE Group, one of the largest real estate companies globally, believe that industrial REITs like Prologis are well-positioned to weather market downturns.

Additionally, the expectation is that interest rates may stabilize or even decrease in the near term. According to the CME FedWatch Tool, the market projects a potential decrease in the federal funds rate from 5.5% to around 4% by the end of this year. This projection may bode well for commercial real estate transactions.

Furthermore, the upward trend in e-commerce is expected to continue for several years. Straits Research forecasts an annual growth rate of 7.7% for the warehousing and storage services market through 2030. With these favorable conditions, Prologis appears to be a solid stock for long-term investment.

Investing in Prologis stock offers the opportunity to benefit from the growing demand for logistics facilities, the company's track record of consistent growth, and its strong position in the industry. While potential challenges may arise, Prologis's resilience, coupled with positive industry trends, makes it an attractive prospect for investors looking for stable long-term returns.

Note: The information provided in this article is for informational purposes only and should not be construed as financial advice. Always do your own research and consult with a qualified financial advisor before making investment decisions.