Illustrations by Ben Simons

Since the early 2000s, blockchain technology has made significant strides in transforming various industries, including real estate. The traditional process of transferring real property involves multiple elements that need to be organized, filed, and recorded, often requiring intermediaries such as brokers and lawyers. These factors, combined with the size of transactions, contribute to the illiquidity of real estate markets. However, the concept of real estate tokenization has the potential to overcome these barriers and revolutionize the industry.

What is Real Estate Tokenization?

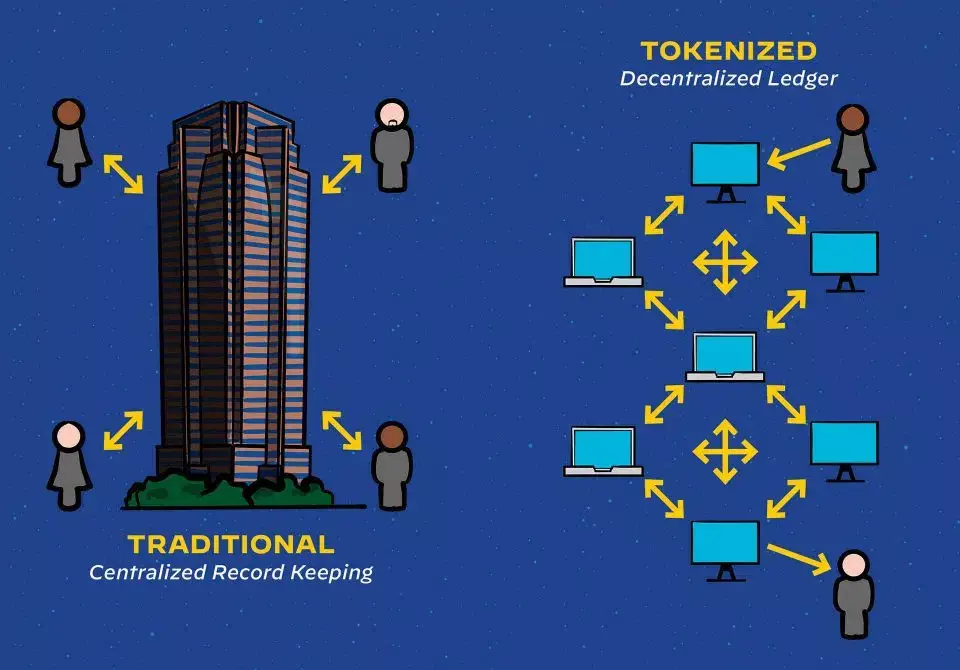

Real estate tokenization involves the digital fractional representation of asset rights and ownership through blockchain technology. By utilizing Distributed Ledger Technology (DLT) and smart contracts, real estate tokenization enables faster, cheaper, and more efficient transfers of ownership compared to traditional methods. Fractional ownership, smart contracts, and distributed ledger technology are the key components of real estate tokenization.

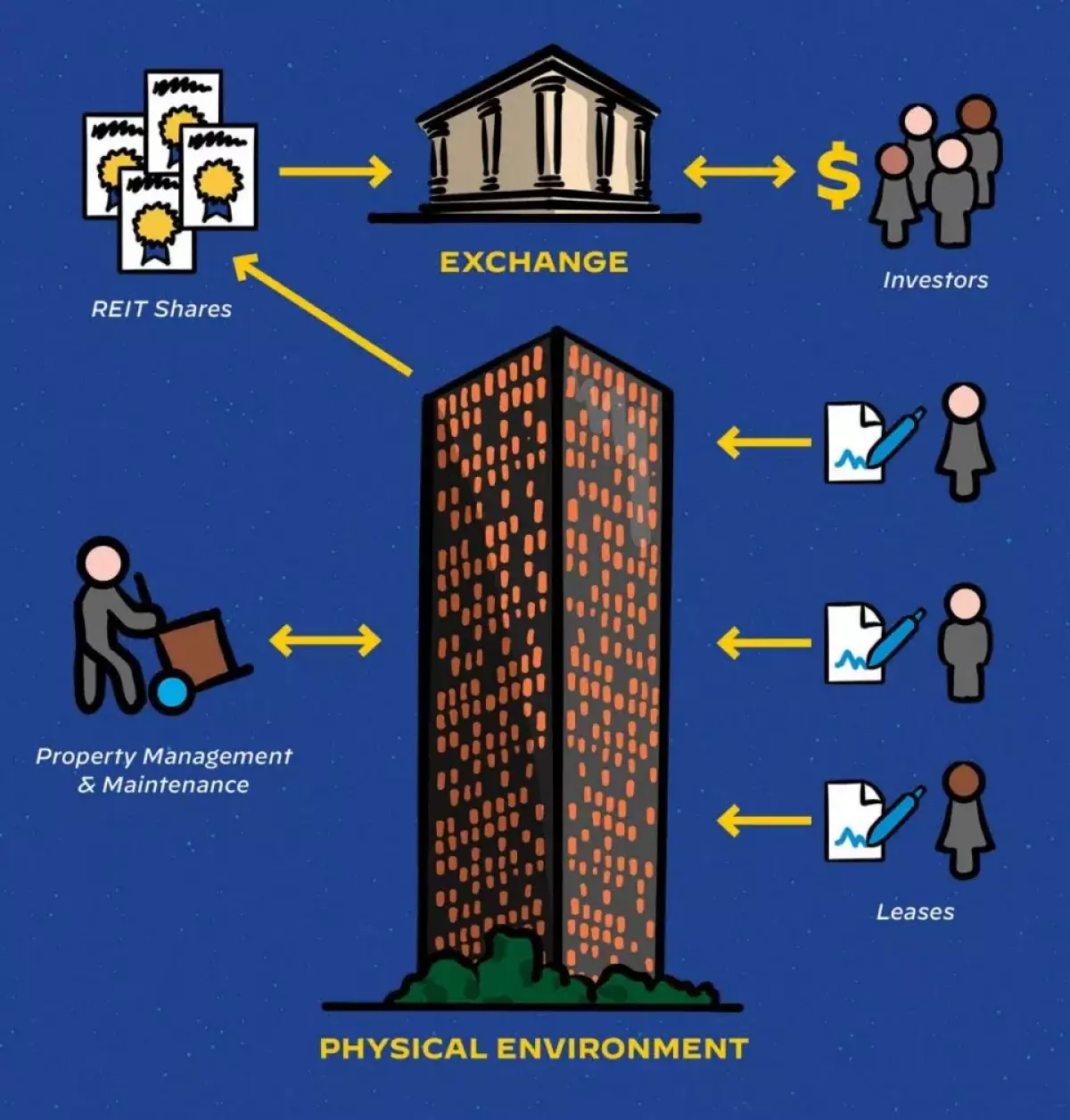

Diagram 1

Diagram 1

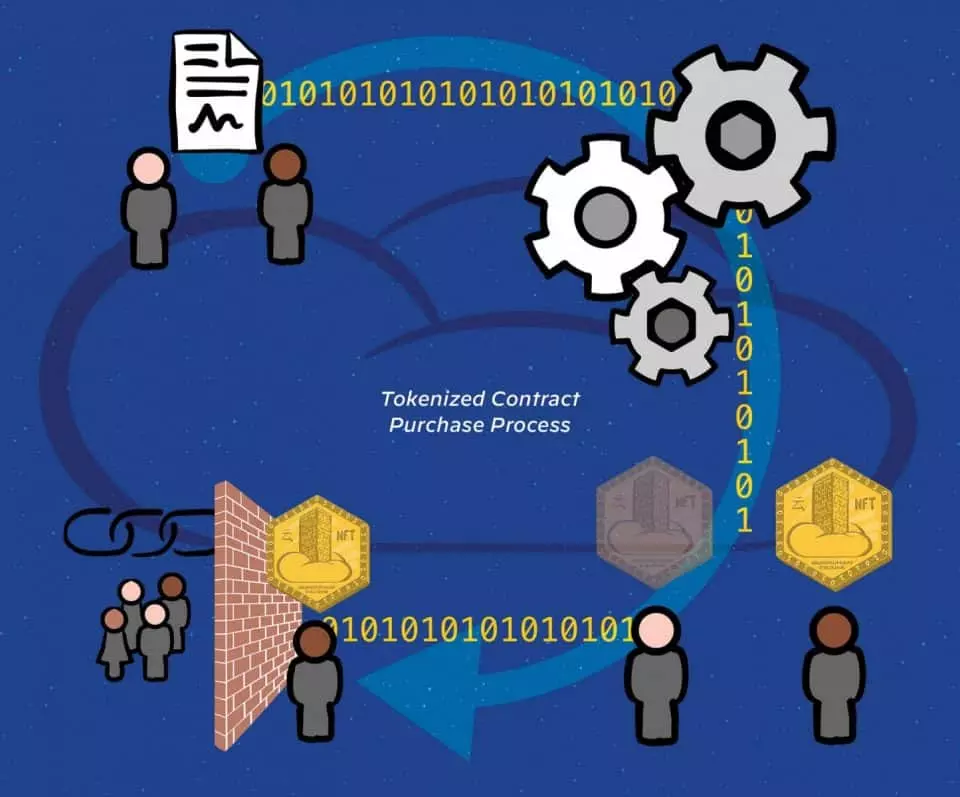

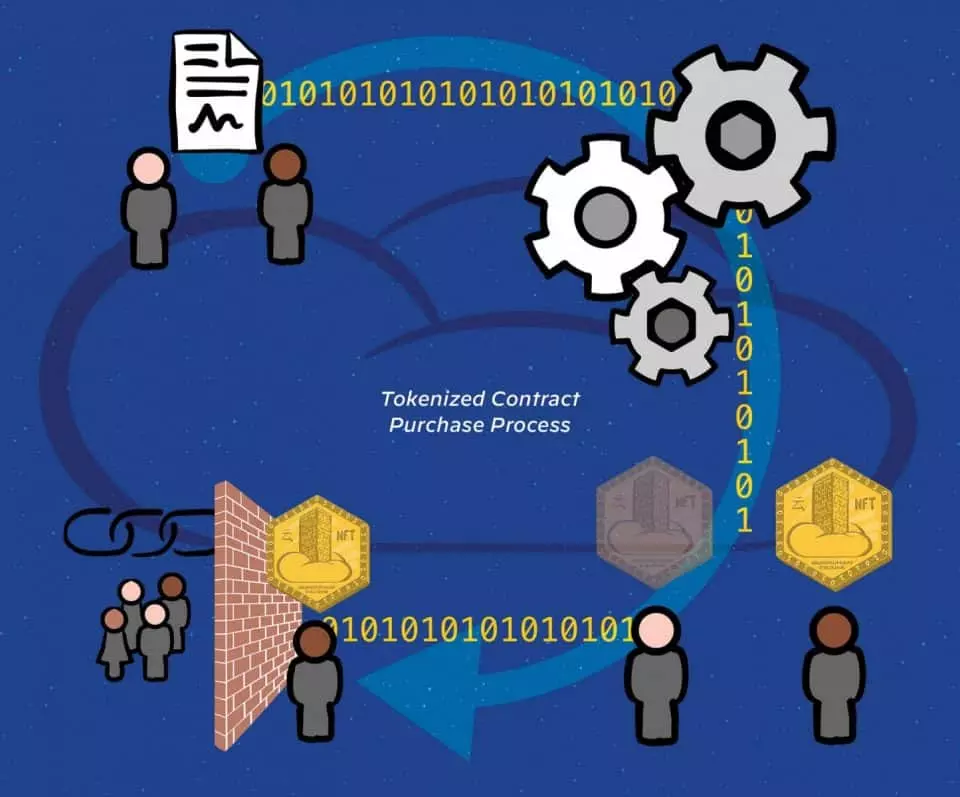

Real estate can be acquired and tokenized similar to Real Estate Investment Trusts (REITs). A legal entity that owns real estate can issue security tokens representing shares in the rights and ownership of the underlying asset. Investors can trade these tokens in secondary public markets, similar to how shares of REITs are traded. The main difference is that tokenized real estate trades occur directly between investors in a cloud environment, with the transaction record stored in a digital ledger.

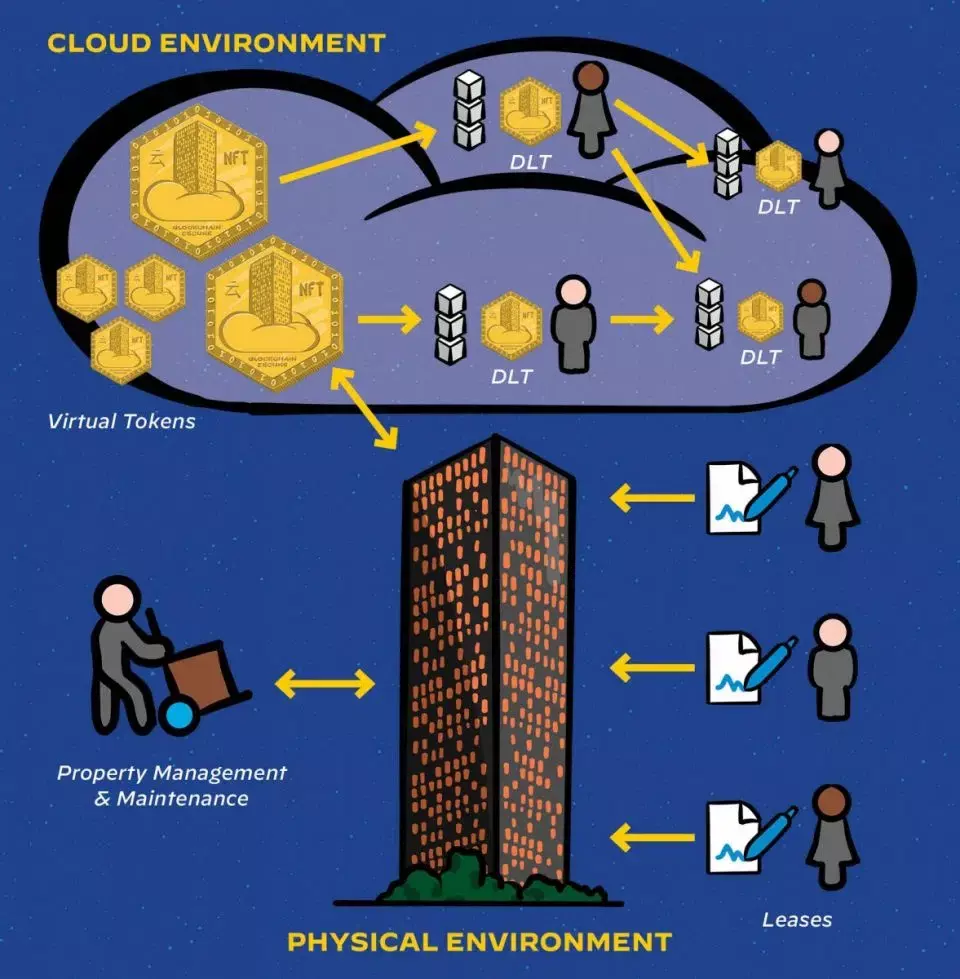

Diagram 2

Diagram 2

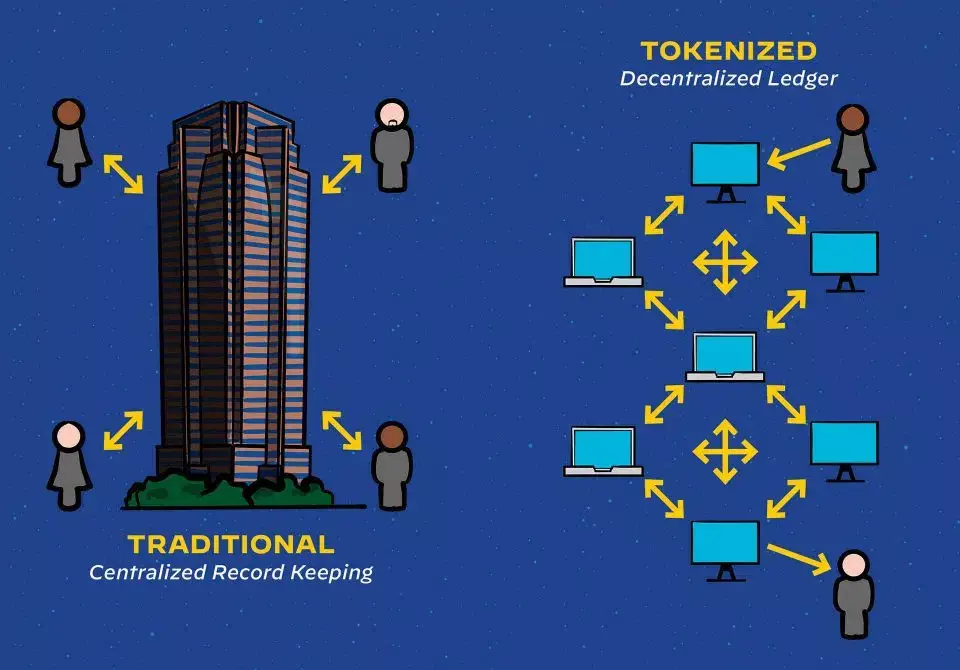

The advent of peer-to-peer online platforms and blockchain technology in 2008 has facilitated economic decentralization and the automation of transactions. Real estate, with its characteristics of requiring intermediaries and record-keeping, aligns well with the features of blockchain technology. Distributed ledger technology ensures transparency, immutability, and secure record-keeping across a network of nodes. Every transaction is validated and recorded by all nodes on the network, eliminating the need for a central authority.

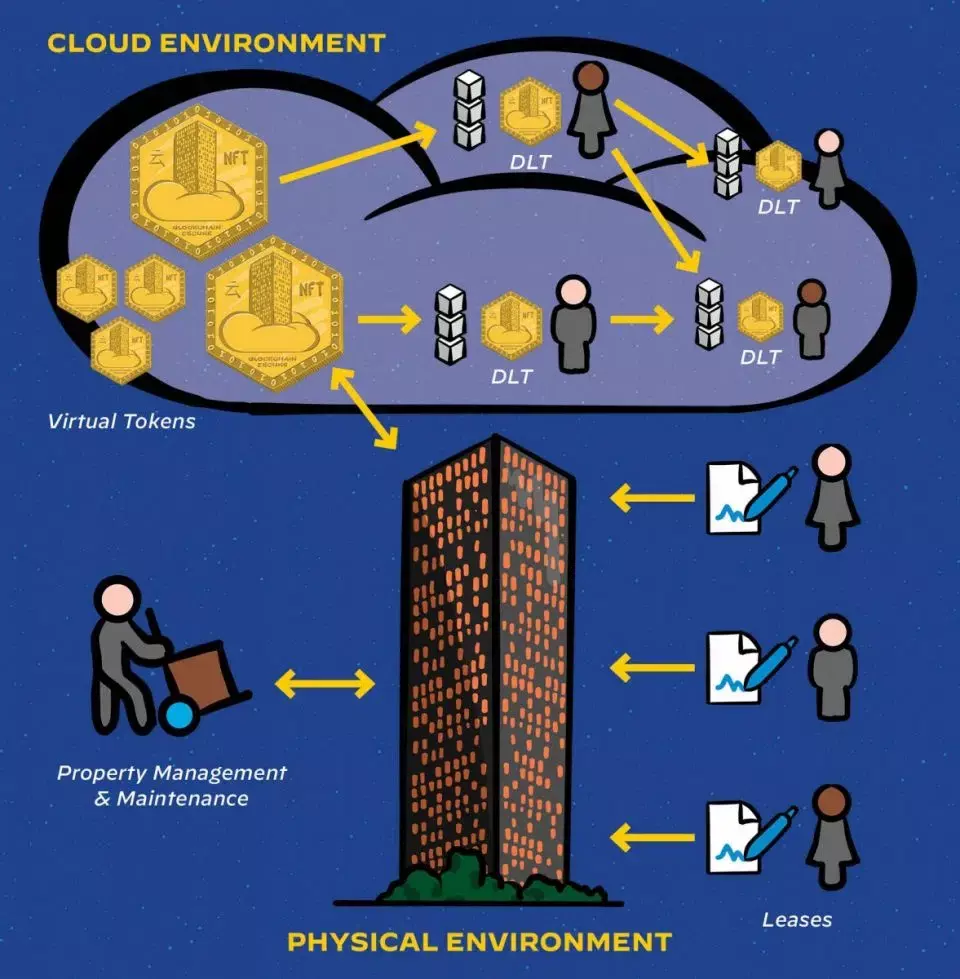

Diagram 3

Diagram 3

Smart contracts, blockchain-based digital legal contracts, play a crucial role in tokenized real estate transactions. They automate and enforce equity transactions related to the token, making the process frictionless. Parties involved in the agreement establish rules and conditions for actions such as rent payment, property management, and ownership transfer. These contracts are digitized, publicly recorded, and automatically executed upon meeting the specified conditions, ensuring transparency and efficiency.

Diagram 4

Diagram 4

Tokenized real property exchanges listed within smart contracts enable buyers to claim ownership when the conditions set in the contract are met. Smart contracts can also incorporate other legal agreements such as property management and rental payments, eliminating the need for expensive intermediaries. These digital automated features have the potential to increase the liquidity of real estate markets by freeing up assets and allowing for broader investor participation.

Implications of Real Estate Tokenization

Real estate tokenization offers several benefits. Firstly, it significantly reduces the paperwork required for property transactions through smart contracts, resulting in time and cost savings. The efficiency and speed of transactions also increase due to the elimination of intermediaries. Additionally, tokenization enhances liquidity in real estate markets by allowing small fractional interests in properties to be traded easily and at a low cost.

According to Anthony Tuths of KPMG, real estate tokenization is gaining traction as it offers a more efficient and transparent way of conducting transactions. Tokenized real estate provides greater liquidity and reduces barriers to entry, making it an attractive proposition for investors. Transactions conducted on the blockchain are transparent, enabling real-time price discovery and making real estate markets more efficient.

Tokenized real estate is not treated any differently from physical property in terms of taxation. However, there are concerns regarding scams and the need for regulations to protect investors. As the market develops, tokenization has the potential to democratize real estate ownership by allowing fractional ownership of various property types.

While the tokenization of real estate brings numerous benefits, there are still legal implications that need to be addressed. Investors must exercise caution and ensure that tokens represent real properties to mitigate the risk of scams. The application of securities laws to tokenized assets can provide additional protection against fraudulent activities.

In conclusion, real estate tokenization has the potential to revolutionize the industry by increasing liquidity, reducing costs, and speeding up transactions. It offers a more efficient, transparent, and accessible way to invest in real estate. While the market is still in its early stages, understanding the possibilities and implications of tokenization allows us to envision an entirely new way of conducting business in the future.