Mayor Eric Adams has expressed his willingness to consider property tax breaks for middle-class co-op and condo owners in New York City who are burdened with costly building upgrades due to the implementation of the new "green" mandate. The mayor made these comments during a testimony in Albany on the state budget, stating that he understands the challenges faced by working-class people living in co-op apartments and recognizes the value and assets they hold.

The proposal for tax abatements comes as residents anticipate the financial implications of Local Law 97, which affects around 800,000 co-op and condo apartments in the city. The law aims to reduce greenhouse gas emissions by imposing limits on buildings' emissions, requiring them to upgrade their heating systems from fossil fuels to electric heat.

State Assemblyman Edward Braunstein raised the issue and suggested collaborating with the city to offer property tax abatements as an incentive for co-op owners to comply with the new energy mandates. Mayor Adams responded positively, stating his administration's readiness to work together to find a solution.

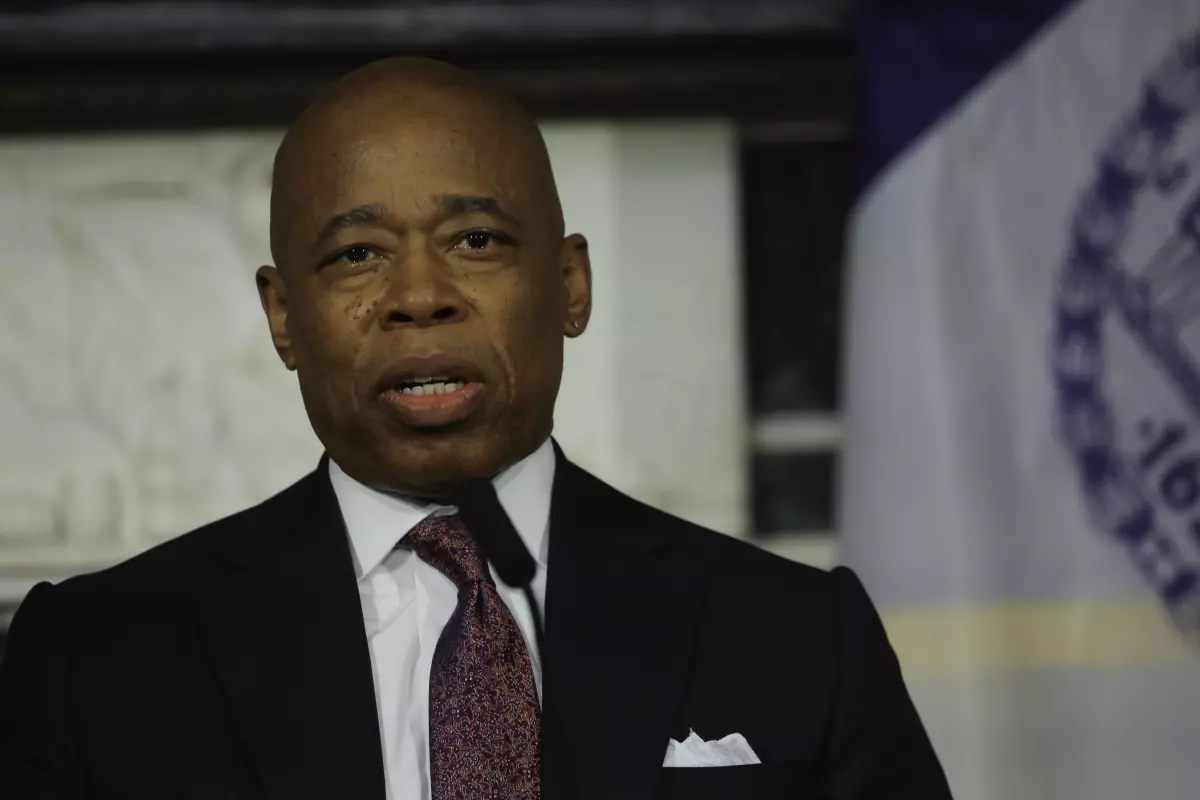

Mayor Eric Adams said he would consider tax breaks for middle-class co-op and condo owners who have to pay for updates when the state’s green mandates begin. James Messerschmidt

Mayor Eric Adams said he would consider tax breaks for middle-class co-op and condo owners who have to pay for updates when the state’s green mandates begin. James Messerschmidt

Adams expressed his commitment to minimizing the financial burden on co-ops and property owners. He emphasized that his administration is actively taking steps to support them. The mayor's willingness to alleviate the costs through property tax abatements reflects his understanding of the difficulties faced by residents and his determination to find practical solutions.

Local Law 97, also known as the Climate Mobilization Emissions Law of 2019, was enacted to facilitate New York City's goal of reducing carbon emissions by 40% by 2030 and 80% by 2050. The law primarily targets existing buildings, which account for a significant portion of the city's carbon emissions. While the majority of the 50,000 covered buildings are already in compliance, the law requires those over 25,000 square feet to replace their old heating systems with electric heat.

The law requires buildings with more than 25,000 square feet to switch from heating oil and natural gas boilers to electric heat. ZUMAPRESS.com

The law requires buildings with more than 25,000 square feet to switch from heating oil and natural gas boilers to electric heat. ZUMAPRESS.com

To support co-op owners in coping with the costs, Braunstein and state Senator Kevin Parker have introduced the GREEN Buildings Act in Albany. The act proposes tax abatements for co-op owners for up to 10 years, helping to alleviate the financial burden. Homeowners for a Stronger New York, a group representing co-op residents, is actively advocating for the bill and urging constituents to support it.

Nancy Clopton-Diaz, treasurer of the board of managers at Orion Condominium in Hell's Kitchen, emphasized the urgency of the situation, stating that homeowners, including co-op and condo residents, are currently facing expensive retrofits or substantial fines. The GREEN Buildings Act, according to Clopton-Diaz, provides the necessary incentive and support for reducing greenhouse gas emissions. She expressed her hope for collaboration with Albany lawmakers to pass the bill during this legislative session.

The co-op/condo advocacy group warns that failure to make the required upgrades could result in fines totaling $200 million in 2022 and $1 billion in penalties by 2030. While the cost of implementing the proposed bill and providing tax abatements is not specified, Braunstein and Parker's goal is to reduce greenhouse emissions in older low-rise garden-style co-op complexes.

City Hall has yet to comment on the proposal beyond the mayor's testimony. It remains to be seen whether the city can accommodate the proposed tax breaks for green buildings. However, Mayor Adams' openness to working with legislators and finding ways to support co-op and condo owners demonstrates his commitment to addressing their concerns.

As New York City strives to become more environmentally sustainable, it is crucial to consider the financial impact on residents. Mayor Adams' proposal for property tax breaks offers a promising solution to ease the burden on middle-class co-op and condo owners and promote compliance with the green mandates. By supporting these residents, the city can move closer to its carbon emissions reduction goals while ensuring the well-being of its citizens.

(Words: 507)