Understanding the Metrics That Matter

Investing in real estate can be a profitable venture, but it's important to approach return metrics with a critical eye. Two widely used metrics for measuring returns in multifamily deals are the Internal Rate of Return (IRR) and the Equity Multiple. While both have their merits, it's crucial to consider them together to get a comprehensive understanding of an investment's potential success.

Image credit: sanaulac.vn

Image credit: sanaulac.vn

Internal Rate of Return: Accounting for Time Value of Money

IRR is a measure of the rate of return earned on each dollar, for each period of time it's invested in. It takes into account the time value of money, which recognizes that a dollar today is worth more than a dollar in the future due to its potential to earn interest. IRR is often used to compare different investments with the same holding period, allowing for a fair assessment of potential returns.

However, IRR has its limitations. It doesn't reveal absolute returns on an investment or consider the length of the investment period. For a more comprehensive evaluation, we need to complement IRR with another metric: the Equity Multiple.

Equity Multiple: Measuring Absolute Returns

The Equity Multiple represents the percentage of an investor's funds that will be returned by the end of the investment. It's calculated by dividing the investment's total cash flows by the original investment amount. Unlike IRR, the Equity Multiple provides a clear indication of the absolute return on an investment.

However, the Equity Multiple does not account for the time it takes to earn the return. Two investments with the same Equity Multiple may have significantly different holding periods. Therefore, it is essential to consider both IRR and the Equity Multiple together to obtain a holistic evaluation.

Finding the Right Balance

To determine the overall success of a project, it's crucial to evaluate both IRR and the Equity Multiple. IRR accounts for the time it takes to earn a return, whereas the Equity Multiple measures the absolute return on an investment. These metrics should be considered in conjunction with other factors, such as cash on cash return, to make informed decisions.

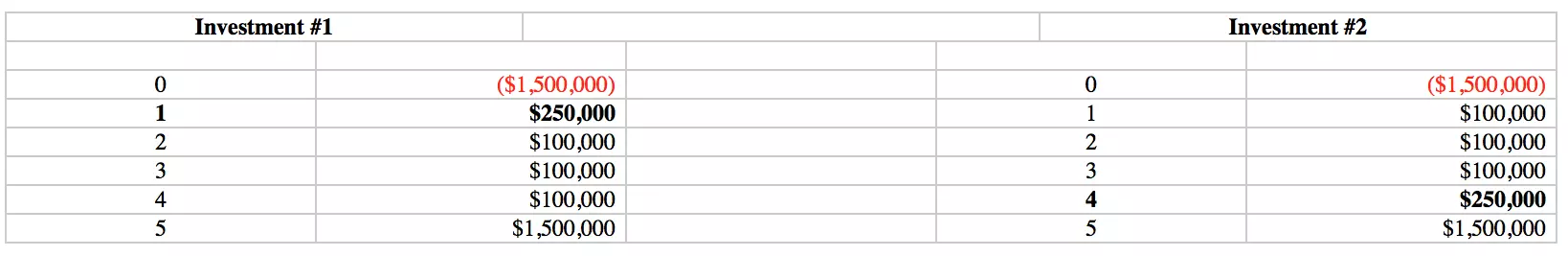

In Example 1, two investments produce similar cash flows but in a different order. Investment #1 returns $250M in year one, while Investment #2 returns $250M in year four. Due to the Time Value of Money concept, Investment #1 has a higher IRR (~7.84%) than Investment #2 (7.37%). However, both investments have the same Equity Multiple (1.37X). Therefore, Investment #1 is considered better due to its higher IRR.

In Example 2, Investment #1 has a lower IRR (10.10%) compared to Investment #2 (11.32%). However, Investment #2 has a higher Equity Multiple (1.53X) and ultimately returns more money. This highlights that the Equity Multiple can sometimes provide a more accurate representation of an investment's success.

The Power of Due Diligence

To make informed investment decisions, it's always recommended to conduct thorough due diligence. Evaluating both IRR and the Equity Multiple, along with other relevant metrics, helps determine if a project aligns with your investment goals. By considering the time value of money and absolute returns, you can gain a comprehensive understanding of an investment's potential.

Glossary of Key Terms:

- Internal Rate of Return (IRR): The rate of return earned on each dollar, for each period of time invested in.

- Equity Multiple: A measure of an investment's absolute return, calculated as the total cash flows received from the investment divided by the total amount invested.

- Net Present Value: The difference between the present value of future cash inflows and future cash outflows.

- Time Value of Money: The concept that a dollar available today is worth more than a dollar available in the future due to its potential to earn interest.

- Holding Period: The length of time an investor plans to hold an investment.

- Due Diligence: The research and analysis performed on a potential investment opportunity.

- Cash on Cash Return: A measure of an investment's return, calculated as the ratio of before-tax cash flow to the amount of cash invested.

Investing wisely requires a comprehensive evaluation of available metrics. By understanding the nuances of IRR and the Equity Multiple, you can make more informed decisions and maximize your returns.

Join Me at MultifamilyBootcamp.com

Related quotes to consider:

Follow Rod on Instagram for tons of great quotes: